The phrase “loan origination” refers to the initiation/completion of the home loan process, while the “loan origination fee” is the cost of the associated service.

Yes, mortgage lenders and brokers need to make a living, they aren’t working for free, so they must charge fees and/or sell their loans for a profit.

It begins when a borrower submits their financial information to a bank or mortgage lender for loan processing.

Depending on documentation type, a borrower will have to supply certain credit, income, asset, and employment information to a specified bank or lender to initiate the underwriting of the loan application.

Along with that, the borrower will have to sign forms that allow the mortgage broker (if applicable) and bank or lender to pull a credit report and release information about the borrower.

Once the information is submitted to the bank or lender, an underwriter will decision the application, either approving, suspending, or declining the loan.

To sum it up, loan origination is simply the creation of a mortgage. It may begin with a phone call, an e-mail, a mortgage rate quote, or a referral from a real estate agent.

Loan Originators Are Salespeople

- Those who make homes loans for a living are known as “loan originators”

- Just a fancy way of saying loan officer or mortgage broker

- It is simply the individual who helps you get a home loan

- One way these folks make money is by charging loan origination fees

So who’s behind all this loan origination activity anyway?

Well, loan originators of course! They’re also known as loan officers, mortgage brokers, loan specialists or simply salespeople.

Or some other silly name a company comes up with like “loan hero” or “loan scientist.”

These originators may work on behalf of individual mortgage brokers, or for large retail banks that originate thousands of mortgage loans each month.

(See mortgage brokers vs. banks for more on that distinction).

Either way, their main job duty is to get you in the door and persuade you to apply for a mortgage with them, whether it be a purchase money mortgage or a mortgage refinance.

Now this isn’t to say that they’re pushy salespeople, it just means their highest priority is “getting a sale.”

They can also be quite helpful in guiding you through the home loan process, largely because both your incentives and theirs are aligned.

You want your loan to close and they get paid when it does. So everyone is on the same page.

What Is a Loan Origination Fee?

- The fee paid by the borrower to the lender to obtain a mortgage loan

- Typically expressed as a percentage of the loan amount, but can also be a flat fee

- Represents the commission earned by the loan officer or mortgage broker in exchange for funding your loan

- Not charged by all mortgage lenders

The fee associated with the origination of a home loan is called, you guessed it, a loan origination fee.

They are typically referred to as mortgage points, which are expressed as a percentage of the loan amount.

For example, if the loan amount is $100,000, and you see a $1,000 loan origination fee on the paperwork, the bank or broker is charging you one (1) mortgage point.

If they’re charging $2,000, it would be two points. Three points? That’d be $3,000. And so on…

Conversely, you may see a flat dollar amount charged for obtaining a home loan that isn’t based on loan amount.

This “loan origination fee” is paid to the loan officer or broker who initiates and completes the loan transaction with the borrower, and is only paid out if and when the mortgage loan funds.

The origination fee covers their commission for getting you a home loan, often because they aren’t paid a salary or base pay. And they aren’t working for free.

Origination Fee vs. Mortgage Points

- While origination fees are often expressed as points (e.g. 1%)

- You may pay mortgage points for other reasons not related to lender compensation

- Such as to lower your interest rate (a form of prepaid interest)

- In this case they are actually known as discount points and are not commission fees

While we’re on the topic of points, I want to clarify that origination fees and points aren’t necessarily the same.

While origination fees are often represented as points, it’s possible to pay discount points as well, which have nothing to do with commission.

If you want to buy down your mortgage rate, which is totally optional, you’ll pay these discount points at closing.

This could be on top of any commission paid to the originating bank or broker for helping you obtain your loan.

For example, you could pay one point to lower your rate and another point to the bank/broker to cover their commission. In total, you’d pay two points, but for two different reasons.

Are Origination Fees Just Junk Fees?

