A “home appraisal” is a comprehensive report that determines the value of your property based on a number of factors, ranging from gross living space, to the view and the year a property was built.

If you plan on purchasing a new home with a mortgage or refinancing your current loan (or even getting a reverse mortgage), you will most likely need to order an appraisal. It might also be required for a home equity loan.

Typically, a bank or mortgage broker will handle this for you, but you will still have to foot the bill unless the cost is built into your mortgage rate.

The appraisal is a key component of the home buying process, and important to both you and your lender.

The bank will want to know that the home financing they provide can be supported by the collateral, and you’ll want to make sure you’re not paying more than the home is worth, within reason.

Home Appraisal Costs

- The cost of a home appraisal can vary

- Based on property type, location, and size

- And by bank and mortgage lender

- But most range from $300 to $600

Often when you apply for a mortgage, a deposit is requested by the lender early on to cover the cost of the appraisal. This is how they keep you invested so you don’t go elsewhere during the process.

Home appraisals typically cost anywhere from $250 to $750, with most falling somewhere in between $300 and $600. The cost will vary based on property type, location, and square footage.

Multi-unit properties and properties in rural areas will usually cost more to be appraised than a single-family residence in a densely populated area.

Additionally, a condo appraisal will generally cost the same as a home appraisal, despite the former often being much smaller.

This could be because appraisers must still assess the entire building/complex, which can be time consuming as well.

If the property is a multi-million dollar home, your appraisal could cost over $1,000, and if the loan amount is in the multi-million dollar range, you may also be on the hook for a second appraisal.

How Is My Home Appraised?

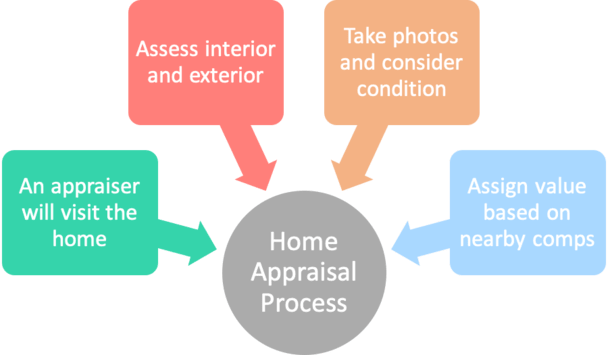

- An appraiser will visit your home to determine its condition

- They’ll conduct both an interior and exterior evaluation

- Then compare your property to recent home sales in the area

- Known as “comps” to come up with an appraised value

The most common type of appraisal for a residential property is the Uniform Residential Appraisal Report, or URAR.

It consists of interior and exterior photos, comparison sales (comps), and a complete cost breakdown of the property, such as square footage, lot size, the number of bedrooms and bathrooms, and any home improvements.

This type of appraisal is a blend of both a market and cost approach to determine its fair market value.

The cost approach establishes the value of the home by determining what the cost would be to rebuild the structure from the ground up.

The value approach determines value using comparison sales in the immediate area that have sold within a recent period of time.

When the appraiser arrives at your home, they will take both interior and exterior photos of the property and jot down lots of notes as they move from room to room.

If it’s mortgage refinance, there’s a good chance you’ll meet the appraiser.

The home appraisal process may take an hour or less (some appraisers look around longer than others).

Note: Due to COVID-19, the appraisal process may differ in an effort to minimize or completely eliminate human interaction. This might even require you to take your own photos of the home.

They will also take photos of recently sold, comparable homes in the neighborhood that are being used in the report.

These other properties are comparison sales, or “comps” as their known in industry speak, which are recent sales of like homes.

They are broken down in the appraisal report as well, and compared to the subject property side-by-side.

Each comparison sale is given or deducted value in a number of categories based on how it stacks up against the subject property.

The net value of the comparison sales are then averaged to come up with a median appraised value for the subject property.

Tip: The assessed value of your home is for property tax purposes and could be quite different than your appraised value, which is what the lender uses.

Are Mortgage Appraisals Accurate?

- In general, they tend to be pretty accurate

- For home purchases, they’re often close to the purchase price

- And for refinances they tend to come in at value

- But there will always be exceptions

- And two different appraisers will likely come up with two different values

A recent trend in the industry has been using appraisal management companies (AMCs), which critics claim rely on real estate appraisers that aren’t familiar with the neighborhoods they work in.

This is where arguments start because a lot of times the real estate agent and/or mortgage broker will disagree with the comps used in the appraisal, especially if the property doesn’t appraise at value.

They’ll claim that they should have used X property (a higher valued one) instead of the cheaper ones in the report.

But the independent appraiser licensed to do the job is the one in charge, not the interested party trying to get a sale.

The same type of thing may happen when a borrower is refinancing a mortgage and hoping to get a favorable value.

If it falls short, the homeowner may argue the appraiser’s decision. Of course, it will likely fall on deaf ears.

Ultimately, you will be at the mercy of the appraiser’s valuation analysis, which can certainly range depending on the comps they use.

Whether that’s accurate or not is debatable, but what is likely is that different property appraisers will come up with different values.

It’s doubtful that two appraisers would come up with the exact same price. However, they’ll likely be fairly similar to one another, and ideally not material to the outcome of the loan.

The value of the property is one of the most important factors when it comes to securing financing.

Banks and mortgage lenders need to ensure your property is in good condition, and truly worth what you or your broker say it’s worth because it’s the collateral for the loan.

Any possible valuation inconsistencies will likely cause investors to shy away from purchasing the mortgage, leaving the bank or lender with a vacant property and a major loss if the property declines in value.

Even Donald Trump could agree to buy a shack and fail to obtain a mortgage because the property itself simply isn’t marketable.

This is why they rely upon professional appraisals from an unbiased third party to come up with a fair home valuation.

Do Homes Sell for Their Appraised Value?

