You may have seen or heard ads for a “no cost refinance” lately, a mortgage loan program that promises no fees or out-of-pocket expenses when you refinance your existing mortgage.

While this type of offer is by no means a new concept, or unique to any one lender, it’s definitely a subject worth visiting to ensure you understand what you’re getting when you choose this option.

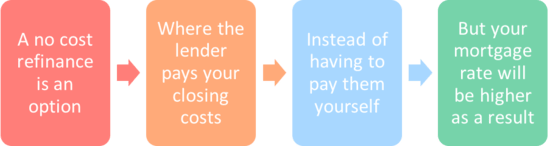

Ultimately, you’ll be given the choice to pay lender fees and third party closing costs out of pocket, or have them absorbed via a lender credit.

If you opt for the latter, you may not have to pay anything at closing, but in exchange your interest rate will be higher.

That’s the “catch” I suppose, but that doesn’t necessarily mean it’s a bad thing. Read on to learn more.

What Is a No Cost Refinance?

- A mortgage refinance usually results in out-of-pocket costs

- To account for things like lender fees and third-party services

- A no cost version means you don’t pay these fees directly

- But you might wind up with a higher mortgage rate as a result

A no cost refinance is a home loan transaction in which the mortgage lender pays some or all settlement costs on your behalf.

This includes typical lender fees such as processing and underwriting fees, the appraisal fee, and loan origination fees, along with third party costs like title/escrow fees and so on.

You may be asking yourself how banks and lenders make up for the absence of fees that normally must be paid during a mortgage refinance (or home purchase) transaction.

Well, assuming the lender actually pays your closings costs, doing so will bump up your interest rate, sometimes substantially, in order to make up for the missing fees that are typically charged to the borrower at closing.

No Cost Loan = Higher Mortgage Rate

- The tradeoff for a home loan with no fees is a higher interest rate

- It’s not a freebie (no one works for free in the mortgage industry)

- But it might be possible to get the best of both worlds

- If you take the time to shop around with different lenders

It’s a simple trade – pay nothing now, but pay more over the life of the loan thanks to a higher mortgage rate. We’re talking bigger monthly mortgage payments and more interest paid over the loan term.

For some borrowers, a no cost loan is a necessity because they don’t have the required funds on hand to pay all the fees at closing. But for others, it’s simply a decision that will need to be made during the loan process.

Assuming you have the cash on hand to pay closing costs, do you want to hold onto your money, or would you rather obtain the lowest rate possible?

If you allow the bank to pay these costs for you, you won’t receive the lowest rate possible. But you might be happy to accept a slight rate increase and put your money to work someplace else, such as in a retirement account or other investment.

Pay Attention to the Terms of the No Cost Deal

- Not all no cost refinance deals are created equal

- Some may just cover lender fees like origination, underwriting, and processing

- While others may also include third-party costs like title and appraisal

- Find out exactly what the lender is paying on your behalf before you proceed

The terms of no cost loans will vary by lender. Some programs may cover ALL closing costs, while others may still charge you for certain third-party fees such as appraisal/inspection, title, escrow, and even mortgage points!

For example, if a bank advertises a “no lender fees loan,” they will still expect you to pay for all third-party fees, along with prepaid interest, and any property taxes and insurance required for an escrow account.

Be sure to pay attention to what fees are and are not covered to determine if it’s a good or bad deal.

These deals can vary from one company to the next, so take the time to read the fine print.

Keep in mind that mortgage brokers can also set up a no cost loan for you, tacking on a lender credit to offset the fees typically associated with a home loan. This too will result in a higher interest rate.

Regardless of which path you choose, you can still attempt to negotiate a lower rate whether it’s no cost or no fee, like you would any other mortgage.

[How to Lower Your Closing Costs]

No Cost Refinance Example

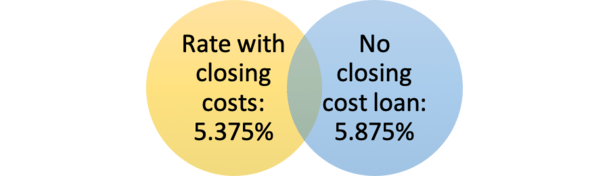

| $500,000 Loan Amount | Paying 1 Point ($5,000) | No Cost Loan |

| Mortgage Rate | 5.375% | 5.875% |

| Other Closing Costs | $2,500 | $0 |

| Total Upfront Cost | $7,500 | $0 |

| Monthly P&I Payment | $2,799.86 | $2,957.69 |

| Monthly Savings | $157.83 |

No cost refinance: 5.875% mortgage rate, NO fees.

Standard refinance: 5.375% mortgage rate, $7,500 in fees.

Imagine you’re able to qualify for a $500,000 loan amount at an interest rate of 5.375%, paying a point to the lender and another $2,500 in closing costs, totaling $7,500.

While this may seem like a large upfront cost, the trade-off should be a lower interest rate.

With a typical no cost mortgage, you’ll cruise through the process without paying a dime at closing, but you may wind up with an interest rate of 5.875% or higher for the very same loan.

Each month, you’ll pay an additional $157.83, or roughly $1,900 more annually if you select the no cost option at an interest rate of 5.875%.

As you can see, it’s a case of pay less now, but a lot more over time. You’re basically financing the costs you didn’t pay at closing, which will be more expensive in the long run.

Over 30 years, the higher interest rate equates to roughly $57,000 in cost assuming the mortgage is held for the entire loan term.

You Can Structure a Home Purchase Loan at No Cost

While these deals are often discussed in the context of a refinance, it’s also possible to structure a home purchase loan at no cost.

