While most homeowners probably don’t have a refinance on their radar (due to the big jump in interest rates), take note that fees for cash out refis are going up in about a month.

Back in October, Fannie Mae and Freddie Mac announced new loan-level pricing adjustments (LLPAs) for cash out refinances.

The move was intended to help the Federal Housing Finance Agency (FHFA) better support “core mission borrowers,” aka promoting affordable housing.

That same announcement included the elimination of upfront fees on HomeReady and Home Possible loans, and for first-time home buyers with limited incomes.

Those fee reductions went into effect December 1st, but the increased cash out fees don’t go live until February 1st, 2023.

Cash Out Refinance Fees More Than Doubling in Some Cases

There aren’t a ton of reasons to refinance at the moment, given the doubling in mortgage rates from the start of 2022 until now.

But those in need of cash might consider a cash out refinance depending on the circumstances.

Unfortunately, these transactions are set to get even more expensive come February 1st, 2023.

The FHFA, which oversees both Fannie Mae and Freddie Mac (roughly 80% of the mortgage market), said it has “targeted increases to the upfront fees for most cash-out refinance loans.”

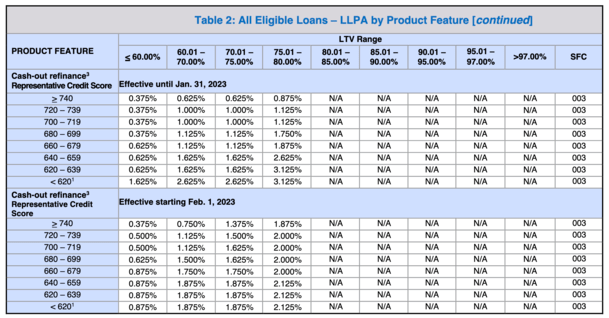

As you can see from the chart above, LLPAs will be more than doubling in some cases on cash out refinances.

For example, a borrower with 740 FICO score and an 80% loan-to-value (LTV) ratio will see the LLPA for cash out rise a full percentage point.

On a $500,000 loan, we’re talking another $5,000 in upfront fees, which would likely translate to a higher interest rate instead of paying/deducting that amount from loan proceeds.

That could raise your interest rate .25% to .50% depending on the lender, making the cash out refinance even more unattractive.

Simply put, LLPAs are typically absorbed via a higher mortgage rate instead of being paid out-of-pocket.

Wait to Cash Out If Your FICO Score is Below 660?

Meanwhile, borrowers with FICO scores between 620-660 will see their cash out refinances become cheaper in many cases.

Looking back at that chart, a borrower with a 625 FICO score and an 80% LTV will see their LLPA fall from 3.125% to 2.125%.

So for this hypothetical homeowner, there’s a case to be made to wait to cash out if you’re thinking about doing so.

This borrower would actually see their cash out refinance become cheaper, which is essentially the rationale behind these changes.

Borrowers who are ostensibly more in-need will see pricing relief, while more creditworthy borrowers will pay a premium.

This reminds me of the catch-22 that is risk-based pricing on mortgages. The most at-risk borrowers, due to low credit scores and down payments, often get stuck with the highest mortgage rates.

That equates to a higher monthly payment, which increases their risk of default. And they’re already the riskiest borrowers to begin with!

These changes by the FHFA might be one way of addressing that issue.

A Good Credit Score Will Still Save You Money on Your Mortgage

While I explained that those with low FICO scores could benefit by waiting to cash out, there’s a catch.

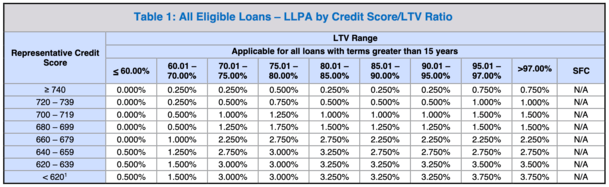

There is also an LLPA for credit score for all transactions, which is much more expensive for borrowers with low FICO scores.

For example, a borrower with a 620 FICO and an 80% LTV is hit with a 3% LLPA, while the borrower with a 740 FICO and 80% LTV only pays .50%.

That’s a full 2.50% higher for the low-FICO borrower, which more than makes up for those positive cash out LLPA changes.

In other words, you’re typically going to save more money on your home loan by coming to the table with the highest credit score possible.

But if you just can’t get your credit score to budge, it could become cheaper to pull cash out of your home once these changes are implemented.

Another point about waiting to refinance is that timing the market is a fool’s errand. We don’t know where mortgage rates will be next week, let alone next year.

These latest changes are on top of the increased LLPAs for second homes and investment properties announced earlier in 2022.

- Will Mortgage Rates Be Higher or Lower by the End of 2025? I Asked AI. - July 2, 2025

- Rocket Mortgage Completes Redfin Takeover, Offers $6,000 Home Buyer Credit - July 1, 2025

- Mortgage Rates Quietly Fall to Lows of 2025 - June 30, 2025