- Homes generally appraise at/above the purchase price

- Assuming the agreed upon price is customary and not an outlier

- The key to success is plenty of nearby comparable sales that reinforce the purchase price

- But it’s not uncommon for appraised values and sales prices to diverge

The answer is that it depends. It’s entirely possible for a home to sell at its exact appraised value, but appraisals are typically ordered by the bank (an appraiser selected) after a buyer and seller agree to a certain purchase price.

What generally happens is the appraiser affirms the value found in the purchase contract.

Sometimes they’ll assign a slightly higher value, and other times they won’t be able to find a value to substantiate the sales price.

This can happen if the buyer offered a lot more than asking to beat out other bidders.

It’s not to say they paid too much, it’s just that the other comparable properties sold for significantly less in the professional opinion of the appraiser.

In that case, the buyer and seller may need to go back to the drawing board in order to resolve the valuation inconsistency.

What If the Appraisal Is Lower Than the Purchase Price?

- There are options if the appraisal comes in low

- Ask for an appraisal review

- Put more money down

- Hope the lender will allow a higher LTV

- Or attempt to renegotiate the price with the sellers

One issue that happens pretty frequently is the appraised value coming in lower than the agreed upon purchase price.

This is a common problem because home buyers will often overpay for their dream home, either because of a bidding war or because of an emotional attachment.

Whether it’s truly overpaying is a question for another day.

For example, if you agree to buy a home for $200,000, and apply for a loan with 20% down, you’d need a loan amount of $160,000 and a $40,000 down payment.

That equates to a loan-to-value ratio of 80%, which is simply $160k divided by $200k.

Now imagine the lender comes back and tells you that the property only appraised for $190,000.

Your $160,000 loan amount based on the new $190,000 value would push the LTV to ~84%. And yes, lenders use the lower of the sales price or the current appraised value.

They don’t care what you’re willing to pay for it. They care what an independent appraiser says it’s worth in case they foreclose on you and wind up with it one day.

Anyway, this could be a problem as your loan would now require private mortgage insurance because the LTV would exceed 80%, and that’s if the lender could even offer you a loan above 80% LTV. Often they can’t.

The solution would be to either ask for a review of the appraisal, renegotiate the purchase price (lower) with the seller, look into other loan programs, or put more money down, assuming you have extra cash on hand.

Of course, you might wonder if you’re overpaying for the property if it doesn’t come in “at value.”

Using our same example, if you decided to move forward with the full purchase price and wanted to keep your loan at 80% LTV, you’d only be able to get a $152,000 loan.

That means you’d need to come up with $48,000 for the down payment, as opposed to the original $40,000. The upside is a slightly lower mortgage payment.

You could try to get the seller to lower the sales price too, but that might be a losing endeavor in a hot market.

However, if there’s not a lot of interest in the property, you might be able to get somewhere using this approach.

If you’re selling your home, keep this in mind to avoid dealing with low appraisals, which can lead to buyer fallout and eventual home price reductions.

Appraised Value Higher Than the Purchase Price?

- If the appraisal comes in “high,” which isn’t really a thing

- It doesn’t mean a whole lot other than you may have gotten a good deal

- Or at least didn’t necessarily overpay for the property

- It won’t change the math on your home loan

The opposite could also happen, though it won’t amount to much more than a slight ego boost, and perhaps some additional home equity.

If your appraisal comes in higher than the purchase price, give yourself a pat on the back and breathe out. You’ve cleared one major hurdle in the mortgage process.

However, your lender isn’t going to let you borrow more because of it. Remember, they’ll use the lower of the sales price or appraised value.

So really, nothing changes. You just might feel a little better knowing the property actually appraised.

The terms of your loan should remain the same. This is true of short sales as well. You won’t get extra borrowing capacity just because you’re buying below fair market value.

Be Present When Your Home Is Appraised

- It’s good to be present during an appraisal

- To answer any questions the appraiser may have

- It’s also recommended to clean before they arrive

- And generally put your best foot forward

If you already own your property and are getting it appraised for a refinance, it can be helpful to be there on the day. If it’s a purchase, the current owners likely won’t invite you over.

Anyway, once the lender schedules the appraisal date, make plans to be there to help show the appraiser around the property. You’ll likely need to let them inside.

I also recommend cleaning up the property (curb appeal) to ensure it looks its best, and also being polite and friendly with the appraiser. Real estate agents should extend the same courtesy.

Sure, some may argue that it shouldn’t make a difference if you’ve tidied up around the house, or whether you offer the appraiser a glass of water or a coffee. But for me, it never hurts to be kind.

If you (or the listing agent) are present, you can also point out any recent home improvements that may boost the home’s value, or discuss market trends and similar homes you feel might be overlooked.

Besides, a home that is clean and uncluttered can feel bigger and more expensive than a similar home, and that might be just enough to get a borderline value to where it needs to be.

The same holds true for home inspections, which are separate from the appraisal. It can pay off big to be present when the home inspector arrives.

The Appraisal Review

- If the appraisal comes in low

- Some lenders may order an appraisal review

- To challenge the assessment

- But it’s possible to come in even lower…

Once a home appraisal is ordered, if there are valuation issues the bank or lender may order a review of the appraisal.

The review will be conducted by another appraiser or simply by the use of an AVM, or Automated Valuation Model. This is where many borrowers get into trouble.

If the review comes in low, or if the property is deemed incomplete, hazardous, or unique in any way, a bank may decline the loan and deny financing to the potential borrower.

Even if the borrower has outstanding credit and assets galore, a faulty, unique, or overvalued property can kill the deal.

That’s why it’s always important to use a qualified appraiser who assigns a realistic value to your home so there aren’t any surprises when it’s do-or-die time.

It’s better to know the true value of your home upfront before you sign any contingencies or purchase contracts.

And remember that the quality of your appraisal will determine the quality of your review (unless it’s automated).

The review appraiser will always find the home’s value based on what is given to them.

If they receive a poor appraisal report, they will likely assign a poor value.

I’ve seen brokers submit multiple appraisals and receive completely different values based solely on the original appraisal itself.

