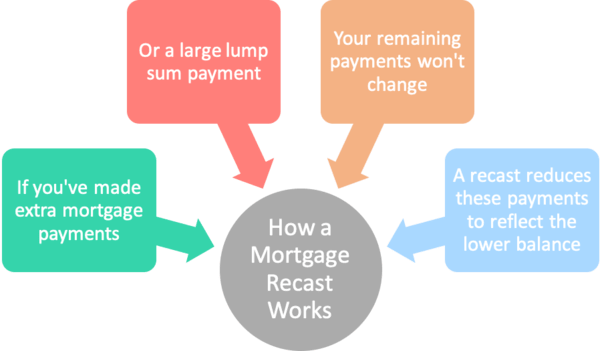

You may have heard that you can lower your monthly mortgage payment without refinancing via a “mortgage recast.”

These two financial tools are quite different, which I’ll explain, but let’s first discuss recasting to get a better understanding of how it works.

In short, a mortgage recast takes your remaining mortgage balance and divides it by the remaining months of the mortgage term to adjust the monthly payment downwards (or upwards). Let’s focus on the downward portion for now.

The downside to mortgages is that the monthly payment doesn’t drop if the balance is paid faster. That’s right, even if you pay more than necessary, you’ll still owe the same amount each month because of the way mortgages are calculated.

So if you made biweekly payments for a period of time, or contributed one big lump sum payment after some sort of windfall, you’d still be forced to make the original monthly payment until the loan was paid in full.

In this case, you could benefit from recasting your mortgage to a lower monthly payment.

Mortgage Recast Example

Original loan amount: $250,000

Mortgage interest rate: 4%

Original monthly payment: $1,193.54

Balance after five years: $226,000

Lump sum payment: $51,000

New loan balance: $175,000 (it’s lower but the payment doesn’t change without a recast)

Let’s assume you started out with a $250,000 loan amount on a 30-year fixed mortgage set at 4%. The monthly payment would be $1,193.54.

Now let’s pretend after five years you came upon some cash and decided to pay the mortgage balance down to $175,000, despite the amortization of the loan dictating a balance of around $226,000 after 60 payments.

As mentioned, the monthly payment wouldn’t change just because you made an extra payment. Although you owe a lot less than scheduled, you’d still be on the hook for $1,193.54 per month with the $175,000 balance.

The upside is that the mortgage would be paid off way ahead of schedule because those fixed monthly payments would satisfy the lower balance before the term ended.

But suppose you’d like to get your remaining monthly payments lowered to reflect the smaller outstanding balance. That’s where the mortgage recast comes into play.

How a Mortgage Recast Works

- You make a large lump sum payment toward your mortgage (there’s usually a minimum amount)

- It is applied to your outstanding loan balance immediately

- Your bank/servicer reamortizes your loan based on the reduced balance, which lowers future payments

- Usually have to pay a fee for this service

Instead of refinancing the mortgage, you’d simply ask your current lender or loan servicer to recast your mortgage.

This is also known as reamortizing because the original amortization schedule is adjusted to account for any extra payments made.

So using our example from above, you’d have 25 years remaining on the 30-year loan at the time of the extra payment.

If the loan were recast, the monthly payment would drop to about $924 to satisfy the remaining $175,000 balance over 300 months.

Your mortgage rate is still 4%, but your monthly payment is lower because the extra payments you made are now factored into the remaining term.

That’s about $268 in monthly savings for the homeowner looking to slow their mortgage repayment, despite making a lump sum payment or some extra payments early on.

While you’d still save money on interest due to the extra payment(s), you wouldn’t be required to make your old, higher monthly payment.

As such, you’d save more than you would had you paid the mortgage on schedule, but less than you would if you made extra payments and kept paying your original monthly amount.

So the recast is kind of a middle-of-the-road strategy to get some monthly payment relief and save on some interest.

But those who are laser-focused on paying off their home loan as quickly as possible won’t necessarily want to employ this strategy.

Recast Payment vs. Original Payment

| Original Payment | Recast Payment | |

| Mortgage Rate | 4% | 4% |

| Loan Amount | $250,000 | $175,000 |

| Loan Term | 30 years | 25 years |

| Monthly Payment | $1,193.54 | $923.71 |

| Total Savings | $269.83 |

Here’s a breakdown of the recast payment vs. the original payment, using our example from above.

You’d save about $270 per month thanks to the smaller outstanding balance. This could free up cash for other uses.

Recast Fees and Requirements

For a “small fee” (usually), your lender will take your outstanding balance and remaining term and reamortize your mortgage.

This fee can range from $0 to $500 or more. You need to inquire with your lender beforehand to determine the cost, if any, as it can vary.

Some lenders may also have a minimum amount that you must pay to reduce the loan balance if a lump sum is required, such as $5,000 or more.

This lump sum payment is made in conjunction with the recast request and you wind up with a lower monthly payment as a result, though the interest rate and loan term remains unchanged.

