Social media has been abuzz lately with news that Fannie Mae no longer requires a minimum credit score.

Traditionally, both Fannie Mae and Freddie Mac required a minimum credit score of 620 to get approved for a mortgage.

So if you wanted to get a conforming loan backed by one of the two companies, you needed at least a 620 FICO score.

But as of November 16th, minimum credit score requirements will no longer apply to loans submitted to Desktop Underwriter (DU), which is Fannie Mae’s automated mortgage loan underwriting system.

Freddie Mac made the same change a while back and it seemed to generate far less news.

Simply put, if you have a credit score below 620, you can technically get approved for a mortgage backed by Fannie or Freddie now.

No Minimum Credit Score for Fannie Mae or Freddie Mac?

Let’s discuss what this change actually entails.

Specifically, per Fannie Mae the “the minimum representative credit score requirement of 620 for loan casefiles for one borrower and minimum average median credit score requirement of 620 for more than one borrower will be removed for new loan casefiles created on or after Nov. 16, 2025.”

This means a single borrower with a sub-620 FICO score can now get approved for a loan backed by Fannie Mae or Freddie Mac.

And multiple borrowers no longer need an average median credit score of 620 (blended score) to get approved.

So the hard credit score cutoff is gone. There is more wiggle room and instead of a black and white view, it has become gray.

However, this only applies to loans that go through automated underwriting.

That’s most of the loans backed by Fannie and Freddie, as manual underwriting is less common and reserved for loans that fall outside the box.

Importantly, they aren’t abandoning credit scores entirely. They are still going to run your credit with all three bureaus (eventually maybe just two) to determine your credit history and scores.

From there, their automated underwriting system “will rely on its own comprehensive analysis of risk factors to determine eligibility.”

Credit Scores Will Still Play a Big Role Despite No Minimum Score Requirement

As stated, they’re not ignoring credit scores or credit history now.

Instead, Fannie and Freddie are taking a broader view using technology to determine how the borrower’s credit factors into the overall loan scenario.

When you apply for a mortgage, there are many things the loan underwriter will look at to determine whether you’re approved or denied.

This includes things like your income, assets, employment, and credit history, along with property-specific aspects like the appraised value, down payment, occupancy, etc.

Going forward, there’s going to be a more complete assessment that ditches the hard credit score cutoff.

The rationale is that it’s too rigid and doesn’t take into account the overall picture, thereby excluding otherwise creditworthy borrowers.

After all, it’s entirely possible that a borrower could have a 615 FICO score but be much less of a credit risk than a borrower with a 760 FICO score.

But to determine this, their automated system will need to look at myriad factors.

They’ll take the borrower’s credit scores and history and factor in things like down payment, asset reserves, income, DTI ratio, employment, etc.

Then the system will decide if the borrower can be approved, even if their credit score falls short of the classic 620 threshold.

By the way, 620 FICO scores have long been considered the last stop before subprime.

Anything below a 620 FICO is considered a subprime mortgage, so perhaps technically you can call these loans subprime.

But How Many Sub-620 FICO Score Mortgages Will Actually Get Approved?

Here’s the thing with this change though. While Fannie and Freddie are scrapping a minimum credit score, chances are most approved loans will still have a 620+ credit score.

Remember, the loan still has to make it through their automated underwriting system. So you’ll need a lot of solid compensating factors if your scores are below 620.

That means you’ll need things like a large down payment, lots of assets, a reasonable DTI ratio, solid employment, etc.

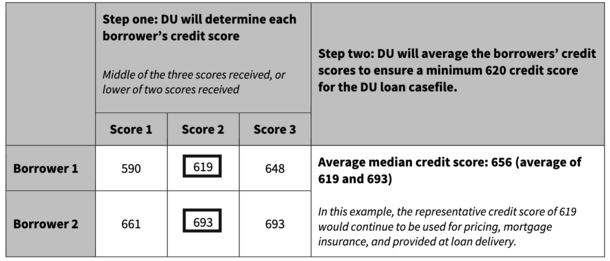

I spoke to some loan officers that have gotten sub-620 credit score loans approved but it was always with an average median score above 620.

An earlier change made by Fannie and Freddie allowed sub-620 credit scores as long as a co-borrower’s score pushed the blended score above 620.

For example, a borrower with a midscore of 591 and a co-borrower with a midscore of 693 would average out to 642.

This was already permitted before they got rid of the minimum credit score.

Chances are most loans that get through the automated underwriting gauntlet will have a 620+ average median score.

On top of that, individual mortgage companies may impose lender overlays that require a minimum credit score.

Lenders are allowed to limit their own risk if they’re concerned the loans won’t perform.

To summarize, this isn’t the return to Wild West underwriting, though I understand how someone who sees a dramatic headline might believe that.

Read on: What credit score do you need to get a mortgage?

- Mortgage Rates Inch Back Toward the 5s Despite Big Job Gains - February 11, 2026

- Lower-Rate Mortgages Are Paid Down Faster Even If They Have 30-Year Loan Terms - February 9, 2026

- Mortgage Rates Are Lowest in February - February 7, 2026