So you got a “mortgage late.” You thought you paid your home loan on time, but for some reason the bank or loan servicer never got your mortgage payment.

It happens every day. Homeowners fail to pay their mortgage on time for one reason or another. I’ve heard every excuse in the book as a former Account Executive. Unfortunately, most fall on deaf ears.

Typically, mortgage lates occur when homeowners are struggling financially or between homes.

It’s understandable when you move from one home to another, paying off one mortgage and acquiring a new one.

But you need to be extremely careful during that period to ensure everything is paid as agreed.

Again, any excuse you throw out probably won’t cut it, even if it was someone else’s fault, which it sometimes is.

Mortgage Lates Will Sink Your Credit Scores

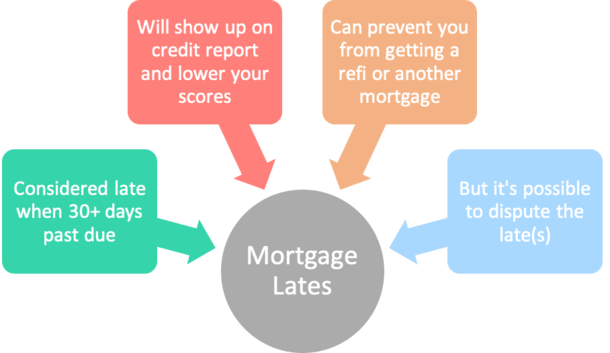

- Late mortgage payment(s) must be 30+ days past due to impact credit scores

- If you’re only a few days (or even weeks) late you’ll likely only have to pay a late fee

- So a 30-day late typically doesn’t happen by accident (you get a lot of time to sort it out)

- Impact will vary based on credit history and number/severity of late payments

Aside from having to pay any late fee associated with the overdue payment, you’ll also see your credit scores sink big time if you’re 30 days late (or more) on the mortgage.

Depending on where your scores stood prior to the mortgage late, they could fall anywhere from 60 to 100+ points.

But it’s important to note that the delinquency is only relayed to the credit reporting agencies after 30 days, meaning you’ve got time if you’re simply a day or two late (or even a week!).

However, once those 30 days do pass, and it’s reported to the credit bureaus, the damage is done.

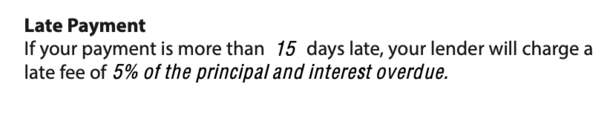

Most loan servicers will allow you to pay your mortgage until the 15th of the month without any penalty. After 15 days, a penalty can be assessed, e.g. if you pay on the 16th of the month. And if 30 days go by, you’re looking at a negative credit event.

Simply put, mortgage lates will severely damage your credit score. And mortgage lenders and banks aren’t particularly keen on lending to homeowners who couldn’t pay their home loan on time in the past.

However, because of the frequency of mortgage lates committed by homeowners in recent years, some mortgage lenders and banks now allow one 30-day mortgage late in the past 24 months before a subsequent home loan application.

So there’s a bit of leeway, perhaps thanks to the housing crisis and the subsequent COVID-19 pandemic.

Unfortunately, that only allows you to be late on the mortgage once in the last two years.

What happens if you miss your payment more than once, or get a “rolling late,” which essentially counts for two late payments?

Or if you get a 60-day late, or worse? What do you do? In most cases, you’ll probably be denied a mortgage.

Get the Mortgage Late Removed from Your Credit Report

- You might be able to get the mortgage late removed from your credit history

- If so, your credit scores may surge higher as a result of the removal

- And you won’t have to worry about mortgage-specific underwriting restrictions

- Most mortgage lenders won’t extended financing with prior late mortgage payments present on your credit report

If you plan on buying a new home, or refinancing your current mortgage, you’ll likely need to get those late mortgage payments removed from your credit report.

Assuming you still qualify for a mortgage with the late payments, you’ll be stuck paying a premium in the form of a higher mortgage rate.

So it’s a problem either way. Now about getting those lates removed. If your mortgage late is valid, there is little you can do about removing it from your credit history.

You got the late for a reason that was nobody’s fault but your own, and you have to pay the price.

But if for any reason that mortgage late was the fault of the bank or lender, the loan servicer, or another third party, it’s possible to successfully get it removed from your credit report.

