To mortgage folks across the country, it’s an age-old question: “Lock or float?”

It’s a question loan officers and mortgage brokers get asked on a daily basis, often over and over again by panicked borrowers and first-time home buyers.

And it might just be the most important answer you come up with during the loan process, as it will determine the mortgage rate you ultimately receive and possibly keep for years.

The interest rate you pick will dictate what you pay each month for potentially the next 30 years (assuming you don’t refinance), so it’s not a decision to be taken lightly!

How Locking vs. Floating a Mortgage Rate Works

- You get the option to lock or float your interest rate when you apply for a mortgage

- If you lock, the interest rate won’t change as long as you fund your loan before its expiration

- If you float, rates may go up or down until you finally lock it in

- Your loan officer or broker may be able to advise you on which move to make

When you submit a home loan application, you will be asked if you want to lock in your mortgage rate or float the rate.

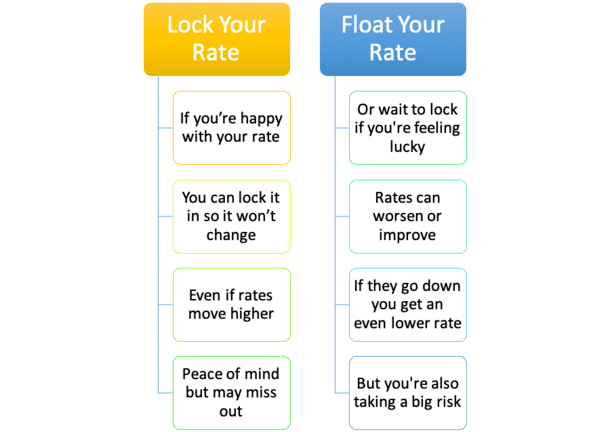

If you choose to lock the rate, you are guaranteeing yourself a certain interest rate on your mortgage.

So if the lender says you can lock in an interest rate of 6.25% on your 30-year fixed-rate mortgage today, and you’re happy with that, they can lock it in for you.

This ensures your rate will not change, even if mortgage rates spike higher over the days and weeks after you lock.

At the same time, this means you won’t be able to take advantage of a lower mortgage rate, assuming they drop even more as your loan closing date approaches.

Note that locks come with an expiration date, such as 15 days, 30 days, and so on. So you must fund your loan before that date.

Conversely, if you choose to float your rate, you’re essentially telling the lender that you don’t like where rates are at, and want to hold out for better.

Or it could just be that your loan approval is still a month away, and you don’t want to lock prematurely and have to pay to extend your lock if it takes longer than anticipated to close.

Either way, your mortgage rate is always subject to change until it is locked.

[Do mortgage rates change daily?]

Lock or Float? Are You Feeling Lucky?

- Floating a mortgage rate is inherently risky because no one knows what tomorrow holds

- It can be a dangerous game to play if you can’t afford a higher interest rate

- But you can potentially wind up with a lower mortgage rate if you do choose to wait

- One tip is the more time you have until closing, the greater your chances of securing a lower rate

When deciding between locking and floating, you need to assess your situation. Every borrower has a unique story, and every day is different, so there is no hard and fast rule here.

Some borrowers may not be comfortable with “letting it ride.” While others may be market experts and have a good handle on the direction of mortgage rates.

Generally, what’s bad for the economy is good for mortgage rates, which explains why they are so darn high at the moment. High inflation has caused mortgage rates to spike.

If you prefer to sleep at night and “like” where mortgage rates are right now, locking might suit you better than floating.

And if you think mortgage rates aren’t going to get much better, again, locking is probably the move.

Additionally, if you can’t risk taking on a higher mortgage rate (think a DTI ratio on the brink), locking your rate would be very smart to avoid any future hiccups or a denied loan application.

You Can Choose to Float Your Mortgage Rate If You Can Absorb a Higher Payment

On the other hand, if you think mortgage rates have room to fall before loan closing, you may choose to float your rate.

After all, 30-year fixed mortgage rates surged as high as 8% and have since recorded a decent pullback. And they could drop even more if the trend continues.

So why not wait it out a little longer if you’ve got time?

Instead of locking in a rate of 7% on a 30-year fixed today, you might be able to take advantage of all the uncertainty going on (shaky economy, incoming Fed rate cuts, etc.) and wait for your rate to fall to say 6.5% or lower.

If that happens, you’ll save money each month via a lower mortgage payment and a lot more over the life of the loan.

Even if rates don’t improve substantially, you might be able to snag a larger lender credit to offset your closing costs if pricing gets somewhat better.

Just be mindful that you’re taking a chance. And you only have so much time before you must lock your rate in order to initiate the loan closing process.

Rates could worsen significantly, raising your monthly payment and your DTI ratio. This could even jeopardize your application altogether. So be sure you can absorb worst-case pricing.

Tip: How to track mortgage rates.

