Well, here we are. It took longer than expected, but mortgage rates have finally strung together a decent rally after nearly three years of increases.

They fell below year-ago levels a week or two ago, per Freddie Mac, and took another big leg down after a softer-than-expected jobs report on Friday.

As for why, fewer new hires, increased unemployment, and slowing wage growth all point to a slowing economy. And interest rates tend to drop when the economy cools.

In addition, the Fed is expected to pivot and begin cutting rates, which could act as another tailwind for lower mortgage rates.

This has many thinking we’ll see another surge of home buyer demand, and potentially a big jump in home prices. But is it true? Do lower interest rates increase housing prices?

Do Lower Interest Rates Actually Increase Home Prices?

It’s entirely logical on the surface. If something people want becomes cheaper overnight, demand for it should hypothetically increase.

And if demand increases, the price might rise as supply decreases, especially if there are already too few homes for sale.

But if that were true for single-family homes, why didn’t asking prices crash over the past year and change?

Shouldn’t demand have fallen as mortgage rates spiked higher, leading to price cuts?

After all, rates on the 30-year fixed mortgage nearly tripled from its record lows in the mid-2s in early 2021 before peaking at just above 8% last fall.

Using the same logic above, home prices would surely nosedive as buyers fled the market, leading to a massive supply glut.

Instead, home price appreciation simply cooled off and home prices continued to increase in most parts of the country.

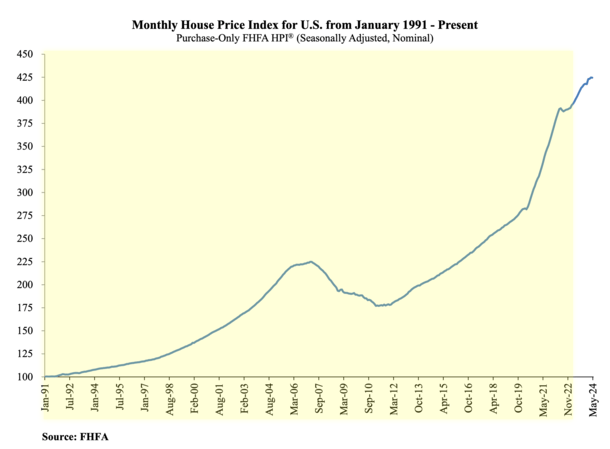

In fact, if you look at many home price indices, we have new all-time high home prices pretty much every month.

Home Prices Continued to Rise as Mortgage Rates Nearly Tripled

Just take this chart from the Federal Housing Finance Agency (FHFA), which oversees Fannie Mae and Freddie Mac.

Their latest report released on July 30th revealed that home prices increased a solid 5.7% from May 2023 to May 2024.

However, home prices were flat month-to-month from April after rising 0.3% a month earlier.

Still, if you look at the chart, you’ll see that home prices didn’t slow much as mortgage rates began their ascent at the start of 2022.

There was a brief pause as the housing market digested the near-tripling in rates, but then prices continued their ascent unabated.

So if we want to argue that there’s an inverse relationship between rates and prices, this last few years wouldn’t be a good example of that.

All we’ve really seen is a positive correlation between rates and prices, in which BOTH have risen together.

And now that mortgage rates appear poised for a bit of a rally, should we ignore that and say they have a negative relationship?

Can we say prices should have fallen when rates went up, but now that rates are falling they should go up even more?

Maybe There’s Just Not Much of a Correlation at All

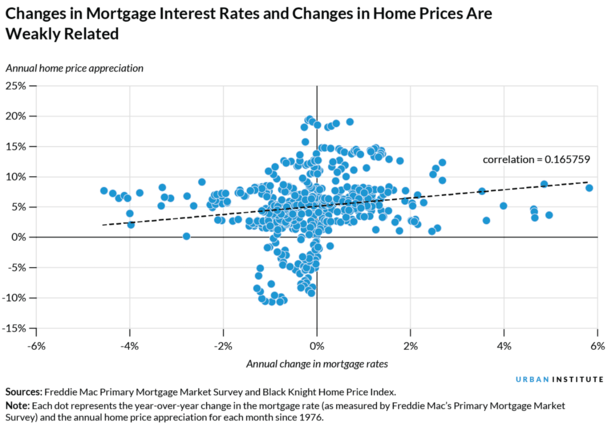

Instead of trying to invent a relationship between mortgage rates and home prices, maybe we should just come to terms with the fact there isn’t a strong one.

And there’s nothing wrong with that. If you look at history, changes in mortgage rates and home prices are weakly related, this according to the Urban Institute.

I’ve posted this chart before, but here it is again if you don’t believe it. You’ll see all types of combinations of annual mortgage rate and home price changes.

These little dots won’t make it easy to make the argument that when mortgage rates fall, home prices rise. Or vice versa.

Instead, you’ll see instances when they rose together, fell together, or sometimes, to fit the popular narrative that isn’t necessarily true, went in opposite directions.

Of course, nominal home prices (not adjusted for inflation) rarely go down to begin with, so we don’t even have that many examples to look at.

The takeaway is that home values are driven by much more than interest rates alone.

Tip: A cooling economy can lead to lower interest rates (how are mortgage rates determined?)

Why Would Home Prices Fall If Mortgage Rates Got Cheaper?

Well, just look at the economy…sure, mortgage rates are important because they can make a big impact on affordability.

The lower the rate, the more a home buyer can afford, all else equal. In fact, a 1% drop in mortgage rates is worth an 11% decrease in price.

But this simplistic view ignores cash buyers. And it ignores the financial health of prospective home buyers who need to get approved for a mortgage.

Just consider the last few days. The stock market has gotten hammered, with the Dow Jones falling more than 1,000 points today and the Nasdaq off nearly 600 points.

This sell-off was sparked by concerns about the health of the economy, with weaker data expected to usher in Fed rate cuts.

There’s a good chance that softer data will be accompanied by lower mortgage rates too.

Simply put, signs of a slowing economy improved the odds for a Fed rate cut, and also gave bonds a boost, which are a safe haven for investors when times get tough.

But if households are in worse shape because of said data, you’re going to have fewer home buyers out there. You could also have more sellers, perhaps even distressed ones.

Taken together, we might have a situation where the supply of homes for sale rises and prices fall, despite a big improvement in mortgage rates.

So yes, home prices could in fact go down, even if mortgage rates are lower!

But that’s not a foregone conclusion either, and will likely be highly variable based on economic strength and individual market dynamics throughout the country.

The main message here is there’s no strong correlation any which way. Thinking otherwise might simply lead to disappointment.

Read on: Is it better to buy a home when interest rates are high?