As of January 26th, 2015, Fannie Mae let lenders use a proprietary tool called “Collateral Underwriter,” which provides an automated appraisal risk assessment complete with a risk score, risk flags (potential overvaluation), and messages to the submitting lender that warrant further review.

CU works by leveraging an extensive database of property records, market data, and analytical models to analyze appraisals for quality control and risk management purposes.

In the future, lenders may be granted waiver of representations and warranties on value so they can lend more freely, at least when it comes to questionable property values.

[Soon you may be able to buy a house without an appraisal.]

How Long Is an Appraisal Good For?

- Home appraisals have a limited shelf life

- It is dependent on the home loan type

- But most aren’t portable from lender to lender regardless of time

- Meaning if you don’t use the same lender it won’t be valid anyway

Wondering how long an appraisal is good for? It’s a tricky answer because most appraisals aren’t portable, meaning if you get one, you can’t take it to another lender anyway.

So first you have to consider whether you’ll be using your old appraisal with the same lender that ordered it.

If you are, you might be able to use it within a 12-month period, but chances are the lender will need to update it if it’s been longer than four months.

By update, I mean reinspect the exterior of the property and determine if the property value has declined since it was originally appraised. Banks need to ensure they’re not giving you an old, higher value.

A situation where you could use an old appraisal would be if you were thinking about refinancing with a certain bank, then pulled out for one reason or another.

Then a few months later, decided to go through with it again. But as noted, it would need to be with the same lender.

Also consider that the value might be higher, and you wouldn’t get to take advantage of that if you reused your old appraisal.

For Fannie Mae and Freddie Mac, you’re looking at four months, at which point the property would need to be reinspected and the appraisal updated.

For FHA loans, there is a 120-day validity period for appraisals, which can be extended for another 30 days if certain conditions are met.

If an appraisal update is performed before the original appraisal expires, it can be good for as long as 240 days.

For VA loans, the validity period is typically six months and appraisals expire once the loan transaction has closed.

This means you can’t use the same appraisal for a purchase and a subsequent refinance, even if it’s within a six-month period.

For USDA loans, appraisals must be completed within 150 days of loan closing. If they are any older, they might be valid again once updated.

The takeaway is that most of the time you can’t use an old appraisal, so don’t bank on it. Just try to close your loan the first time around.

Although a home appraisal is irreplaceable, you can do some quick research on your own by using a free internet house values tool that generates a quasi-property appraisal in a matter of seconds by simply typing in the home address.

Read more: How accurate is a Zestimate?

Scott,

It sounds like they’re just using recent sales comps, which is standard. Perhaps the most recent ones were lower than they were in 2011, which is somewhat surprising given the recent home price gains in most areas of the country.

Hi Colin –

I am looking to buy a second property for investment/vacation purposes. I found a developer that is looking to unload their model home and I can purchase for about $80K less than asking price (list price $635K, sell price $555K). I’m pretty sure that any lender will want 20% down to avoid PMI. Is that correct? I’m trying to be creative and not put any more cash into this than possible. Can I ask the lender to sell at full list, knowing it will appraise for that, and then have them pay the $80K difference as part of my down payment?

Brett,

A lender will go off the lower of the appraised value/purchase price to determine LTV and it must be at/under 80% to avoid MI unless they build MI into the rate.

Hi Colin!

My husband and I purchased our first home about two years ago. We were approved for a conventional mortgage through Wells Fargo, but had to pay PMI because we fell short of the 20% down payment. At that time, the home was appraised as a 3 bedroom home with the third bedroom being a converted garage. It looks like it was done correctly. It has A/C, electric, and the flooring is also level to the rest of the home.

We recently had another appraisal to potentially remove the PMI since home values have gone up in our area. The new appraisal, however, did not count the converted garage as a bedroom since it was (apparently) not permitted. We purchased the home without knowing this and there were no red flags throughout the process.

I have contacted our real estate agent, who has been doing this for over 20 years, and she has never encountered a problem like this. I’d like to have the PMI removed, but I’m afraid of stirring the pot and creating more trouble than its worth. What advice could you give us?

Vanesa,

I’ve heard of this happening, though semi-surprised the first appraiser didn’t notice it wasn’t permitted. Could try to get it permitted so it can factor in to the value to drop PMI.

We have been trying to refinance our home. The lender we have been going through sent an appraiser from a different part of the state and he even told us he was not familiar with the area. Also, he used comps outside of our zip code (lower end homes). I requested from our lender for another appraisal since the first one was not familiar with the area, but they told us it is illegal. Is it illegal to request another appraisal from a more local company?

Kim,

Not sure what they are saying is illegal, perhaps handpicking an appraiser. But they should be able to get a second independent appraisal from an approved company if it warrants another look.

My husband and I got our house appraised during a drive by appraisal and it came in $20k lower than a house that sold less than a month ago (which is the same house model and elevation, same sq ft.) how is that possible??? Our house has more upgrades than the one that just sold for 20k more…I know it was a drive by but shouldn’t our house come in at the same value as the one that just sold?

Hey Colin,

I bought a condo and the mortgage appraisal came out at 15k$ less than my purchase (about 2%) and I found some mistakes in it. I’m trying to talk to chase to change it, they tried to appeal but since all the comps were in the appraisal (though it was wrong) they said there’s nothing they can do. Is that so? Can a manager not approve this?

Thank you.

Kameron,

Could be two different appraisal companies with different risk appetites so it’s possible. Maybe point this out to your lender to see why yours came in lower to see if there’s a detail you or they missed.

Yaron,

Sometimes it’s possible to overturn, sometimes it’s not unfortunately. You can ask Chase to get a second opinion (ideally on their dime) to see if the value comes through. Mistakes as you refer to them might be subjective…

Hi Colin,

I’m curious if the appraisals banks get for your house are the same as the market value counties use for Property Taxes?

Thanks

Colin,

We applied and received a loan recently. The money has been already used to pay several other creditors. Part of this process involved a drive by appraisal, which the lender arranged, and the loan amount was subsequently determined by the lender based upon the appraisal performed. Now, about a month after the loan was approved and money provided to us, the lender has contacted us and says “we (the lender) made an LTV calculation mistake and as such, we want to re-do a full appraisal.” They seem in a great hurry to do this, and have stated it will not cost us anything and that “for our inconvenience” they will re write the loan at a slightly lower interest rate.

