Let’s talk mortgage basics: “What is the loan-to-value ratio?”

If you’re currently shopping for a home or already going through the mortgage loan process, chances are you’ve heard the phrase loan-to-value ratio get thrown around on more than one occasion.

You may have also encountered the acronym “LTV” while perusing mortgage advertisements or playing around on mortgage rate comparison websites.

Regardless of what’s going on in the housing market, you should know all about this very important term when applying for a home loan.

Why? Because it can greatly affect mortgage rate pricing, refinance options, and overall loan eligibility.

How to Calculate the Loan-to-Value Ratio (LTV)

- It’s actually one of the easiest calculations you can make

- Simply divide the loan amount by the appraised value or purchase price

- And you’ll wind up with a percentage known as your LTV

- The tricky part might be agreeing on a sales price and getting the home to appraise at value

Simply put, the loan-to-value ratio, or “LTV ratio” as it’s more commonly known in the industry, is the mortgage loan amount divided by the lower of the purchase price or appraised value of the property.

If we’re talking existing mortgages (in the case of refinance loans), it’s the outstanding loan balance divided by the appraised value.

When calculating it, you will wind up with a percentage. That number is your LTV. And the lower the better here folks!

It’s actually very easy to calculate (no algebra required) and takes just one step. You don’t even need a mortgage calculator. In fact, you might be able to run the numbers in your head. Honest!

Let’s calculate a typical LTV ratio:

Property value: $500,000

Loan amount: $350,000

Loan-to-value ratio (LTV): 70%

In the above example, we would divide $350,000 by $500,000 to come up with a loan-to-value ratio of 70%.

Using a basic household calculator, not a so-called “LTV calculator,” simply enter in 350,000, then hit the divide symbol, then enter 500,000. You should see “0.7,” which translates to 70% LTV. That’s it, all done!

This means our hypothetical borrower has a loan for 70 percent of the purchase price or appraised value, with the remaining 30 percent the home equity portion, or actual ownership in the property.

LTV ratios are extremely important when it comes to mortgage rate pricing because they represent how much skin you have in the game, which is a key risk factor used by lenders.

A Lower LTV Ratio Means More Ownership, Better Mortgage Rate

- The lower your loan-to-value ratio the more home equity or down payment you have

- Which is another way of saying ownership or skin in the game

- A low LTV equates to a lower mortgage rate because you’re viewed as less risky

- It means the bank is risking less since you are more invested in the underlying property

Essentially, the lower the loan-to-value ratio, the better, as it means you have more ownership (home equity) in the property.

Someone with more ownership is less likely to fall behind on payments or foreclose, seeing that they have a greater equity stake, aka financial interest to keep paying the mortgage each month.

They’ve also got more options if they do struggle with payments, as they could just sell the property without taking a loss (or the bank losing money).

Not only that, but banks and mortgage lenders also set up pricing adjustment tiers based solely on the LTV ratio.

Those with lower LTV ratios will enjoy the lowest interest rates available, while those with high LTVs will be subject to higher mortgage rates and/or closing costs.

For example, if you’re being “hit” by the lender for having a less-than-stellar credit score, that adjustment will grow larger as the loan-to-value ratio increases (higher LTV ratio = greater risk).

So if your mortgage rate is bumped a quarter percent higher for a loan-to-value ratio of 80%, that same pricing hit may be increased to a half percentage point if the LTV ratio is a higher 90%.

This can certainly raise your interest rate in a hurry, so you’ll want to look at all possible scenarios with regard to down payment and loan amount to keep your LTV ratio as low as possible.

More importantly, just maintain an excellent credit score and you’ll have plenty of loan options, regardless of your chosen down payment or available home equity.

80% LTV Is a Very Important Threshold!

- Keep your mortgage at/below 80% LTV if you want to save money

- You won’t have to pay private mortgage insurance (PMI)

- And it should result in a lower mortgage interest rate with fewer pricing adjustments

- You’ll also enjoy greater lender choice as most banks will lend up to 80% LTV

Most borrowers (who have the means) elect to put 20% down when buying a home, as it allows them to avoid mortgage insurance and the much higher pricing adjustments often associated with LTVs above 80%.

