When you take out a mortgage, whether it’s a home purchase or a refinance, you must pay “closing costs.”

These costs can vary considerably from transaction to transaction, but typically amount to 1-6% of the purchase price or loan amount.

For example, on a $450,000 home purchase you might pay $13,500 (3%) in closing costs. Ouch!

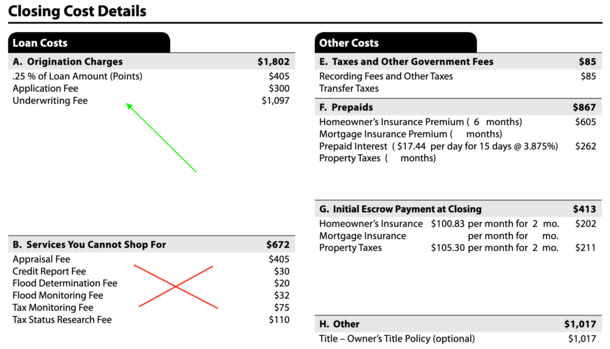

The reason it’s so pricey is because of the many people involved in the home loan process.

There are fees that must be paid to the bank/lender, and fees that must be paid to third parties, such as title/escrow and insurance.

Along with optional costs such as mortgage discount points, which lower your interest rate.

You will also have to pay for various inspections, a home appraisal, property taxes, per diem interest, and much more.

Whether you pay these fees out-of-pocket is another question, but either way there will be a cost, and you must pay it in one way or another.

Key Takeaways on Reducing Mortgage Closing Costs

- Closing costs vary widely by lender, loan type, and loan amount – be sure to shop fees too!

- Fees differ because some lenders bake costs into rates while others itemize fees

- Negotiate everything: Haggle with lenders, tell them you have other quotes, ask for discounts

- Agent credit: Ask your real estate agent for a commission rebate to reduce your costs

- Seller contribution: Ask the sellers to offer a credit toward closing costs

- Lender credit: Ask the lender to give you a credit to offset their fees and third-party ones

- Lower upfront costs (via a lender credit) might mean a higher rate but it can be worth it if you don’t plan to keep the loan long term

- On a refinance demand a “reissue rate” for title insurance (it’s cheaper)

- Closing late in the month reduces prepaid interest and can mean less cash out-of-pocket

- Shop around and you might be able to get a low rate AND low closing costs combined!

How Much Are Closing Costs on a Mortgage?

- There is no set amount that everyone pays in mortgage closing costs

- Fees can vary substantially based on the loan amount and loan type

- And the lender you choose to work with (also time of the month when you close)

- Typically range from 1-6% of the purchase price or loan amount

Closing costs can vary tremendously from one home loan to the next.

It depends on a number of factors, including your loan amount, the way you structure your loan, which lender you use, and when you close during a given month.

For example, if the lender you work with charges a flat 1% loan origination fee, that’ll cost $10,000 on a $1 million purchase and $5,000 on a $500,000 purchase.

Further complicating this is the fact that not all lenders charge origination fees directly. Some may simply bake it into the interest rate.

Additionally, some may charge separate loan processing and underwriting fees, while others may not.

Next, you need to determine if you’re paying discount points to obtain a lower mortgage rate, or if you’re simply taking the par rate offered. This can greatly affect total closing costs too.

Then there are third-party fees, such as title/escrow and home appraisal fees, which can vary significantly as well.

Additionally, you need to consider prepaid items like property taxes, homeowners insurance, and interest, which could amount to a big sum if there are impounds on your loan and you need to set up an escrow account.

When you close in the month can also have a big impact on closing costs. Those who close late in the month can reduce per diem interest, whereas someone who closes early in the month could pay nearly 30 days’ worth of interest at loan closing.