In reality, you can *attempt* to get the late(s) removed either way, though you’ll probably see a higher rate of success if it wasn’t really your fault.

Steps for Mortgage Late Removal

- Get a copy of your credit reports (all three of them)

- Get in touch with the bank, lender, or loan servicer reporting the late(s)

- If they were at fault and will admit it, get a letter in writing and ask them to fix it

- If it was your fault, you can still try to dispute the delinquency and get it removed

- Similar to the speeding ticket rule where you win if no one “shows up”

The first step is to determine what mortgage account is showing up as delinquent on your credit report.

Get a free credit report from each bureau (official website) and find out exactly when and from whom the mortgage late is reporting.

The next step is to call, e-mail, or write to the lender, bank, or loan servicer reporting the mortgage late on your credit report.

Discuss the late payment with the representative and explain why you believe it is erroneous. This step can be quick and easy, or quite painstaking depending on how easy it is make your point and clear up the mistake.

Assuming the bank or lender recognizes their error, they may agree to send you a letter on their company letterhead detailing the mortgage late, complete with the account number and the time the late or late payments occurred.

They should also inform the credit bureaus of their mistake, which will boost your credit scores once the delinquency is eventually removed.

It is essential to keep the letter you receive from them in a safe place, or even make copies of it. You may need to use this letter next time you apply for a mortgage or any other line of credit.

If you need to resolve the mortgage late payment immediately, once your credit is pulled by a bank or lender, simply send a copy of the letter to the credit reporting company the bank or lender used to pull your credit.

Once they receive the letter, they may be able to remove the late(s) and issue what is called a “credit supplement” that proves it is resolved.

Rapid Rescore to Boost Your Credit Scores Fast

- If you need your credit scores increased quickly after removing the late payment

- Consider looking into a rapid rescore service (inquire with your broker or loan officer)

- It’s basically an expedited data refresh of your credit history

- Otherwise it could take weeks for the changes to reflect in your credit scores

While you may have solved the mortgage late problem, your FICO scores could still be deflated for a while before the credit bureaus take notice.

Assuming you need a mortgage immediately, you may not have time to wait.

In that case, you will likely need to do a “rapid rescore” as well to update your credit scores with the three credit bureaus.

Instead of waiting for the next data refresh, which could take weeks to a month or longer, you can do a sort of forced credit score update in a matter of days.

This same method can boost your credit scores if you recently paid off some credit card balances or other loans, and the lower balances haven’t yet been reflected in your scores.

It can come in handy if your credit scores are just below a certain key threshold, such as a 780 credit score, which is often needed to receive the lowest mortgage rate available.

Just take note that rapid rescoring typically comes at a cost, which will vary by company and by the number of items that need updating.

Do not waste your money on rapid rescoring if you don’t have a legitimate excuse for the lates, or paperwork to document any error made by the issuing bank or lender.

You really only want to go the rescore route if you know the new information has been accepted, and just not updated yet.

Plan in Advance Because Credit Score Changes Take Time

- It’s probably best to work on late removal long before you apply for a mortgage

- Even if you can get your lates removed quickly (and your credit re-scored for a fee)

- It can be very time-consuming to successfully complete a credit dispute

- And you may have more success with additional time on your side

Perhaps a better plan is to resolve any credit reporting issues long before you apply for a mortgage, instead of rushing what could be a very critical and time-consuming issue.

If you aren’t planning to apply for a home loan in the near future, but want the mortgage lates removed, the easiest way to do it might be online.

Simply visit the credit reporting bureaus websites and look for their dispute page. I have listed them below for your convenience.

– Equifax dispute page

– Experian dispute page

– TransUnion dispute page

You will need to fill out an online form to locate your credit file, then provide any documentation you have to make your case.

The good news is it’s free and you’ll get an answer within 30 days. So it’s possible to have your issue resolved fairly quickly, assuming you’re successful.

Earlier, I noted that you can attempt to have virtually anything removed from your credit report. While this is true, there’s no guarantee of success.

It’s basically like hoping a cop won’t show up to court if you got a speeding ticket. If they’re a no-show, you generally get let off the hook, even if you were at fault.

Similarly, if a loan servicer or mortgage lender doesn’t respond to your dispute, the credit bureau might remove the mortgage late, even if it actually was your fault.

Here’s the problem; your mortgage delinquency is probably on all three of your credit reports.

