While there are a lot of new faces and startups in the mortgage industry these days, few companies have stood the test of time, especially with the Great Recession rearing its ugly head in the early 2000s.

But one mortgage company, Houston, Texas-based Cornerstone Home Lending, has been serving its communities since 1988.

Not a lot of mortgage lenders out there can claim they were slinging loans in the 80s, but this company can.

The direct-to-consumer retail lender has more than 30 years of experience doling out home loans to satisfied customers.

But also takes the time to embrace new technologies as evidenced by their smartphone app and digital process.

Cornerstone Home Lending Fast Facts

- Retail mortgage lender based in Houston, Texas

- A division of Cornerstone Capital Bank, SSB (FDIC insured)

- Founded in the late 1980s by Marc N. Laird and Judy Belanger

- Licensed in 45 states and D.C. with 200 offices in 22 states

- Over 500 loan officers and 1,500 team members nationwide

- Funded roughly $2.8 billion in home loans during 2024

- More than half of loan volume came from Texas and Washington

- Says it has helped 600,000+ families get financing since inception

- Has in-house processing, underwriting, funding, and loan servicing

As noted, Cornerstone Home Lending, or CHL for short, has been around a while, much longer than the average mortgage company these days.

And in 2022, they began operating as a bank thanks to a merger between Cornerstone Home Lending and community bank Roscoe Bank, which resulted in Cornerstone Capital Bank.

They say they’re licensed in 45 states and D.C., but don’t appear to lend in Connecticut, Delaware, Maine, New Hampshire, New York, Rhode Island, or Vermont.

In their latest full year, they closed about $2.8 billion in home loans, with a home purchase loan share of roughly 94%.

The rest were home refinance loans, split among rate and term refinances and cash-out loans.

Interestingly, more than half of overall loan volume came from just two states, their home state of Texas and far away Washington.

A good chunk of their total production consisted of conventional home loans (68%), with another 17% FHA loans, and 14% VA.

Most of the loans closed last year were 30-year fixed mortgages, though they also originated 15-year fixed mortgages and 7/1 ARMs as well.

They claim to rank #30 nationally in annual home loan volume, and 10th nationally among independent mortgage companies.

Cornerstone also operates some joint ventures with home builders, including a brand called “Velocio Mortgage” that offers some big mortgage rate buydowns.

So there’s a possibility your mortgage will come from them if you purchase a new-construction home.

Applying for a Mortgage with Cornerstone Home Lending

- You have the option of getting pre-qualified via their website or smartphone app

- Visiting a physical branch office if one is located near you

- Or calling them directly to go over a loan scenario and get pricing

- But it’s unclear if you can formally apply without human assistance

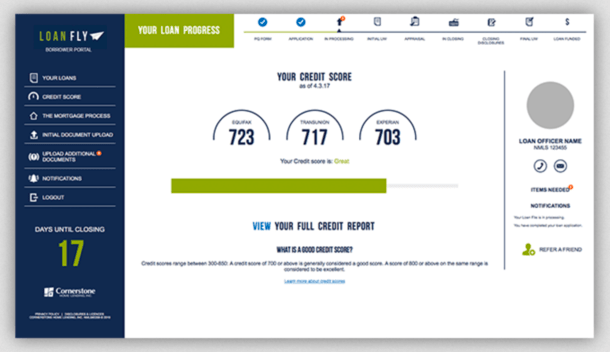

To get the ball rolling, you can either visit their website and navigate to the “prequalify” page, or download their smartphone app called LoanFly and then click on “prequalify.”

Both methods require you to fill out a short form with just your contact information, at which point you’ll be contacted by a loan officer.

They say you can get pre-qualified for a mortgage in as little as 15 minutes during normal business hours.

From the LoanFly app, you can also request a mortgage rate or a callback from a loan officer.

Alternatively, you can call Cornerstone Home Lending directly to get pre-qualified or to discuss a loan scenario. Or visit a local branch office if one is located near you.

Branches appear to be located in the following states: AK, AR, AZ, CA, CO, FL, MD, MO, MS, MT, NC, NM, NV, OK, OR, TX, UT, VA, WA, WI, WY

It’s unclear if you can actually apply for a mortgage on your own, which is often an option with the most tech-savvy mortgage lenders these days.

Once in contact with a loan officer, they can walk you through the loan process and answer any additional questions you may have.

After your loan has been submitted, you can use the borrower portal to check loan status, upload documents, and satisfy conditions, via the app or the website.

