Mortgage rates were already at 15-months as we entered 2026, and now they’re moving even lower.

The catalyst today was another weak jobs report, this time courtesy of ADP, which tracks private payrolls.

The company said 41,000 jobs were created in December, which fell short of the 48,000 expected.

It wasn’t a huge miss, but it was enough for long-term bond yields to drop, which translates to lower 30-year fixed mortgage rates.

But there’s still a lot more jobs data to come this week, including job openings, initial jobless claims, and the monthly jobs report from the BLS on Friday.

Mortgage Rates Start 2026 Off the Way They Ended 2025

If the second half of 2025 was any indication of how things would go in 2026, it could be a nice little year for mortgage rates.

The continued driver has been weak employment data, which tends to result in lower mortgage rates.

Weak economic data translates to a cooler economy and lower inflation, which in turn can lead to rate cuts and also lower interest rates on long-dated mortgages.

With regard to the ADP jobs report, private employers added 41,000 jobs in December, which was significantly better than November, but still below forecast.

If you recall, November jobs were negative according to ADP, though they did revise them from -32,000 to -29,000, so a slightly less worse reading.

On the one hand, you could look at December’s report as an improvement and possible stabilization after such a bad month.

But given it came in below forecast, it still led to lower 10-year bond yields, which serve as a bellwether for the 30-year fixed.

The 10-year was about five basis points lower today on the news, falling to around 4.13%. It’s been stuck around those levels since September though.

Meaning we’ll probably need more bad labor data and/or softer inflation to actually break through the fortified 4% threshold.

That could mean that mortgage rates will be mostly flattish, even if they improve by another eighth of a point or so.

However, it could still be enough get the national average down below 6%, which would be a big psychological win for the housing industry.

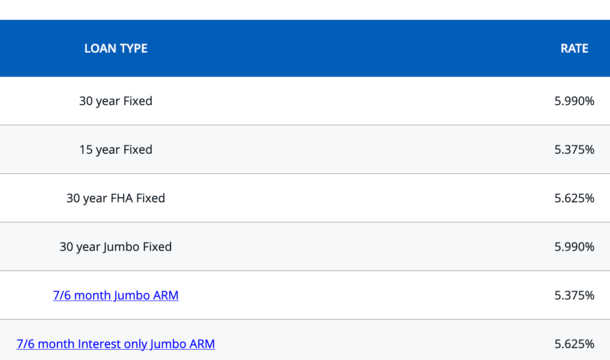

Another Big Bank Drops All Its Mortgage Rates Below 6%

Yesterday, I posted about a large bank advertising all its mortgage rates below 6%.

Today, another one has followed their lead and all its rates, which require about one discount point and a 20% down payment, are below 6%.

If this continues, and we don’t see any major setbacks, it could signal a big shift to a new lower tier of mortgage rates.

That could solidify the move to lower mortgage rates if more investors are buying MBS in these lower coupon buckets.

In other words, more liquidity and demand in the lower rate buckets means they stick around and we don’t just jump back to 6.5% or higher.

So it’s a positive development and also something that can drive more optimistic sentiment from prospective home buyers.

Last year, we had similarly low rates at times, but we also had times when rates were above 7%. The same goes for 2024.

If we can stabilize at these lower levels, and avoid the same setbacks, we could actually see home sales rise and see buyers and sellers get more comfortable transacting in general.

Read on: 2026 Mortgage Rate Predictions

- Mortgage Rates Did Nothing All Week Despite Lots of Big News - February 21, 2026

- Mortgage Rates Hit a Wall in Latest Attempt Into the 5s - February 19, 2026

- Home Loans Could Get Cheaper If Banks Re-Enter Mortgage Game Thanks to New Rules - February 18, 2026