If you don’t believe mortgage rates and home prices can fall together, just look at what home prices have done in the face of 7% mortgage rates.

Despite the 30-year fixed surging from sub-3% levels to near-8% levels in less than two years, home prices hit fresh all-time highs.

So why is it so difficult to imagine the opposite scenario, where both interest rates and property values fall in tandem?

It seems the human mind wants there to be an inverse relationship between rates and prices when there often is not.

The good news is it’s possible that both rates and prices moderate from here, ushering in a better level of housing affordability.

Home Prices and Mortgage Rates Don’t Have Much of a Relationship

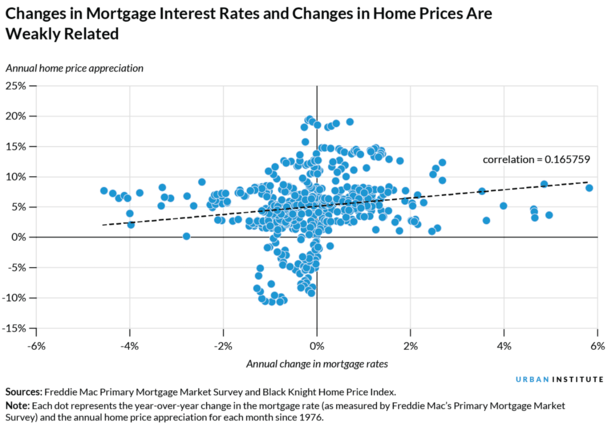

The Urban Institute wrote an article last year about the relationship between home prices and interest rates when mortgage rates were rapidly ascending.

They noted that since 1976, there has been “a positive but weak relationship” between the two.

In other words, higher mortgage rates are often accompanied by higher home price appreciation, though this tendency isn’t robust.

Still, it defies the logic many housing bears and everyday humans possess, where they assume higher mortgage rates must equate to lower home prices.

After all, if it becomes more expensive to purchase a home, the price must come down. That’s their argument at least.

But when you look at other necessary items (shelter also being a necessity), people don’t stop buying them because the cost goes up.

And one also needs to consider why mortgage interest rates are high to begin with. Often, interest rates are high because the economy is running hot.

This means there are more consumers out there making more money, which ostensibly means more of them can afford to buy expensive houses.

One other factor to consider is all-cash buyers – a large percentage of home buyers forgo mortgages to get the deal done, especially investors.

So while higher interest rates might affect the average home buyer, they don’t affect everyone.

Home Prices and Inflation Have a Strong Positive Relationship

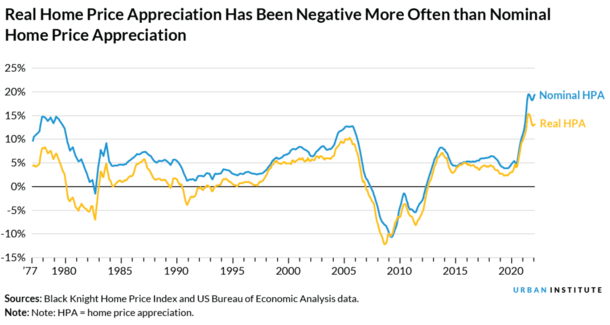

While higher mortgage rates and home price appreciation have a weak, but still positive relationship, inflation and home price appreciation have a strong one.

That is to say that a higher rate of inflation is associated with higher home price appreciation.

And this association is significantly stronger than the relationship between mortgage rates and home prices.

Inflation has been front and center for the past couple years, and the Fed has been actively fighting it via 11 fed funds rate hikes since early 2022.

At the same time, home prices haven’t fallen, though the rate of appreciation has. Still, when you consider the 30-year fixed more than doubling in such a short time span, you’d expect housing market carnage.

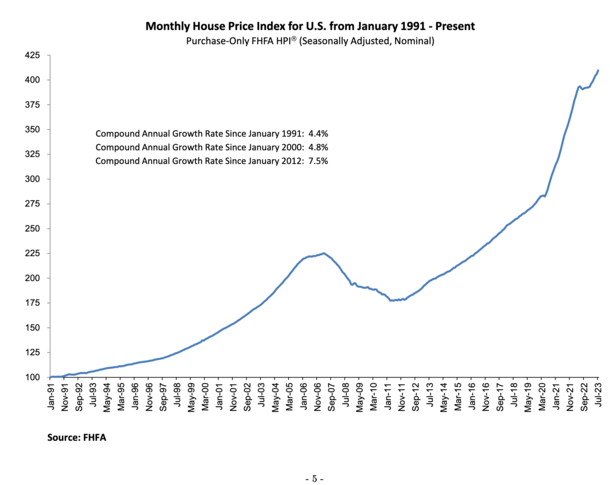

Instead, we’ve seen home prices hit new all-time highs. Last week, the FHFA reported that home prices were up 0.8% in July from a month earlier, and up 4.6% year-over-year.