- Loan origination fees aren’t necessarily so-called “junk fees”

- They are commissions paid out for helping you obtain a loan

- And just because you aren’t charged the fee directly doesn’t mean it’s the better deal

- Look at the big picture (APR) to determine the best offer

The loan origination fee is not necessarily a junk fee seeing that many loan originators don’t get paid salaries, as noted. So they need to get paid somehow.

But some lenders may not charge them and refer to them as unnecessary or excess charges as a result.

However, if they don’t charge you directly, it just means they’re making money a different way, perhaps via a higher interest rate and/or by charging other lender fees.

Certain mortgage bankers can earn a service release premium (SRP) after the loan closes by selling it to an investor on the secondary market.

This isn’t a fee imposed on the borrower directly, though a higher-rate mortgage may fetch a higher SRP.

In any case, someone will always be making money for originating your loan, as they should for providing any other service.

So don’t get fired up about it, just try to negotiate costs lower as best you can. Or go elsewhere for your loan if you’re not impressed.

The reason it’s sometimes given junk fee status is that it’s often a fixed percentage, which means it’s not necessarily tailored to your specific loan or the amount of time/risk involved.

For example, why should a bank charge the same 1% loan origination fee on both a $200,000 loan amount and a $700,000 loan amount if the work is more or less the same?

This would mean our first borrower would only be charged $2,000 for a mortgage, while the second borrower would be charged a staggering $7,000, which is nearly 4x the commission!

If these fees were based on a dollar amount instead, skeptics may not consider them junk. Or may think they’re less junky.

A new group of fintech mortgage lenders are often waiving the origination fee and/or not charging it to begin with, which may signal its eventual demise.

Breaking Down the Loan Origination Fee

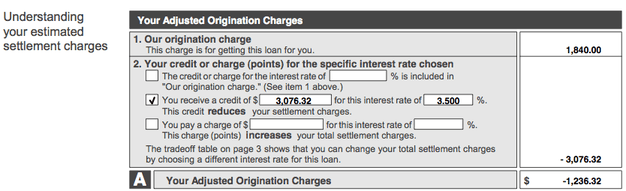

This is a screenshot of an actual Good Faith Estimate (since replaced by the Loan Estimate), which displays the adjusted origination costs.

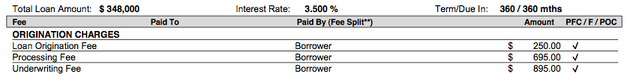

In the example above, the loan origination charge is $1,840 on a $348,000 loan amount, which makes the fee roughly half a percentage point (.50%).

This particular broker charged a $250 origination charge, a $695 processing fee, and an $895 underwriting fee, which combined make up the $1,840 total.

Note that these fees are represented as one lump sum on the Loan Estimate, so ask for a breakdown to see what you’re actually being charged. Or refer to your Fees Worksheet.

The corresponding Fees Worksheet pictured above breaks down the origination charges so you can better understand what you’re being charged and why.

Although not pictured here, lenders typically display a percentage on the same line as the Loan Origination Fee, such as 1.000%, if applicable. This will give you a better idea as to what you’re actually being charged.

Now let’s refer to the top screenshot again. Our borrower also received a lender credit of $3,076.32, which offset the entire origination charge and more, resulting in an adjusted origination charge of -$1,236.32.

This remaining amount was put toward other closing costs, reducing the borrower’s out-of-pocket expenses.

So the borrower didn’t actually pay the fees out-of-pocket. The originator still got paid, but via a higher interest rate to the borrower, which allows the lender to offer the credit in the first place.

However, the borrower will pay extra interest (thanks to the higher interest rate) for every month they hold the loan.

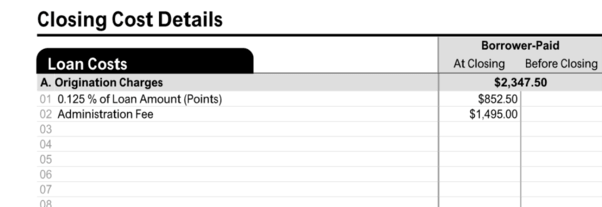

Check Page 2 of the Loan Estimate or Closing Disclosure to See What You’re Being Charged

On the newer Loan Estimate (LE) or Closing Disclosure (CD) forms, you’ll see this information on page 2 of either form under the section titled “Loan Costs.”

