With mortgage rates staying stubbornly elevated, new narratives are being written in an attempt to change that view.

A popular one of late has been arguing that mortgage rates aren’t that high today. Or not as high as people think.

The rationale is that when you zoom out, mortgage rates are actually pretty middle of the road historically, which bucks the misconception that they’re high.

After all, they were in the high double-digits in the 1980s, and still start with a 6 today. Seems okay, right?

So is it true that mortgage rates aren’t so bad?

Context Is Key for Mortgage Rates

I could sit here and tell you the same thing. That mortgage rates aren’t that high. But what purpose would that serve if the proposed monthly payment still doesn’t pencil?

And what solace would that provide if you knew you missed the boat on snagging a 2-3% fixed rate just a few years earlier?

It probably wouldn’t give you any comfort unless you’re an extreme optimist. Instead, you’re probably just doing the math like everyone else and not liking what you see.

If you’re a prospective home buyer today, mortgage rates are top of mind. And you probably don’t care what the long-term average is for the 30-year fixed.

Spoiler alert: It’s a higher 7.75%, or about 75 basis points (bps) above current levels.

Does this mean the 30-year fixed is a screaming bargain today? I wouldn’t say so, but others might try to make that argument.

The biggest pain point of the past few years has been the magnitude of change in mortgage rates (going from sub-3% to 7%+ in just over a year).

Sure, mortgage rates sit below their long-term average. And without a doubt, they’re more than half that of the 1980s mortgage rates, when the 30-year fixed nearly cracked 19%.

But knowing that still might not change the fact that buying a home today has fallen out of reach for many.

Home Buyer Affordability Remains a Challenge but Is Slowly Improving

Perhaps instead of looking at mortgage rates in a vacuum, we should consider overall housing affordability.

After all, mortgage rates could be higher today and buying conditions more affordable, assuming home prices were lower and/or wages were higher.

Taking a holistic view allows us to reduce focus on mortgage rates and look at the big picture.

It also forces us to ask why housing is so expensive today, an answer that commonly goes back to a lack of available supply.

There’s still a deficit of homes for sale in most markets nationwide, though it is beginning to ease some.

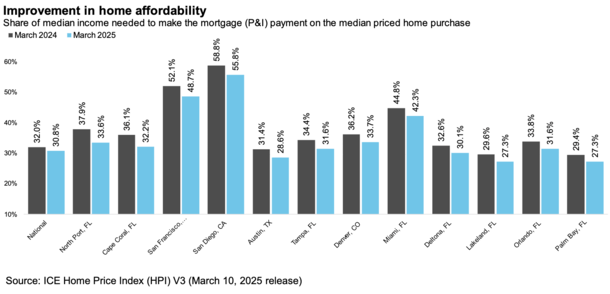

A recent report from ICE found that the share of median income required to make a principal and interest payment fell from 32% in March 2024 to 30.8% in March 2025.

It’s not a huge difference, but at least it’s moving in the right direction. And ironically, as pertains to this post, it’s likely better mostly due to lower mortgage rates.

So as much as folks want to say mortgage rates don’t matter, they do. They’re a bit lower than they were a year ago, despite remaining elevated.

In fact, a 1% drop in mortgage rates is equal to a 10%+ drop in homes prices. Meaning it’s probably more effective to get rates lower than it is a price correction/crash.

Especially when there is a shortage of homes on the market. Supply is really what drives prices, not mortgage rates.

Another Soft Spring for Home Buying Due to High Mortgage Rates?

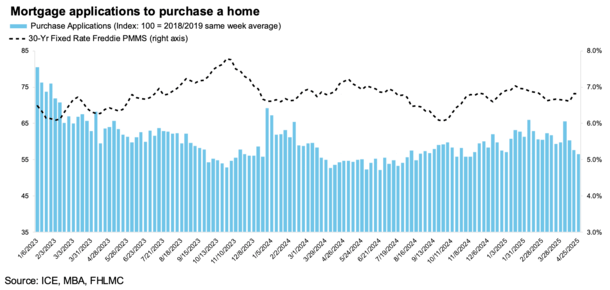

A different report from ICE from May found that home purchase applications haven’t risen as much as one would expect for this time of the year.

We’re basically at peak home buying season and despite many YoY gains in weekly mortgage applications, the numbers just aren’t there (also recall 2024 home sales were the worst since 1995).

Through April 25th, applications rose in each of the prior 13 weeks, but were only up 3% YoY in the week of April 25th.

ICE noted that it’s “a much lower rate of growth than the typical +9% to +24% expected” during this time of the year.

So even if mortgage rates “aren’t that high,” combined with where home prices and wages are, they appear to be cost-prohibitive.

The proof is that home purchase apps “spiked in the immediate aftermath of reciprocal tariff announcements in early April” when mortgage rates temporarily dipped.

So it’s clear rates still matter, a lot. And if/when they go down, home buyers tend to pounce.

At the same time, one could argue that the artificially low mortgage rates seen over much of the past decade masked other issues like eroding affordability due to rapidly ascending home prices and a lack of available supply.

We essentially got away with it while mortgage rates ran at more than 50% off their historical, long-term average.

But now that rates are back to “normal,” the math simply ain’t mathing.

Read on: The Trick Home Builders Use to Sell More Homes

- Mortgage Rates Extend Winning Week Thanks to Cool CPI Report - February 13, 2026

- Mortgage Rates Fall Closer to 6% as Jobless Claims Rise - February 12, 2026

- Mortgage Rates Inch Back Toward the 5s Despite Big Job Gains - February 11, 2026