For example, say you’re buying a $500,000 home and the seller offers a 1% credit for closing costs. You’ve now got $5,000 to offset any lender fees and third-party costs.

On top of the seller credit, you might also receive a rebate from your real estate agent and/or rely upon a lender credit to absorb the remaining costs.

In the end, you might have a slightly higher mortgage rate, but more money left over to cover moving expenses, new furniture, and so on. This can boost liquidity at a time when it is often strained.

And it’s entirely possible that you’ll refinance in the near future if rates improve, at which point it won’t matter what the rate was on the old loan.

Just be mindful of the maximum interested party contributions (IPCs), which limit how much you can receive in credits (Fannie Mae source).

Granted, these limits are pretty liberal, so it shouldn’t be difficult to stay within acceptable levels.

Is a No Cost Refinance a Good Idea?

- In general, it can make a lot of sense if you don’t keep the loan very long

- Upfront closing costs usually take several years to recoup via lower payments

- So those who expect to sell their home or refinance again in a short period may benefit

- When shopping around ask for quotes with and without costs to determine the value

This is the point where you need to ask yourself what you plan to do with the property and the mortgage.

If you’re planning on moving or upgrading to a more expensive home in just a few years, or if you’re the type who refinances often, paying upfront costs for a lower interest rate will probably be a losing endeavor.

For you, a no cost loan may actually be a good choice because the rate won’t matter for than a year or two.

After all, there’s no reason you should pay for a lower interest rate if you’re only going to turn around and sell/refinance a few months/years later. You’ll probably never realize the savings!

But if you plan to stay in the home for five or more years (or whenever the break-even point takes place), it could make sense to pay a little more upfront for future savings.

Why? Well, that $200 discount each month might ease your budgeting woes in the future, and amount to some serious savings if you stick with the mortgage for the long haul.

The same goes for someone who buys a primary residence they plan to rent out in the future. You can secure a lower rate if you occupy it initially since rates on investment properties are higher.

So take the time to determine your projected tenure in the property. And also gather quotes with and without quotes.

No Cost Mortgages Aren’t Necessarily Good or Bad

To sum things up, a no cost mortgage isn’t inherently good or bad. They aren’t a scam and they aren’t magic. The money is either paid upfront or over time.

Their associated benefit or cost will really depend on your unique financial situation, what the fees are, how long you keep the loan, and what the interest rate impact will be.

Make sure you do the math and compare options before signing on the dotted line.

Also watch out for banks that “bundle” your closing costs on top of your loan amount, increasing the size of your loan, effectively making it a “no-cash loan.”

Though you may avoid out-of-pocket expenses and upfront fees, these costs are not lender-paid, and the loan is not a true no cost loan.

You simply pay the fees over the life of the loan instead of at closing. And you’re stuck with a higher loan amount to boot! Not necessarily a great deal.

As noted, you can also get a no cost loan for a home purchase, though it might take a combination of a lender credit, a credit from your real estate agent, and seller concessions to make it all work.

Lastly, don’t forget to negotiate your mortgage rate. It might be best to ask the lender what their best rate is first, then tell them you want a no cost refinance option as well.

That way you can see what the difference is without showing your hand. If you tell them right away that you want the loan at no cost, you may never know how low the rate could have been.

No Cost Refinance Pros

- No money paid out-of-pocket or rolled into the loan amount

- Can still obtain a low mortgage rate if you take the time you shop around

- Rate may be comparable to other options that require closing costs

- Even a higher interest rate may not matter if you don’t keep the loan very long

- Especially useful if you only plan to own for a short period (or plan to refinance soon)

No Cost Refinance Cons

- No closing costs means a higher interest rate in exchange

- You pay for the lack of upfront fees over time via the higher mortgage rate

- Your mortgage payment will be more expensive for the entire loan term

- Can cost you a lot more if you keep your mortgage for a long period of time

- May leave money on the table if entire credit isn’t used (make sure it is!)

Read more: Buying down your interest rate.

We have a 30 year loan with an interest rate of 4.25. 26 years left on the loan. Owe $40,000.00. Would a no cost refinancing be a good option?

Thank you

Nancy,

It depends what your goal is and what the new interest rate will be. You aren’t that deep into the loan so restarting it may not be an issue, though you’ll want to determine the savings based on how long you plan to keep the new loan.

Hi, just spoke to the mortgage associate regarding “No cost refinancing”. Current balance is 150K at 5%, was offered 3.875% at no cost + third party fees paid by the bank but the balance will be approximately $152K due to payoff amount + escrow + 15days of Interest charge…is this real? What is the actual benefit to the bank?

Anna,

Banks can offer no cost loans because they still make money by selling and/or servicing the loans. It doesn’t matter what your current interest rate is as long as they can make money on the new loan. Keep in mind that if you pay those closing costs yourself the interest rate would likely be lower, such as 3.5% for example.

Thinking about a cash out refinance. We owe $204,000 with 28yrs left on a 30 yr @ 4.25%. House is valued at $300,000. Would like to take $30,000 out with minimal out of pocket at closing. Am I dreaming? Thanks

Bob,

Why would you be dreaming? The LTV with the cash out would still be below 80% based on your numbers, though your rate may not be much better than 4.25%. Could also explore a second mortgage (HELOC, etc.) if the rate on the first is worse.

Question, please…

I owe roughly $160K on my home. It is currently valued at $240K. I need roughly $35-40K for home improvements. One bank is offering a cash-out refi at 4.125% interest rate, but only giving me $25K due to closing costs. However, this option does keep my mortgage roughly the same as it is now. Another bank is a heloc loan at 5.24% & no closing costs. Which is the better deal?

