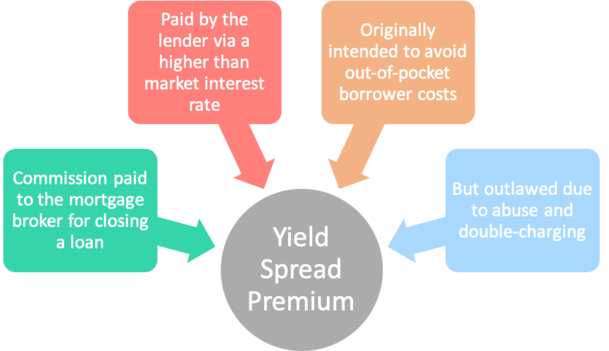

The “yield spread premium,” or YSP as it was known in the industry, was a fee paid by a mortgage lender to a mortgage broker in exchange for a higher interest rate, or an above market mortgage rate.

It was a common form of compensation prior to the Great Recession, at which point it was banned.

Though the borrower may have qualified for a mortgage at a lower interest rate, the broker or loan officer could charge this fee and give the borrower a slightly higher rate in order to make more commission.

This practice was originally intended as a way to avoid charging the borrower any out-of-pocket fees, as brokers could earn their commission AND cover closing costs with the YSP.

However, as expected, the yield spread premium wound up as just another fee the borrower got stuck paying.

Instead of being charged YSP only, borrowers were often charged YSP and an upfront origination fee.

Effectively, borrowers were charged twice on their home loans, which explains why this practice has been outlawed.

Careful You Aren’t Charged Twice on Your Home Loan

- A mortgage broker or loan officer could effectively charge a borrower twice

- Once on the back-end via the yield spread premium

- And also on the front-end of the loan via origination fees

- This allowed them to make a ton of money per loan (but cost the borrower way too much!)

The big problem with yield spread premiums was homeowners were charged twice on a single transaction.

This meant a borrower taking out a home loan could be charged on the back-end via YSP and on the front-end via out-of-pocket costs like a loan origination fee.

If so, you were effectively just being double-charged for the same service. It’s like going to a retail store and paying the retail price for a product and also a separate fee to the person who sold it.

Of course, a broker may have split up his or her fees by charging a half percent via the yield spread premium and another half percent in loan origination fee.

This wouldn’t mean the broker was necessarily charging you twice. Their commission was simply being broken up, with some money coming out-of-pocket and some coming in the form of a higher mortgage rate.

But often it just boiled down to charging borrowers more for the home loans they took out.

If you bought down your rate, there wouldn’t be any yield spread premium since you’d actually be paying discount points to lower the interest rate on the back-end.

Of course, this meant you’d need to pay a commission out-of-pocket as well, so it could get pretty expensive if you went after a super low rate.

Also note that the YSP verbiage varied, and yield spread premium may have read as “par-plus pricing”, “rate participation fee”, “service release fee” and so on.

Yield Spread Premium Was Used for No Cost Loans

- For borrowers who didn’t want to pay anything out-of-pocket

- It was common for loan originators to get paid via YSP

- This simply raised the borrower’s interest rate and thus their monthly payment

- But it didn’t result in any direct costs to the borrower at closing

Banks and brokers also used to charge a yield-spread premium as a way of providing a no closing cost loan.

Basically, the bank or broker would charge a YSP large enough to offset any upfront fees the borrower would have to pay, and still end up with enough money to make a decent commission as well.

An example would be a broker who charged no mortgage points or fees, but charged a YSP of 2% on a $400,000 loan.

The total compensation to the broker is $8,000, and the other fees associated with the loan may be $3,500.

The borrower won’t have to pay the $3,500 in fees as it will be subtracted from the broker’s YSP of $8,000, leaving the broker with $4,500 net commission.

It sounds like a good deal, but the interest rate the borrower ultimately receives may be substantially higher than it would be at the par rate.

This means the borrower will have both a higher monthly mortgage payment and pay much more interest throughout the duration of the loan term.

