There are a variety of different types of mortgage lenders out there that originate home loans, from small mom and pop shops that only offer mortgages to institutional, dare I say too-big-to-fail banks that also pitch student loans and credit cards.

There are also online mortgage lenders with no brick-and-mortar presence, along with a new breed of so-called mortgage disruptors that are trying to digitize the home loan process.

Additionally, there are home loan lenders that specialize in certain types of loans, such as FHA loans and VA loans, or home loans for those with bad credit.

Ultimately, you have a lot of options when it comes to getting a mortgage loan, even though it’s mostly a commoditized product.

By that, I mean mortgages aren’t all that different and many lenders offer the same exact loan products, regardless of the channel in which they are obtained.

Nor does the branding really matter (no one can see your mortgage and can’t you openly flaunt it), though how and where you get one can make a big difference in terms of interest rate and closing costs and saving money!

Additionally, there are some nuances that I’ll discuss below to give you a better idea of the mortgage ecosystem.

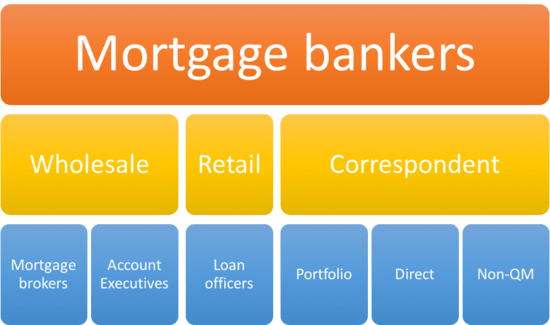

Mortgage Bankers

- A mortgage banker is a generic, all-encompassing term

- Used to describe an entity or individual that originates mortgages

- It can refer to banks, non-banks, or even individuals running their own shop

- Some of the bigger names include Chase, loanDepot, Quicken Loans, and Wells Fargo

Mortgage bankers are essentially “mortgage lenders” that originate their own loans and then either keep them or sell them in pools on the secondary market to investors such as Freddie Mac and Fannie Mae, along with other private investors.

If they are non-depository institutions (non-banks), such as Guild Mortgage, they may finance the loans with warehouse lines of credit extended by other lenders, but quickly sell them off on the secondary market so they can originate new loans.

Wells Fargo Home Mortgage, Quicken Loans, and Chase are three of the largest examples, though much smaller operations also share this distinction, including regional credit unions, online mortgage lenders, and various other mortgage companies.

As you probably know, Wells and Chase are depository banks that allow customers to open checking and savings accounts, whereas Quicken and loanDepot are not.

This detail can matter if/when another housing crisis hits to ensure these companies have collateral if a lot of loans go bad.

Anyway, the term mortgage banker is pretty much an umbrella term to describe any entity that funds their own mortgage loans, and synonymous with the phrase mortgage lender.

Some may specialize in mortgage refinancing, while others might be big on home purchase lending or construction loans.

Of course, big names like Chase and Wells Fargo aren’t just mortgage banks and probably won’t be referred to as such because they offer every type of loan under the sun, from car loans to business loans to home equity loans and more.

For the past many years, Wells Fargo has been the top lender, but with Quicken Loans threatening of late, they could unseat the San Francisco-based bank in the near future.

Portfolio Mortgage Lenders

- These are mortgage lenders that retain the loans they make (which is actually quite rare these days)

- Most mortgage companies are in the originate-to-distribute business (sell off loans quickly after closing)

- Portfolio may also refer to specialty loan programs offered exclusively by these banks

- Some large examples include Chase, Flagstar, and U.S. Bank

Portfolio mortgage lenders originate and fund their own loans, and may keep and service them for the entire life of the loan.

Because they typically offer deposit accounts to consumers, such as checking accounts and savings accounts, they are able to hold onto the loans they fund indefinitely.

The term portfolio refers to the loans being kept in-house, on the bank’s books (in their investment portfolio).

As such, they are also able to offer more flexibility in terms of loan programs and mortgage underwriting because they don’t need to adhere to the guidelines of secondary market buyers or other investors.

