Yet another disruptor, known as Divvy Homes, is out to change the rent-to-own space so more renters can become homeowners.

Divvy says it’s like a lease, but unlike a typical lease, it’s designed to help you inch your way to homeownership with every lease payment you make.

That way you’re not “throwing away money on rent,” the common argument people make against renting.

While it’s not that cut and dry, as renting actually has lots of advantages over homeownership, this setup might work for someone not quite ready to own.

How Divvy Works

- Divvy is a new rent-to-own company

- Currently available in select markets nationwide

- Allows you to buy a home with just 2% down payment

- Without having to qualify for a mortgage

At the moment, Divvy is available in the metros of Atlanta, Cleveland, Dallas, and Memphis, St. Louis, and Tampa. Here’s how it works.

First, you select a home that’s available for sale on the market, just as you would if you were purchasing it.

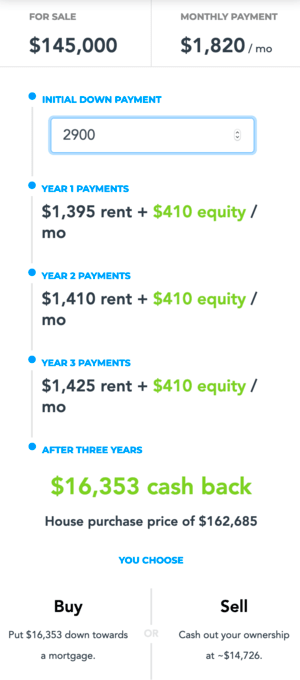

But instead of buying it yourself, Divvy purchases it on your behalf. They do require that you put down 2% of the purchase price at closing, with the company covering the rest.

The rest includes closing costs typically associated with a mortgage, along with the remaining 98% of the purchase price.

Interestingly, you are required to take a quiz as part of the closing process, and attend a webinar to ensure you understand what you’re getting into.

The property must also pass inspection, and of course you’ll need to sign your lease and send initial payment with sufficient time to clear before closing.

Once it closes, you’ll be locked into a three-year lease, with no obligation to buy at the end of the 36-month term.

However, if you do stop making payments during that time, Divvy will consider the lease broken, and will only refund half of the total dollars accumulated via monthly payments.

How Divvy Payments Work

Each month, you make a payment just like you would if you rented/owned, but the Divvy payment consists of one part rent (about 75%) and one part “home savings” (about 25%).

Divvy sets the rent based on the neighborhood’s fair market rent for location, size, etc.

Over time, you earn “equity credits,” which the company likens to a home savings account.

As noted, you begin with at least 2% in equity credits, and build toward 5% to 10% over the course of a three-year lease.

At any time, you can convert those equity credits into a down payment to purchase the property.

You can also choose not to buy the home after your three-year lease ends, at which point Divvy will sell the home and cash out your equity credits.

If you go that route, Divvy will only share 8.5% of the home’s final sale value, as they need to deduct 1.5% to cover selling costs.

At any time, you can see how much you’ve accrued via the Divvy portal, assuming you plan to apply for a mortgage and purchase the place.

Which Homes Are Eligible for Divvy?

- Single-family homes and townhomes (condos only if fee simple)

- Purchase price must be between $60,000 to $300,000

- Cannot be a bank-owned property or foreclosure

- Must be in good condition

Like a normal home purchase, you use a real estate agent to look for a suitable home that fits within your budget, once you are fully approved with Divvy.

Divvy says nearly all listed homes fit their fairly wide criteria, including single-family homes and townhomes. Condos don’t qualify unless title is “fee simple.”

However, the price must fall between $60,000 and $300,000, and the acreage cannot exceed two acres. Additionally, the deed must be “fee simple.”

They also don’t allow for the purchase of foreclosures, pre-foreclosures, short sales, bank-owned, county-owned, and Fannie/Freddie-owned properties.

How to Qualify for Divvy

- Must document income (make at least $2,400 per month)

- Must have a credit score of 550 and higher

- Have to pass a background check including rental history

- Down payment of 2% required before closing

Like a traditional home purchase and/or mortgage, there are qualifying requirements to ensure you can make payments going forward.

This includes a credit check, an income check, proof of down payment, and a background check, since you’ll be a renter.