Amber,

It depends how long it will take you to pay back the loan, but you could probably get a first mortgage at a lower rate than 5.24% with no closing costs if they’re offering you 4.125% with closing costs. But you also have to consider the fact that if you refinance the first mortgage it resets the clock and interest is paid over a new 30-year term.

I owe 450k at 4.25%. A broker is offering 3.75% with $3300 lender’s credit to pay of all closing costs (about $2900) which are listed on the HUD-1. There is also a 1.25% YSP to the broker by the lender. This deal not only saves me money (about $200/month) but also costs nothing out of pocket. It also gives me the option to not have an impound account which I really want. Anything I’m missing or overseeing? Or am I being ripped off by the broker? I don’t know what my par rate is.

Broker says the lender’s credit will be shown once the loan is closed and not on initial disclosures which makes me a bit nervous. Is this how it is usually done?

Josh,

You could ask what the par rate is if you were to pay the closing costs yourself to see how low the rate could be. The loan also technically resets the amortization period if it’s the same term. And the lender credit should be on the Loan Estimate form.

My draw period is up in 3 months. Interest only payment on a cash-out will go from 370 to P&I of 1000/month(loan balance of 112k) Mortgage pymt is 800(loan balance of 90K). That extra 600/month will hurt a bit… refi fees are steep and its a condo/TH so will a no-cost refi benefit me? I plan on staying here for the long haul also. Please help. Average selling prices have been in the 250-260k range as of late. Thank you in advance.

Micah,

Chances are you can consolidate both loans into one and ideally get a good rate at 80% LTV or lower. Not sure what your current rate is on the first/second but rates are super low again. And yes you can ask about doing it with no cost for a slightly higher rate and no/limited out-of-pocket costs, but you plan to stay for a long time it might make sense to go for a lower rate and pay the closing costs. The fact that it’s a condo/townhouse shouldn’t have much effect on the rate, possibly none if you can get the LTV down to 75%.

My husband and I are in the process of purchasing a house through a short sale. A family member is gifting us the money to purchase it since it is a cash sale only. We will need to pay the family member back within 1 year.

I’ve been told in 10 months we should start looking into refinancing cash out loan. We would not have to put the 20% down providing the house appraises for more than the purchase price. And we will only get 80% of the appraised value.

Am I understanding this correctly or is there something I am missing?

Lynn,

It would rely on home prices rising enough to appraise at the value you need/want…meaning there’s no absolute guarantee since no one knows with certainty where home prices will be in the future.

I refinanced a VA loan, at no cost to me, last winter. My current interest rate is 3.5%. I keep getting flyers about very low interest rates. The new Loan Estimates and Closing Disclosures are harder to read than the old Truth-in-Lending HUD forms! There was a mistake when I closed on the VA IRRL (Interest rate reduction loan) with regard to the settlement agent information not being correct so I have two Closing Disclosures (the first one with the error and the second, corrected one) that show an $1170 increase from the Loan Estimate to the Final in the line on page 3 that says “Down Payment / Funds from Borrower.” I did not pay a down payment to do the IRRL. There is some type of scam going on but I am not smart enough to see it.

Faith,

If you have a 30-year fixed, 3.5% is a seemingly great rate…it doesn’t get much lower. Not sure what the $1170 is for…could ask your loan officer to explain.

I currently have a 3.5% IR on a VA Loan which I just found out I can have reduced to a 3.25% IR. There are no fees or closing costs with the refi and they say that I will save $40K in interest and $59 on the monthly note. We have $193,375 remaining on the loan. The thing is we never readjusted our original loan payment so we have been paying $145 every month to the principal, which we would add the $59 and just continue the course (along with bi-weekly payments to get the extra payment a year). So is this quarter reduction worth it? My other half is apprehensive because following the first refi we had to pay taxes. Your thoughts?

Byron,

The refi will restart the loan, which could be a negative if your goal is to pay it off in full and it’s already been paid for several years. And a quarter percent isn’t a very big drop in rate. Have you considered a shorter loan term if you’re currently on a 30-year? The rate would be lower, monthly payment higher, but interest savings also higher (and paid off faster obviously). Ultimately you have to compare total costs of both loans side-by-side to get the entire picture and determine which is best for your situation. Make sure that $40k figure is accurate and factors in your current special payment setup that you mentioned. Not sure what taxes you’re referring to.

Interesting post. I think the main thing you left out was the benefit of no cost refi’s when it helps reduce your mortgage rate. I’ve been in the industry awhile and have been don’t these types of refinancing for my clients to help them reduce their rate upwords of 2%. Those closing costs can be hefty but if it helps save borrowers $200/month, why wouldn’t you refinance?

Colin

We were in the midst of closing last week, and the day before closing the deal fell through (buyer couldn’t fund). I am moved out in an apartment in one state, my wife is an an apartment back by the house.

We now have three monthly payments; we are still selling, and are seeing great market interest in the house, so would it be prudent (if our goal is to sell in the next 2-3 months) to ‘no-cost’ refi to lower our monthly obligations?

Thanks kindly

Michael,

Sure it can benefit the borrower and still be no cost, I just like to point out that there is indeed a cost, and the rate could be even lower.

Marc,

Lenders would likely frown upon this if your intention isn’t to occupy the property for more than a month or two. It could also get hairy if you do wind up finding a buyer right away, or if the lender sees that you recently listed the home (on MLS records) and denies the refinance request on that basis.