For example, Flagstar Bank has a ton of a different loan programs available, some of them proprietary thanks in part to the fact that they bring in customer deposits, meaning they’ve got liquidity on hand if the loans sour for any reason.

This freedom means unique loan products and special offerings that other banks simply can’t or are unwilling to offer, such as adjustable-rate mortgages and high-LTV loans that don’t require mortgage insurance.

Additionally, once their loans are serviced and paid for on time for at least a year, they are considered “seasoned” and can be sold more easily on the secondary market.

U.S. Bank and Chase are two bigger examples of portfolio mortgage lenders.

Correspondent Mortgage Lenders

- These lenders make loans using other lenders’ loan programs

- But can underwrite in-house and fund them in their own name

- May resell loan products from multiple “sponsors”

- Some major investors include Caliber Home Loans, Fifth Third Bank, Impac Mortgage, Pacific Union Financial, Pennymac, and Vista Point Mortgage

Correspondent mortgage lenders originate and fund loans in their own name, then sell them off to larger mortgage lenders, who in turn service or sell them on the secondary market.

This arrangement means they don’t have to disclose the origination fee to borrowers, which can be a big advantage.

The loans can be underwritten in-house by the correspondent mortgage lenders if they are delegated to do so (often need a high net worth), but the loan programs are based on terms and guidelines approved by the larger mortgage lender, or “sponsor.”

If the correspondent is non-delegated, loan underwriting must be performed by the sponsor.

Correspondents usually have an array of products from different sponsors, and act as an undisclosed extension for those larger lenders.

In other words, a small correspondent mortgage lender may resell Pennymac products and/or Impac Mortgage products under their own name to borrowers.

To provide some actual examples, Freedom Mortgage Corp. is a big FHA loan and VA loan correspondent, and Caliber Home Loans is a large correspondent of all home loan types.

Direct-to-Consumer Mortgage Lenders

- A lender that features a direct path to the borrower with no middlemen

- Typically underwrite their loans in-house and close with their own funds

- Also known as consumer-direct mortgage companies

- Some large examples include Bank of America, ditech, loanDepot, and Quicken Loans

A direct mortgage lender is simply a bank or lender that works directly with a homeowner and underwrites their product in-house, with no need for a middleman or broker.

They are also known as “consumer direct mortgage companies,” or direct-to-consumer (DTC).

Mortgage bankers and portfolio lenders usually fall under this category if they have retail loan operations.

Though there is a slight distinction between retail and DTC, in that retail implies having physical branches while DTC can simply be a call center.

In other words, with retail or distributed retail, there are branches where a consumer could theoretically go and sit down with a loan officer in person.

Conversely, with DTC you could only call someone by phone (or work with them remotely via your smartphone or computer).

These companies can offer anything from a USDA loan to a reverse mortgage to conventional mortgages and jumbo loans. The loan options are endless really, depending on the entity’s risk appetite.

Examples include Bank of America, Chase, loanDepot, Quicken Loans (Rocket), and Wells Fargo, though smaller entities could share this distinction as well.

For example, you could visit a bank branch and get a mortgage and a credit card and an auto loan, all in one place, though you might want to go through a mortgage-specific channel instead.

Online Mortgage Lenders

A subcategory of direct mortgage lenders in the Internet age would be online mortgage lenders, who as the name suggests work exclusively online.

This means they don’t have brick-and-mortar branch locations, at least at the retail level.

So you can’t visit a branch or speak to someone face-to-face, but the trade-off might be a faster loan process and ideally a lower mortgage rate.

The idea is they can streamline operations and cut out the unnecessary stuff, then pass along the savings to consumers, leveraging emerging technology to get the the job done.

Some examples include Amerisave, Better, CrossCountry Mortgage, Intelliloan, Sebonic Financial, and even Quicken’s Rocket Mortgage.