While that might sound too good to be true, consider that high interest rates are often correlated with periods of strong economic growth, low unemployment, rising wages, and high inflation.

Put another way, when the economy is hot, home prices tend to rise because more people have money and jobs to support mortgage payments, even if they grow larger.

This means housing demand can increase or at least remain steady, even if affordability erodes over time.

Housing Affordability at Its Worst Since 1984

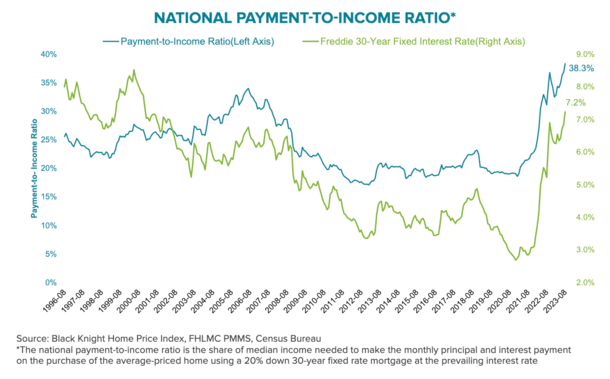

Of course, affordability has worsened significantly of late because both rates and prices have continued to rise, pushing the national payment-to-income ratio to its highest level since 1984.

Per Black Knight, it takes a $2,423 principal and interest payment to purchase the median-priced home with 20% down and a 30-year fixed mortgage.

This is up 91% from $1,155 just two years ago, when the Fed ended Quantitative Easing (QE) and began their campaign known as Quantitative Tightening (QT).

Clearly this has slowed home price appreciation, which had been running at a double-digit clip. But as noted, prices keep on rising.

More importantly, it has crashed home sales, which were above six million in 2021 and now on pace to be below four million in 2023.

Nominal Home Prices Are Sticky and Rarely Fall

The Urban Institute noted that mortgage rates have mostly just declined since 1976.

There have only been a few periods when rates increased more than 1.5 percentage points year-over-year.

However, rates did rise rapidly from September 1979 to March 1982 (remember those 1980s mortgage rates) and from September 1994 to February 1995.

This caused the rate of home price appreciation to slow quickly, similar to what we saw lately.

During that 1979 to 1982 mortgage rate rise, home price appreciation decelerated from 12.9% to just 1.1%.

And from September 1994 to February 1995, it slowed from 3.2% to 2.6%.

During each of these time periods, real home price appreciation (adjusted for inflation) went negative, but nominal home prices only went negative once a recession was under way.

In other words, you need the economy to fall apart if you want home prices to come down. And guess what could also come down at the same time?

What About Falling Home Prices Combined with Lower Mortgage Rates?

So we’ve discussed how home prices and mortgage rates can rise together, though the relationship isn’t a strong one.

But that a robust economy tends to lift home prices higher, as has been the case over the past many years.

If that’s true, can’t the opposite also be correct? Can’t mortgage rates and home prices fall at the same time, perhaps because of disinflation and a cooling economy?

The answer is yes they can. If and when the economy takes a turn for the worse, the Fed could pivot and begin cutting its own policy rate.

At the same time, mortgage rates could retreat from recent highs and make their way lower as well.

And home prices could also begin to fall as a recession sets in, resulting in job losses, pay cuts, higher unemployment, and lower housing demand.

This counters the notion that mortgage rates back in the 4-5% would set off another housing market frenzy filled with bidding wars and rapidly appreciating prices.

Simply put, if home prices and mortgage rates can rise together, they can also fall together.

Ideally, we see moderation on both fronts, with home prices maybe pulling back from recent highs, at least on a real, inflation-adjusted basis, while mortgage rates also ease.

This could help to tackle the affordability issues currently plaguing the housing market.

Just remember though that the other big problem is supply. There simply aren’t enough homes for sale, and as we all know, scarcity leads to higher prices.

- UWM Launches Borrower-Paid Temporary Buydown for Refinances - July 17, 2025

- Firing Jerome Powell Won’t Benefit Mortgage Rates - July 16, 2025

- Here’s How Your Mortgage Payment Can Go Up Even If It’s Not an ARM - July 15, 2025