Would you recommend refinancing if have a 103k balance at 4.5% and will pay off in 3 years. Thinking we will pay about 8000 in interest over that time and any savings off that in refinancing would be negated by refinance fees?

Thanks

Mike,

Well, if you’re able to do it at no cost and snag a lower rate and thus save money on payments each month without incurring any out-of-pocket costs it could make sense. Paying fees that won’t be recouped in three years might not be wise.

Hi Colin,

Thanks for the article. I am looking at a no cost refi right now but I learned as I was going through the paperwork that like you said, the cost is bundled in there; in my case it’s into the loan. We currently owe $342k and have an interest rate of 4.125% on a 30-year loan that matures on 2/1/2042. We are considering a 15-year fixed refi with a cash out for remodeling and are being told we could get around a 3% rate. I was told we only had to cover the appraisal fee but I see fees like credit report, tax service fee, underwriting, title charges etc totaling over $4518 that will be paid from the loan amount, but I do also see a lender credit of $1500. Our monthly mortgage payment will go up significantly, but we wanted to pay our mortgage off earlier, thus the move from 30 year to 15 year. Bottom line though, are we making a smart decision if we plan on doing a remodel and plan to stay for the long term? Should we look into paying the costs upfront to see if we could even get a lower rate? Thank you in advance!

Would a no cost benefit me if I am refinancing to a 15yr mortgage from a 30yr.

Mac,

It definitely could, though my assumption is most folks looking to switch from a 30-yr to a 15 would seek the lowest rate possible, which would generally mean paying for closing costs. But it’s possible to find a lender with a lower rate than others and no fees if you shop around.

Hi Colin,

This is a great article – thanks for the informative words! Mortgages are exceptionally complex to me and I get buried in the math and jargon.

I bought a $375K house two years ago with an 80/20 loan (due to minimum equity on the loan) and am looking to lower rates with a no-cost option as well as consolidate the loan. Appraiser rated the house at $395K, so we’re still not close to 20% equity yet but no escrow is a requirement for us, given we can make 15% floor through an employee stock purchase program vs letting it make nothing for us in an escrow account.

Current offer on the table reduces rates on both primary and secondary loan rates with ~$2600 in closing costs rolled into the loan. My wife and I don’t plan to be in the house long enough for the math to work out long-term, but the lower payments month-to-month are attractive.

I usually think if a deal is too good to be true, it usually is, but I don’t see any downside except for a couple thousand I’ll make up in 21 months or so. What am I missing? Thanks in advance!!

Rob,

There’s no real catch…it’s really just based on how long you keep the mortgage. Put simply, it makes sense to pay for a rate if you keep said rate for a long enough time to recoup the cost and save monthly. And vice versa. So those not keeping their mortgages long term usually don’t benefit from paying upfront.

I just bought a home 6 months ago for 168k for 30yrs at 4.15%. A no cost refinance has been offered by the same lender at a 3.25% with nothing changing in loan parameters. Looking over the contract I see an increase to the new loan for 10k. But, my new loan saves me $80.00 a month. I see that saving is the point and I still save about $5000.00 over the 30yrs.

Question, should I be surprised to see this when I was told it’s a no cost loan.. Obviously it’s not.

Robert,

As I pointed out “no cost” just means no cost out-of-pocket. There are still loan costs either rolled into the loan or absorbed via a higher interest rate than what you could qualify for. The rate might be even lower if you pay your closing costs, or don’t add them to your loan balance. But yes, it’s possible to go no cost and still save if your current interest rate is that much higher than prevailing rates.

Hello, I have a question about – Zero points ,zero cost with no fees rolled into your loan – what does this really mean

Currently I have a 270,000. loan with an interest rate of 4.25 % 30 year – FHA

I wanted to take 30 k out of our equity for home improvements

New loan would 300,000.00 with 4.25% 30 year-FHA with cash out

is this smart I’m not sure , nothing is No cost i understand we will be paying somewhere but not really sure where these cost would be in our loan…..

Kimberly,

As noted, you pay for the no cost benefit via a higher interest rate. So if they’re offering you 4.25% with no cost to you, it might be 4% with closing costs, for example. So you pay over time via the higher rate as opposed to upfront.

Right now I have a 15 year mortgage at a 3% IR. In 2015 I was layed off from my job. I am now self employed but only for a year and a half. I am having trouble keeping up on my bills. I have a great credit score (790) but not enough income for the bank to refinance my current loan to a 30 year mortgage. I owe $122500 on my house and the value of it is $210000. I haven’t missed one house payment. I have had the 15 year loan for 5 years. What should I do?

Joe,

Might want to speak with a broker or two to see if anyone can work with limited self-employment and/or limited documentation to get you a lower payment…I’m assuming you’d want to stretch to a 30-year term. A refi could drop the payment significantly with both a longer loan term and a payment based on the much smaller $122,500 balance. You might need to wait for the 2-year mark on the self-employment for more options to open up. Good luck.

Thanks in advance!

Current loan: 18 years left on a fixed 6% – $375k

Proposed new loan: 15 years @ 3.375 %

Payments will stay basically the same

New loan would incur loan costs of $5735 with $4613 as cash to close.

Is this a worthwhile expense? The question has come up whether it would make more sense to make one or more extra payments per year and effectively shorten the loan that way. Most appealing aspect of the new loan is the idea of paying off in 15 years.

Monica,

The 15-year term is good in that you don’t reset the clock, assuming you want to pay off your mortgage. As for it being a worthwhile expense to pay thousands at closing, you’d have to compare total loan costs if you were to make extra payments on a slightly higher rate loan with no closing costs (or lower ones) versus the loan you were offered. You basically need to decide if paying closing costs make sense depending on your repayment plan. Paying extra has the potential to both shorten the term and save you interest, even if the rate is higher. Also determine what the closing costs are, if you can lower them somehow, or find a better deal elsewhere and get best of both worlds.

