While refinance applications seem to be slowing, there are still some good reasons to refinance your mortgage, even if interest rates aren’t currently at their best.

First off, let me preface this with the fact that mortgage rates are spectacular. Yes, the 30-year fixed used to be in the mid-2% range, but a rate of around 3% was relatively unheard of until recently (and is still available today).

Unfortunately, the recent increase in rates has dented refinance applications as the pool of eligible borrowers (those who stand to benefit) begins to dry up.

Last week, the Mortgage Bankers Association (MBA) noted that refis slid another 4%, pushing the refi share of total mortgage activity down to just below 62%.

Most industry participants saw this coming, which explains the recent trend of mortgage companies cozying up with real estate agents. But there are still opportunities for homeowners and mortgage lenders to pick up the refi slack.

Refinancing Out of the FHA and Into Conventional

- Mortgage insurance must be paid for life on most FHA loans (unless you put 10% down)

- This is the case regardless of how much you’ve paid down your mortgage

- Often the only way to drop MI completely is to refinance out of the FHA loan program entirely

- Fortunately this is easy to do and a common reason why homeowners refinance their mortgages

Even if rates are a bit higher than they once were, one opportunity that may remain is refinancing an FHA loan into a conventional loan (such as one backed by Fannie Mae or Freddie Mac).

The main benefit of doing this is to remove the compulsory mortgage insurance that must be paid on FHA loans.

Thanks (or not thanks) to the FHA’s stringent mortgage insurance rules, the annual mortgage insurance premium (MIP) must be paid monthly regardless of whether the loan balance falls below 80% loan-to-value (LTV).

The only exception is if the loan originally came with a 10%+ down payment (or 10%+ equity), or if it’s an older FHA loan that’s exempt from the newer rules.

In reality, most FHA loans are 30-year fixed mortgages with minimal down payments, meaning MIP often stays in-force for all 30 years unless you refinance out of the FHA.

This adds to an otherwise low monthly mortgage payment, making even a great mortgage rate a little less attractive.

Many folks took out FHA loans several years ago to take advantage of the low 3.5% down payment requirement, coupled with the low FICO score requirement.

Because home prices have increased so much since then, some of these borrowers may have the necessary equity to refinance into a conventional loan at 80% LTV or less.

Doing so will allow them to ditch the MIP and avoid PMI on the new conventional loan, which could equate to substantial savings.

Let’s take a look at an example of the potential savings:

Original sales price: $300,000

Down payment: $10,500 (3.5%)

Loan amount: $294,566 (includes upfront MIP of $5,066.25)

FHA monthly MIP: $205.06

Total monthly payment: $1,407.60

Today’s home value: $350,000

New refinance payment: $1,178.03 (based on $275,000 loan amount)

Instead of subjecting yourself to ~$200 in monthly mortgage insurance premiums, you might be able to refinance to a conventional loan at 80% LTV or less and rid yourself of that burden.

This could be the case regardless of how much you’ve paid down your loan since it closed. Why? Surging home prices, which can lower your LTV substantially.

So even if you only put down a paltry 3.5% a few years ago, you might have the required 20% in equity to lose the mortgage insurance once and for all.

Tip: Note that the Upfront Mortgage Insurance Premium (UFMIP) is non-refundable if you refinance out of the FHA to a conventional loan. It may be refundable if you refinance to a new FHA-insured mortgage.

Two Things Need to Happen for the FHA-to-Conventional Refinance to Make Sense

- You’ll need 20% equity for this type of refinance to make sense

- That’s the minimum to avoid PMI (80% LTV or lower) on a conventional loan

- And you’ll want a lower or comparable mortgage rate as well

- This ensures your monthly payment drops enough to justify any closing costs involved

Not just anyone can take advantage of this type of refinance. Only those who have gained enough equity and who can obtain a comparable (or better) mortgage rate will win here.