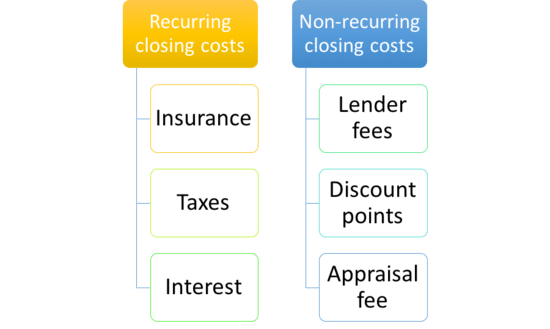

Two Types of Closing Costs – Recurring and Non-Recurring

There are two main types of closing costs on a mortgage transaction.

They include “recurring closing costs” and “non-recurring closing costs.”

As the name suggests, recurring closing costs are those that will be charged more than once, whereas non-recurring closing costs are charged just once.

In other words, the non-recurring costs have to do with the transaction itself, while the recurring charges relate to the ongoing ownership of the loan/property.

Some examples of recurring closing costs (paid more than once):

– Homeowner’s insurance

– Mortgage insurance

– Flood insurance

– Property taxes

– Interest

– HOA dues

*Note that not all fees are necessarily applicable depending on the property, location, loan type, etc.

Some examples of non-recurring closing costs (one-time fees):

– Lender fees (underwriting, processing)

– Loan origination fee

– Mortgage discount points

– Credit report fee

– Appraisal fee

– Home inspection fee

– Termite inspection fee

– Building record fees

– Title and escrow fees

– Doc prep fees

– Recording and wire fees

– Notary and messenger fees

– Transfer taxes

As you can see, there are quite a few costs associated with obtaining a mortgage. And not everyone has the cash on hand to pay for all these fees.

There are also those who like to hang onto their cash and put it elsewhere. For these individuals, there are options to avoid out-of-pocket costs.

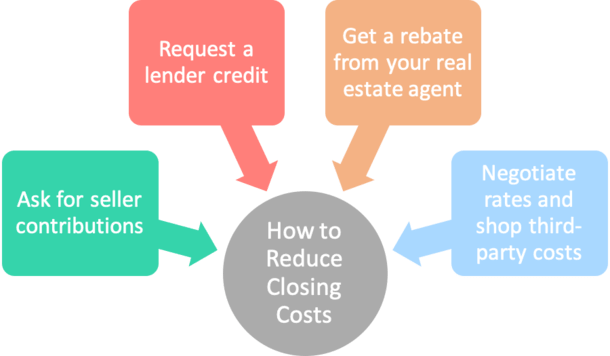

If you want to reduce your closing costs, there are number of strategies to do so.

Use Seller Contributions to Cover Closing Costs

- If it’s a home purchase you can ask the seller to chip in money toward the closing costs

- Either in exchange for a higher purchase price or just via negotiation

- You may also receive a credit as a result of repairs found during the inspection

- This is why it’s very important to get a home inspection (or even multiple inspections)

One of the most common ways to reduce your out-of-pocket closing costs is to get a contribution from the seller (if it’s a purchase transaction).

These so-called “seller contributions” or interested party contributions (IPCs) can be used toward the closing costs mentioned above. But they cannot be used for the down payment or reserves, nor can they end up in the buyer’s pocket.

Note that while a seller credit can’t be used for down payment or reserves, it can free up your own cash to use toward down payment and/or reserves that may have otherwise gone toward closing costs.

When negotiating a sales price, the buyer and seller can discuss these contributions, and their presence will likely lead to a higher contract price.

As a result, the buyer still pays the closing costs by accepting a higher loan amount associated with a higher purchase price. However, the costs aren’t paid at settlement, so it’s easier for the buyer short on cash.

It’s also possible to get a seller credit for repairs that come up during the inspection. This is why it’s so important to take the inspection seriously.

If you’re buying a home, you may actually conduct 3-5 different inspections for separate items like the pool/spa, roof, termite, chimney, and so on.

This is your chance to get money for the many things that might be wrong with the house. Once you present the seller with a request for repairs, they’ll likely offer a credit that you can use toward closing costs or to lower the purchase price. Or both.

The maximum amount of seller contributions allowed varies based on the type of loan (conventional vs. FHA), the property type, and the LTV ratio. The lowest amount allowed is 2% of the purchase price, and the highest allowed is 9%.