Explain the difference between a Home equity loan and a mortgage loan. Currently I have a 1st mortgage and a heloc. My interest is high and I want one loan payment .I also want to take 30k out for home improvements

Currently have a balance of $289k on 30y 4.25 mortgage. 24 years remaining.

Offered a no cost 15y refi at 3.65, with just $1500 lender fees. New monthly payment will erase PMI saving me $130. Total number increased monthly payment of $300, but all that and some going directly to principle each month.

Plan is to move in the next 1-3 years. Home value of $365k.

Does this make sense?

Shawn,

First, you may want to question the no cost aspect of the deal if they’re charging you $1,500 in lender fees. Secondly, if you don’t plan to stay very long, any fees whether charged out-of-pocket or rolled into the loan may not be recouped. Paying to refi for just a year or so of lower payments may not be cost effective. Conversely, if you keep a mortgage for a long time, the lower rate saves you more money, even if there are upfront fees to get said rate. As far as going with a 15-year, that’s a personal choice that will pay down the mortgage a lot faster, but increase monthly payments. If you want to pay down your balance before you move then it can be a good choice. If you simply want the lowest monthly payment, the 30-year should be considered as well.

Hi Colin,

my mortgage has just been sold to a company. Upon reviewing this company on consumer reports and other sites out of 500+ reviews on consumer reports they have a 1 star. This terrifies me. The most common complaints are their mortgage keeps increasing. The complaints don’t say if they have arm loans, in that case well yeah the mortgage will increase. Yet, some of those complaints say the company is saying it is due to escrow. My understanding is the company cannot have more than 1.6% over the estimated tax and insurance. So I am not sure how their mortgages are almost doubling. I am wondering if refinancing is the best option. I understand at some time whom ever has my mortgage can sell it to this company again. I have 24 years left on my current mortgage owe about 90,000 and the house is estimated at 196,000. I would love to take some maybe 15,000 of the equity and do some renovations. My biggest problem I don’t have closing cost. I do plan on staying in this house for many year as I grew up in it. what do you think is best stay with this current mortgage company and keep very good records of all my payments and escrow accounts or refinance with a no or low cost?

Satin,

I don’t know if I’d refinance just because a new loan servicer with poor reviews had my loan. But you said you may want some cash to do renovations, in which case you can look into a refinance of your first mortgage if favorable, or consider a second such as a HELOC or a home equity loan instead. A second might be cheaper and easier, though it wouldn’t get your first mortgage away from this company. Again, who knows the truth about those reviews and what really happened. Best to compare pros and cons of all options and go from there. Good luck.

Hey, Colin

My house is valued at 190,000, with about a 110,000 payoff, with about 9 years left. I need about 20K to pay off outstanding credit card, taxes, and medical bills. Would also like another 10K for home improvements. Decent income (50/55K) but poor/so-so credit (620/650). I would

like to lower my monthly outlaw, as I am maxed out as of now, but do not want to go past another 15 years of new mortgage. I’m 52 and want to be able to own my home free and clear at retirement, then maybe sell it and pay cash for a retirement home out in the country. I’m thinking a cash out refi is my best option?

How do I keep from getting ripped off? I’m not good with this type of stuff…….

Tomsp8,

It depends if your current first mortgage is set at a low rate or not. With your so-so credit, you may not want to get rid of the old mortgage if it has a favorable rate and nearly paid off. Instead, there might be an option to add a second mortgage if you don’t want to mess with the first. But this will increase your monthly outlay, obviously. If your current mortgage rate can be improved (since rates are so low nowadays), a cash out might be the better option to avoid paying more each month while getting the money you need. Just note that you’ll restart your mortgage and take on a higher rate than what’s possible because of your marginal credit. You may want to see if you can clean it up a bit before applying to get the best rate possible. To ensure you’re getting a good rate, it’s advisable to compare multiple lenders so you know what’s out there…and have something to compare it to. Good luck!

Hello Colin,

I have 1st at 3.5 w/10yrs left and a HEL at 3.6 that closed in Apr 2017. The 1st owe 109,000.00 and HEL 48,700.00. Do you think it wise to refinance at any point to merge into one mortgage again?

I owe 183,000. the house is worth per city tax 384,000. our interest rate is 6.5 and we have a low credit score of 640. we have 20 years left. we are thinking about refinancing with our bank. My goal is to pay off 43,000. in debt and lower my house payment. we have a 30 year loan. would it be advised to refinance to a lower interest rate and a 15 year loan.

Ari,

It could be because the Fed is expected to raise rates (which will raise Prime and the rate on that HELOC). But you’ll have to do the math to determine the best structure.

Kathy,

Rates are closer to 4% these days for a 30-year fixed, maybe a bit higher because of your lower credit score. But there’s a decent chance you can get a lower rate. As for 15-year term, that’s up to you. If you want to pay off your mortgage faster, it’s one way to do it. And if you get a rate low enough, the monthly payment could be similar to your existing 30-year payment at 6.5%.

Hi Colin,

My Mortgage servicer contacted me about refinancing my FHA loan, to reduce my rate from 4.75% to 4.25%. They are saying it will be no cost to me. Is it normal for the Mortgage company that is currently servicing your loan to contact the customer to refinance at a lower rate?

Is there a chance they are trying to get something over on me?