YSPs Have Been Replaced with New Compensation Rules

There was a lot of controversy surrounding yield spread premiums, and a long fight between mortgage brokers and large bank and lenders.

The issue at the time was brokers had to disclose the YSP they charged before loan closing, whereas large lenders could avoid doing so.

Lenders could delay disclosure as their yield spread may not have been determined until a later date when the loan was sold on the secondary market.

Simply put, if it was not yet known what they’d earn from selling the loan, it couldn’t be calculated ahead of time.

As a result of the early 2000s mortgage crisis, yield-spread premiums have been banned, and have essentially been replaced by an either/or lender compensation plan and lender credits.

Brokers must now choose either lender-paid or borrower-paid compensation, but not both.

The lender-paid option allows borrowers to avoid paying closing costs out-of-pocket. And can be combined with lender credits if needed.

i’m about to call a credit union to pre qualify. my realtor wants me to use a mortgage company, which makes me think she gets a commision. i feel they cost more & am resentful of all of this clawing & biting to get my money after reading this. because i’m sure they have found other ways to swindle me. it takes the joy out of buying my dream house finally. i’m about to retire & don’t have money to feed the insatiable machine & feel powerless to stop it.

Robin,

All real estate agents have preferred lenders, it’s definitely okay to shop around despite what they might tell you.

Firstly, this information is outdated. Loan Officers can no longer be paid based on the interest rate or the loan amount. YSP or Yield Spread Premium belongs to the borrower to be used to pay loan costs if the borrower is short of cash. So the borrower cannot be “double charged” Dodd’s-Franks makes sure of that. Secondly Robbin Peppin, your Realtor CAN NOT get a referral fee from a lender. This is a MAJOR violation of RESPA and the Colin Robertson should of told you as much. The realtor wants you to use their lender for a very simple reason. They want the loan to close on time as agreed. You see this is how they are paid. No closing – No Paycheck. Also, check with the lender your realtor is referring you too. Chances are this lender is licensed with the National Mortgage Licensing Service (NMLS for short). A NMLS licensed Loan Officer has a fiduciary duty to do what is in the best interest of their borrower. They are held to a much higher standard then those who are unlicensed. The test that one must take is extremely difficult and has over a 30% fail rate. Those who fail, or have felonies or gross misdemeanors can still work in the industry at a depository institution or credit union where they are not required to be licensed, just registered. I would implore you to follow your realtors advice. They know who can close your loan with the least amount of problems. Keep in mind the lenders that work at banks and credit unions work 9 to 5 from Monday to Friday and they get paid if your loan closes or not! However, the loan officer that your realtor is trying to refer you to gets paid only if the loan closes. This means they are going to be there to answer your questions that you will have after 5:00 P.M. and on weekends. When it comes to the biggest purchase you will make in your life isn’t it smart to go with whom the realtor recommends? If you have any doubts about “kickbacks” as they are called, Google “Real Estate Settlement Purchase Act (RESPA for short) Colin Robertson it is imperative that you check your facts before writing. The laws in this business are changing fast & furious. I would be happy to act as a resource should you have questions. A good story would be on the coming TRID disclosure this Oct 1st that will replace the Good Faith Estimate and the Truth in Lending agreement with a new form.

Steve,

I noted at the bottom of the article that YSP has been outlawed and replaced with lender credits. And yes, things change a lot so it’s difficult to have a timely post at all…times, especially in the mortgage biz. Thanks for your comment.

Colin your column about YSP couldn’t have come at a better time. I’m in the process of obtaining a mortgage through a home builder’s finance company of the same name. The last few of days dealing with them yielded nothing but diverting most of my questions after getting caught in a few, lets say, un-truths.

But, I’m actually and mostly directing this towards Steve. After reading your post Steve, I would never trust you to get a loan for me or advise me in any way how to proceed with any type of loan. Your arrogance, the “I know better than everyone” is ridiculous and conceded. Now, I really don’t care about your qualifications, what I do care about is what I got from your post and that’s what’s important and what matters most to me. Stop being so arrogant and condescending when giving your opinion, point to some facts that can back up all the stuff your saying. If not, then it’s just your opinion.