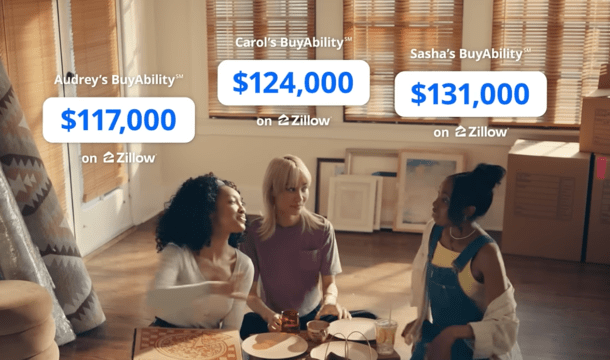

Recently, Zillow began airing a commercial called “Homeowner Mates.” It depicts three women moving into a home together.

It shows their individual “BuyAbility” followed by “Your BuyAbility,” the latter of which combines the purchasing power of all three.

The three women have individual buying power of $117,000, $124,000, and $131,000, but a combined $372,000 when pooled together.

This apparently allows them to go in on that near-$400,000 home purchase, despite not being anywhere close on their own.

While having co-borrowers does indeed boost your purchasing power, the question is it a good idea when it’s a friend (or two)?

It’s Hard Enough to Buy a Home on Your Own

When I first saw this commercial, I was pretty taken aback. It felt somewhat irresponsible, and a lot related to the current housing market being unaffordable for most.

For me, that doesn’t mean forcing your way into a purchase. It might mean holding off on your homeownership goal, saving up more money, perhaps hoping for a raise, and generally getting all your ducks in a row.

Oh, and maybe lowering your maximum purchase price to something you can actually afford!

Instead, Zillow presents a solution to just find a couple close friends and buy the house today.

It pretty much ignores what happens after the dust settles and the moving boxes are unpacked.

It doesn’t get into what happens when one of the roommates wants to move out. It also seemingly glosses over who gets what room, or what happens if one of the co-owners loses their job.

Simply put, it presents a very simplistic view of homeownership, without giving us the whole picture, which could get pretty dark in a hurry.

Ultimately, it’s hard enough to be a homeowner without having to discuss all the what ifs with two other people.

It’s a big decision to buy vs. rent, and exponentially more complicated once you multiply that by three individuals.

Homes Are Too Expensive for Many Americans Right Now

Making it all much worse is this commercial only exists because homeownership has fallen financially out of reach for many Americans.

Clearly the people behind the ad got together and said what are the main pain points for prospective home buyers right now?

And they likely all agreed that it’s too expensive for most to buy a home thanks to a combination of high home prices and elevated mortgage rates.

But instead of recognizing this, they found a creative workaround to tackle the affordability piece, regardless of what the outcome might be.

Ironically, the commercial says, “That’s when buying a home got real.” When the three women pooled their incomes together to make it work.

Sadly, they probably don’t know how real is will become after living together and paying the mortgage for a year.

It’s hard enough to rent with a friend without facing all sorts of pitfalls. To buy a home with a friend and do so successfully sounds like the feat of all feats.

In other words, it probably won’t go well for most. And how do you even work out who gets what if someone wants to move out?

This all sounds so complex, yet is juxtaposed by the three women eating pizza and joking about one of them breaking the other’s vase.

My guess is that would be an afterthought once real problems reared their ugly head.

Maybe It’s Just Not the Right Time to Buy a Home…

As I wrote in my other piece, Marriage and Mortgage May Not Mix, it’s perfectly fine to rent initially, especially if your wedding date and the housing market conditions don’t exactly line up.

The same is true here. There doesn’t need to be a rush to buy, nor do you need to force the issue if it doesn’t feel quite right. Or simply doesn’t pencil.

While I am a huge advocate of homeownership and believe it brings with it a lot of positives, it’s not for everyone. Nor is it always the right time.

I’d personally never buy real estate with friends, and probably not even with family when it came down to it.

Take the time to really think it through if you’re considering this. What will it look like to own a home with your friend(s) a year from now, three years from now, or five? Will you sell at some point or rent it out?

You’re going to need a serious plan if you expect to pull something like this off. Even those who purchased a home recently on their own are feeling the heat.

Now imagine several people dealing with conflicting emotions at the same time. It’s not for the faint of heart.