With regard to income, you must be currently employed and provide income documentation for the past six months, with average monthly income of at least $2,400.

For credit, you (and your co-applicant’s) credit score(s) must be at least 550, which is pretty low.

A background check will also be performed to determine your rental history and any criminal background, including things like eviction, bankruptcy, criminal convictions, etc.

You’ll also need to provide proof of down payment, generally deemed to be the greater of $1,250 or 2% of purchase price.

Once fully-approved, you can shop with a real estate agent to find a home. The purchase price must work within your approved budget.

Assuming everything checks out, you’ll receive a proposal that breaks down payments and your commitment to Divvy, along with a deposit request toward your down-payment (kind of like earnest money).

Then Divvy will work with the home seller to purchase the property on your behalf.

Divvy Covers Maintenance

One nice thing about Divvy is the hybrid set of responsibilities involved.

As a homeowner, you deal with anything that happens to your home, such as equipment breakdown or unexpected damage.

With Divvy, they’ll cover the cost of any maintenance/repairs required to ensure the home is safe and habitable.

This may include roof repairs, HVAC, foundation, electrical systems, and so on.

You are just responsible for identifying these types of issues, and arranging for a contractor to complete the repairs.

Before a contractor begins their work, you must provide their information and cost estimate to Divvy for approval.

Divvy does not cover cosmetic repairs, such as painting, carpeting, landscaping, or appliances. And will not pay for repairs arising out of intentional or negligent damage.

Who Is Divvy Good For?

- If you want to live in a particular home

- Or simply like the idea of homeownership over renting

- But are unable to qualify for a mortgage for whatever reason

- Divvy might be a solution and a middle-ground to test out owning a home

In a nutshell, Divvy is probably geared toward an individual who doesn’t qualify for a mortgage, but wants to buy a specific property.

For example, if you happened to come across your dream home, but a mortgage lender turned you down, Divvy might be able to make it work.

Or if you just like the idea of homeownership over renting, and want to get in on it without delay, Divvy could again be a good option.

Conversely, there are lots of zero down and low-down payment mortgage options available these days that don’t require much more than 2% down.

You may also think you don’t qualify for a home loan, but if you take the time to consult with a mortgage broker or do your own research, you might discover that you do.

The one nice thing about Divvy is that you get the option to buy the place, but can also walk away after three years. And you’ll get most of your money back.

In other words, you could look at it as a three-year test drive to see if the home and homeownership is for you.

Just note that Divvy has a qualification process like a traditional home purchase, so it’s still going to take some work on your behalf.

And after those three years are up, it’s up to you to qualify for a mortgage in order to buy the place. That means you need to be ready or risk losing the house you may have grown to love.

I talked to my adult children about Divvy, as I thought I was telling them about this fabulous secret! They knew about Divvy! I expressed wanting to buy a house and they simply said…:just do it mom” So I look forward to working with Divvy to make my dream come true!

Hi, I’m interested in your Divvy program

I just purchased a property that is in default, will Divvy

purchase the property

This looks interesting. Would like to pursue this program.

Please contact me regarding this.

Hi I am interested in the program

So the monthly payment will be approx 25% higher than market rent, because it includes additional money that’ll go towards your house savings?

That means instead of the $1500 I planned to pay each month, I’d need to get approved to pay $2000, (out of my comfort zone) or choose a house w/lower market rent – maybe $1100 so they can add $400 house savings – keeping me @ my $1500 comfort zone ??

Will Divvy purchase a home if I am already living in it and the owner will like to sell it to me?

Sheryl,

They probably would if the owner was willing to sell it to Divvy for an agreed upon price that suits both parties.

Which credit agency do they run the credit through?

Linda,

In the real estate world, lenders typically do a tri-merge report, aka all three credit reporting agencies, as opposed to just a single bureau.

Would it work with someone in bankruptcy?

Jessica,

Doubtful since you need a minimum credit score of 550 and they check for things like BK.

What if you have an eviction from 5 years ago in your rental history with nothing owed on your actual credit?

Nae,

They say they conduct a background check that includes rental history so it could come up. Whether it’s an issue is another question.