Using our example from above, the home must now be worth X amount to get that LTV down to where it needs to be. I say X because it depends how long you’ve had the loan.

A combination of home price appreciation and the natural amortization of the loan will tell you what the value needs to be.

Our hypothetical loan balance would drop to around $275,000 in just three years through regular monthly payments, requiring a house value of about $344,000 to get the job done.

Fortunately, home prices have skyrocketed in the past several years, so for many lucky borrowers the appreciation alone can push a relatively young loan to the magical 80% LTV mark upon refinancing.

Assuming you’re good to go there, you’ll need to consider the mortgage rate. That is, your former mortgage rate and the refinance mortgage rate.

If you previously had a rate of 2.75% on a 30-year fixed, and the best available rate today is 3.125%, you have to take into account that .375% bump in rate.

The good news is that it shouldn’t affect the mortgage payment by too much.

The old principal and mortgage payment was $1,202.54 plus $205.06 with MIP, making it $1,407.60 out the door (don’t forget taxes and insurance too!).

If the rate were 3.125% instead, the monthly P&I payment would be (based on a slightly lower outstanding balance of $275,000) $1,178.03.

Sure, it’s only about $25 less than the old P&I payment, but you no longer have to pay the $200 in MIP. Together, that’s a significant amount of monthly savings.

In reality, you might actually do even better if you started out with a higher mortgage rate thanks to a low credit score and/or high LTV, and have since improved upon those things.

Often, home buyers turn to the FHA because they have imperfect credit, so assuming your credit scores rise, you might save even more.

FHA-to-Conventional Refinances Took Off When Mortgage Insurance Became Permanent

- When the FHA dropped MI cancellation lots of homeowners began making the switch

- Thanks to healthy home price appreciation and continued low mortgage rates it’s an easy move to make

- It may be possible to drop the pesky annual MIP and score a lower interest rate at the same time

- Check your current LTV based on your property’s current appraised value to see if you can benefit too!

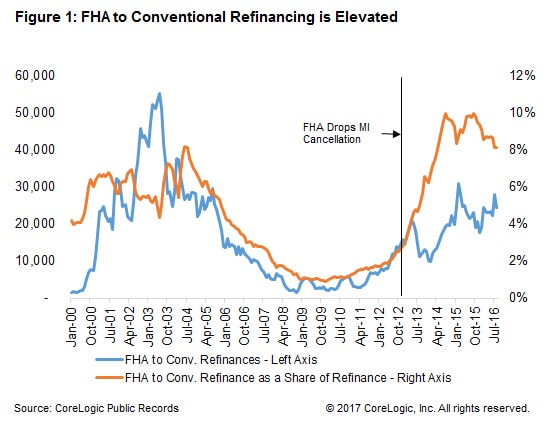

When the FHA changed its policy in 2013 to require mortgage insurance for life, FHA-to-conventional refinances soared.

In 2010, there were only about 4,000 FHA-to-conventional refis per month, or just one percent of total refinance transactions at that time.

If you look at the chart above, you’ll notice FHA to conventional refinance volume jumped, as did its share of total refinance volume.

Since 2013, millions of borrowers have taken out FHA loans, despite this unfavorable rule. Thanks to continuously rising home prices, hundreds of thousands of these borrowers have gone conventional each year.

Those who are currently in an FHA loan might want to consider a conventional loan instead as the monthly (and loan term) savings could be considerable.

Just be sure to take note of how long your FHA mortgage insurance will actually be in-force, and what the new interest rate will be.

Some borrowers with older FHA loans, 15-year fixed mortgages, or those who originally made large down payments might have more favorable insurance requirements.

When inquiring about a refinance, also look into different loan terms like a 15-year fixed if you want to stay on track payoff-wise.

Lastly, there’s a chance the FHA may revisit its mortgage insurance for life policy now that their coffers are a lot more full. But that won’t apply to loans that already funded.

Read more: FHA vs. conventional loan

(photo: Phil Leitch)