Today we’re going to talk about a “temporary buydown,” the latest effort by the mortgage industry to provide much-needed payment relief to borrowers.

In recent months, mortgage rates effectively doubled, straining affordability and cooling the hot housing market.

These higher rates have also had a big impact on the mortgage industry, which is typically reliant on low rates to fuel its important mortgage refinance business.

Mortgage lenders understand the impact these higher rates have had on borrowers and prospective home buyers, so there’s a good chance you’ll see more of these offers pop up soon.

Let’s discuss how these buydown mortgages work, if they can save you money, and the general pros and cons.

What Is a Temporary Buydown Mortgage?

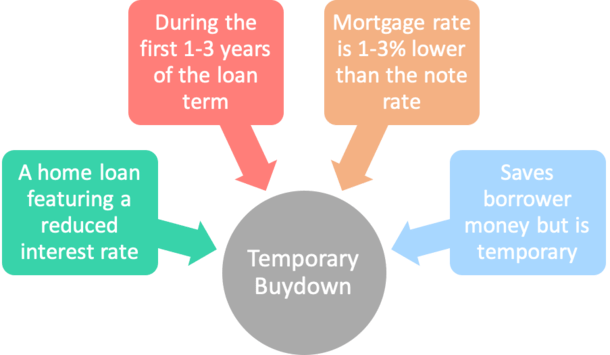

In short, a temporary buydown is a home loan that features a reduced interest rate for a temporary period of time, whether it’s one, two, or three years.

The interest rate may be 2% lower in year one, 1% lower in year two, and then the standard note rate thereafter.

An upfront cost covers these lower monthly payments, with the required funds set aside in a buydown account.

Each month during the temporary buydown period, the borrower makes a reduced monthly payment, with the additional amount released from the buydown account to cover the difference.

This makes monthly payments more affordable during the beginning of the loan term.

Typically, borrowers opt for these buydowns because they expect their income to increase in the near future. Or the buydown is offered by a home builder or home seller to sweeten the deal.

To that end, these buydowns are often paid by a home seller or builder, or perhaps a mortgage lender.

It may also be possible to apply seller concessions toward a temporary mortgage buydown.

Recently, United Wholesale Mortgage (UWM) and CrossCountry Mortgage have introduced temporary buydown programs to offset high mortgage rates.

Types of Temporary Buydown Mortgages

2-1 Buydown

| $400,000 loan amount | Interest Rate | Monthly Payment | Monthly Savings | Annual Savings |

| Year 1 | 3.5% | $1,796.18 | $474.98 | $5,699.76 |

| Year 2 | 4.5% | $2,026.74 | $244.42 | $2,933.04 |

| Year 3-30 | 5.5% | $2,271.16 | $0 | $0 |

There are several buydown loan options out there, with the “2-1 buydown” perhaps the most common.

As the name suggests, it lowers your interest rate by a full 2% the first year, and 1% the second year.

For example, if you qualified for a rate of 5.5% on a 30-year fixed, your interest rate in year one would be 3.5%.

In year two, your interest rate would rise to 4.5%. And in year three (and beyond) you’d pay the full note rate of 5.5%.

As seen above, a homeowner would have a payment of $2,271.16 per month on a 5.5% mortgage with a $400,000 loan amount.

During year one, they’d save $474.98 per month and $5,699.76 annually.

During year two, they’d save $244.42 per month and $2,933.04 annually.

That’s about $8,600 total, which would need to be earmarked to cover the buydown cost over those two years.

3-2-1 Buydown

| $400,000 loan amount | Interest Rate | Monthly Payment | Monthly Savings | Annual Savings |

| Year 1 | 2.5% | $1,580.48 | $690.68 | $8,288.16 |

| Year 2 | 3.5% | $1,796.18 | $474.98 | $5,699.76 |

| Year 3 | 4.5% | $2,026.74 | $244.42 | $2,933.04 |

| Year 4-30 | 5.5% | $2,271.16 | $0 | $0 |

There is also a “3-2-1 buydown,” which is perhaps less common given the enormous expense involved. Though still utilized plenty these days.

This type of buydown lowers the interest rate by a full 3% the first year, 2% the second year, and 1% the third year.