Something seems fishy to me about all this, and I am leery of now the new appraisal comes in lower.

Can you tell me whether or not they are allowed to require this, whether I am obligated to go along with it, and what would happen if the appraisal is performed and the LTV isn’t high enough to support the original amount they lent to us?

Thanks much!

Jen,

No, they’re different because the county probably uses some algorithm to get the assessed value of the property while an actual human being (in most cases) comes to your property to conduct an appraisal when it’s for a mortgage, which while objective, will still be somewhat subjective because it’s performed by an individual and they choose comparable properties to ascribe a market value.

Hi Colin,

Great website and liked the article. I was hoping you could reply to my question.

I am a week away from closing date and still in conditional approval phase. I submitted all the remaining documents underwriter / loan processor asked for + Lender got the credit supplements too. However, the loan processor is waiting for one last document to put the file back in front of underwriter. T

That last doc is an addendum from appraiser. Loan processor said the addendum is to be required because I, the buyer, is getting a commission from my realtor agent (also financing situation changed now as LTV ratio reduced from 90% to 80% with some 8% of property price coming in as gift).

My question is why would the appraiser need to give an addendum if he originally didn’t know about agent commission or if financing structure changed with gift money. How would it change the appraisal value, if at all, because this is not seller’s concession / credits.

Please help me as I am eagerly waiting for clear to close.

Thank you

John

John,

My assumption is that you are an interested party if you’re getting a commission based on valuation.

I live in a very small Historic Town and now my appraiser says my home is unique. I don’t understand. The home has been remodeled. Why I am being labeled this way?

Monica,

So-called “unique” properties can be difficult to appraise because it generally means there are fewer comps to compare it to…doesn’t necessarily mean higher/lower value, just harder to assign value.

Hi Colin! My condo came in 25k less than the price we agreed on. The sellers are not willing to come down on their price and I’m going to lose this deal BC I don’t have the cash to make up the difference. We already re-evaluated the appraisal and it came in again at the same price and they still are refusing. Can I order a whole new appraisal with my bank? I am willing to even pay for it. But I would need the sellers to agree to amend the contract and say that if it comes in lower a third time they have to give it to me for that price

Will the bank allow me to get a new appraisal?

Danielle,

You’ll have to ask your bank – they might be able to use a different appraisal company to appraise the property. You may want to determine beforehand if there are any favorable comps that were overlooked the first two times around.

Colin,

I am in the process of refinancing a manufactured home. This is a FHA loan. The person that I am working with came back and said that the appraisal didn’t have the FHA number on it and that they would have to get in touch with him. Does an appraisal need/have this type of information?

Colin,

Whatup?

My landlord is insisting on yet another appraisal for “refinance”.

We’ve been here for ten years, and it seems like every time she gets wind that something may not be right, she wants to “refinance” again, so needs to send an “appraiser” over.

Let me explain.

Our landlord lived here for ten years before moving on and making this a rental. It is a fairly established neighborhood, so on every side, and across the street, are homeowners all of whom lived here and knew her when she did.

Example: I had my mother living here the last three years of her life. When she passed, my sister and brother in law helped me gather the things she had in storage, and move them here. The next day I got a phone call from my landlord.

She said “I understand you have new roommates!!”

Crazy, right?

Anyway, I have recently fallen ill, and require oxygen. My wife and I like to sit out on the front porch after she returns from work (I can no longer work-for the past six months).

So I’m sure word has gotten to her that I no longer work, that I sit on my porch of an evening with oxygen machine tubes running up my nose.

And lo and behold, here she comes again with yet another refinance!!

I should explain that she holds a fairly high-profile job in a very small community–she knows everyone, and vice-versa. I know she is concerned with her property, and my ability to maintain it–a large selling point when we first moved in. On that note, in ten years here, we have never called to have her remedy situations save for, I believe, three plumbing problems beyond our scope…I took care of the rest.

In any event, as paranoid as this all sounds, I am convinced she wants to have a look around, see how the place looks.

Which is fine. But I’m tired of (every) landlord I’ve ever had telling me they don’t make enough from my rent to cover the payment they make. I’m no dummy. I DO have a real estate license…

Some years back she moved from a condo to a planned community with bay view, and I could understand pulling some money from this place to help develop that.

My question is this.

This would, I believe, mark the third time she’s “refinanced” this place.

At what point does encumbering a property become counterproductive, and if, as she claims, the rent ALREADY doesn’t cover the payment, how much sense does it make to take a larger payment on it??

Isn’t there such a thing as the point of diminishing returns for this?

Thanks for listening to my rant, Colin!!

Christopher,

How do you know she’s taking on a larger payment? Did she say she’s taking cash out, or just lowering her interest rate with the refi. Lots of people are serial refinancers…I remember a similar situation in a rental when I was younger. The owner told me she would refi once every six months…then the whole thing came crashing down. Not sure your landlord would refi just to look inside the place…I’m assuming there are easier ways to accomplish that, perhaps with some maintenance or similar request.

Hello Colin,

We are purchasing a home in St. Charles county, Missouri.

The sell price we offered and was accepted is $380,000.

The appraisal came back at $380,000. Great right? Well no.

The appraisal came back with a quality rating of 4.2 out of 5. I was told there is an appraisal rating of 1 – 5. 1 is best and 5 is worst.

What the heck is a quality rating? I would think it either appraised or it didn’t?

Further explained to me is that anything over a 3 required a desk or field review.

Can you explain any of this. It makes no sense to me.

Thank you,

hello, Can you tell me if I have the right to refuse a home appraiser before they come out? We are attempting to re-fi and the ‘next one in line” doesn’t seem to have the time to make the appointment, nor answer their phone.. Wondering how I can expect confidence in their numbers/homework.