Get a Lender Credit to Offset Closing Costs

- In exchange for a higher mortgage rate

- You can get a credit from the lender to cover closing costs

- This way they won’t need to be paid out-of-pocket

- But the costs are passed along via higher monthly mortgage payments

Another way to reduce or eliminate your out-of-pocket closing costs is via a lender credit.

In exchange for lower settlement costs, you can accept a slightly higher mortgage rate. This works on both purchases and refinances.

For example, a lender might tell you that you can secure an mortgage interest rate of 4.25% if you pay $5,000 in closing costs.

Or give you the option to take a slightly higher rate, say 4.625%, with a $3,500 credit back to you.

If all your costs are paid via a higher rate, it’s a no cost loan, though sometimes this definition only covers lender fees, not third party fees.

Either way, you’ll pay a bit more each month when making your mortgage payment. But you won’t need to come up with all the money for the required closing costs.

Again, your out-of-pocket costs are reduced here, but you pay more throughout the life of the loan via that higher mortgage rate. That’s the tradeoff.

Ask for a Credit from Your Real Estate Agent

- Hello controversy!

- While it’s frowned upon by some real estate agents

- It’s perfectly acceptable to ask for a credit from your agent

- Though they have every right to decline your request

Another way to reduce closing costs is to ask your real estate agent to give you a credit.

If they want your business, or just want the transaction to close, they might be willing to part with some of their commission to help you with closing costs.

For example, if they’re earning 2.5% to close the deal, they might be willing to give you 0.25% of that to help with your closing costs. Sometimes both agents will get together and give a small portion of both commissions to the buyer to get the job done.

And this will actually reduce what you pay since you won’t take on a higher interest rate or pay for the costs via the loan.

Just be careful when combining credits to ensure they don’t exceed the maximum allowed by the lender.

If you find that you’re leaving money on the table, consider using the excess to buy down your mortgage rate or cover prepaid items like escrows.

Negotiate and Shop Your Closing Costs

- Like mortgage rates, you can negotiate closing costs

- Not all fees are compulsory (watch out for junk fees!)

- And remember that costs can vary considerably from lender to lender

- You can also shop certain third-party costs like title/homeowners insurance

It’s also possible to shop around for certain settlement costs, instead of just blindly using the companies your real estate agent recommends.

For example, you can comparison shop for title insurance and/or your homeowner’s insurance and save on costs there. The same goes for your home inspection.

If refinancing your mortgage, ask for the “reissue rate” or “substitution rate” when purchasing the lender’s title insurance policy.

There is no reason you should have to pay full price again for a title search when you’ve been the only person living in the property. This could save you a significant amount of money on closing costs with as much as a phone call to the title company.

Similarly, when looking for a bank to work with, be sure to look closely at the fees they charge. They don’t all charge the same fees/amounts, so finding a lender with a low rate and reduced fees could save you big.

Also watch out for unnecessary junk fees, which can really add up. But remember that certain closing costs just aren’t negotiable, like property taxes.

What Else Should I Know About Closing Costs?

- Closing at the end of the month is one way to cut down on closing costs

- Because you can reduce per diem interest

- But your first mortgage payment may be due sooner

- If refinancing you might be able to roll closing costs into loan

- Also look out for closing cost specials

There are a few other ways to cut down on closing costs. Prepaid interest, which is the per diem interest due between the time you close and your first mortgage payment, can be costly depending on the size of your loan and when you close.

If you close near the end of the month, you can greatly reduce the number of days of per diem interest due at closing. This can significantly reduce your closing costs.

However, the tradeoff is that it’s a very busy time for lenders, and they might not close in time.

For those refinancing, it may also be possible to roll closing costs into the new loan, instead of paying them out-of-pocket.

Again, the implication here is that you’ll be paying interest on those closing costs for as long as you hold your mortgage, as opposed to just paying them at face value upfront.

But it’s worth consideration, especially if you don’t plan to stay in your home, or with the mortgage very long. There’s also a thing called inflation that makes today’s dollars less valuable over time.

