As of 2024, there are lots of options to get a mortgage with no money down, which is surprising given the devastating financial crisis that took place just over a decade ago.

The housing crash in 2008 forced lenders to require larger down payments because home prices plummeted and borrowers simply walked away.

Simply put, if homeowners don’t have any skin in the game, otherwise known as home equity, there’s a better chance they’ll walk away from their homes if they fall behind on payments, leading to costly foreclosures.

Conversely, if a borrower is required to put down say 10% of the purchase price, the lender has a safety buffer, and the homeowner is more likely to continue making payments, as they won’t want to lose that initial investment.

Despite this logic, underwriting guidelines have since loosened and there are countless home loan programs that require zero down payment.

The two most common zero-down mortgages are VA loans and USDA loans, though both have limitations that I’ll discuss below.

There are also zero down options available on conventional loans, typically facilitated via a gift or grant.

No Money Down Mortgages Used to Be the Norm

- It used to be common to buy a home with nothing down

- But the mortgage crisis changed that in a hurry

- Now many borrowers are required to bring in a minimum of 3% or 3.5% down

- Though no down payment mortgages still exist

Back in 2006 and 2007, you could easily obtain 100 percent financing from nearly any bank or lender in town.

The most common structure was the 80/20 combo loan, which is a first mortgage for 80% of the purchase price and a second mortgage for the remaining 20%.

This allowed a home buyer to put nothing down and avoid mortgage insurance because the first mortgage remained at the key 80% loan-to-value (LTV) threshold.

These high-risk financing deals were rampant, and most homeowners took the bait and chose not to put any money down, assuming their property would appreciate endlessly.

This explains why millions of American homeowners became underwater on their mortgages and/or faced foreclosure.

And that’s pretty much why the days of no money down mortgages came to an end, with lenders quickly upping credit score and documentation requirements, while slashing maximum loan-to-value ratios.

So what options do potential homeowners have nowadays when it comes to no down payment mortgages?

Amazingly, it’s still pretty easy to get a mortgage with zero down or close to no money down.

The exception might be jumbo loan amounts which require higher down payments.

The closest I’ve seen recently is 95% LTV, which is actually pretty aggressive and not something most lenders offer.

Jump to zero down mortgage topics:

– How to Get 100% Mortgage Financing Today

– FHA Financing with Zero Down

– Freddie Mac Zero Down Option

– Fannie Mae Zero Down Financing

– VA Loans and USDA Loans Offer Zero Down

– Check Credit Unions and State Housing Agencies

– Big Banks and Lenders Also Offer Zero Down Mortgages Via Grants

– Qualifying for Zero Down Home Loans

– Credit Score Needed to Buy a House with No Money Down

– Use Gift Funds to Get 100% Financing

– Pros and Cons of Zero Down Home Loans

How to Get 100% Mortgage Financing Today

- VA loans (if active duty or veteran)

- USDA loans (if buying in a rural area)

- 100% financing from credit unions

- FHA’s $100 down payment loan program

- HUD Good Neighbor Next Door program

- Various state housing finance agency programs

- Fannie Mae with a Community Second

- Freddie Mac with an Affordable Second

FHA Loans with Zero Down

- While a 3.5% down payment is required for an FHA loan

- It’s possible to get down payment assistance (DPA)

- This can cover the small amount between 96.5% and 100%

- This is one way to effectively get a home loan with nothing down

I provided a little background above about the rise and fall of zero down home loan financing. Now let’s look at what’s left.

Let’s start with FHA loans, which have coincidentally skyrocketed in popularity since the mortgage crisis got underway, available with just a 3.5% down payment.

There was a time, not long ago, when you could actually get an FHA loan with no money down at all thanks to seller paid downpayment assistance, which has since been outlawed.

Today, you can still get an FHA with zero down thanks to HUD’s Secondary Financing program.

It allows certain HUD-approved non-profit organizations and governmental entities to provide second mortgages to borrowers in need of financial assistance.

As you might suspect, these programs are geared toward providing access to homeownership for those unable to qualify on their own. This means there may be income limits that must be adhered to.You can also buy a HUD home (properties previously foreclosed) for as little as $100 down if you use FHA financing.

This is essentially zero down when we’re talking about the purchase of a home. However, you must be an owner-occupant and the properties are located primarily in Southeastern states.

Nationwide, if you are a law enforcement officer, teacher, firefighter or emergency medical technician, you may also qualify for “The Good Neighbor Next Door” initiative.

This program offers HUD-owned single-family homes (one-unit) to eligible buyers at a 50% discount AND with as little as $100 down.