Lorene,

Doubtful but you can ask. Best to be patient in these situations, even if it is frustrating…the loan process takes time, and even more these days with lenders so busy and regulations more stringent.

Hi, my parents home in NY , that they have lived in 35 years ( refi’d many times) is in foreclosure ( or about to be ). They are seniors and will never work again. They owe about 425k ( havent paid mortgage in 2 years ), we just got it appraised and it was appraised at over 700k ( the whole house was upgraded and renovated after a fire many years ago). Is there any way for them to keep the house? reverse mortage, refi ? something. They lived their all there lives and are about to walk away with nothing, they are looking at low income senior places because they can not afford westchester rentals on a fixed income – soc sec & pension. Do they have any options to take advantage that the house has gone back up to pre-2008 prices? Thank you so much for your help in advance

Hi, Colin. We bought a house last year for $75,000 with the real estate agent and appraiser both saying everything had been updated, improved, etc. The first week after closing, everything started falling apart. Septic tank had to be pumped, gas line had to be replaced, plumbing in the master bath and kitchen kept backing up in sinks, showers, and toilets, and hot water heater was deemed to be “condemned” and unusable. We checked over the appraisal again where it was appraised at $90,000. During this past year, we’ve had our stove catch fire (and found wiring throughout the house that wasn’t the correct wire along with scorch marks in the walls, cabinets, everywhere). The laminate flooring they had laid down before selling the house to us started shifting, so my son-in-law who was a flooring specialist for years lifted the laminate flooring up only to find five layers of vinyl flooring with asbestos under the laminate to cover molded floors and sub-flooring. While checking under the house, we found there are parts of the foundation that had been knocked down when the other owners added on to the house years ago. The area between the basement and main floor is being held up with the little green T-posts that you use for fencing. We decided to do more checking to see what else could possibly be wrong with this house. Wrong decision! We have no insulation anywhere in the house, and a very large cabinet that was strategically placed in an odd location in the living room blocks where the previous front door was located. It’s just a large hole with the black sheeting, a couple of 2 x 4s, and the bricks on the outside. No paneling or anything. Just a large open hole.

Since finding all of these things wrong, we have redone all of the plumbing, some of the electrical, and laid some foundation between floors to hold the supporting wall in place since our house had shifted.

My question is, is there anything we can do about the real estate agent and appraiser not being honest with us? If we try to refinance this house, and the new appraisal comes back at a lower price, what happens then? Will we still be stuck with a $75,000 mortgage, or will they be able to go with what the new appraisal shows? Please help! We’ve never been in the situation before.

Thanks so much!

Colin, I am getting ready to sell my home next spring. I had an refi appraisal done about 6 months ago. My question is two fold. Are refi appraisals lower than a new mortgage appraisal and also, the last appraiser listed the heating and cooling system as forced air when it is Geo-thermal. Would those two factors effect the new mortgage appraisal?

we filed an appeal due to a very low appraisal, they denied. Are we allowed to have a different company appraise this home?

Hey Brook,

It depends what the place would actually sell for and the existing liens (and penalties, back interest, fees, etc.)…may want to get in touch with a real estate agent to see if it’s possible to get it listed before it’s sold at auction if it’s determined they can pay off full balance and recoup some money. Good luck.

Stephanie,

Sorry to hear about your house…perhaps some of these things might have been noticed by your inspector during the home buying process? As far as appraisal goes, if it appraises for more you can generally use that new value for a refi, if lower you’d likely abandon your refi.

Steven,

Appraisals can vary tremendously from one appraiser to the next depending on the comp sales they use. Not sure the air would have much effect if any at all. Next spring you may get an entirely different value based on sales around that time, and again, with different appraiser point of view. Generally with a purchase the appraiser will know the purchase price and look to support that value if it makes sense.

Brenda,

Yes, but it sounds like you’ll have to find a new lender and might be subject to paying another appraisal fee.

The appraisal for a 1920s house does not mention lead paint. The house does have lead paint and extensive peeling. Flakes of paint have also contaminated the house periphery, so the soil will have to be abated as well. Does this violate any accepted appraisal rules?

Colin – I’m quite discouraged with what I’m reading! Are appraisals nothing more than a way to devalue someone’s home? We’ve renovated the entire house, inside and out including electrical, A/C, plumbing, heating, roofing, kitchen, bath(s) all bedrooms and livingspaces, landscaping and pool + much more over the last 10 years. We’ve refi’d three times in the last 8 years and the last two refi’s appraised 20k LESS each time. We’re now 45k lower after nearly 100k in renovations. Are we victims of a terrible housing market or bad appraisers?

Karen,

Sadly your home is subject to market forces and the surrounding homes, even if it’s the Taj Mahal…it can certainly help to make improvements, but it still may not be enough to swing the value meaningfully. In other words, home improvements are generally good for the occupants to enjoy and perhaps to increase the sales price in the future, but may not affect the appraised value significantly.

Here is a follow-up to a question posted on 8/19/16 that never got answered.

Apparently the rating is generated by FannieMea based on some information they have in their database. Many factors play into the perception of the information they have. These are red flags to the lender that may or may not have substance. It’s up to the lender to decide to have another appraisal or move on with the initial approval. After talking to another lender they tell me the lender usually just moves on with the initial appraisal. Our lender decided to have another appraisal.

A little information about our lender and loan. We have taken out a very unconventional loan called All-In-One. I’m not going to get into the specifics, but it’s basically a line of credit.

The lender is not local and knows nothing of the area. I can only assume that is why they decided to get a second opinion. I was also assured by the financial institute I was working with that when this happens almost 100% of time the original appraisal is justified by auditing appraiser.

The second appraisal came back and it was $50,000 less than the original appraisal. Can you believe that! Which one is right? They are so far apart it questions the integrity of the appraisal process or at least the appraisers.

Now there is a protest and each appraiser justifies their findings to the other in hopes that there is some adjustments made to bring both appraisals in line with the correct or assumed valuation.

The two appraisers justified their appraisals and didn’t budge.