Wholesale Mortgage Lenders

- These lenders work directly with independent mortgage brokers

- They provide them with loan programs and pricing they can resell to borrowers

- Brokers submit loan applications to the wholesale lender for approval, processing, and funding

- Some examples include Carrington Mortgage Services, Freedom Mortgage Corp., and United Wholesale Mortgage

Wholesale mortgage lenders operate via the B2B channel. They rely upon independent mortgage brokers, who are third-party originators that are client-facing. These individuals don’t work directly for wholesale lenders, but rather act as business partners.

Brokers operate on the retail end with borrowers (home buyers), while simultaneously working with an Account Executive (AE) at the wholesale mortgage lender to fulfill processing, underwriting, and loan funding.

The borrower never actually interacts with the wholesale mortgage lender or the AE, only the broker does. Fun fact: I was an AE while working in the mortgage industry.

The wholesale mortgage lender funds the loan, and will usually sell it on the secondary market within a month or two.

Many mortgage companies have both wholesale and retail divisions, such as Rocket Mortgage via its Rocket Pro TPO business unit.

Wholesale lenders can be independent entities as well. One example includes United Wholesale Mortgage (UWM), currently the nation’s largest mortgage lender overall.

They don’t work in the retail or DTC channels, but advertise to consumers directly via their wholly-owned website Mortgage Matchup.

Tip: How to get a wholesale mortgage rate.

Warehouse Lenders

- These B2B lenders actually provide financing to mortgage lenders

- Who may need short-term capital to fund their loans

- Especially if they are non banks without the benefit of customer deposits

- This allows them to go out and fund more loans and keep their business liquid

Warehouse lenders provide financing to other mortgage lenders so they can originate their own mortgages.

This short-term funding provides big and smaller lenders with liquidity so they can focus on making more mortgages while selling existing ones on the secondary market.

Smaller mortgage bankers and correspondent lenders rely on warehouse lines of credit to finance their operations.

They pay back the warehouse lines of credit whens loans are sold, and may give a cut to the warehouse lender for each loan that is eventually sold.

The mortgages are used as collateral for the temporary financing.

Subprime Mortgage Lenders

- These lenders offer loans to borrowers with low credit scores

- Typically 619 and below

- Who don’t qualify for financing with Fannie Mae and Freddie Mac

- Although many government home loans fall into this category too

Subprime lenders tend to focus on homeowners with less than stellar credit, otherwise known as bad credit.

While the definition of subprime varies from lender to lender, most in the industry characterize it as lending to borrowers with credit scores below 620.

But other issues may persist, including limited income and assets, or inability to provide documentation.

As a result, mortgage rates provided by subprime mortgage lenders will be much higher than those at standard lenders, all else being equal. That equates to a higher monthly mortgage payment.

Essentially, subprime lenders are willing to take on more risk for a greater reward (a sky-high interest rate).

Post mortgage crisis, they’ve largely disappeared and have been replaced by FHA mortgages, which only require 500 credit scores, and non-QM loans.

Non-QM Mortgage Lenders

- These lenders provide out-of-the-box solutions

- That don’t adhere to the Qualified Mortgage rule

- Due to credit issues or inability to provide documentation

- Such as a recent credit event (foreclosure) or bank statements to qualify

This category has since been replaced by non-QM lenders, which make loans that fall outside the Qualified Mortgage (QM) rule.

Things like interest-only, stated income, balloon mortgages, and loan terms beyond 30 years are considered non-QM.

A debt-to-income ratio above 43% is also considered non-QM, though Fannie Mae, Freddie Mac, and the FHA have a temporary pass for the time being.

Once that ends, this loan category may explode in growth, just as subprime did leading up to the housing crisis.

However, loan quality might be a lot better than that of their predecessors so a straight up comparison isn’t entirely fair.

The major difference will be lower loan-to-value ratios, which ensures borrowers have skin in the game (more home equity) so they don’t walk away when things go downhill.

Alt-A Mortgage Lenders

- This category was popular pre-mortgage crisis

- Usually involved borrowers who lacked a down payment

- Or had imperfect credit scores

- Or an inability to document income/assets

Then we have Alt-A mortgage lenders, which typically offer mortgages to borrowers with reduced documentation, limited or no down payment, and/or credit scores mostly between 620-660.