After that, your mortgage rate returns to the note rate for the remainder of the loan term.

So if the note rate were 5.5%, you’d be looking at 2.5%, 3.5%, and 4.5% in years 1-3, respectively.

You get 36 months of reduced mortgage payments!

1-1 Buydown

| $400,000 loan amount | Interest Rate | Monthly Payment | Monthly Savings | Annual Savings |

| Year 1-2 | 4.5% | $2,026.74 | $244.42 | $2,933.04 |

| Year 3-30 | 5.5% | $2,271.16 | $0 | $0 |

A “1-1 buydown” reduces your interest rate for the first two years of the loan by 1%.

Using our same example, a 5.5% note that would be reduced to 4.5% for years one AND two.

After that, the mortgage rate would return to 5.5% for the remainder of the loan term.

Some home builders have shifted to offering this type of buydown because it’s cheaper for them.

1-0 Buydown

| $400,000 loan amount | Interest Rate | Monthly Payment | Monthly Savings | Annual Savings |

| Year 1 | 4.5% | $2,026.74 | $244.42 | $2,933.04 |

| Year 2-30 | 5.5% | $2,271.16 | $0 | $0 |

Going the opposite way, you might come across a “1-0 buydown,” which is simply a 1% reduction the first year.

So if the note rate were 5.5%, you’d get a year at 4.5% before the mortgage reverted back to 5.5% for the remainder of the loan term.

In mid-September 2022, Rocket Mortgage launched its so-called “Inflation Buster,” a 1-0 buydown that provides customers with a reduced interest rate during the first 12 months.

For example, instead of a rate of 5.75%, they might get a rate of 4.75% for the first year, with Rocket covering the difference in monthly payment automatically.

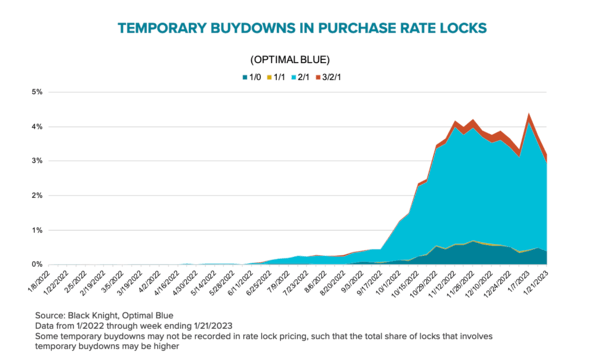

As you can see, the 2/1 buydown loan is most popular, followed by 1/0, and 3/2/1, per data from Black Knight and Optimal Blue.

What Is the Cost of a Temporary Buydown?

To determine the cost of the temporary buydown, you need to add up the monthly savings during the years when the interest rate is reduced.

For example, if it’s 1-0 buydown, you’d just multiply the monthly payment savings for 12 months.

So if the loan amount was $500,000 and the rate is bought down from 7% to 6%, you’d be looking at monthly savings of $328.76, or $3,945.12 total.

If we’re talking about a 2-1 buydown with a rate of 5% in year one and 6% in year two, the total cost would be $11,653.92. It includes the $7,708.80 saved in year one.

Of course, this cost is footed by someone other than the borrower.

But if you’re getting that contribution, you have to weigh it against other possible uses, such as a purchase price reduction or credit toward closing costs.

Temporary Buydown Rules

Note that temporary buydown periods typically can’t exceed three years. So the options above will likely be the only terms available.

Additionally, the annual increase in mortgage rate is generally capped at 1%, probably to avoid payment shock.

As noted, borrowers still need to qualify at the full note rate in most instances, unless a borrower is expected to see a large increase in future income (for certain loan types).

Buydowns are also only permitted on certain property types, such as primary residences and second homes, with investment properties often prohibited.

But can be used in conjunction with an FHA loan, VA loan, or conforming mortgage backed by Fannie Mae or Freddie Mac.

It may be possible to use a temporary buydown on an adjustable-rate mortgage with the VA or Fannie/Freddie, but not the FHA.

They’re also only generally permitted on home purchases, not refinances, and a minimum FICO score may also be required.

The buydown funds must also come from a home seller, builder, or lender, not the borrower themselves. But the contribution can be split amongst those parties.

