A little bit of mortgage Q&A: “When do mortgage payments start?”

New homeowners (and those refinancing a mortgage) often wonder when mortgage payments start, as there’s sometimes a considerable gap between loan closing and the due date of the first monthly payment.

For example, you may have been told by your real estate agent or mortgage broker that payments won’t start for 45 days or longer and express some intense optimism as a result.

But you might be skeptical as well, and for good reason. Why would it take so long to start paying your mortgage lender back? Let’s find out!

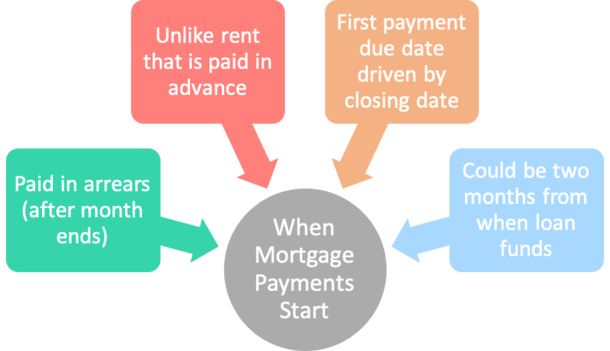

Mortgages Are Paid in Arrears

- Unlike rental payments that are paid a month in advance

- Mortgage payments are paid after the fact (arrears)

- Because interest must actually accrue before it becomes due

- So once the month is over you pay interest for that time period

This phenomenon occurs because mortgages are paid in arrears, not in advance, meaning payment is made at the end of a certain period, such as one month.

Because interest is accrued on a mortgage balance each month, it cannot be paid until after the fact.

Simply put, your mortgage payment made on the first of the month will cover last month’s interest, along with taxes and insurance, and principal (if applicable).

This differs from monthly rental payments, which are paid in advance for the month they cover; if you rent a property, your payment due on say August 1st covers rent for the month of August.

You are paying the landlord ahead of time for the privilege to live in their property.

It makes sense if you think about it. With rent there isn’t a loan involved, and thus no interest. So it doesn’t need to accrue first before it is paid.

You just make your payment and get to stay in the property for the month.

With a home loan, it’s the opposite, which explains the time lag you might experience after first taking out a mortgage.

First Mortgage Payment Determined by Closing Date

- Your first mortgage payment is driven by the closing date

- If you close late in the month, your first payment will be due about a month later

- If you close early in the month, you may get nearly two months before the first payment is due

- Be sure to speak with your loan officer about timing this if you want payments to start sooner or later

It’s gets tricky when you start making mortgage payments, as the start date of your first payment is determined by your closing date.

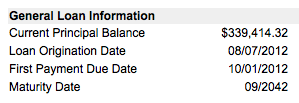

Example: If you close your mortgage on August 20th, your first mortgage payment isn’t due until October 1st.

However, at closing, you would need to pay the remaining interest for the month of August, or 11 days worth; this is typically known as prepaid interest, and appears as a closing cost.

In this particular example, assuming your mortgage rate was 5.50% and the loan balance was $300,000, the daily interest rate ($45.83) x 11 would be $504.17.

Some borrowers think they’re skipping a monthly mortgage payment, but in fact they’ve paid the 10 days of interest in August and the full month of September by the time the October payment is due.

You can, however, avoid costly out-of-pocket upfront expenses by closing at the end of the month.

Doing so cuts down on the amount of prepaid interest that is due initially, but it doesn’t make a difference long-term. And your first mortgage payment will be due sooner.

If you close early in the month, you’ll pay many more days of prepaid interest at closing but your first mortgage payment won’t be due for about two months, as our scenario above illustrates.

For example, if you close on the 7th of August, you’ll pay about three weeks of interest at closing, but you’ll have nearly two months to make your very first mortgage payment.

In fact, because lenders typically provide a grace period to pay up until the 15th of the month, you could actually have more than two full months before the first payment is due.

What If You Close Super Early in the Month?

However, if you close very early in the month, say on the 1st, 2nd, or 3rd, there might be an option to receive a credit from the lender for those few days of prepaid interest.

Then you’d make your first payment the very next month for the full amount of interest due.

This way you can start tackling your mortgage if your goal is to pay it off sooner rather than later. And you can keep closing costs down if money is tight, or if cash to close is an issue.

But don’t forget about other prepaid items, like homeowners insurance, property taxes, and HOA dues, for which reserves may also increase if your loan closing date falls into the next month.

There is an advantage to closing early in the month though; mortgage lenders are typically a lot less busy.

This has to do with a company’s monthly funding goals and getting those loans closed by month’s end for the borrower’s sake.

And really, you should have enough money set aside for closing costs regardless of when your home loan funds.

Read more: 21 mortgage questions commonly asked, answered.

(photo: thejaymo)

- Mortgage Rates Are Lowest in February - February 7, 2026

- Mortgage Rates Move Back Toward Three-Year Lows as Stock Market Crashes - February 6, 2026

- Two-Thirds of Home Buyers Will Hold Off If Mortgage Rates Rise Even Slightly - February 5, 2026

Ok so if the loan origination date is 8/7/2020 and the first payment due date is 10/1/2020, and it’s a 30 year loan, when is the actual last payment due date? Is the last payment date 10/1/2050? Or is the actual last payment on 10/7/2050 (consisting of a stub period from 10/1/2050 through 10/7/2050)? Or if the final payment is 10/1/2050 do you actually pay September’s payment plus the stub payment 10/1 – 10/7 all paid on 10/1/2050? Is it actually a 30 year loan or is it shortened because of the initial odd days’ interest?

What happens if you pay the #1st payment at closing and pay every payment on the 1st of the month every month every month until the loan is paid off?

Henry,

Typically there’s no benefit to paying on the 1st vs the 2nd, 3rd, or even 15th of the month because the interest is already calculated on an amortized mortgage on a monthly basis. So a homeowner who pays on the 5th of every month would owe the same interest as someone who pays on the 1st of every month. But you can call your servicer to be sure. One exception is HELOCs that calculate interest daily and thus can benefit from earlier payments.

This does not apply to all mortgages. TSB mortgages are paid in advance not in arrears. The payment on the 1st of January covers January and so on.

Ted,

Are you referring to a UK mortgage?

can a lender get into trouble if they fail to calculate the prepaid interest correctly?

Ron,

I assume they would just amend the error if it wasn’t calculated correctly the first time.