Cornerstone Home Lending Loan Options

- Home purchase loans and refinance loans (including cash-out refinances)

- Conventional loans backed by Fannie Mae and Freddie Mac

- Government loans backed by the FHA, USDA, and VA

- Jumbo home loans

- Fixed-rate and adjustable-rate options available

Cornerstone is currently approved and in good standing with Fannie Mae and Freddie Mac, along with the FHA, VA, and USDA.

They offer both home purchase loans and refinance loans, but it’s unclear if they offer second mortgages or home renovation products.

The details on their website are a bit scant when it comes to loan options, though they do mention the loan types above, along with jumbo loans.

Additionally, you can get a fixed-rate mortgage or an adjustable-rate mortgage, with varieties like a 30-year fixed or 15-year fixed, and a 5/1 ARM or 7/1 ARM.

So all the usual stuff but nothing too fancy by the looks of it.

However, they say their loan officers have access to hundreds of loan products, which means there’s probably more than what’s listed on their website.

There’s also mention of 50+ investor sources with over 300 loan products available to their customers.

Cornerstone Home Lending Mortgage Rates

Cornerstone doesn’t advertise its mortgage rates online so we don’t know where they stand pricing-wise.

The only thing they say is that they offer “ultra-competitive rates,” which begs the question, why not share them?

Additionally, there’s no information regarding lender fees, so we don’t know if they charge a loan origination fee, underwriting fee, and so on.

If and when getting a quote from Cornerstone Home Lending, be sure to compare it to other lenders to see how competitive they are.

There are literally thousands of mortgage lenders out there to choose from, so put in the time if you want a great rate with low closing costs.

Cornerstone Home Lending Reviews

First off, they’ve got incredible reviews on Zillow, with a 4.95-star rating out of 5 based on feedback from 3,300+ past customers.

What’s nice about the Zillow reviews is you can see who the customer worked with, click on that individual’s name, and get all their reviews as well.

This is helpful with large mortgage companies that have tons of employees since experiences can vary greatly from one loan officer to the next.

Many of the Zillow reviews indicated a lower mortgage rate than expected, while many said the closing costs were as expected.

They also have a 4.8/5 rating from 500+ Google reviews.

On BirdEye, they’ve got a 4.5-star rating based on more than 1,100 reviews, so they seem to be consistently highly-rated.

They also list a bunch of customer reviews right on their website, which seem to the most recent ones available.

Cornerstone Home Lending is BBB accredited since 1997 and currently has an A+ BBB rating. Their dozen or so customer reviews on the BBB aren’t great, which is the norm for BBB customer reviews.

In conclusion, they appear to be a legit mortgage company with the backing of an FDIC-insured bank, though it’s unclear if you can apply for a home loan without human assistance.

It’s also hard to tell what loan programs they offer, or what their pricing is like because their website is light on details.

As such, you’d have to get in touch with a loan officer, determine loan types offered, and obtain a loan quote to see where they stand.

Then take that information and compare it to what other banks and lenders can offer.

One bright spot is that all the loan processing, underwriting, and servicing happens in-house, under one roof.

Cornerstone Home Lending Pros and Cons

The Good

- Excellent reviews from thousands of past customers

- A+ BBB rating, accredited company

- Backing of an FDIC-insured bank

- Offer a free smartphone app and online borrower portal

- Physical branch locations in many states where they operate

- In-house processing, underwriting, funding, and loan servicing

- Average industry tenure of its employees is 10+ years

The Possible Not-so-Good

- Not licensed in all states

- Unclear if you can apply for a mortgage on your own (only offer a pre-qual form)

- Don’t list specific loan programs that are available

- Do not advertise their mortgage rates or lender fees

- More information on their website would be helpful!

(photo: Zeev Barkan)

- Mortgage Rates In the Dark Again Thanks to Another Government Shutdown - February 3, 2026

- When Comparing Mortgage Rates, Ask for the No-Cost Option First! - February 2, 2026

- What New Fed Chair Kevin Warsh Means for Mortgage Rates - January 30, 2026

Cornerstone lending financed the construction of my home with no money down on a conventional loan, started 2021, finished 2022. The holdup was the manufacturer building the home and delivering it. We tried to do a VA loan but the rural area dirty road where I live doesn’t have a road agreement by all parties. No money was required while the home was being constructed, which was a manufactured home. Super easy to work with and their representatives were very quick to respond. reaching them, even by text to the main officer handling my case, Luke Wagner in WA State, was very easy!

Heather Smith NMLS# 421355 was a good Mortgage Loan Officer. She needs however to be more responsible on returning phone calls in a timely manner and she also needs to return phone message as well.

Being a great Loan Officer requires responsiveness and willing and able to combing through all avenues to get the deal to completion.