There you’ll find the Origination Charges, which may include a flat fee and/or a percentage of the loan amount represented in points.

In this example, the borrower was charged an eighth (0.125%) of the loan amount in the way of discount points and an administration fee of $1,495.

The fraction of a point may have lowered their interest rate slightly, while the so-called admin fee covered typical lender services like underwriting and processing.

The discount point is totally optional, but if removed would likely raise your interest rate to the next tier.

Average Loan Origination Fee

- The most common fee is probably 1% of the loan amount

- Which means the cost can vary considerably based on the size of your home loan

- A smaller loan amount could result in a higher percentage fee and vice versa

- You may be charged higher or lower (or no) fees depending on loan amount and broker/lender in question

In the mortgage world, it’s hard to provide universal answers, seeing that mortgages can differ tremendously.

The loan origination fee can vary based on who you decide to work with, the types of loans in question, and how complicated your loan is.

If you’ve got a cookie-cutter loan that you can get anywhere, this fee should be low. The opposite is also true. Either way, the loan origination fee is negotiable! And it can be offset using a credit, as seen above.

If I had to throw out a number, I’d say the most common origination fee is 1% of the loan amount, which many banks will include in the fine print next to their advertised rates.

Wells Fargo used to include this exact disclaimer on their mortgage rates page, but it has since been removed.

Some banks and lenders may not even charge an origination fee explicitly, though a variety of closing costs such as underwriting and processing could amount to a comparable fee when all is said and done.

That’s basically what we saw in the fees worksheet above. It doesn’t really matter what they call it.

Maximum Loan Origination Fees

- Many mortgages today are capped in terms of what lenders and third parties may charge

- While this could potentially limit how much you’ll pay at the closing table

- It can still be up to 3% of the loan amount in most cases so these restrictions may mean very little

Most types of mortgage loans don’t cap the fees lenders may charge borrowers.

However, many of today’s mortgages, especially those backed by Fannie Mae and Freddie Mac, are so-called Qualified Mortgages, which afford lenders certain protections.

In order to meet this definition, total upfront points and fees may not exceed 3% for loan amounts of $100,000 or more.

This essentially limits what a lender can charge in the way of fees, though it’s still fairly accommodating.

If lenders don’t care to meet the QM rule, they can charge whatever upfront fee they’d like.

The U.S. Department of Housing and Urban Development (HUD) used to limit the maximum loan origination fee to 1% for FHA mortgages, but eliminated that rule for loans originated on or after January 1st, 2010.

The move aligned with changes to the Real Estate Settlement Procedures Act (RESPA), which required the sum of all fees and charges from origination-related services to be included in one box on the Good Faith Estimate (GFE).

HUD assumed the new consolidated figure representing all compensation to the mortgage lender and/or mortgage broker for loan origination would likely exceed the specific origination fee caps previously set for government programs.

However, HUD said at the time that the rule change wouldn’t be a free-for-all for mortgage lenders and brokers to charge whatever they please going forward.

There is still a maximum fee that may be charged on an FHA reverse mortgage, which is the greater of $2,500 or two percent of the maximum claim amount (MCA) of the mortgage, up to $200,000, plus an additional one percent for any portion greater than $200,000.

A maximum of $6,000 in origination fees may be charged on FHA reverse mortgages, regardless of the total loan amount.

And if you’re taking out in a VA loan, a maximum origination fee of 1% remains in place.