Mike,

It’s pretty common – they probably just scrub all their accounts to determine who could “benefit” from a refinance then go from there. Whether it’s a good deal for you or not depends on a number of factors that you need to assess personally. In general, I like to shop around instead of taking the first offer that comes to me, regardless of what it is that’s being sold to me.

Hi Colin,

We have a 3.75 %, 15 yr. mortgage with a current balance of $255,000 with 7.5 years left. The home value is approx. $650,000+. Current monthly payment is $2650, we are entertaining a thought of a no-cost refi to lower our payments. We have an offer of 30 yr. mortgage that will decrease our payment by $1000/mo, with no prepayment penalties..

Steven,

It’s up to you…obviously the monthly payment will go way down because you’re starting a fresh 30-year term with a small loan balance…the downside is you’ll pay a lot more interest over the next three decades if you refinance and keep that new loan for a while. So it’s your decision if you want payment relief now or interest relief.

Hi Colin,

I have started process of refinance with an online broker at 2.74% interest rate for 15 yrs. balance on my current loan is 272K and it’s for 30 yrs.

Lender has provided me the loan estimate disclosure with fees. Some fees are borrower to lender and some are borrower to third party (such as Appraisal, etc). Me and broker talked about low cost and he and I agreed that I don’t need to have an appraisal. Now if I had an appraisal I would have paid that cost upfront. I haven’t paid any cost for appraisal so far. However, he gave me loan estimate disclosure which has appraisal fee mentioned with all other costs. I asked him about it and he said it will be removed at later point once we are close to finalize everything.

My question is how much trust I can put in his words? Should I trust what he is saying and wait for final figures or should I fight from now to get that fee line item be removed from the estimate?

Note: one thing is sure there won’t be any appraisal happening that I know for sure.

Thanks Kruz.

Kruz,

Hmm, might be listed there in case there is in fact an appraisal required and as a safety measure for him to disclose it upfront. That being said, he might be right that it won’t be ordered, but may not be 100% sure.

Does it make sense for us to refinance from our current FHA loan @ 3.625 rate to a “no cost” conventional loan @ 4.25-4.375 rate?

Hi, I currently have 25 years left on a 30 year mortgage, 3.75% APR. I spoke with my existing mortgage company today about refinancing to a 15 year conventional loan to get rid of mortgage insurance on my FHA loan. She said that my interest rate would still be 3.75% and I would have around $2200.00 in closing costs. Is this wise, or just wait for the PMI to drop off and go with it? I already pay an extra $150 to principle a month, so the difference in payment would only be $8 a month extra. Thanks

Cathy,

It depends on the total cost of the monthly payment (including mortgage insurance) and what your goal is with the loan…e.g. lower payment or pay off mortgage faster…

Christine,

You could shop around and see if other banks/lenders can beat your current rate and do so with little or no closing costs. A 15-year rate should be lower than a 30-year. Typically, existing lenders don’t offer very good refinance deals unless rates have fallen substantially, but outside banks are generally happy to swoop in and offer better.

Hi,

We just closed the house 6 months ago at 4.15 % interest rate for 30 years fixed on a $450000 house with 10% down.

My mortgage broker called and said we can do zero cost refinancing for 3.125 for 15 years fixed

or

2.875% for 15 years fixed with closing cost which he says will be approximately $2000. We have about $395000 loan left.

We are planning to stay in this house for at least 10 years.

Please advice which is better no cost refinancing at higher rate or closing cost at lower rate.

Sal,

Basically try to figure out your breakeven point where the $2,000 costs are recouped via the lower payment attached to the 2.875% rate. If it’s well before 10 years, it may be the better deal for you, despite the upfront out-of-pocket costs.

my mortgage lender is saying it will go further down so no need to spend money on closing now, is that a good idea, when I calculated looks like we will save $4000 over the 10 years going with lower interest rate and paying the closing costs. What do you think?

Sal,

It’s up to you. If you can handle the larger payment of the 15-year fixed and want to pay down your mortgage quicker, as you said, it can save you some money.

Colin:

In the process of refinancing my mortgage from 4.5% to 4.125%. I currently owe $349K, with the refinance returning the loan to $358K. My question is: when the underwriter rejects the loan file due to questions on your credit report can this take up to 60 days (questions were concerning my student loan consolidation). Also, is this a way to boost the closing cost considering I have had several rate locks and the mortgage rate increase from 4.00 to 4.125 over this time period?

Wenn,

If you’re saying the lender delayed the closing, ideally they would cover the extension costs, but if some of the blame falls on you, the costs may also. Rates may have fallen since you first applied though, meaning it may be possible to let the lock expire and relock at today’s pricing, assuming they allow it, or apply elsewhere for better pricing.

Hi Colin,

I want to refinance my mortgage on a rental property (I don’t own another home just had to move out of the state). My credit union would refinance because it’s a rental. I still owe $116k on the $136k on the 40 year mortgage at 5.375% but pay $350 extra a month on it with the rental income and still save money. I want to get $65k out to pay off my remaining student loans and have money for a down payment for a house in the state I’m now living in instead of continuing to pay $1850 a month in rent. Should I refi my house to do this or just continue to pay down my student loans and save money on my own to gather a down payment for another home? Keep in mind, I can’t save much while I’m paying off the student loan debt, I’m throwing money at it like a stripper on a pole. It’ll take me another 8 months to pay them off if I don’t refi.