They are typically not refundable unless the mortgage has been paid off ahead of time, in the case of a refinance or home sale.

If this were to happen, the proceeds would typically go toward paying off the mortgage or be returned to the borrower/lender (source). Be sure to ask about this!

Mortgage Buydown Pros and Cons

- Buydowns lower your rate for the first 1-3 years, but upfront cost matches the savings

- No real benefit unless it’s being paid for by the seller or builder

- Or if you have extra credits from agent/seller that you can’t use elsewhere

- But beware of a higher sales price in exchange for the buydown

- And note that you must still qualify at the full note rate, not the bought-down rate

- Might be better than a permanent buydown because funds are refundable if you sell/refinance

While receiving a reduced mortgage rate the first couple years sounds nice, the upfront cost generally equals the savings.

In other words, you’re not really saving any money, you’re simply allocating funds in a different manner.

Basically, paying upfront instead of monthly, though if someone else is footing the bill, like a home seller or builder, it can be considered a money-saving move.

Just consider that the sales price might be inflated to cover the cost of the buydown.

Also note that mortgage lenders typically still require you to qualify at the actual note rate. So if the post-buydown rate is 5.5%, you need to qualify at that rate, even if you get a 3.5% rate in year one.

In the past, some underwriters may have allowed a lower qualifying rate, but that became a big no-no after the housing crisis in the early 2000s (VA loans might be the exception).

So what’s the point then? Well, as noted, if a third party is covering the cost of the buydown, why not take it?

Or if you have extra funds from a home builder or seller that can’t be used otherwise, or you don’t want to use them toward say the down payment or other closing costs.

Is It Better to Lower Your Mortgage Rate Permanently?

Perhaps a better alternative is paying mortgage discount points, which result in a lower interest rate for the entire loan term.

This is known as buying down your rate, on a permanent basis.

For example, you might pay one point upfront for an interest rate that is .375% lower for the entire 30-year loan term.

The caveat is if rates decline further after you take out your loan, you might benefit from a rate and term refinance.

And if you haven’t broken even on the upfront cost, you might leave money on the table when refinancing.

So it’s important to have a plan, and an expectation for where mortgage rates might go up in the years following the home purchase.

If they’re expected to drop a lot, paying points can be a losing proposition. But if they’re slated to rise or stay flat, it could be a winning move.

Another option is to go with an adjustable-rate mortgage that offers a fixed-rate period the first five or seven years (5/1 ARM or 7/1 ARM). You actually save money via a lower interest rate.

And in the case of discount points, save money once the breakeven period has passed.

Temporary Buydown FAQ

1. What is a temporary mortgage buydown?

A temporary mortgage buydown is an option that allows the borrower to enjoy a lower interest rate for a specific period of time (e.g. 1-3 years) that reduces monthly payments, making the loan more affordable initially.

2. How does a temporary buydown work?

A seller or builder offers a credit at closing to fund the interest rate buydown, with the money set aside in an escrow account and drawn upon each month to cover the difference between the note rate and bought down rate.

3. Who pays for the buydown?

The buydown can be paid for by the borrower if they are credits at their disposal, the seller to attract buyers without lowering the home price, the builder for the same reason and to make the loan appear more affordable, or by the lender to simply sweeten the deal.

4. Can I refinance after a buydown?

Yes, and any unused buydown funds should be refunded or applied to the outstanding loan balance so they aren’t wasted.

But in the case of a permanent buydown, points paid upfront are non-refundable, so refinancing too soon could mean leaving money on the table.

5. What’s the difference between a temporary and permanent buydown?

Temporary Buydown: Lowers the interest rate for 1-3 years, after which it reverts to the higher note rate.

Permanent Buydown: Reduces the interest rate for the full loan term, e.g. 30 years on a 30-year fixed loan.

Read more: Temporary vs. Permanent Mortgage Buydowns: Which to Choose and Why

- UWM Launches Borrower-Paid Temporary Buydown for Refinances - July 17, 2025

- Firing Jerome Powell Won’t Benefit Mortgage Rates - July 16, 2025

- Here’s How Your Mortgage Payment Can Go Up Even If It’s Not an ARM - July 15, 2025