What a difference a decade makes, at least when it comes to paying the mortgage on time.

A new report from Black Knight revealed that mortgage delinquencies fell more than 5% in January to reach their lowest point since 2000, which appears to be as far back as the data goes.

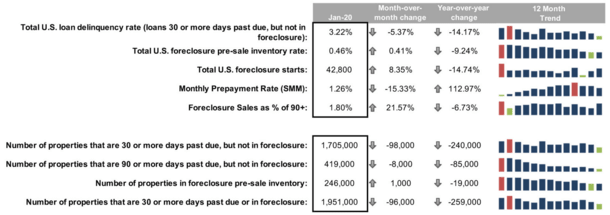

Overall, the U.S. home loan delinquency rate, which counts mortgages 30 or more days past due, but not those in foreclosure, was just 3.22%.

That was down 5.37% from December and 14.17% from January 2019.

You can thank rising home prices, super low mortgage rates, and an improved economy for that, along with properly underwritten mortgages.

Fewer Than Two Million Americans Past Due or in Foreclosure

Thanks to the continuing improvement in mortgage payment behavior, there are now less than two million homeowners behind on the mortgage or in foreclosure, the lowest total since March 2005.

While that’s also positive news, there was an uptick in foreclosure starts in January, perhaps related to a holiday moratorium the preceding month.

Starts rose 8.35% from December, but were still down 14.74% from a year earlier.

Meanwhile, the number of loans in active foreclosure were mostly flat month-to-month (+1,000 properties in foreclosure), and down a big 19,000 from a year ago.

That left the national foreclosure rate unchanged.

In total, 1,951,000 properties are either 30 or more days past due or in the process of foreclosure.

Mississippi Worst When It Comes to Non-Current Mortgages

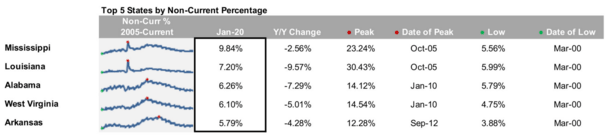

While we look solid nationally, some states continue to struggle with the housing bust that ended nearly a decade ago in most places.

For example, in Mississippi nearly 10% of properties are non-current, meaning delinquent or in foreclosure.

It’s similarly dire in Louisiana (7.20%), Alabama (6.26%), West Virginia (6.10%), and Arkansas (5.79%).

The good news is the non-current rate in Mississippi is down 2.56% from a year ago, and well below its peak of 23.24% seen in October 2005.

The same goes for those other states mentioned, though they’ve seen even better improvements year-over-year.

California Mortgages Are Performing the Best

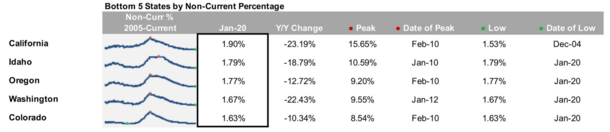

In terms of most on-time mortgages, California is tops. The Golden State boasted a non-current rate of just 1.90% in January, down a whopping 23.19% from a year ago.

The non-current rate peaked at 15.65% in February 2010, and was lowest in December 2004 at 1.53%.

So it appears California is on its way to a record low as well, assuming we don’t get derailed.

Homeowners are also making mostly on-time payments in the states of Idaho (1.79% late), Oregon (1.77%), Washington (1.67%), and Colorado (1.63%).

In all of these states, the non-current share of mortgages hit an all-time low last month.

Recipe for a Housing Boom

- With mortgage lates hitting all-time lows in many states

- Housing inventory the lowest it has been in years

- And mortgage rates marching toward record lows again

- There’s a good chance home price appreciation is going to reaccelerate in 2020

When you consider the fact that mortgage delinquencies are hitting record lows and inventory is at its lowest point since 2013, it’s easy to make an argument for booming home prices in 2020.

This is especially true when you factor in the 45 million Americans expected to reach the age of 34 over the next decade, which is the median age of a first-time home buyer.

If most everyone is paying their mortgage on time, and very few are interested in selling, there’s kind of nowhere for home prices to go but up.

Of course, we’ve seen this movie before, and if affordability doesn’t improve, we could go down a dark road again filled with creative financing solutions.

I just noted yesterday that no doc mortgages are making a return, though perhaps a little different (hopefully a lot better) than their predecessors.

And if housing still isn’t affordable with mortgage rates nearing record lows, you have to worry a little bit if wages don’t improve.

Of course, existing homeowners are going to enjoy the ride, assuming they like living in their homes, seeing that there’s nowhere really to go.