Jennifer,

Not sure how you’d be able to get $65k out if you currently owe $116k on a $136k property. I’m assuming it’s worth more and the $136k was your original loan balance? Anyway, the choice is really yours and depends on the interest rate of the student loans and what the new refinance rate would be on the rental. The downside with rentals is that the rates are higher than primary homes and it’s harder to get a higher-LTV loan. But it depends how high the LTV is, and with rates a lot lower than the mid-5s these days, it could be something to look at. Really just have to do the math, make a plan, and consider the alternatives and how they stack up. Also have to consider if you want to pay off the rental or take on more debt, though a shorter-term mortgage and lower rate may pay down the balance a lot quicker than the current setup. Good luck!

Hi Colin,

My home is worth approx $237,000 (accord. to Zillow) I owe $90,863 on the 1st with a 3.125% adjustable rate and $30,927 on the HE with a 4.125% rate. My payment on the 1st is $572 & going up in Jan to $605. Payment on the HE is $315. I would like to refinance & combine the loans, pay off some debt ($16,500) get a low rate, & take out some money for renovations while keeping my house payment close to the same. My credit score’s are excellent (757, 754) I came close to getting approved through a credit union a year ago but they denied my refi at the last minute because my only source of income is maintenance/child support that at the time was going into a joint account with my ex husband. I set up an account in my name only & showed that history for 6 months (what they wanted). I went to reapply & they said no because the amount deposited didn’t match the amount in the divorce decree (he was deducting money from my check for kids insurance) Sorry for the long email but I’m recovering from a divorce where my ex handled the finances. First, am I dreaming to want all this? & second is it typical for the lender to want to see the specific maintenance/child support amount from the divorce decree deposited in my checking account for 6 months before they will revisit my application or should I look for another lender? I have a lot of health problems and am not able to work at this time & am wondering if that’s part of the problem. I have maintenance for another 4 years and have contacted a lawyer to look into applying for disability.

Stephanie,

Generally, when it comes to underwriting stuff like that, they want to paper trail and document everything so it all adds up, and more importantly, makes sense. Perhaps if you can prove the difference in those child support and post-insurance child support deposit amounts with another document that details the cost and purpose of the insurance, it might be sufficient to the underwriter. But they all have their own modus operandi and comfort level. The loan officer might be able to communicate this to the underwriter to see what will work beforehand so you know in advance what you’ll need to get that approval. Good luck!

Question

Would is be better to refinance to pull money out for remodel or obtain separate financing from company doing the remodel?

LaVerne,

Good question. Part of it has to do with the current state of your mortgage. In other words, if you can refinance and also lower your existing mortgage rate while getting the cash you need, it could be a win-win. But if you refinance only to get some small sum of money and make your mortgage more expensive in the process, it might defeat the purpose. It also depends on the financing terms of the remodel company. Another option is a home equity line or loan behind the first mortgage used to pay for the renovations that doesn’t disrupt the first, assuming you like where your current mortgage is.

Hi Colin, Currently my loan is 4.65% apr took on Sep/2018. and I m seeing the interest rates are down now. One of the mortgage broker offering me NO COST refi for 4.35% with an overall save of $140/mo approx. is that a good deal? Also, will my amortization schedule extends if I go with this refi/30 years fixed?

Am I gaining or losing on this transaction?

If you take a new 30-year fixed, it’ll extend amortization by how many years you’ve already paid plus 30 more. In your case only 31 years total give or take so not as dramatic as perhaps other refinances. It’s possible to offset this resetting of the clock by paying extra each month to stay on the original 30-year schedule if your goal is to pay it off in full. Could also keep shopping and see if other lenders can get you even lower than the rate you quoted. Generally a lower rate with no costs will save you money but as noted you have to consider loan term as well. Good luck.

Hi I have an FHA loan that is a 30 year at 5.875 interest. I still owe roughly $63,000 on the loan and the house is worth about $250,000. I would like to refinance to a 15 year at a lower interest rate to lower my payments. I would prefer not to pay out of pocket. My understanding is that it is not a good idea to stick with FHA and instead go traditional. Is that correct? And if I do FHA does the PMI start all over again even though I no longer have to pay it now? I honestly have no idea what I’m doing so I could use some advice.

Wendy,

With regard to mortgage insurance, all new FHA loans are subject to it, so it’s something you’d want to avoid on a loan with such a low LTV,and thus go conventional instead. In terms of not paying out of pocket, it’s possible with just about any lender. Your rate is just going to be a bit higher to compensate for lack of fees, but shopping around can help ensure you get the best rate regardless. Also consider a short term on new refinance loan to avoid paying a ton more interest. Good luck!

So I have about $250k left on my loan and about 28 years left. Property is valued at $330k. My original loan was at 275k and I have PMI due to a small down payment of 5%. The mortgage broker says he can get me a 0 out of pocket refinance and knock off my PMI and bring it to a 20 year loan with payments going up only about $200/month (including what I save from knocking off my PMI which is about $130/month) Is this something that is advise able? I am not planning to stay in this house for more than 6 years.

Tofeeq,

It depends what your goal is – to save money on monthly payments or pay down your mortgage faster. The proposed refinance will mean more money going toward paying off the loan, as opposed to going toward interest and PMI. Consider what the remaining loan balance will be after those six years if you keep your existing loan versus if you do the proposed refinance. That should help you determine what makes the most sense.

I am refinancing my home I have 25 years left so I am going back to a 30 year loan. My rate now is 4.25 and they are offering me a 3.00 rate. my payment will go down by $253.00 a month. They are only charging me 2087.00 in fees. Does this sound correct??

James,

Doesn’t sound unusual given rates have plummeted in recent weeks. This is exactly why millions of homeowners are refinancing their mortgages.

Hello, I have a home valued at $665,000 currently and a balance of $279,000 with 22 years left on mortgage @ 4.25%.