Lastly, check out special programs like HomePath and HomeSteps, which offer closing cost assistance if you take part in homeownership education courses.

And be sure to look into state homebuyer assistance programs that offer incentives to first-time home buyers.

FAQ: Reducing Closing Costs on Your Mortgage

1. What are closing costs?

Fees paid at closing to finalize loan funding. They typically range from 1-6% of the loan amount or purchase price and include lender fees, third-party fees like title insurance and appraisal, along with various taxes, prepaid interest, and homeowners insurance.

2. Why do closing costs vary so much?

Costs can differ based on loan amount, loan type, lender fees, and timing of closing (end of month vs. beginning of the month).

3. Can I negotiate closing costs with my lender?

Yes, you can ask the lender to waive their own fees like application or origination charges. Complaining or threatening to walk away and use a different lender might push them to offer a better deal, though success isn’t guaranteed.

4. Are there fees I can’t negotiate?

Yes, certain costs like property taxes, government recording fees, and transfer taxes are non-negotiable, regardless of the lender you use.

5. How can a lender credit reduce closing costs?

A lender credit can reduce upfront cash needed in exchange for a higher interest rate. A 1% credit on a $500,000 loan amount will give you $5,000 to put toward closing costs to avoid paying it out of pocket. But your rate/payment will be higher as a result.

6. Can a real estate agent help lower closing costs?

Yes, you can request a credit from your agent’s commission (e.g. 0.25% – 0.50% of a 2.5% commission) in states where rebates are permitted (check your state).

While agents can refuse, they might agree if it ensures the deal closes, especially if they value your business. I’ve personally done this in the past, though many agents say they won’t do this and that their fee is firm. Like most things, it’s negotiable…

7. Can real estate agents pay closing costs directly?

No, agents can’t pay your closing costs directly. They can only rebate a portion of their commission to be used toward your closing costs.

8. Can I roll closing costs into my mortgage?

Yes, if it’s a refinance, you can add closing costs to the loan balance to reduce out-of-pocket expenses, but you’ll pay interest for the life of the loan and the payment will be higher (due to larger loan amount).

9. Can the home seller help with closing costs?

Yes, if it’s a purchase, you can negotiate with the seller by asking for a credit to pay a portion of your closing costs (known as a seller concession). This tends to work best in a buyer’s market where sellers are highly motivated.

10. How does closing at the end of the month save money?

Closing late in the month reduces prepaid interest. For example, closing on the 29th means paying interest for just a couple days, versus nearly a full month if you close on the 5th (since mortgages are paid in arrears).

11. How can I tell if I’m overpaying for closing costs?

Shop around with different lenders/mortgage brokers and review the Loan Estimates (LE) they give you to compare fees. Look for so-called “junk fees” like excessive underwriting and processing charges on top of loan origination fees.

Read on: Are closing costs included in a mortgage?

- UWM Launches Borrower-Paid Temporary Buydown for Refinances - July 17, 2025

- Firing Jerome Powell Won’t Benefit Mortgage Rates - July 16, 2025

- Here’s How Your Mortgage Payment Can Go Up Even If It’s Not an ARM - July 15, 2025

There is another trade off on prepaid interest that many buyers are not aware of. Closing early in the month will result in prepaying interest for the majority of the month at closing but will delay that first house payment for nearly two months. This is particularly useful for low- and moderate-income first-time homebuyers with smaller mortgages (and lower monthly interest) who are coming from rental properties and can negotiate a per diem rent with their landlord.

I was able to get a 1% credit for closing costs from the bank handling my short sale. All I did was threaten to walk away from the deal and they conceded. And no, they didn’t raise the price of my offer in exchange for that credit. Woo hoo!

Good work. It never hurts to ask for a credit or bluff that you’re thinking about walking away. Often times complaining will get you somewhere in the mortgage industry…

With a purchase loan, you cannot roll closing costs into the loan. That is allowed only for a refinance. Therefore, asking the real estate agent to pay for closing costs does not reduce your loan amount.

The loan amount is set by the price minus the down payment. Closing costs must be paid for with cash (cashier’s check or wire) at the closing table.