It might also be possible to request a recast if you’ve been making extra payments over time and simply have a much lower balance than the original amortization schedule would indicate.

Also note that you may only be given the opportunity to recast your mortgage once during the term of the loan.

Tip: Generally, your mortgage must be backed by Fannie Mae or Freddie Mac in order to be recast. Jumbo loans may also qualify. It is not an option for FHA loans or VA loans unless it’s a loan modification.

Mortgage Recast vs. Refinance

- If a loan recast isn’t available (or even if it is)

- You can go the mortgage refinance route instead if you qualify

- Doing so may actually save you even more money

- Via a lower interest rate and possibly a reduced loan term at the same time

Alternatively, a homeowner could look into a rate and term refinance instead if they were able to get the interest rate reduced at the same time.

The refinance route could be beneficial because the loan-to-value ratio would likely be low enough to avoid a lot of pricing adjustments.

Let’s say the original purchase price was $312,500, making the $250,000 mortgage an 80% LTV loan at the outset.

If the balance was knocked down to $175,000, and the home appreciated over that five years to say $325,000, all of a sudden you’ve got an LTV of 54% or so. That’s super low.

And perhaps you could obtain a lower interest rate, say 3.50% with no closing costs thanks to a lender credit.

That would push the monthly payment down to around $786, though the term would be a full 30 years again (unless you select a shorter term).

The downside to the refi is that you might restart the clock and pay closing costs. You also have to qualify for the refi and deal with what could be a lengthy underwriting process.

In either case, a lower monthly payment would free up cash for other objectives, whatever they might be. A lower mortgage payment also lowers your DTI, which could allow for a larger subsequent mortgage on a different property.

When a Recast Increases Your Mortgage Payment

- A loan recast can actually increase your monthly payment

- Assuming it’s an involuntary one performed by your lender

- Examples include interest-only loans once they need to be paid back

- And HELOCs once the draw period comes to an end

As mentioned, there are cases when a recast can actually increase your mortgage payment. These situations occur when you’ve been paying less than what was required to pay off the mortgage by maturity.

Two examples come to mind. One is an interest-only mortgage, which as the name denotes, is the payment of just interest each month.

The interest-only period only lasts the first 10 years on a 30-year mortgage, at which point you’ll need to play catchup to pay the mortgage balance off in time.

Your lender will recast your mortgage after the IO period ends and the monthly payment will be significantly higher to account for the fully-amortizing payment over a shorter, 20-year term.

Another example is a HELOC, where you get a 10-year draw period and 15-year repayment period. It could be some other variation, but once the draw period ends, you must begin repaying the loan.

The loan will recast to ensure monthly payments satisfy the debt by the end of the remaining term.

In both these instances, you can avoid the upward recast by refinancing the loan or paying it off in full before a recast is necessary. You could also sell the property before the recast occurs.

Mortgage Recast Pros

- Lowers your monthly payment without refinancing

- Reduces your DTI

- Boosts liquidity for other needs/expenses

- Might be free or very cheap to execute

- Easier and probably much faster than refinancing

- Can still make higher payments if and when you want

- Doesn’t extend your original loan term like a refi can

Mortgage Recast Cons

- Takes longer to pay off your mortgage with lower monthly payments

- You may pay more interest if the loan is paid more slowly

- There may be a fee to recast your loan

- May require a minimum lump sum payment to qualify

- Could be more beneficial to refinance to a lower mortgage rate at no cost

- Not an option for FHA/USDA/VA loans

(photo: Damian Gadal)

After I recast our loan – when can I refinance?

Barbara,

Not sure there’s a specific waiting period (if any), would have to reach out to individual lenders to be sure. But if you paid to recast, you might lose those associated savings, though it could make sense if refinance rate is much more attractive.

is it possible for a lender to recast a loan that initially put less than 20% down thus removing the PMI after paying the loan down below the initial 20% down and thus removing the PMI after recast?

Todd,

You mean by using the new value of the property to make the remaining balance dip below 80%? I highly doubt it – a more typical way of accomplishing this would be by refinancing the loan using the new, higher value to obtain an LTV of 80% or lower.

Todd,

Yes. I am doing it right now. I just got a BPO with my lender to check current LTV, and if it is not at 80% then I will put in extra funds in form of recast to get 80% LTV and recast in one swoop. Good luck!

Frank,

Did you consider your existing mortgage rate versus what current rates are? Could be able to save more via a refinance vs. recast. Just something to think about.

A few years back I had a mortgage company that would reamortize my loan yearly, for free, based on what I owed not what I borrowed. I believe they were set up and forced out of business because they went against the status quo. Do you know of any other mortgage companies that offer this type of customer service? A company with some morals who is not willing to rip people off?

David,

That may have been due to the product, such as an option ARM, not the company itself. Most mortgages today are fixed and probably wouldn’t need to be re-amortized annually.