Fewer adjustments mean you can secure a lower interest rate on your mortgage. And if you can avoid PMI at the same time, it’s a win-win for your monthly housing payment!

You may also find it easier to get approved, as virtually all banks and mortgage lenders will accept LTVs of 80% or less.

But you don’t necessarily need to put 20% down to enjoy the benefits of a low-LTV mortgage.

Also Get to Know the Combined Loan-to-Value Ratio (CLTV)

Looking at the above example again, if you were to raise the first mortgage amount to $400,000 and add a second mortgage of $50,000, the combined loan-to-value ratio, or CLTV as its known, would be 90%.

Banks and mortgage lenders have both LTV and CLTV limits, meaning they won’t allow homeowners to borrow more than say 80, 90, or 100 percent of the property value.

These limits came down after the Great Recession but are creeping back up again…

Let’s do the math here; again, no mortgage calculator required!

Simple math: $400,000 + $50,000 = $450,000 / $500,000 = 90% CLTV

You would have a first mortgage at 80% LTV, and a second mortgage for an additional 10% LTV, making the CLTV 90%. Simply add up both numbers.

Sometimes borrowers elect to break up home loans into a first and second mortgage, known as combo mortgages.

This keeps the loan-to-value ratio below key levels, thereby reducing the interest rate and/or helping the homeowner avoid private mortgage insurance.

Tip: The undrawn portion of a home equity line of credit (HELOC) typically isn’t included in the CLTV calculation.

Max LTV by Home Loan Type

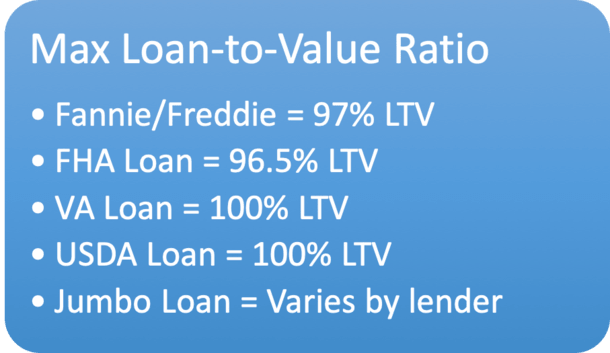

- FHA loans go as high as 96.5% LTV (3.5% down payment)

- Conforming loans (Fannie/Freddie) go as high as 97% LTV (3% down)

- USDA and VA loans go to a full 100% LTV (zero down)

- Jumbos, cash-out refis, and investment properties are much more restrictive

- And there is no maximum LTV in many cases for streamline refinances

There are certain LTV limits based on home loan type, with conventional loans (non-government) typically being more restrictive than government loans.

And mortgage refinance programs often less accommodating than home purchase loans.

At the moment, you can get an FHA loan as high as 96.5% LTV, which is just 3.5% down payment.

You can get a conventional loan as high as 97% LTV, which at just 3% down is higher than it used to be.

In recent history, the maximum was 95% LTV, but now Fannie Mae and Freddie Mac are competing directly with the FHA.

[See FHA vs. conventional for more on that.]

You can get either a VA loan or USDA loan at 100% LTV (which represents no money down).

These are the most flexible loan programs LTV-wise, but they are also only available to veterans or those living in rural areas, respectively. So not everyone will qualify for these types of mortgage loans.

There are also proprietary home buying programs from various private mortgage lenders that allow for 100% LTV financing if you take the time to shop around.

If it’s a jumbo home loan, a cash-out refinance, or an investment property, the loan-to-value will be a lot more limited, potentially capped at just 70-80% LTV, depending on all the attributes.

And finally, those underwater or upside down borrowers you hear about; they owe more on their mortgage than the property is currently worth.

This can happen due to negative amortization and/or home price depreciation.

A quick underwater loan-to-value ratio example:

Property value: $400,000

Loan amount: $500,000

Loan-to-value ratio (LTV): 125%

As you can see, the underwater borrower has a LTV ratio greater than 100% (this equates to negative equity), which is a major issue from a risk standpoint.

For the record, you get 1.25 by dividing 500 by 400.

