Another interesting trend has emerged from the latest mortgage forbearance data, this time courtesy of a new report from data analytics company Black Knight.

Nearly 5 Million Now in Mortgage Forbearance Plans

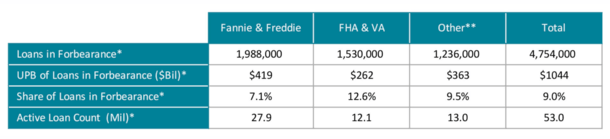

- 4.75 million borrowers in active forbearance plans (9% of all mortgages)

- FHA/VA forbearance rate rises to 12.6% as of May 19th

- Fannie/Freddie forbearance rate climbs to 7.1%

- Other loan type forbearance rate (portfolio loans and private-label) up to 9.5%

First things first, some 4.75 million homeowners, or about 9.0% of all mortgages, are now in COVID-19 mortgage forbearance plans, per the company’s McDash Flash Forbearance Tracker.

That represents more than $1 trillion in unpaid principal balances, just to give you an idea of what loan servicers and the GSEs could be on the hook for.

Both FHA loans and VA loans continue to exhibit the worst levels of forbearance, at 12.6% of all loans, versus just 7.1% for GSE-backed loans (Fannie Mae and Freddie Mac).

Other types of loans, such as portfolio loans and private-label securities, have a forbearance rate of 9.5%.

While things have settled down lately, Black Knight said the pace of forbearance has risen “slightly in recent days,” with the number of active forbearances climbing by about 93,000 over the past week.

However, that’s still a ~70% decline from the 325,000 jump during the first week of May, and 93% below the first week of April when active forbearance plans surged by almost 1.4 million in just one week.

That’s to be expected though – the more borrowers in forbearance plans, the lower the percentage gains in subsequent weeks.

Borrowers Are Still Paying Their Mortgages Even Though They Don’t Have To?

- 46% of homeowners in forbearance plans made their April mortgage payments

- This could back up a recent study about many not actually needing the help

- Or it could just be a timing issue that will resolve itself next month

- Mortgage payment data from May isn’t as encouraging with just 21% paying as agreed

Perhaps more interesting is the fact that homeowners are continuing to pay their mortgages while in forbearance plans.

The company’s new “McDash Flash Payment Tracker” found that of the 4.25 million homeowners in mortgage forbearance plans as of the end of April, nearly half of them made their payment anyway.

This backs up the idea that some homeowners may be using forbearance simply as a safety net, as imposed to it being a critical need, something cited in a recent LendingTree survey.

However, before loan servicers and mortgage lenders get too excited, it could be a lot different in May.

As of May 19th, just over a fifth of homeowners in forbearance plans (21%) made their May mortgage payments.

Black Knight said roughly 1.4 million homeowners who made their April mortgage payments are at risk of “becoming past due in May if those payments are not received before the end of the month.”

Of course, past due is a bit of an overstatement since it doesn’t count as a true mortgage late, nor are credit bureaus allowed to report the borrower as delinquent.

However, you might see reports saying mortgage delinquencies spike because forborne loans are still counted as delinquencies.

So while the data from April was encouraging, it might prove to be short-lived and possibly misleading as well.

It could have just been a timing thing where these borrowers had requested forbearance around the time they made their April mortgage payments, possibly fearful they’d be shut out if they didn’t make their payment first.

Additionally, now that more details are known about how mortgage forbearance is repaid, it’s going to be a lot more attractive to those in forbearance plans.

It’ll also be enticing for those not currently in forbearance plans, who if they read up on the rules, will realize it’s a pretty sweet deal to not have to pay the mortgage for six to 12 months.

And once that period is over, they still won’t have to pay back the missed payments in a lump sum, or even enter a repayment plan.

Rather, they can just kick the can down the road and worry about the missed payments when they refinance the mortgage or sell their home thanks to COVID-19 payment deferral.

Really, it’s no worries all around because the missed payments will simply mean they get less when they sell, or wind up with a slightly higher loan balance when they refinance.

It’s such an attractive offer that I wouldn’t be surprised if homeowners went for it just to boost liquidity and put money elsewhere, possibly to earn higher returns.

We also now know that it’ll be easy to get a mortgage after forbearance too, with a waiting period of just three months for those who pause payments, and no wait for those who continue to pay as agreed.

- UWM Launches Borrower-Paid Temporary Buydown for Refinances - July 17, 2025

- Firing Jerome Powell Won’t Benefit Mortgage Rates - July 16, 2025

- Here’s How Your Mortgage Payment Can Go Up Even If It’s Not an ARM - July 15, 2025