I think it goes without saying that everyone with a mortgage (or thinking about getting one) wants the lowest interest rate possible. After all, who wouldn’t want to save money each month for the next 30 years or so of their life?

Remember, this isn’t a one-off purchase, it’s a decision that will affect your pocketbook month after month for the foreseeable future. So getting the pricing right is imperative.

Let’s say you qualify for a mortgage at a rate of 5%, but you’re not happy with the rate. Assuming any attempt to negotiate your mortgage rate lower fails, you do have another option.

What are mortgage discount points?

- Discount points are a form of prepaid interest

- Instead of paying more interest monthly via a higher interest rate

- You pay more at closing in one lump sum

- In exchange for a lower interest rate for the life of the loan

That brings us to the topic of “mortgage discount points,” which can be paid at closing to reduce your mortgage rate.

Simply put, you have the option to pay a percentage of the loan amount, also known as a mortgage point, to lower your interest rate by a certain amount.

For the record, the ratio of points to rate discount is never perfectly proportional. So I can’t tell you that one discount point will equate to a .25% reduction in rate. It always varies.

But I can mention that discount points are considered a form of prepaid interest because the upfront cost lowers the amount of interest you would normally pay during the loan term. The good news is that means they’re also tax deductible.

Let’s look at an example of discount points in action:

Loan program: 30-year fixed-rate mortgage

Loan amount: $200,000

Par rate: 5% (what you qualify for at no cost)

Desired interest rate: 4.5%

Total cost: 2 discount points ($4,000)

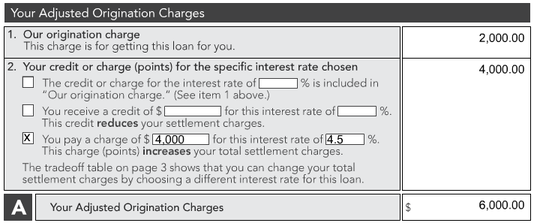

Say you qualify for an interest rate of 5% with no costs other than a loan origination fee of 1% ($2,000). But you want to secure an even lower mortgage rate, perhaps 4.5%. In order to do so, you’re told you’ll need to come up with more money at closing to pay mortgage discount points.

The mortgage broker or bank will do the math and determine that you need to pay “X” amount of discount points to lower your interest rate by a half of a percentage point.

In our example, it would take two discount points to lower your rate by the desired 0.5%. Again, this can vary, but we’ll use those numbers to illustrate the potential cost.

The cost of two mortgage discount points on a $200,000 loan amount is $4,000 (2% of $200k = $4,000) to obtain the desired mortgage rate, as seen on the GFE pictured above.

That $4,000 would lower your monthly mortgage payment from $1,073.64 to $1,013.37, a savings of roughly $60 a month. So in exchange for lower mortgage payments each month, you’d pay more at closing. That’s the tradeoff.

A lower rate would also help you pay down your mortgage balance faster, something that also needs to be considered alongside the monthly savings.

If you decided that a rate of 5% was good enough, you would avoid paying the discount points and reduce closing costs substantially. In our example, you’d have $4,000 in your pocket, instead of wrapped up in your mortgage.

Does it make sense to lower my rate using mortgage discount points?

- The key is knowing how long you’ll keep the mortgage

- Because that will dictate the actual savings

- You can’t just assume you’ll keep it for the full loan term

- Since most home loans are only kept for a fraction of the time

Before actually paying mortgage discount points, you need to be sure it actually makes sense to buy down your interest rate.

The answer to this question will vary greatly depending on what mortgage rate you are initially offered, how much it costs to buy down the rate, and how long you plan to stay with the mortgage/in the home.

In our example, you essentially need to recoup the $4,000 spent on discount points in order to make it a good deal.

The only way to get that money back is to pay your reduced-rate mortgage each month for a period long enough to where you cover the upfront cost and begin saving money each month. This is known as your breakeven period.

As mentioned above, the lower interest rate means your mortgage is paid down faster because a greater portion of the payment each month is going toward the principal balance as opposed to interest. This can also get you closer to that key breakeven point.

The Longer You Keep Your Home Loan, the Better, If You Pay Points

- If you do happen to pay discount points

- You’ll be rewarded more the longer you keep the loan

- Since each monthly payment will be lower as a result

- The reverse is also true so try to determine your tenure ahead of time

As a rule of thumb, mortgage discounts points make more sense for those who plan to stick with their mortgage for the long-haul, as the interest saved over the years can be exponential.

On the other hand, if you plan to move or refinance again in the near future, paying mortgage discount points could be a complete waste of money.

While mortgages generally have terms of 15 or 30 years, most homeowners don’t see them through to maturation. Not even close.

Instead, they sell or refinance long before that time. So there are definitely a lot of borrowers out there leaving money on the table when paying points.

Also be sure to consider your asset situation before making the decision to pay any extra at loan closing.

If you don’t have a lot of money saved up, you won’t want to blow what little you do have lowering your mortgage rate by some incidental amount. It’ll just make you more house poor.

You always have the option to pay more toward the principal balance each month if you want to save on interest, even if you didn’t elect to pay points at closing.

Doing so could accomplish the same basic objective while giving you more flexibility.

And as I mentioned earlier, mortgage discount points aren’t a perfect science, meaning it could cost three points to lower your interest rate one percent, or just two points to lower it three-quarters of a percentage point.

So be sure you ask your mortgage broker or loan officer about all possible options to ensure you get the very most out of your mortgage discount points.

Tip: Don’t focus on a certain interest rate, as the cost may not justify the discount. For example, if you have your eye on a 4% mortgage rate, don’t just blindly pay for it so you can tell your friends about your low rate.

If the cost isn’t justified, look at other options. It may cost half the price to go with a rate of 4.25% instead and barely cost you much more monthly.

- Rocket Mortgage Completes Redfin Takeover, Offers $6,000 Home Buyer Credit - July 1, 2025

- Mortgage Rates Quietly Fall to Lows of 2025 - June 30, 2025

- Trump Wants Interest Rates Cut to 1%. What Would That Mean for Mortgage Rates? - June 30, 2025