I would like to build a new unit on property and cannot decide whether a Cash out refi or Heloc would benefit me. I seek $200,000 to complete project. My credit score was 756-774 and drastically dropped this month to 720 with Experian. What advise could you provide?

Eddie,

You’d have to get rate quotes for both products to compare, but it could be cheaper to go cash out if you can lower your rate in the process. You might also be able to refinance to a shorter term like 25-year or 20-year fixed to avoid restarting the clock, assuming it’s affordable and you want to pay it off.

I have 2 investment properties that I am thinking of refinancing. I owe $679,246 on one with 4.75% interest (this property was purchased in 2019), it’s a duplex, and I owe $627,145 on the second one with 3.5% interest rate ( this property was purchased in 2018). I don’t have a problem paying the closing costs upfront, but would like to make these loans 15 years at the lowest rate possible. Can this be accomplished or am I wishing unrealistically?

Fay,

The refinance can probably be accomplished, but not sure how much lower you’ll get rate wise if at all. You’ll have to shop around to see. Another option, assuming rates aren’t favorable, is to pay extra monthly to amortize it like a 15-year fixed.

Hi Colin

We currently have an adjustable 30 at higher than current rates. Property value is $600k, mortgage is $291k with HELOC of $13k. We would like to combine and then take out between the $20-30k for home improvements. Best rates have been for 30 year. Any advice on best way to go?

Patricia,

Makes sense to combine the loans into one along with the additional cash out. Would still be a very low LTV based on $600k property value, meaning mortgage rate should be very competitive assuming credit is good too. From there it’s up to you what type of loan to choose – 30-year for lowest payment, or 15-year if you want to pay down mortgage faster and not restart clock.

Good Day Colin,

I am so consumed and scared to make a decision on whether to refinance. My loan was sold “again” and this time something isn’t right. SPS sent me my first two statements and the amount is a higher rate and my monthly went up. I thought with all the Federal rates changing to around 1% I would see a smaller monthly and rate. So I was thinking maybe I do a No Cost Refi. My current rate is 4.84083% and as I look around I am so unsure of who is honest and how to move forward. I don’t have cash available, and now my monthly mortgage went up from 1,300. to 1,500 and I can’t afford it. But I don’t want to add years to my loan since I am half way done and only have 15 years left. HELP??

Hi Poiema,

Not sure what type of loan you have currently, maybe it’s adjustable? But 15-year fixed mortgage rates are close to 2.5% at the moment, so it might be possible to switch to that program if you don’t want to start over without a big jump in payment, especially if your outstanding loan amount is much lower today. Or alternatively pay extra each month on a 30-year fixed (pricing around 3%) so it amortizes like your original loan schedule. Definitely options with rates so low today. Good luck!

Hello Colin,

Thanks for all of the info posted here. Question for you.

I have a current 30yr mortgage which I am 9 years into already with a rate of 3.75% I am putting an extra $500/month on the principal with the intent to pay down as soon as possible. My estimation is that I can knock off about 10yrs of the remaining 21 by doing so. My question for you is whether it is worthwhile to refi with the hope of lowering my rate to near 3% or lower. I want to pay the loan off as soon as I can with the least amount being put out. Having trouble in discerning if it is worth it to have some cost associated with the refi in order to get a lower interest rate. I would probably still want a 30yr mortgage so as to not be locked to the 15 but would continue to put extra cash to the principal.

Would you recommend staying put or doing a refi? Credit is not an issue BTW.

thanks,

Matt

Matthew,

Ultimately, one looks at the breakeven point of the refinance to determine when the savings will start, based on recouping upfront costs. But since you’d be paying extra each month, you kind of reduce the impact of a refinance because the savings from a lower interest rate aren’t fully realized.

Run the scenarios through a calculator to see the aggregate interest paid if original loan is kept, based on your extra payments, vs. refinancing to a lower rate and new term, including your extra payments. You may find it to be similar if refinancing to another 30-year term. But it depends on the interest rate difference and how long you’ve been paying extra, etc.

Hello Colin

I am currently 3 years in on a 30 year loan at 4.0% and am looking to refinance at zero cost. Current loan size is about 470K. I believe a no-cost refi would be practical simply because rates are so low, currently around 2.9%. Am I correct in my assumption? About how higher 2.9% would the lender’s rates be for No cost refi?

thank you

Stephen,

The choice to go no cost or not no cost depends on several factors like whether you want to pay more and keep the loan a long time, and thus benefit from a slightly lower interest rate. Or if you want to take a slightly higher rate, which as you said are super low at the moment, in exchange for not having to pay anything at closing. The decision is more about how long you plan to keep the house/loan and what else you’d do with your money, e.g. invest in the stock market or elsewhere. One could argue to lock in the lowest rate possible right now assuming they don’t go any lower, but they continue to surprise us and break new records, so there’s a chance a lot of people could be refinancing again if that happens, which would benefit the folks who went no cost.

Are no cost refinances usually no fee refinances? How often do the closing costs of prepaid interest and escrow actually get covered by the lender? Since escrow for the new mortgage typically gets returned from the old mortgage, isn’t the prepaid interest and escrow essentially the lowest reasonable cost to the client?

Ab,

No-cost and no-fee are mostly synonymous. Typically, a lender will at least cover their own fees, like loan origination, and sometimes third-party stuff as well like title and appraisal, but not always. It depends how large of a lender credit there is, and what the total costs are. Either way, they can often structure it where the borrower pays nothing out-of-pocket. The big question is how high your interest rate will need to be for that to happen.