I had a short sale nearly 4 years ago which requires 10% down. I can pay about 7% down payment for the houses I’m interested in. Would a higher down payment reduce the monthly payments required if I used your program?

I tried to prequalify and I was immediately rejected due to “foreclosure in the last 4 years.” However, I did not go into foreclosure. I was already in the process of selling my home when I got notice that I was in PRE-foreclosure. But, I sold the home and paid it off before it was actually foreclosed on. Aside from that I meet all the requirements. Will Divvy work with me?

Adrilea,

May want to reach out to the company directly to see if they consider extenuating circumstances. Their automated system may not be able to differentiate pre-foreclosure vs. foreclosure.

Interesting program. Would it work for me if I’ve had interrupted work history? I moved to a new state on my savings; found a job in the healthcare industry 2.25 months later, then the government contract with the company I worked for was terminated 2 months later. I just landed another healthcare job but won’t have 3 months’ pay statements by the time I need to move into a house (I’ll have 4). My credit score and rental history are excellent.

We have 4000.00 down, total family income above 2400.00 monthly, credit score in the 600 range, excellent rental history, no problem with background checks. with the job i am on now my income exceeds the requirements but is only for 9 months out of the year.

would like to speak to a representative in reference to the program.

divvy does not cover the repair expenses. they set aside a part of your payment for maintenance and any repairs come out of that fund. if it is greater than the amount you have saved, they cover the cost, but my understanding is that you have to pay it back, either when you buy the house or out of your cash out option. also – they have an early purchase price of 18 months, but after that, the price is set. there should be a sliding scale of how long you have used their money and when you are buying it out.

They denied me once I discharged my Ch 7 in 6/2020. They would like for you to post discharge by 1 year… So good luck if you’ve reached that mark 🤞🏾

I am a Metro Atlanta local agent partnered with Divvy Homes and familiar with the process. If you are looking to lease purchase please feel free to contact me info@miaballard.com.

I am interested in purchasing a tiny home and land to put it on. Will Divvy help me to purchase the tiny home and land? Is the $2400/month they are looking for your gross or net amount? Also, I am retired but my income is above the $2400/month and I receive this on a stable basis. Will they consider my retirement as a barrier even though it is stable income?

Angela and Colin, I would like to be included in the reply to Angela’s question.

Thank you.

I don’t have good credit not sure if I qualify for this program I hope I do

Can someone please call me, I’m old school and I prefer to speak to a person.

Can you get in the program if you and spouse are both on fixed incomes?

I am in the Dallas, TX area and would like an agent to reach out to me please. Thank you.

I am a licensed agent in the Atlanta and surrounding areas. I have partnered with Divvy on 5 purchases and they are great! It’s been very easy. If you are interested you can contact me at kimberly@bennproperties.com

I would like to purchase a home, through the lease to purchase program but I need to know how to go about using 401k savings.

I filed a chapter 13 paid off in 2019 but did not get discharge paperwork because of covid until 9/2020 credit score 700 debt/ income ratio low, income over $2500 a month. How long do I need to be discharged I feel like this is a barrier for most people or debt/ income ratio is high…

I am interested in this program, I live in Memphis, TN

Currently, I resided in Tampa, FL and have been renting all of my life. My lease will be up in March 2021 and I am definitely interested in this program.

Do y’all help self employed people?

Hi I a veteran and I plan to use my va loan to buy my house once I get my credit were I want it will divvy still work with me

Hello,

I’m a realtor here in the Atlanta, Ga area. I have helped plenty of clients on their path to homeownership. Divvy is a really great program and if there are multiple offers on the same property Divvy will go to Bat for you. They really are an excellent way to ease into home ownership.

Hi I am very interested in the Divvy program. I live in AZ Phoenix. I want to buy a home because I pay to much for rent. For a 2bd 2ba apartment with roaches. I guess I should be greatful because they rented to me with my first eviction on my name. I got it because I moved into this apartment that was infested with roaches. I was only there for 30 days. That’s how bad they were. Then I’m in this apartment and I have a death in my family. I had to take a few mo off of work and I lost that apartment. Now I’m in this apartment and I pay extremely to much for rent and they have roaches to. Divvy please help!

We signed a three-year lease for $1625 in July 2019, that lease will expire in July 2022. We are looking forward to trying Divvy rent to own program next year.