Freddie Mac Zero Down Option

- Freddie Mac requires a minimum 3% down payment

- But you can combine the first mortgage with an Affordable Second

- Together this can cover any required down payment and closing costs

- This is makes it possible to get a home loan with nothing down or even out-of-pocket!

Mortgage financier Freddie Mac offers its Home Possible Advantage Mortgage, which requires as little as three percent for down payment.

But if you tack on an Affordable Second, which is a second mortgage option for low- and moderate-income borrowers, you can get a combined LTV (CLTV) as high as 105%.

This means no down payment required and additional funds to cover closing costs, and even property renovations!Like the FHA, these second mortgages need to come from an authorized source, such as an approved government agency, a CDFI, credit union, or the borrower’s employer.

The good news is the Affordable Second can’t be more than 2% higher than the mortgage rate on the accompanying first mortgage.

And they can be used on a 1-4 unit property as long as it’s owner-occupied.

Fannie Mae Zero Down Financing

- Fannie Mae also has a zero down home loan option

- If you combine their 97% LTV first mortgage with a Community Second mortgage

- Like Freddie it allows a CLTV as high as 105% to cover your closing costs as well

Fannie Mae offers a similar loan program via its HomeReady loan program, which calls for just three percent down as well and allows gift funds for the down payment.

Additionally, you can subordinate a Community Second behind the first mortgage and get a CLTV as high as 105%, which again means no down payment required to purchase a home. Or closing costs.

Again, this second mortgage must come from an approved federal agency, a state or local housing finance agency, a non-profit organization, the borrower’s employer, or a regional Federal Home Loan Bank.

And the interest rate can’t be more than 2% above the rate on the first mortgage.

It may even be a “silent second” in which payments aren’t due. You simply pay it off when you refinance or sell the property.

VA Loans and USDA Loans Offer Zero Down with Less Hoops

- These government home loans offer a more straightforward approach

- You can take out a loan at 100% LTV aka zero down without a second mortgage

- But there are far more restrictions in terms of allowable borrowers and property types

- So they won’t work for all prospective home buyers

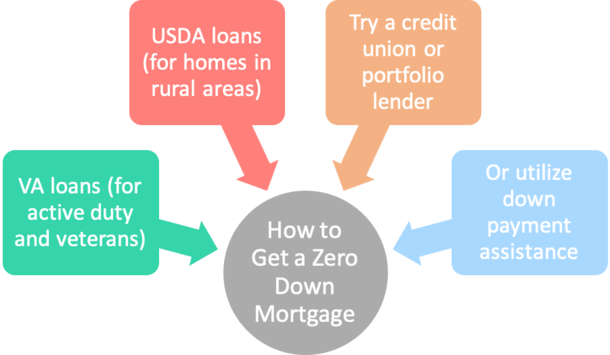

Today, the most widely used zero down mortgage programs are offered by the USDA (only in rural areas) and the VA (military and their families).

What’s nice about these loan programs is that you get 100% financing in a single home loan. No seconds required. And the max LTV of 100% comes standard.

And there is no ongoing mortgage insurance on VA loans, despite the lack of a down payment.

Unfortunately, these programs are only available to those who purchase properties outside the city or to those who serve(d) this country, respectively.

If you don’t fall into either of those categories, it might be harder to secure a mortgage with nothing down.

Check Credit Unions and State Housing Agencies for No Money Down Mortgages

- Be sure to check out your local credit union

- And/or state housing finance agency (HFA)

- Both may offer a zero down mortgage solution

- Often times these special loan programs aren’t widely publicized

As you can see, there are still many ways to score a no down payment mortgage.

In addition, NASA FCU and other credit unions offer so-called “high loan-to-value mortgages” to select customers.

There are also so-called doctor mortgages for physicians that provide 100% financing when ordinary buyers must provide a down payment.

And some private lenders even exceed 100 percent financing (125% second mortgages) despite the recent housing crash!

Also be sure to look into what homebuyer assistance is being offered by your state housing finance agency.

The California Housing Finance Agency (CalHFA) offers “silent seconds” that go behind first mortgages, which can be conventional (Fannie/Freddie) or government mortgages (FHA/USDA/VA).

They feature deferred payments, meaning you don’t need to pay a dime until the property is sold, the loan refinanced, or otherwise paid in full.

For example, California home buyers can take advantage of the MyHome Assistance Program, which offers up to 3.5% of the purchase price to cover the down payment and/or closing costs.

Combined with a first mortgage, this could give buyers the opportunity to purchase a home with nothing out of pocket.

Some of these silent seconds are even forgivable after a certain period of time, meaning they don’t ever need to be paid back if you stay in the home long enough.

They also recently launched the California Dream For All Shared Appreciation Loan that requires no down payment in exchange for a portion of your home’s appreciation when you sell.