And because mortgage lenders pull a tri-merge credit report, you’ll need to get the late cleared up with all three credit bureaus. The chances of getting all three to not respond might be a big ask and require a lot of luck.

Now if you do have legitimate documentation and upload a copy during the dispute process, there’s a good chance removal will be successful.

But as I warned, the process can take several months for your scores to reflect the changes.

Still, if the late payments are removed, your credit scores may rise substantially, potentially pushing you from subprime to A-paper, which could save you thousands on a mortgage.

How to Get Mortgage Late Fees Waived

- You’ll be assessed a fee before your home loan is considered delinquent with the credit bureaus

- This fee can vary but could be up to 5% of the total amount due (not cheap!)

- You might be able to get the fee waived if you make your payment and call your servicer ASAP

- Simply tell them it was an oversight that won’t happen again and they might let it slide!

If you didn’t make your mortgage payment on time, perhaps just after the 15th of the month, you will likely be assessed a late fee.

In this instance, you’re simply looking at a monetary penalty before it becomes a credit score issue. This is an important distinction.

Of course, it can be a pretty penny, perhaps 5% of the principal and interest payment. So $50 for every $1,000 in payment, or $100 on a $2,000 mortgage payment!

Your first step is to make the past due mortgage payment ASAP before it’s actually reported to the credit bureaus (prior to it being 30 days late).

And once you’ve done that, reach out to your loan servicer to ask for the late fee to be waived. I know firsthand many cases of a simple phone call reversing the fee.

Just explain that it was an oversight that won’t happen again, and chances are the customer service representative will provide a waiver as a one-time courtesy.

In summary, always pay your mortgage on time, no matter the circumstances.

Mortgage lates are one of the best ways to harm good credit, and poor credit will lead to a higher mortgage rate or no mortgage at all next time you apply!

Tip: How to get a mortgage with a low credit score.

- UWM Launches Borrower-Paid Temporary Buydown for Refinances - July 17, 2025

- Firing Jerome Powell Won’t Benefit Mortgage Rates - July 16, 2025

- Here’s How Your Mortgage Payment Can Go Up Even If It’s Not an ARM - July 15, 2025

Colin,

Great article. I saw the following and I need to comment because so many people are stuck in their loans because of one Mortgage late. Usually a honest mistakes and I understand, but it’s still your fault.

“Here’s the problem. If your mortgage late is substantiated, there is little you can do about removing it from your credit history. You got the late for a reason that was nobody’s fault but your own, and you have to pay the price.”

Your readers need to know that they need to have a VERY good story before calling the lender. Please don’t wing it. They must either show that it’s the lender’s fault or is some sort of mistake on “their ” end. I highly suggest that your clients leave it to a professional. Call someone, anyone, but do not try to talk their way out of it. We have clients who tries to give the Sob story, but ends up admitting to the late or lates which “substantiates” the late like you said while it’s being recorded. A sob story will NOT work because the agents on the other end of the line have heard EVERY single story under the sun.

Thanks,

Chad

Hey Chad,

What do the pros do differently that the agents on the other end haven’t heard or seen before? Just curious, thanks for your note.

Colin,

Ans: The right story. One must create a story that makes it “their fault.” There are alot of laws and legal tricks that one can use. Every case is different – how is not something I can answer here. =)

The agents/robots on the other end of the line is mainly looking to stick to “the script” and never “accept fault” because if the banks/creditors/data furnishers say, “sorry, it was our fault” (in writing) can becomes proof in a court of law if the that particular late mortgage payment causes harm to the client. If this late causes the borrow to lose a property (with equity) then the creditor is then liable for the lost which can be in the 100s of thousands.

IE: Common story: a loan/note gets sold from one paper holder to another, then to another. Borrower sends payment to an old lender with a couple of days left before it’s late. The check, then, bounces back to the borrower 15 days later. The mortgage payment is late. uhhh-oh…. The borrower’s scores drop by 80-100 points. The borrower is stuck with that company for at least 24 months and a refi is not possible.

FICO is funny, at least to me. The range is 350-850 (loosely) For a credit card: from 350-680 its a automatic denial or you get 300 bucks with 24% APR; from 720 – 850 it’s an automatic approval. so, the difference is 40 points guys and gals; the true range of FICO is 40 points! (it is a bit better with RE because the most secured loan at 620). So, if you are a A student, imagine going to F with one late payment. FICO is broken.

C