Divvy prices are tooooo high. Decent homes in the $200K range and up are $2200 per month or more with only $300 going towards equity. Divvy makes a KILLING literally on the monthly rent. For example, $200,000 home with a 4 or 5% interest rate which they are easily getting assuming they really have the capital to purchase all the homes in their portfolio is well below $1900 which is what you’ll be giving them. They are basically predatory lenders. I’d stay FAR FAR AWAY from this grift. I bet they will get called out for their so-called disruption scheme and won’t be around long term. NOT INTERESTED!

I agree with Sally. on a $350K home I rented for $1100 for three years… they would not be paying factoring $825 for rent and $275 towards equity. They would be charging me 1100 plus a fixed “repair expenses” amount (maybe 150 mo? I’m being optimistic) + 275 towards equity. Specially since “fair market value” in my neighborhood for similar homes when I finished my contract was 1450/mo. So I would be paying $1525… for an apartment I was paying 1100 to begin with. I am better off keeping the 275+150= 425 in the bank, which will be 15.300 at the end of 3 years, instead of $ 9900. In the meantime, they would end up keeping 39.600 plus any unspent “repair” money.

I wonder why Divvy won’t reply to statements like the one you made……

I am interested in renting a DIVVY home.

I’m excited, relocating from Illinois. The process was quick. Awesome customer service. They were patient in answering all of my questions and concerns. I feel quite comfortable with the program. I mean where else can you go and the company purchases the house for you and you have time to buy it over time? It is definitely a program that allows options. I love it so far. :-)

Hi Timothy, has anyone reached out to you? I am a real estate professional in the Atlanta Area. I’d love to speak more about this program with you.

Do you ever cover a house more than 300,000 it’s almost nearly impossible to find a home that price in Denver area.

Thank you,

My husband and I are interested in the program. I have credit score of 733, 697, and 673 respectfully, have pretty much zero debt, have three credit cards all paid as agreed, no late charges and I only have an 18% debt to income. NO negative anything on any credit report and same goes for my hubby, perfect rental history, no criminal history, both college educated. Our monthly income is $7180, have the 2% needed down in our savings account and have worried really really really hard but we were denied by Divvy saying we don’t have enough credit history…I’m terribly upset and madder than ten thousand hornets…. getting my hopes up only to be let down for doing all the right things.

I’m interested in your program in Arizona areas.

I guess they probably thinking he already figured this out so he should have his own home by now if he is able to save money monthly for 3 years on his own. He shouldnt be looking at this type of programs

I would like a representative to reach out to me please

Do you accept spouse if only has an itin number?

What does your debt income ratio need to be to qualify?

The example is a bit concerning. The rental world is nuts. That’s why so many renters are hungry to get into home ownership. The ludicrous idea that a house worth less than 150k is worth paying $1800 a month makes my skin crawl. I could buy a 300k home and be paying less than that for both payments and escrow combined. I am trying to get away from a predatory leasing office that wants to jack my rent to $1700 on a house worth less than 200k. Why would this be attractive? It’s a trap to fall behind and get evicted. Something I doubt these folks have any qualms over.

I’m moving to Florida in December if 2021 and will be looking for a place.

How funny that they tell you that you have to make a certain amount a month and have a certain credit score. I was well above and beyond the criteria, I make much more a month than they want you to and my credit score is 700 but they declined me. Just another way to gather your information. Now they have my cell, home address and social security number.

Will you be expanding to the Orlando, FL

area.

Hi what is your realtor information?

Do you except passed bankruptcy if it’s been discharged. Or will having a past bankruptcy disqualifies you automatically for your program.

I’m very interested in this program! I don’t want to rent an apt anymore. I want a townhouse or a single family home to rent. I want to purchase my own home. Can someone please help me! I have my elderly mother that will be living me and she’s showing signs of early dementia and she’ll be living with too. I’m in a desperate state my lease up on 8/31/21. I’ve been leaving voice messages and emails requested tours to different properties and no one has contacted me back yet. Would divvy find a home for me asap?

I am a licensed realtor and my clients are looking to speak with someone. Is there another direct number or email they can reach out to?