If down payment is an issue, check out what’s being offered in your state by visiting your state housing finance agency website. There are some really great deals out there.

Just note that these mortgage programs are offered by mortgage companies that have been approved and trained by corresponding housing agencies, so rates/fees/service may vary.

Big Banks and Lenders Also Offer Zero Down Mortgages Via Grants

The latest zero down offering I’ve come across from a large company is loanDepot accessZERO, which combines an FHA loan and a 5% repayable second mortgage.

Movement Mortgage has a similar product called Movement Boost that covers both the down payment and closing costs.

Frost Bank out of Texas also recently unveiled 100% financing via its Progress Mortgage, though income limits do apply.

There is also the Bank of America zero down mortgage, which relies upon a grant and a 3% down home loan.

Note that many of these loan programs are reserved for low-to-moderate income applicants. But there are plenty more if you take the time to search.

Qualifying for Zero Down Home Loans

- Only available on 1-4 unit primary residences

- Purchases only, no refinance transactions in most cases

- Loan amounts often limited to conforming or lower

- Must provide full documentation

- Often must have two months of asset reserves

- Often must be a fixed-rate mortgage

- Often must be a first-time buyer

- Must setup an impound account to pay taxes and insurance

- May be subject to higher rates/fees

Note that not everyone qualifies for these types of mortgages because they’re reserved for borrowers in need of assistance.

I’ve provided a general list of requirements above that apply to many of these programs.

Typically, a zero down home loan will only be available to those purchasing a 1-4 unit primary residence. This may include condos along with single-family homes.

However, second homes and investment properties will likely not qualify for maximum financing.

Also don’t expect a 100% cash out refinance these days. Those days are long gone.

Often, you’ll need to be a first-time home buyer and/or earn an income that is at or below the median in the county you wish to purchase the home. And you’ll need to document your income, employment, and assets.

This is to ensure that these types of programs foster safe, responsible, and affordable lending for those who need it most.

In other words, if you’re a real estate investor you probably won’t be able to take advantage of these programs.

They are intended to help those most in need, who want to realize the dream of owning a home, but don’t necessarily have the means.

What credit score is needed to buy a house with no money down?

- The VA and USDA allow very low credit scores for 100% financing (possibly under 600)

- Most other zero down loan programs require good to excellent credit scores in order to qualify

- Make sure your credit is in great shape prior to your property search

- This will ensure you’re eligible for the widest array of loan programs

Outside the VA and USDA, which are pretty liberal when it comes to credit scores, you might be required to have good or excellent credit to qualify for zero down financing.

Some brave lenders used to be willing to allow 500 FICO scores on VA loans and 550 FICOs on USDA loans. But now they might require 620-640 FICO scores if putting nothing down.

For Fannie and Freddie, you’ll need at least a 620 FICO, possibly even 640, to tack on a Community Second or Affordable Second depending on the state housing finance agency in question.

The same credit score requirement tends to apply to FHA loans with subordinate financing from a state agency or non-profit.

Meanwhile, I’ve seen credit unions require 720+ FICO scores. So if you want more options, work on your credit beforehand!

Loan amounts are typically capped at or below the conforming loan limit as well, unless it’s a specialty product, such as the POPPYLOAN in the Bay area, which is reserved for high-earners who lack down payment funds.

Lastly, expect to have to open an impound account to pay your taxes and insurance monthly with your mortgage payment.

This is generally a requirement for anyone who puts less than 20% down on a home purchase.

[3 Ways a Low Down Payment Can Raise Your Mortgage Payment]

Use Gift Funds to Get 100% Financing on a Home Purchase

- Even if a zero down loan isn’t an option for you

- It might be possible to get a gift for or the down payment and closing costs

- This way you don’t have to provide anything out-of-pocket

- And you’ll have instant home equity when your loan closes

One last note. While some 100% financing programs have come and gone, there are still quite a few loan programs that require just three percent down or less.

In order to obtain a zero down loan, you can ask an eligible donor to provide you with a gift for the difference. So if it’s an FHA loan that requires 3.5% down, get that 3.5% in the form of a gift from a family member.

Likewise, if it’s a conventional loan that calls for 3% down, ask a relative or your spouse for the remainder in the form of a gift. That way you can buy a home with nothing out of your own pocket.

In many cases, a minimum contribution from the borrower’s own funds is not required, so it’s effectively zero down despite the LTV coming in below 100%.

While it’s not traditional zero-down financing, the end result will be the same. In fact, your mortgage payment will be lower because the amount financed will only be somewhere between 96.5%-97% of the purchase price.