The problem with homeowners in these situations is that they have little incentive to stick around, even with a modified mortgage payment, as they’re so far in the red that there’s little hope of recouping home value losses.

However, the popular Home Affordable Refinance Program (HARP) allowed millions of underwater homeowners to refinance to lower rates with no LTV limit. And many of these folks are probably now back in the black.

Today, this type of program still exists, but is a permanent option known as a high-LTV refinance, or HIRO for short.

So there are options to refinance and get a lower interest rate, as long as your loan is owned by Fannie Mae or Freddie Mac, no matter the mortgage balance relative to the property value.

Same goes for FHA loans and VA mortgages thanks to the FHA streamline refinance and the VA IRRRL option.

Despite being far behind new homeowners entering the market in terms of building home equity, many of these formerly-underwater borrowers now have lots of equity thanks to rising home prices and several years of paying down their mortgages.

That’s why you have to consider the long-game in real estate and never give up, even when times get tough. This also illustrates why home buying shouldn’t be a quick or hasty decision.

A Lower Loan-to-Value Can Save You Money!

- A lower LTV generally results in a better interest rate

- Which means cheaper monthly mortgage payments

- It puts more of your hard-earned dollars toward the principal balance each month

- Potentially saving you thousands of dollars over the life of the loan!

As noted, a lower LTV will likely result in big savings thanks to a lower interest rate.

Additionally, you may be able to avoid costly private mortgage insurance, enjoy expanded loan program eligibility, and have an easier time getting approved for a mortgage.

If your LTV is higher than you’d like it to be, there are some creative options to lower it.

Borrowers Can Reduce Their LTV in a Variety of Ways

- Come in with a larger down payment if it’s a home purchase loan

- Ask for gift funds to increase your down payment

- Or break your mortgage up into two separate loans (combo loan)

- Make extra payments or a lump sum payment for a refinance to get the LTV down before you apply

- Or simply wait for natural amortization and home price appreciation to lower your LTV over time

If we’re talking about a home purchase, simply bring in more down payment money and the LTV will be lower. Easier said than done, sure, but possible for some.

Perhaps someone will gift you the money or act as a co-borrower?

Alternatively, you can look into breaking up your financing into two loans, with both a first and second mortgage.

If it’s a mortgage refinance, simply pay down the mortgage balance a bit more before you apply, whether on schedule or by making extra mortgage payments.

This can be especially helpful if you’re super close to a certain LTV threshold, or just above the conforming loan limit.

Speaking of, pay close attention to your LTV – if it’s just above 80% or some other meaningful tier, think about adjusting your loan amount down (your loan officer should advise you here!).

Lastly, there’s another way existing homeowners can get their LTV down and it requires no effort whatsoever.

You don’t have to do anything except sit back and watch your property value increase over time, thereby lowering your LTV in the process. Of course, the opposite can happen too if home values drop!

But as noted, real estate should be treated with a long time horizon, so be sure you have the ability to ride the ups and downs and make moves when it’s most favorable to you.

Read more: 10 ways to build home equity.

- UWM Launches Borrower-Paid Temporary Buydown for Refinances - July 17, 2025

- Firing Jerome Powell Won’t Benefit Mortgage Rates - July 16, 2025

- Here’s How Your Mortgage Payment Can Go Up Even If It’s Not an ARM - July 15, 2025

Important to note that a lower LTV does not always result in a better or lower interest rate. For example, conventional, Fannie Mae and Freddie Mac pricing is worse at 80% LTV than it is at 85%-95% LTV. 75% LTV is the same pricing as 85-95%.

Therefore, borrowers putting down 20% are actually getting worse pricing than if they had put down 5-15%. 25% down is actually going to result in the better or lower rate. People get hung up on 20% down because that is when private mortgage insurance no longer applies.

Also important to note that a lower LTV does not result in a better or lower interest rate on FHA loans, USDA loans or VA loans. The interest rate is the same, regardless of the LTV.

Good points John. What about relative total payment once you factor in PMI? I know loan amounts will vary with different down payments, but how much is the borrower taking on with PMI, or is LPMI an option as well to get the interest rate comparable?