It was an ARM (3/1) but even during the initial period the re-amortize was done. I was paying down my mortgage very quickly. I believe it had everything to do with this fact. It is a shame that not all loans are done this way. No one should have to pay double for their home.

Hi! In which scenario do I pay less interest, with a 30 year $300k mortgage @ 3.25%:

1) making a $500 incremental mortgage payment each month

or

2) not making an incremental payment each month and instead recasting with $12,000 every 24 months?

Is recasting a way to reduce total interest paid?

Thanks!

William,

Recasting is typically intended to lower monthly payments, since paying extra each month doesn’t lower subsequent payments unless you recast the loan. However, paying extra does lower total interest paid.

Todd, depending on your loan program the MI should auto cancel around 78%. No recasting or refi required. FHA and USDA MI is for the life of the loan.

If you recast, can you extend the term? I had a 15 year and extending it to 30 will significantly reduce the monthly payment.

Sam,

A recast is more about aligning remaining payments with the outstanding balance, not increasing or decreasing the term. Plus you get a discounted interest rate on a 15-year fixed so I doubt a bank would give you an extended term for free.

Suppose that I have a 30 year conforming loan mortgage, and have been making bonus payments for the past 5 years. My current payoff date reflecting my bonus payments is 23 years from today.

If I recast with a bulk payment, is my payoff date still 23 years from today (i.e. recast reflects end date from current amortization schedule that takes into account bonus payments), or does it return to 25 years from today (i.e. recast is based on original amortization schedule)?

Michael,

They would likely keep you on the original loan term with same maturity date, with adjusted monthly payments to reflect the extra amount paid.

I am currently paying PMI in addition to my loan, but am also about to put $$ toward significant home improvement. Could I appraise the home after improvement is done and then recast the mortgage to remove the PMI, given loan to value would be at that 20% mark needed to drop it?

Kathleen,

If you have a Fannie Mae- or Freddie Mac-backed loan, it’s possible to request a borrower-initiated termination of PMI using the property improvements for the value, but the LTV ratio must be 80% or less. A recast may not be necessary to drop PMI, but you could do that as well if you wanted lower monthly payments. Of course, with interest rates so low, a refinance could possibly accomplish both these things wihout having to prove the improvements increased the home’s value by X.

Your information is wrong. If you recast a loan, your payment goes down and your remaining payment period does NOT change. So you pay less for the same amount of time at the same interest rate. No fees either than perhaps a negotiable one time $50 charge.

Charles,

The repayment period can change because instead of the mortgage being paid off ahead of schedule due to the extra payment(s), it’s now paid off at original maturity.

I have a mortgage of 449,500 at 2.99% fixed for 30 years.

I am about to recast putting down 250,000 more to reduce the overall debt to 199,995. When I recast will my interest rate be readjusted? Can I have the recast realigned to a 15 year versus a 30 year loan?

Henry,

A recast generally keeps your same amortization schedule but lowers monthly payments based on a smaller outstanding balance. Conversely, a refinance could result in a lower interest rate and new loan term of your choice, such as a 15-year fixed.

I thought recasting would be a good option to help us reduce our total interest payments but bank rep recommended against it , I don’t understand why ?

Situation: original 30 yr fixed loan started on 11/21 @ 395k for 2.75%, have been making extra payments with balance now @ 380k – no cost for recasting and would add the reduced interest payment towards principal. thoughts?

Sarah,

A loan recast is helpful to reduce your monthly payment, but won’t lower your interest expense. It would actually increase interest if you slow down your repayment. It’s intended for those who want to pay less each month. Not those who want to pay off their mortgage faster or save money.

do the recast and take the savings from the lower payment and put it towards the principle. if you can keep paying extra to the balance, you’ll pay it off faster and thereby save interest

Hello,

Just reading Rob’s comment and that is exactly what I was wondering about. If I recast my loan (resulting in a lower monthly payment), but continue with my current payment I would pay my loan off sooner, correct? Would this also lower the amount of interest I would pay over the life of the loan, just as much as it would if I did not recast but made extra payments?

Lisa,

You could recast and continue making the original payment, but the reason most people recast is to obtain a lower monthly payment.

If you don’t care about that flexibility you could just pay extra each month (and/or via lump sum) without the recast.

Run different scenarios via an amortization calculator to see the total interest expense.

Does my co-signer have to sign the Loan Modification Agreement if I do a recast?

Andre,

Sounds probable if they are a co-signer on the original loan. The lender/servicer will likely advise.

When recasting a loan, does the new amortization schedule change the interest vs principal ratio over the remainder of the loan? I am finally at the point where I pay more principal than interest and want to know if the new amortization schedule (after the recast) would change the ratio where I would be back at a point where I would be paying more interest than principal in my monthly payment?

Charlie,

Yes, it would change because you’d have a different loan balance and new loan term. If you plug in the new balance at recast and remaining loan term (along with the interest rate) into an amortization calculator, you’ll see the breakdown.