So, the AMC (Appraisal Management Company) has to sit down and go over each appraisal and decide which one is right and compare all the details and come up with an agreed upon value. It took two days so you know there is some real work going on right? No! The AMC picked a number right in the middle and valued the $380,000 property at $355,000. Brilliant!

What a joke. The relocate company handling the sale is furious. After cooler heads prevail they reduce the price to $365,000 and the lender will only lend 80% of $355,000. We came up with some extra cash and both realtor adjusted their commissions to get this done.

We got through this. Just wanted to point out what a sham the whole appraisal process is.

Thanks for listening even though I got no feedback.

Steve

Steve,

Thanks for sharing your experience…apologies for not responding, I remember looking into the appraiser ratings but couldn’t find much on the topic.

Hi Colin,

I live in Miami, Florida. I want to buy a house for 430k. I qualify for 344k so the rest I planned to pull a cash out from a paid off investment property I have rented. I did the appraisal with the lenders prefered company. The appraisal came 25k-30k lower than what I was expecting. I sent back comparables and will try to dispute it. In case the results of the dispute are not favorable to me. Does it exists a way in which a lender takes everything into consideration and says ” well because of 25k i am going to loose a 430K loan applicant mind just approve it and move foward with both loans”. What else can I try? Seller wont come lower, we already negociated 30k. (List price is 459k) any idea or suggestion would help! Thanks!

I am trying to eliminate my PMI from Wells Fargo and I am being told that I have to use their appraiser for the cost of $550 and it could take 4-8 weeks until the process is finished. I asked if I could use a certified appraiser and they said no. They also told me that I have to reach 78% of my original value if I do not order an appraisal. I am currently at 81.9% at my value and I know my house will appraise by 20%. Knowing that wells fargo was just in the news about overcharging for appraisals does this seem like an excessive amount and wait period? When I asked if I could dispute the $550 they told me that I could not. Am I stuck or do you think there are other options not including paying the principal down.

Chris,

It doesn’t sound that excessive, to be honest. I’m sure there are cheaper appraisals, but there are also costlier ones…

The lender ordered a re-appraisal of the condo that I’m trying to buy and asked me to pay for the second appraisal fee. Is this a common practice? The first appraisal shows the home value is greater than the loan amount.

Joyee,

Hmm, if the first appraisal came in over value it’s a bit odd to ask for a second, especially on your dime. May want to fight that fee or ask realtor/seller to chip in. If it came in under value and you asked for a second opinion it would be more reasonable for you to pay.

Hi Colin,

Really cool to see you actively keeping up to date with questions and replying over the years. I have a question:

I have a townhouse, its actually one structure but is a multifamily structure so it fits two family at 1645sqft each. It was listed as singe family townhome but i’m purchasing both sides. This is an investment property and already tenant occupied. Now the bank estimated costs to be $655 each. I was a bit outraged with the cost. I have other friend who bought the same townhome for investment purposes less than a mile away & it was just one side so I was thinking collectively they would run lower together. Appraisals came back much lower for him, either in the 5’s or 4’s. I received my appraisal but no invoice. Is that standard to include? When researching the appraiser, they have the same office address as the lender. What are your thoughts as far as how i can go about getting a fair cost?

We applied for a conventional loan with one company and ended up having to switch to another. The appraisal just came in last night from company #1 but company # 2 says we need a new one and that this is due to new government regulations. Can you explain this for me?

Sonja,

Appraisals often aren’t portable, meaning one lender can’t use another lenders appraisal.

Hey Colin,

Lots of comments and questions above here, hopefully this is not redundant. My question: is there typically any difference in home values for owner vs lender ordered appraisals, other than what they can be used for? My situation is similar to the first one posted by John Gonzalez 11/10/14, I am going through a divorce and wanting to keep the house and pay her appropriate equity. We have to refi as she has the property sole and separate so I suggested we just get the refi app started and the lender ordered appraisal. She wants to have a separate owner ordered appraisal first (thus forcing me to have another for the refi) under her presumption that the appraisals would somehow be different in value. experience with this? any supporting documentation?? -THANKS in advance.

Hello Colin, I was trying to refinancing an FHA loan, my actual loan amount is $224,598, the lender want to do a conventional and changed already two times the numbers, last Loan estimate was that my loan amount will be $231,000 included the closing cost and the escrow. They ordered an appraisal, that I paid $475, and came out $375,000. The lender sent me the closing disclosure with $235,500 my loan amount with a closing cost increased for almost $4000. When I asked explanation they said that I told them that my house had a value of $385,000 so they have to charge me 0.728 points and other stuff. They didn’t send me a revise Loan estimate and my house is not under value. They keep calling me saying that I will save so much money and in six month I can refinancing with $0 closing cost. I don’t trust them and I want the money back from the appraisal, what I can do? Thank you.

Matthew,

Generally appraisers know a “value” beforehand that is tied to the loan application, then either affirm that value or come up with a different one (higher or lower). That might be tough in your situation as your wife will probably want something entirely objective. Just know that the appraisal she orders may differ in value from the one you get with the refi, and she should know it could be lower (or higher).

Salyas,

If your loan amount is only around $231k and value is around $375k, your LTV is very low, around 62%. That should give you a lot of options and the lowest rates, assuming you have good credit. May want to shop around with other lenders if you feel they’re giving you the runaround. Not sure what their appraisal fee refund policy is, may have to read what you signed. Good luck!

Thank you Colin!

Move all of your valuables out of the home or temporarily put them in a closet (which is usually not photographed unless it adds significant value.)

A buyer and buyers’ lender will not accept your plans as sufficient information for an appraisal.

You are more vulnerable when listing and showing your home than getting an appraisal.

I applied for a home equity loan. My credit is not good but the credit union I went through said they would look over my credit and call me back to let me know if they will go through with appraisal. They called back the next day and ordered appraisal which they are paying for. They wouldn’t go all this way if my loan would not be approved would they? Only borrowing a small amount and they said as long as my home appraised for 50,000 which is will I will be OK. I am waiting for appraisal to call but just would love to hear you say that it looks good!!

