As home prices and mortgage rates continue to rise, lenders are becoming a lot more creative with their product offerings to increase affordability and flexibility.

One of the more unique loan programs currently being showcased is called the “HarmonyLoan,” which as the name implies, promises to make everyone happy.

It takes the standard adjustable-rate mortgage and sprinkles in options and peace of mind, giving borrowers more incentive to choose an ARM over a more expensive fixed-rate option.

The HarmonyLoan Is a One-Click Refinance

- Instead of having to go through all the trouble of a typical refinance

- Those with a HarmonyLoan can simply click a button

- To reset their interest rate lower

- It could come in handy if rates drop or you’re nearing an adjustment on an ARM

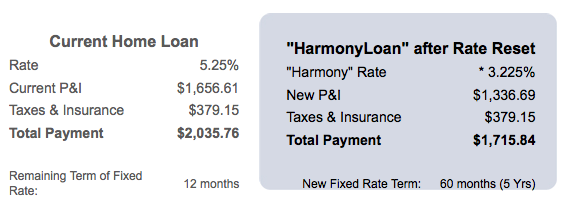

Pictured above is a favorable example of a HarmonyLoan Rate Reset.

Here’s how the HarmonyLoan works. You start with a hybrid ARM, or even a fixed-rate mortgage.

Loan options include the 5/1 ARM, 7/1 ARM, 10/1 ARM, 30-year fixed, and 15-year fixed.

Six months after loan closing, you will get the first opportunity to reset your interest rate. After the first six months, you can reset every 120 days, but the loan must be current with no late payments in the past 12 months.

For example, say you originally locked in an interest rate of 3.25% on a 5/1 ARM, and rates eventually fall to 3% or lower.

As long as six months have gone by initially, you can reset your mortgage rate with the click of a button.

Instead of applying for a refinance, filling out a bunch of paperwork, having your credit report pulled, and paying lots of closing costs, you simply click a button on a website to reset your rate.

The trademarked “one-click rate change” is just about as easy to clicking a button to accept the new loan terms available.

Once you click, a HarmonyLoan Rate Reset Form is created, which can be signed via DocuSign and processed almost immediately.

From then on, you’ve got a new interest rate and a new fixed-rate term, assuming it’s an ARM. Though the fixed portion of the term changes, the overall mortgage term is still 30 years and no longer.

Now normally a borrower wouldn’t refinance if their rate only fell an .125% or .25%, but with the HarmonyLoan, there are no closing costs and no underwriting hassles, so if they offer you a lower rate, there’s no reason not to take it.

Additionally, you can extend the fixed portion of your ARM. For example, say you originally take out a 7/1 ARM. After five years of enjoying a fixed payment, you log-in to the website and see you’re able to reset to an even lower rate.

Assuming you take them up on their offer, you’ll get an additional seven years of fixed mortgage payments.

So you effectively extend the fixed portion of your ARM, making it fixed for 12 years, if not longer if you reset and fix it again in the future.

You can also agree to a slightly higher rate reset to lock in another fixed-rate period.

In other words, if your seven-year fixed period is coming to a close, you can extend it by resetting to a rate maybe an .125% or .25% higher, effectively avoiding a major reset higher once it becomes fully adjustable.

With regard to the fixed-rate HarmonyLoan options, you can only reset your interest lower, for obvious reasons.

Is the HarmonyLoan Just a Marketing Gimmick?

- Borrowers likely pay a premium for the one-click refinance option

- Meaning their initial interest rate will be higher all else being equal

- And if mortgage rates just keep rising over time

- They probably won’t ever see any benefit

I don’t really take the fixed-rate HarmonyLoan seriously, seeing that it’s being offered at a time when mortgage rates are near record lows and only heading higher.

Someone who takes out a fixed HarmonyLoan will probably never reap any benefit, and actually probably pay a premium at the outset for the option to reset it.

As far as the adjustable-rate HarmonyLoan goes, it could actually benefit a homeowner, depending on the initial rate offered.

My guess is that the interest rate will be higher on the HarmonyLoan than the standard market rate for an ARM, given the option to reset it with a simple click.

And if interest rates just continue to climb, it might not make sense for the borrower.

However, if interest rates stay relatively flat, or even fall, the HarmonyLoan could actually save a homeowner money, and allow them to extend their ARM’s fixed period quite a bit.

This could also benefit someone who wouldn’t otherwise qualify for a refinance if their LTV were too high, or if their income took a dive.

But it involves a lot of market speculation, which the average Joe probably isn’t too comfortable with.

(photo: Emily Stanchfield)

Hi Colin,

I have a quick question. What index is the 5/1, 7/1 and 10/1 ARM’s tied to? Also, if one can click a button and lower his/her rate by .50%, then who eats the difference? Please PM me as I’m very interested in this loan program.

Pretty sure it’s the 1-Year LIBOR. As far as eating the cost, I’m assuming the interest rates borrowers obtain via HarmonyLoan are priced a bit higher to compensate for the ability to reset the rate for free.