Moreover, a real estate agent cannot contribute toward closing costs on the Settlement Statement or in the loan itself. That is a violation. The only way a real estate agent can help is to pay the buyer separately, outside of the loan.

Carolyn,

Per HUD, real estate agents may rebate a portion of their commission to the borrower in a real estate transaction.

Source: https://www.justice.gov/atr/public/real_estate/faqs.html

Typically an underwriter will require an addendum to the contract reducing the agents commission and recommend the credit (reduction) come from the seller (not the agent). Why? Not sure…but here in CA it has become the norm!

Is it economical to make a mortgage payment in the same month as selling your house or should I roll it into the bank payoff on the loan at closing?

Keep in mind: purchasing houses BEGINS with a well planned plan for your own escape strategy! People find out more about residential financial investment attributes and house investment purchasing then they think. The mls is one of current and definitive source about house directories and homes for sale.

Asking others, especially your Real Estate agent to contribute their commission is really not a good way to go. It gives the impression that one cannot really afford what they are purchasing. As a Real Estate Agent, I work very hard for my clients and for my commission and I don’t feel that it is right or fair to ask for part of my commission. Do I ask for part of their salary when they don’t purchase a home? No, I don’t. My commission is how I make a living and is part of the agreement between a seller and their agent who in turn splits it with the agent who brings the buyer. This agreement between the seller and the listing agent is not part of the buyers purchase contract.

Debra,

That’s understandable, but I don’t think it gives off the impression of being unable to afford the home. I think it’s a negotiating tactic and why not ask? Obviously no one wants to give up anything, but the agent may realize a small concession that gets the deal done is better than losing the client entirely and spending many more hours finding another (thereby wasting more time and money in the process).

I don’t agree at all!! It is not appropriate to negotiate an agents commission in order for the buyer to take down their closing costs. It would be similar to me asking the buyer to contribute to my automobile fund so I don’t have to spend as much money on gas serving my clients. Using other’s resources to “get the deal done” does not translate to good negotiating skills in my book. The seller is paying my commission, not the buyer.

If an agent wants to make a concession in a contract that’s a whole different subject. I have never asked anyone to discount their fees, because its the same way I make a living. If find it offensive that so many people think that my pocket is there for the picking. I find humor in that you once worked Mortgages. But now BLOG THE TRUTH… the truth is Agents and Lenders and the like work really hard for their commissions and depending some transactions/time involved can be broken down to almost minimum wage. I do not discount on request. I run my business on x% I do not incorporate your costs into mine. If i chose to pay a home warranty its because I want to gift it.

Michelle,

It’s an option…I knew I’d get flak for even mentioning the idea of a real estate agent forgoing any of their commission. You don’t have to, you probably won’t in most situations, but it’s a possibility. When I worked in the industry I had no control over my commission and was always honest. I had no reason not to be. This blog is built on the idea of providing more transparency to the industry so not sure what your point was? It’s okay to disagree without slinging mud.

It’s not an option! It’s a ridiculous grab at others commission to ” help” a buyer out. Who ” helps” an agent out? Agents have bills associated with running a business as well as their personal expenses. Why is it okay to ask for a contribution? Do people ask you to contribute to their expenses from whatever it is that you do now? Let’s see when it’s all said and done, agents may make minimum wage. We are not like lawyers who bill per hour, quarter of the hour, etc for our intellectual property. It’s all given up front hoping to receive a commission for a job at the end! I don’t know of another industry that provides free service and then gets paid. I think it’s unconscionable for you to make that a suggested option to buyers. So, what do you do for work now, anyway?

Colin, Please tell me you’re kidding about asking for part of the agents’ commission. The commission is negotiated and agreed to prior to a contract ever being proffered, and if it’s paid by the Seller it’s none of the Buyers business, period. It’s carved up many ways before either agent sees any of it, and then it’s typically taxed on both sides for self employment, federal and state income taxes, and then the agent is responsible for his/her operating expenses. You might want to try being an agent before you suggest reaching into their pockets. Again, on behalf of the 20+ agents and Broker Associates in my 2 offices, please tell me you’re not serious.