Cyndi,

If you aren’t worried about the appraisal coming in at value and that’s the only issue, you shouldn’t have anything to worry about. I know these things are nerve-wracking but you’ll get your answer soon. Good luck!

Hi Colin, have you heard of a lending institution waiving an appraisal and then financing based on the selling price? We bought a home in 2007 and there was no appraisal required. We bought the house in 2007 for $490K and were required to pay PMI. In 2010, we refinanced and had an appraisal that came in at $372K, so we are still paying PMI! We just can’t figure out why, looking back, did our original lender loan us such a large amount without an appraisal…and is this legit?

Jessie,

I doubt a lender wouldn’t use an appraisal – maybe the fee was paid by someone else? It just wouldn’t make sense for the lender to not independently assess the value of something they essentially own. The difference in price is likely because 2007 was a market peak for much of the country.

Colin,

we had to switch lenders for our loan, from a bank to a Credit union. The appraisal had to be reassigned to the credit union, they charged us 350.00 on top of the 625.00 we already paid for the appraisal. We can’t figure out who just scammed us, the appraiser, the bank, or the Credit union?

Larry,

Unfortunately, most appraisals aren’t portable. Lenders have approved companies they work with that vary from bank to bank. It’s kind of like if a seller said his guy says the house is worth X, and you respond with, well, I want to get my own opinion of the value. Regardless, it’s no fun paying duplicate fees…

Hi Colin,

We are in the middle of re-financing a home that we bought with an investment loan. Now that we have done our remodeling, we decided we wanted to keep the house and are set to sell the other in a just a few weeks. We originally paid $75,000 and are needing to re- finance around $70,000 now. The bank requested an appraisal that came in last week at $88,000. Now (two days before closing) the bank is saying that there is no way in 3 years the property value has gone up that much and they sent my husband a letter saying they are lowering the appraisal to $64,000. Can they do this just willy nilly?

I’ve seen it happen because ultimately the bank is extending the financing and has to be comfortable with the valuation. But it might be possible to contest it or ask them to get a second appraisal or BPO on their dime if you had to pay for the original appraisal.

We are refinancing with BofA. Amount owed is 160k. The company the bank hired appraised the house at 245k. We are still under the 80%,but we have seen recent sales in the area of 270k and up. Our house is well kept. How does a low appraisal in a refinance affect us?

Jack,

There are often different pricing adjustments at certain LTV tiers such as 65%, 70%, 75%, 80%, and so on. It sounds like you’re around 65% so there’s a good chance the lower value isn’t affecting your mortgage rate. You can ask the lender if there are any pricing hits on your loan and/or if pricing would improve if the value were higher.

We’re selling our house in a hot market, listed it for $210,000 and were under contract for $215,000 within 48 hours. Appraisal came in on 6/2 and appraiser listed both the purchase price and appraisal value at $210,000 and for 14 days has refused to adjust (at least) the purchase price to the correct $215,000. Because it technically isn’t under-value I’m not allowed a copy of the appraisal report to dispute his findings, nor can we negotiate with the buyer until the appraiser fixes his mistake. He listed our home well within the range of comparibles but I think he’s so irritated at the buyer’s real estate agent for trying to contact him for 14 days that he’s refusing to do anything at all. What can we as sellers do?

Colin,

I currently have an FHA loan, I am considering to purchase a second home as a primary do to work as a conventional loan after being approved i recived an additional email saying my second home has to be 100 miles away from my current home to even consider it as a rental income.this is what the lenders requirements are? That seems to get I did some research and saw that it should be at least 50 mile radius not 100 .please advise.

SD,

Hope that cooler heads prevail and everyone comes to their senses. Or the buyer might have to make up the difference if they want the house for $215k if the former doesn’t pan out.

I applied for a refinance with BoA everything was good

except I did not want a 30 year loan, I paid for the

appraisal ,the agent offered me another option which

was to include my wife on this loan, every thing was the

same except my wife was this loan. Again, he said

another appraisal was needed, I paid for it, but no one

has ever showed up or called to preform another

appraisal. I have canceled my application with BoA and

have asked for the cost of the second appraisal ,which

was never done. can I expect a refund or not!

David,

If no one did the work you would expect a refund, but that doesn’t seem to be entirely clear. May want to get in touch with BofA directly to ensure you get refunded your money if the second appraisal never was completed.

We are attempting to purchase a home and have a signed buy/sell agreement with sellers for the house with the purchase price of $265,000. In the other items section, the sale is stated to include a couple other items like a mower and kayaks. Our lendor is telling us that she thinks when it goes to underwriting, they will require a third-party appraisal of the “extra” items and that even if the house fully appraises for $265,000, we will be required to show up to closing with cash for the appraised value of the extra items. So we asked her if the underwriters do that, if we could file an amendment at that time to remove those items from the agreement and she said, “no, the underwriters will be on to you.” (whatever that means). Does this make any sense to you? It sounds fishy to us. Thank-you.

Ozzy,

That sounds strange, not sure why a home appraisal would be affected by items such as a mower and a kayak that have nothing to do with the value of the home, especially if they’re giving them away to you. Seems like a silly thing to get upset about or jeopardize a big purchase. Hopefully cooler heads will prevail.

I have a rental property that was appraised 9/15 and recently I had the same mortgage company ask me to refinance only to have the appraisal value drop over 30k? Received the appraisal yesterday. What are my options?

Bruce,

I outlined some of the options in the post, such as challenging the value, restructuring the deal, asking for a second opinion, etc. Could also apply elsewhere and hope for better, though additional costs. Good luck.

Hi Colin, had a refinance of my home in April with appraisal coming in at 205k. Went back to the same bank, Quicken Loans, in October for another refinance and this time with appraisal coming back at 155k. How can that be so different?

Rick,

That seems peculiar; you may want to compare the appraisals side-by-side if you still have the original to see what comps were used and what else changed, and perhaps also ask the lender what the discrepancy is, as it appears to be quite glaring.