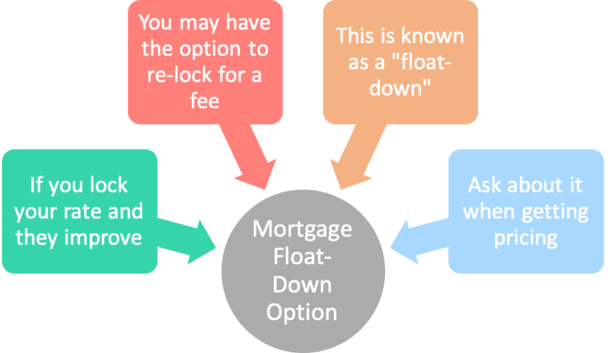

A Mortgage Rate Float-Down Might Be an Option Too

- A float-down may also be an option with some banks and mortgage lenders

- It allows you to lower your already locked-in interest rate for a small fee

- The option goes into effect if rates fall significantly after you lock in your rate

- At that time you may be given the option to re-lock at the lower rate despite previously locking your loan

Aside from floating and locking, you might also be given the option to “float down” your rate. Be sure to ask your broker or loan officer about their float-down policy when inquiring about pricing.

A float-down is an option that becomes available once you lock your rate to take advantage of potential interest rate improvements after the fact.

It’s kind of like an insurance policy for your rate lock if rates get even better.

For example, say mortgage rates fall dramatically after you lock. Go figure!

If they do, you could have the one-time option to float the rate down to current levels for a small cost.

This allows you to take advantage of interest rate decreases if you want an even lower rate, despite already being locked in on an earlier date.

However, as noted, there is often a cost to the float-down, and it could be quite significant. There’s also no guarantee rates will improve once you lock.

The cost of a float-down will range from bank to lender, and could run anywhere from .125% to .375% of the loan amount (or higher) to take advantage of current pricing.

So for higher loan amounts, say on a jumbo home loan, it could be a pricey option.

However, you should still come out ahead even when factoring in the upfront cost thanks to that lower interest rate.

Just make sure you stay in the home (or keep the mortgage) long enough to recoup the fee.

Other Lock/Float Considerations

- Ask what your lender’s float down policy is before you lock

- Their policy could act as a sort of hedge to your decision

- Ask how long the lock period is (e.g. 15 days, 30 days, 45 days, etc.)

- Think about how long you’ll keep the property and the mortgage

- If selling/refinancing soon, floating might be a more acceptable strategy

- Track market conditions (MBS prices, 10-year bond yield) to determine if it’s in your best interest to lock or float

Not all lenders have the same float down policy. In fact, some may not even offer one. Or it could be less attractive than others out there.

Some lenders may offer to split the difference with you if rates drop substantially after locking.

For example, if rates are .25% lower than when you originally locked, they may lower your rate by .125% as a courtesy free of charge.

Others may renegotiate the lock (rate lock break) just to keep your business if rates have really plummeted, so it never hurts to try to haggle a bit if that happens.

Just keep in mind that lenders generally have restrictions on when you can execute a float-down, how low the rate can/must drop, and how long the lock can be extended (if at all).

The float-down option can usually only be applied once and it must occur before the lock expires, often within a designated time period before the loan is set to close.

If purchasing a home or building one (new construction), you may be given an extended rate lock option with a built-in float-down option, sometimes referred to as “lock and shop.”

Some lenders also offer free float-downs, as is the case with Quicken Loan’s RateShield Approval, which allows you to lock in your rate before finding a home.

Once you find a property, they’ll give you the lower rate automatically if rates improved since you locked. It’s their way of securing your business ahead of time.

Regardless of what option you choose, be sure you understand the consequences of both locking and floating a mortgage rate.

Comparing Locking vs. Floating

| Locking | Floating | |

| Rate is… | Guaranteed until lock expiration | Subject to change daily until locked |

| Risks | No risk of increase, but could miss out on improvement | Can go up or down until you lock |

| Flexibility | Might be able to float-down if rates improve | Can lock whenever you want up until loan docs are drawn |

| Best for… | Those who are happy with rate and can’t risk higher rate due to DTI limits | Those who can absorb higher rate or think rates will fall and have time to wait |

Locking vs. Floating FAQ

What is the difference between locking and floating a mortgage rate?

In short, locking means your rate is guaranteed if you close by the lock expiration date. Floating means your rate is subject to change until locked in.

When should I lock my mortgage rate?

There is no universal answer, and nobody knows the future, but a general rule of thumb is to lock if you’re happy with the rate offered and don’t expect it to get much better before you close.

What are the risks of floating my mortgage rate?

Simply put, the rate can increase and not go back down before closing, saddling you with a higher rate on your loan until you refinance or sell the property.

How long does a rate lock last?

They can range from 7 days to 365 days, though common lock periods are 15-45 days, with 30 days perhaps the most common. This coincides with the amount of time it takes to fund a mortgage.

Can I change my mind after locking or floating?

If you lock, no, your rate is locked, though as mentioned, a float-down might allow you to improve your locked-in rate. If you float, you haven’t yet made up your mind and can freely change it!

Tip: Most lenders will probably err on the side of locking your rate because they won’t want to explain why mortgage rates moved higher if they happen to get worse while floating. But it’s ultimately your decision to make!