This type of mortgage lender falls somewhere between a prime lender and a subprime lender.

Borrowers may use an Alt-A mortgage lender because they have a tricky loan scenario or a sticking point that makes it difficult or impossible to close with a traditional mortgage lender.

For example, if you need to refinance your mortgage after a recent credit event, they might be able to accommodate you. The risk appetite of an Alt-A lender is probably deemed medium-high.

Mortgage Brokers

Mortgage brokers work independently with both banks/mortgage lenders and borrowers, and need to be licensed.

Their job is to get in contact with borrowers and close deals. Once they have a loan application, they can send it to a mortgage bank or a wholesale lender that they work with.

Since they work with a variety of wholesale lenders, they can be helpful in finding the best mortgage fit for you based on your unique needs, instead of being at the mercy of a single bank’s loan programs and/or guidelines.

They also need to process the loan before and after it is approved, and can negotiate pricing with the bank or mortgage lender to receive a commission, formerly known as a yield spread premium.

Mortgage brokers may also form partnerships with real estate agents to maintain a steady stream of new business if refinancing is slow.

Some brokers are actually quite large and employ a large number of employees.

One such example is C2 Financial Corporation, based out of San Diego, CA. They claim to have more than 400 originators and over 100 wholesale lender relationships. The same goes for Chandler, AZ-based NEXA Mortgage.

Loan Officers

Loan officers may work at retail banks or under mortgage brokers, and basically do the same thing a broker would do, except they don’t necessarily need to be licensed, depending on the institution in question.

They solicit borrowers using direct mail, telemarketing, linking up with real estate agents, and similar practices.

Brokers usually provide them with office supplies and leads, and each may take a split of the total commission.

They may not be very experienced, so take caution if and when one solicits you to ensure they are well educated on mortgages.

Big banks often hire loan officers in call centers and may not provide much training other than a script and some computer programs to navigate the sales process.

At the same time, some can be very knowledgeable and helpful in funding hard-to-close deals. They may also make suggestions, like improving your credit so you can land a lower mortgage rate.

Mortgage Disruptors

- Better

- Clara

- Lenda

- Redfin Mortgage

- Rocket Mortgage

- SoFi

The latest group to be added to this page are the so-called “mortgage disruptors,” who some may argue cater to Millennials and Generation Z.

They tend to be companies that operate exclusively online, or in app form, allowing borrowers to submit a mortgage application via smartphone and avoid human interaction during the entire mortgage process.

Some may offer proprietary loan options such as programs that target those with student loans, while others simply adhere to the rules of Fannie Mae and Freddie Mac, the FHA, and VA.

Their goal seems to be modernizing the stagnant mortgage industry and speeding up the loan process.

Aside from being able to apply online, others may charge a reduced origination fee or completely eliminate the loan officer in an attempt to save you money and remain unbiased.

There are many examples, including Better Mortgage, Clara, Lenda, SoFi, and even Redfin Mortgage, which caters to home buyers looking for one-stop shopping.

SoFi Mortgage actually offers personal loans and student loans too, which seems to be common with this new breed of lenders.

I suppose you can throw Quicken and their Rocket Mortgages in this category too.

- UWM Launches Borrower-Paid Temporary Buydown for Refinances - July 17, 2025

- Firing Jerome Powell Won’t Benefit Mortgage Rates - July 16, 2025

- Here’s How Your Mortgage Payment Can Go Up Even If It’s Not an ARM - July 15, 2025

Thanks for the rundown. Didn’t realize how many different types of mortgage lenders there were. Pretty complex stuff!

Loan Officers definitely need to be licensed under the SAFE Act. They cannot originate loans if they aren’t.

David,

True, older article that needs updating. Thanks.

Thanks for the info!

Soooo….who makes the most money out of these lenders? If you want to sell loans, be a broker, LO, etc.

Which lender would you make the most money working for/as?