Is there a downside to not having a house you are buying appraised? The mortgage Company is saying I can waive the appraisal.

Thanks,

Christine,

A potential downside is paying too much for a house, but the lender would likely still do their diligence to ensure they aren’t financing an overvalued property. And buyers likely do their own research to ensure they’re comfortable with the purchase price.

Is one in default if one does not come up with the difference between the appraised value and the contract selling price. The builder says I am and says will keep all of the 10% initial deposit if I do not come up with the difference and the other 10% at closing.

Bought a foreclosed home from bank and selling to another party. Does the electric and water have to be on for the appraiser

Martin,

May want to ask the appraiser directly, but they may have to demonstrate that certain appliances work.

Appraisers can be bias. You could have 6 comps all 500 sq ft smaller than your house and all be valued higher, and the appraiser will not have been inside any of them just the outside. So yes it involves a certain amount of politics like everything.

We refinanced last year to take cash out to add downstairs full bath, remodel/insulate entry, and to do new counter top in kitchen. Mortgage appraisal was $375k. This year we were thinking about selling, after $50k in improvements market appraisal is $275-$325. How can this happen in a market that is rising?

Tina,

You may want to compare the comps (other nearby sold properties) used in each appraisal to see how they differ. Values can be subjective and also change over time for any number of reasons, but the comps should help make sense of it.

I am approved for a loan for 260,000. I am putting 3% down. I have had 2 different lenders send appraisers out on 2 different houses. They both came in at 86% of the asking price. I find that odd. Seems like the appraisal process is taking into account my down payment to make sure the bank it getting closer to a 20% equity value. Is that legal? Are appraisers coached??

Dave,

Look at the comps – see why they’re coming in low. Could be your housing market is inflated at the moment. Appraisers are objective and shouldn’t have any incentive for the property not to appraise.

Why would a lender not want an appraisal to include a cost report

My husband and I are looking to buy my brother-in-laws half of a house their father left to them. My in-laws are money hungry and even though we told them that we were getting an appraisal by the bank, they want their own done by a friend of theirs. Are we obligated to take their appraisal’s value or can we use the one from the bank?

Kaitlin,

If your bank is providing the financing, they will likely only go on the appraisal they order themselves, not the seller’s. Hopefully the values are similar to avoid any hoopla.

Hi Colin,

I am weeks from closing and I have been asked to signed a waiver regarding timing of receipt of appraisal report. Do I have to sign that? on the paper it says it is not required but they keep asking me to sign that paper.

Nicol,

I assume it’s the waiver to receive a copy of the valuation three days before closing, which should be voluntary as you said. If you have a copy of appraisal and are conformable with it, waiving may not be an issue to you. Have them take the time to explain the waiver thoroughly so you’re comfortable to proceed with signing or not signing.

I just typed a book explaining everything prior to that copy & paste comment, but I don’t see it posted! Please tell me it is in your inbox or somewhere to restore?

Andrew,

I read it – search for my page on PMI instead and you’ll get your answers. Long story short, appraisal shouldn’t be required for auto removal, but for borrower requested, appraisal might be needed, especially if home prices have depreciated since purchase.

If a second appraisal is obtained by the bank, because the first appraisal is older than 12mo.. Must the new appraisal value be relied upon? If the second report shows a lower value, can the bank ‘throw that out’ and have a reinspection done on the original report to solidify the original value by the original appraiser?

No investors are involved.

Liz,

Generally speaking, they’d use the latest appraisal for valuation purposes. In terms of challenging the appraiser’s opinion, one could ask the lender to review the one that came in low or potentially order a third appraisal. Take a look at the comps used in both appraisals side by side to see what went wrong.

Hey Colin,

I can’t believe that you are still answering these questions all these years! That is awsome!

So I want to buy the house that I have been living in for 10 years from my parents. They are going to sell it to me for 300k. It will probably appraise for 380k. Will I have to come up with the down payment since it appraises so much higher than the cost?

Thanks!

Carice

Hey Carice,

If you’re thinking gift of equity, the ~$80k gift could be used as the down payment and put your LTV just below 80% to avoid mortgage insurance and ideally result in a lower mortgage rate. Just be sure to work out all the details with the lender upfront to avoid any hiccups. Good luck!

Hey Colin,

I have a buyer that signed a purchase contract with EMD. The lender did a AVM which came in lower that the purchase price and did not approve the loan. Buyers choose to not get a certified appraisal and requested the EMD. Sellers will not sign the EMD to be released to the buyers because the buyers did not get the home appraised through a licensed appraiser. What is your take on this? Who get the EMD? Buyers or Seller?

Salina,

In general, I don’t understand why a seller would fight and keep their home stuck in limbo if their buyer has no interest in moving forward, even if it’s aggravating. So in situations like these, ideally both parties decide it’s best to move on amicably…especially if it’s a hot market and other buyers are around.

Hello Colin,

I recently found out that the lender appraised my condo with one of their “own appraisers”, according to my mortgage broker.

A couple of questions for you:

1. I thought a 3rd party appraiser would have to be involved? Are there any cases where mortgage lenders have their own appraisers doing the appraising? Would this be an advantage, disadvantage or neutral for me?

2. I can’t help but feel I “overpayed” for my condo unit. Does the fact that my condo was successfully appraised mean at this current point in time, my condo is worth what I paid for it (if not more)?

3. Are we able to ask our mortgage broker to obtained the appraisal value? I am truly curious as to what it appraised for.

Thanks alot,

George

George,

One of their “own appraisers” probably just means a third-party company that they work with on a regular basis, not some internal appraiser. In terms of it being successfully appraised, that just means it came in at value (either the exact price you paid or perhaps slightly more). All that really means is an appraiser was able to justify the sales price. It doesn’t mean you overpaid or underpaid, it’s just a verification of value based on other comparable sales in the vicinity and is used for lending purposes, not necessarily what a buyer would pay you if you tried to sell today. Lastly, you should be given a copy of the appraisal as YOU likely paid for it.