Chuck,

I know it’s not for everyone, and a very polarizing topic at that, but is it not a standard industry practice? There are tons of real estate rebate websites around that advertise agents who offer rebates and there are plenty of large companies that rebate commission such as Redfin. I understand that a good agent can negotiate a lower sales price and save their buyer even more without giving up commission, but everyone has their own strategy.

Redfin?? That is all you’ve got! It’s not a polarizing topic, it’s just one that has no business being suggested by someone who is NOT in the business. Redfin… that is laughable! If someone wants a cut of my commission to lower their costs, then I will refer them to Redfin. I would rather refer those types of buyers to someone who will do the job that they deserve….very minimal!

Colin,

With all due respect, no. It isn’t a standard industry practice. It’s what the part-timers and bottom feeders do, and most of the time they are marginally competent at best.

The problem we need to fix is the ridiculously low barrier to entry to be an agent. Because of the above mentioned part-timers and bottom feeders we’ve allowed our level of professional respect to devolve to only slightly above sleazy used car salesman, and we’ve done it to ourselves..Add to that the Brokers that promote the discount model and hire anything with a pulse that passed a test, and it only gets worse.

And lastly, if you’ve never sold real estate, no. You don’t understand.

Peace.

I was enjoying the content and thinking about adding your link to my webpage. But as an industry we have little respect for the mountain of stress we carry through a transaction. What you don’t understand is that this deal seeking buyer isn’t going to ask for the discount upon the first conversation and negotiate what we are working for… Oh no, they are going to wait and present it like it isn’t an option. And BAMM we are robbed of the hours we have already worked.

Amy,

And you have every right to NOT negotiate your fees based on the excellent level of service you provide to the customer.

Colin, First, thank you for your suggestions and I am including that of asking a realtor to rebate a small portion of their commissions to get a deal done and therefore saving the borrower at closing. I am not in the real estate industry or the mortgage broker industry but have purchased and sold 7 homes throughout my lifetime this has been due to corporate transfers, job changes and just upgrading. I have as borrower/purchasing party done exactly this on several occasions and in both instances the agents quickly cut their losses to get a deal done. I have even sold two homes myself paying no sales commissions to real estate agents period. I must confess though that it is not for the amateur negotiator. Given purchasing a home is usually the largest and most important financial transaction of a person’s financial life the need to be a shrewd operator actually a responsibility of the wise and not an option. This includes learning early in life that while purchasing a home is an emotional process that forming emotional relationships during the process is ill advised. It has always helped in my dealings to remember no matter how much I might “want” a property that if real estate is viewed as anything other than the commodity that it is you are most certainly going to pay more. That and the more one allows their emotions and the influence of relationships in any business dealing will again come at a price. Thanks for looking out for the actual purchasers and owners cause the “Truth,” is one can save tens of thousands if not much more over a lifetime by avoiding paying any commissions at all.

Josh,

Well said! Good to see someone being savvy and shrewd and approaching home buying in a more pragmatic manner.

It’s too bad your getting so much grief from your article. I enjoyed reading it as I came across this literature looking for a way to refinance my home since I’m going through a divorce. Not something I anticipated and will be a bottom feeder if I must and certainly ask if I am in the situation where I have to sell or refinance.

Niki,

Thanks…I don’t mind, I understand why interested parties don’t want you to think you can negotiate their fees. And I’m also happy enough to let anyone state their case.

People tend to forget or just don’t realize realtors wheel and deal to get your home or property at a lower cost than the what it’s listed for. In turn most individuals going at it on their own usually don’t stand a chance at doing so.

The money realtors can save you with their bargaining skills alone can make up for a lot of the buyers expenses. New homebuilders set their prices higher for this reason. Just like car lots do with automobiles.

Why would a realtor do this when a lower price means less for them percentage wise? It’s our job. We are consumers too. What’s best for the buyer is best for us.

My agent is working very hard and has earned every dime dealing with me as a first time homebuyer. I know she wants to secretly drop me but she’s too nice. I would never ask her to do such. I think her cut is not enough.