You’ve heard about, you know about it.

Last week, Silicon Valley Bank was the target of a bank run, prompting the FDIC to take over the troubled company on March 10th.

It was the first bank failure since October 2020, and was quickly followed by another failure, NYC-based Signature Bank.

That prompted the Federal Reserve to create the Bank Term Funding Program (BTFP) over the weekend.

It offers loans to banks, credit unions, etc. for up to one year, using U.S. Treasuries, agency debt, and mortgage-backed securities as collateral, valuing the assets at par.

The move is intended to backstop these institutions and calm financial markets. But what will happen to mortgage rates?

Silicon Valley Bank Was First Bank Failure in 870 Days

Before the Silicon Valley Bank (SVB) failure, we had gone a cool 870 days without a bank failure.

My guess is prior to last week, the term “bank failure” wasn’t a big search term, nor was it a concern on anyone’s radar.

Instead, we were all fixated on inflation and the Fed’s many rate hikes to tackle said inflation.

Somewhat ironically, those very rate hikes are what did in SVB. The company held a bunch of long-term debt like mortgage-backed securities, which had lost a ton of value due to rising rates.

This time it wasn’t subprime mortgage debt, but rather agency-backed 30-year fixed mortgage debt.

It wasn’t toxic on the surface, but because mortgage rates had risen from sub-3% to around 7% in just over a year, holding those old MBS wasn’t good for business.

SVB also catered to venture companies, startups, and high-net-worth individuals. Meaning if they decided to pull deposits, there’d be big amounts of money at stake from a small number of customers.

Meanwhile, a bank like Chase has nearly 20 million bank accounts. And they’re mostly tied to customers with relatively small deposits, meaning no bank run.

What Does the Fed Do Now? Raise Rates or Pause?

Before this whole fiasco, the Federal Reserve was mostly expected to raise its fed funds rate another .50% next week.

Then the probability of a .25% made sense once SVB unraveled. Now it’s possible the Fed doesn’t increase rates at all.

And expectations for the Fed’s terminal rate have fallen to around 4.14% for December compared to 5%+ as of last Friday.

The fed funds rate is currently set between 4.50% to 4.75%, which means the Fed may cut rates between now and the end of 2023.

Despite the Fed’s ongoing fight with inflation, this banking fiasco could take precedence.

It’s also possible that data will support a softening stance on inflation along the way.

Either way, mortgage rates may have peaked for now.

Mortgage Rates Tend to Go Down as Banks Fail

The 10-year bond yield, which closely tracks long-term mortgage rates, was priced around 4% before SVB blew up.

Today, it’s closer to 3.5%, which alone could be enough to push 30-year fixed mortgage rates down by a similar amount.

And if the Fed does indeed hold off on a rate hike and eventually signal a more dovish stance, mortgage rates could continue to trickle lower.

A quick glance at 30-year fixed rates and I’m seeing vanilla loan scenarios priced in the high 5%-range.

If this turns out to be a turning point, we might see a return to mortgage rates in the 4s by later this year.

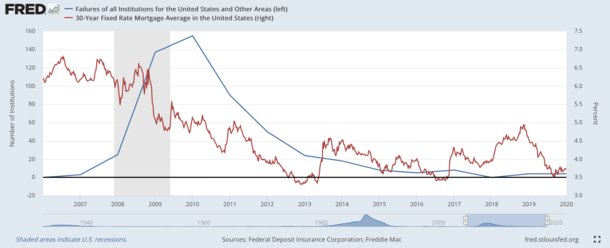

But what about some past precedence? I created a graph that charts bank failures (in blue) and the average 30-year fixed mortgage rate (in red).

The data compares FDIC Failures of all Institutions for the United States and Other Areas and the Freddie Mac 30-Year Fixed Rate Mortgage Average in the United States, retrieved from the Federal Reserve Bank of St. Louis.

I focused on the Great Recession, as hundreds of bank failures took place then. It’s not clear that will happen again here, but it’s something to look at.

As you can see, the 30-year fixed trended down from the 6% range to the 4% range as bank failures surged in 2009 and 2010.

Of course, the Fed also introduced Quantitative Easing (QE) in late 2008, whereby they purchased treasuries and mortgage-backed securities (MBS).

The Bank Term Funding Program (BTFP) isn’t quite that, but does lend itself to easing as opposed to tightening.

For the record, mortgage rates also trended lower during the savings and loan crisis of the 1980s and 1990s.

There’s a Good Chance Mortgage Rates Move Lower, But It Could Be Choppy

Without getting too convoluted here, the SBV situation (and BTFP) was likely a positive for mortgage rates.

Simply put, this development has forced the Fed to take its foot off the pedal and reevaluate its interest rate hikes.

The .50% drop in the 10-year bond yield in two days indicates significantly lower mortgage rates.

If the Fed reinforces that by holding rates steady next week and leading with a more dovish tone, mortgage rates may continue their downward trajectory.

But there’s plenty of uncertainty, including the CPI report tomorrow. The Fed won’t want to totally abandon its inflation fight it data indicates it’s still a big issue.

To that end, I expect mortgage rates to improve over time in 2023, but things could be choppy along the way.

And there could be a lot of dispersion between lenders. So be extra diligent when obtaining pricing from one mortgage company to the next.

Things will likely be volatile while banks and mortgage lenders navigate this tricky environment.

I expect mortgage rate pricing to be cautious as no one will want to get caught out on the wrong side of things.

This further supports the idea of lower mortgage rates later in the year as the dust settles and the picture becomes clearer.

Ideally, the end result is a ~4% 30-year fixed mortgage rate that fosters a healthy housing market with better equilibrium between buyer and seller.