Smaller Home Loans May See Higher Fees Percentage Wise

- Because the loan origination fee is percentage-based, it will generally be higher on smaller loan amounts, all else being equal

- This ensures the originator is paid adequately for their time and energy as most loans require a similar amount of work regardless of size

- So it might be best to look a the dollar amount instead of focusing on the percentage or number of points

Also consider that for smaller loan amounts, a larger loan origination fee will need to be charged, seeing that it’s expressed as a percentage and won’t go nearly as far as a similar percentage on a large loan.

For example, a $100,000 loan amount with a 1% fee is only $1,000, whereas a $400,000 loan amount with the same 1% fee would be $4,000. And both loans could require the same amount of work.

In fact, sometimes the smaller mortgages can be even more a burden to close. So consider the dollar amount as well.

With regard to Qualified Mortgages, a higher 5% max fee is allowed for loan amounts between $20,000 and $60,000.

You May Not Be Charged an Origination Fee, However…

- The loan origination fee is totally optional and not always applicable

- Some lenders simply don’t charge it because they make money in different ways

- Others may allow you to waive it in exchange for a higher interest rate

- Pay attention to both the interest rate and closing costs (APR) to determine if it’s a good deal

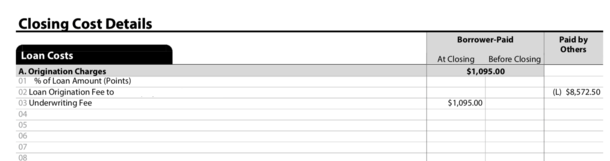

Brokers and banks may not even charge a loan origination fee directly to the borrower, depending on the terms of the deal.

In the screenshot above, there isn’t a borrower-paid loan origination fee, only a loan underwriting fee. However, the broker is still paid $8,572.50 by the lender, as seen in the “paid by others” column.

A true no cost loan doesn’t include a loan origination fee paid for by the borrower because it’s an out-of-pocket expense.

While you may not pay the fee, your interest rate will likely be higher as a result, all else being equal.

So that $8,572.50 likely pushed the mortgage rate up .125% or .25%, which will cost you monthly for as long as you hold the loan.

Loan originators have to make money somewhere, so if there is no fee charged on the front-end, they’ll make up for it on the back-end. Or when they sell the loan off to an investor.

As noted, they can earn their commission when they sell the loan off to another company after closing. As such, it doesn’t need to be revealed because it’s not yet known what this figure is.

Either way, all lender fees that are being charged should always be fully disclosed on the Loan Estimate (LE) and Closing Disclosure (CD).

Pay close attention to this figure to see exactly what you’re being charged, whether paid out-of-pocket or via a higher-than-market interest rate.

Most upfront banks and brokers will charge no more than 1-2% of the loan amount, although this can vary by loan amount and by lender.

Mortgage Lenders That Don’t Charge an Origination Fee

- Better Mortgage

- Filo Mortgage

- HomeLend Mortgage

- Homelight Home Loans

- LoanFlight Lending

- Owning

- PenFed Credit Union

- Redfin Mortgage

- Wyndham Capital Mortgage

As noted, not all lenders charge origination fees. I’ve listed several above, but it’s just a sample.

This is especially true with the newer breed of fintech mortgage lenders, many of which charge no lender fees whatsoever.

Some of these companies don’t even use commissioned loan officers, and they rely a lot on technology, so it’s easier for them to waive the fees.

However, you may still have to pay third-party fees, such as title/escrow, appraisal, and prepaid items like interest, property taxes, homeowners insurance, etc.

And even without the mortgage origination fee, they might not offer the best combination of rate/fees known as APR.

For example, Lender A may offer a rate of 5% with a one percent fee, while Lender B offers a rate of 6% with no fee. This isn’t apples-to-apples.

Be sure to compare the origination charges, all lender fees, AND your interest rate among different banks and lenders to get the complete picture.

Looking at just one or two of these figures won’t provide an accurate assessment as to whether it’s a good deal or not.

If you take the time to shop around, you may be able to avoid the loan origination fee altogether and get that low rate you’re after!