Hi! I’m interested in your program. My wife and I just finished paying off a chapter 13 bankruptcy. Both of our incomes are 120,000 per year combined. We have no debt and was wondering do we qualify for this program.

Never trust a vendors’ website that has no phone contact. The numbers don’t add up.

This has been a terrible experience from beginning to end. They bought my family a house with open sewer lines and expect us to deal.

This seems like a wonderful program…I saw the market they are in…but I did not see Michigan…

I want this so bad but I dont want to get my hopes up and they dont handle Michigan…???

Shelley,

Not yet, but could expand to new markets over time.

This DivvyHomes website is asking for my full social. Is this a scam or it it really Divvy Homes? Is it safe to type in our full social security number online? Pre-qualification: We need to perform credit verification, it says.

I see the rent will be pretty high and I do understand it’s because your put on a saving plan but do the monthly amount stay the same or change once the home has been purchased from divvy and is there an option to purchase early.

DON’T use this company, wouldn’t purchase a dog house through them!!!! This is the worst home purchase based company on the planet!!!! Is nothing but a steady runaround and rejection after rejection. It seems like they want only high end homes hoping the buyer can’t afford them and they can resell them at a higher profit!!!! Where do I start! first the company never contacts you with answers to questions, and if they do the answer is very vague and seems like a computer response. You never get a person, just a leave message and nothing. They right from the start ask for money. Give me a 50$ set up fee, don’t disclose any of the “Requirements” (and there are a lot of them, many quite outlandish!!!), and they never really do give you specifics. On several homes I asked for “specifics” to why they rejected the home, and got answers a stranger could have come up with. Then before they can do any inquiries they want an additional 500$ deposit prior to doing much of anything. They indicate the prefer a bank transfer. DON’T DO IT. Getting refund is near impossible. With Credit Card you can file fraud complaint, which we did. Then you submit house after house and they find all kinds of reasons to reject it. We had one home that passed the ridiculous requirements only to have then Divvy team sabotage the purchase with a “we can withdraw the offer to buy right up to closing”. What seller would agree to such a open-ended way to cancel! Only a very stupid or desperate one, which is what I think they pray upon. From day one, its a battle to do anything with Divvy. It leaves not only the seller but buyer in a state of limbo. VERY bad business practices. You send requests for what they reject the home and you get, it didn’t meet requirements. They send you a link that gives you nothing. Just the home didn’t meet the “requirements over and over again. In closing I spoke to local three agents that also have very bad dealings with Divvy so this in not a one off. Should have read the reviews, google has tons of them, all with same issue. If you’re smart run don’t walk away.

So, after researching Divvy, I have found that in the greater Orlando area of Florida, you need to have a base annual income of $160,000 minimum?! Who of us average folks, makes that kind of money. So, apparently my husband and I can NOT use Divvy regardless of what income we have and our lower credit score. A bit deceiving I believe. So, we will not be going any further with our application.

I have tried to work with you guys my co-buyer passed away and you are trying to keep our down payment for 45 days after move out date which I need to move I am disabled and do not have the funds to move out. I cannot qualify with just my income so you said you are terminating the lease since the co-buyer is no longer living. I have been asking for just the down payment to move and you can take the current rent due, past utilities if any and damages if any out of the home savings we accumulated for the year living here. The $7300 down payment was given to you upfront to hold when we moved in it should not take 45 days for you to return it. I understand the 45 days for the balance return out of the home savings fund. I cannot move or give you a date because I do not have the money to move but will if you give me back the down payment which you have included in the equity of the home which is technically not equity the equity is the home savings accrued down payment is the down payment I’m just trying to resolve things

It is very clear that Divvy is not working in the best interest of their customers and Home Owner’s. There is no way to explain why a $350,000 house cost $2,470/month and a $247,950 house cost $2,550/month. Same city. Same zip code. This makes absolutely no sense, at all. Especially when, “Divvy is currently [under] bidding 30% on every property” Lastly, I witnessed Divvy plaster over rotted walls & doors, paint them and claim that the rotted-molded wood that I pressed my finger through from the inside, to the outside of the house…was “repaired”. You don’t repair rotted walls & doors, you replace them; regardless of the fact that you’re selling at a loss, FIX IT like you’ve heard of integrity. Divvy is here to rob me of my future, by selling me a dream.