However, keep in mind that 2-4 unit primary residences, second homes, and high-balance loans typically require a five percent minimum contribution from the borrower’s own funds. So this trick won’t work on all transactions.

Pros of Zero Down Home Loans

- Requires you to save less money

- Can buy a home sooner

- Can potentially buy a more expensive house

- Less money tied up in an illiquid asset

- Put fewer dollars at risk if things go south

- Might be able to invest money elsewhere for better return

- Can eventually refinance to better terms if home prices rise

Cons of Zero Down Home Loans

- Harder to find financing

- Mortgage payment will be higher every month with larger loan amount

- Mortgage rate will likely be higher

- You will pay mortgage insurance, even if not explicitly via higher closing costs or rate

- Could fall into an underwater position more easily

- Might be difficult to refinance if you want to change your loan terms

Read more: Primer on mortgage down payment requirements.

- UWM Launches Borrower-Paid Temporary Buydown for Refinances - July 17, 2025

- Firing Jerome Powell Won’t Benefit Mortgage Rates - July 16, 2025

- Here’s How Your Mortgage Payment Can Go Up Even If It’s Not an ARM - July 15, 2025

want to know more about how i can get 100% home loan

Mani,

The methods I mentioned above cover many of the zero down options today. Local housing agencies may also help with any down payment and closing costs to make the loan zero down as well.

The only thing that was left out, Of those 100% financed USDA loans is that the buyer will still have to cough up between $4000-10,000 to close, and about another $600.00 for the home inspection. So I’ve found the 100% financing route a tad misleading.

The National Homebuyer’s Fund offers an FHA loan that actually gives you a 5% grant to meet your down payment requirement. Credit score needed is 640. If you are in Oregon or Washington I can help. The program is also available in Colorado, Hawaii, Idaho, New Mexico, and Utah, but you would have to find a licensed lender locally. If you need help in Oregon or Washington I would love to help answer any questions! My number is (503)750-5096

I am a pre-qualified VA home loan looking for a home. The problem is, sellers don’t want to sell to you because there is no down payment, therefore the risk of walking away from the deal is an issue. Call it discrimination, call it whatever you want, but it is hard to find property with no money down.

Well planned ahead strategy from developers, $$$big people, few went down, we had bad economy,yes, but it has been a plan from beginning.

People were given loans, defaulted, some got help, but the government is aiding. Hud gives $100down no down knowing of all catches that will not let people get homes. So the only ones buying them is big $$, developers, scouts are paid, All Illegally done corrupted system..

I’m recently divorced and starting over. I’m 37 and cringe reach and every time I hand over $800+ to my landlord! If like to start putting my money towards a long term investment. Thank you

Alicia Fayard

It’s never too late to start over. Good luck Alicia!

Thanks for the post, Colin. I can’t believe the banks and financial institutions got away with selling/packaging on all those mortgages. And *we* get stuck with the cost, in terms of higher interest rates and fewer options.

Hello

I hold a lease option on a property I current live in but I’m not in a position to buy yet my uncle has offered to purchase the home I have already gave $10,000 down to the owners but if my uncle buys the home how can he get credit for that $10,000. Also how can he obtain a loan with no money down I should mention he is 75 if he purchase the home he will be moving in with us.

James,

Depends why your uncle is involved, is he helping you qualify with income or down payment? If you gave them $10k, how is that being reflected in the purchase? Will they sell the property for $10k less than the original agreed upon price? Or will it be applied to the purchase price once you go through with the purchase? If not, you may still need a down payment if you’re unable to obtain a no down payment loan. Or maybe the seller is offering their own financing?

Wanting to purchase a cabin as a rental investment . Just unsure how to make it work and obtain a mortgage for the property. I am limited to my down payment if any.. but see this as huge investment and game changer .

Stacy,

Unfortunately zero down and investment property don’t go well together these days. Typically, you need a hefty down payment to buy an investment property nowadays because of the risk involved.

Just secured a 100% loan from USDA, credit rating is better than 47% of Americans (over 740) and the homeowners were willing to absorb $8000 of the settlement costs. We did not ask for a reduction in the price of the home as we were asking for them to absorb the closing costs which will only effect their bottom line.

My husband’s credit score is 780 and mine is 684 coughing up $4,000 processing fee is no problem with us if the mortgage is 100% financing of a $260,000 4 br/3ba single family house with $950.00 monthly mortgage+ utilities. Anyone can lead us to the lender?

The American dream of home “ownership” is nothing but a joke! The average American has 62% of their net worth tied up in their home, but how much INCOME does that investment earn? Nothing! or better yet, NEGATIVE nothing! Property tax, insurance, upkeep, HOA dues, etc. on a paid off home can take a HUGE bite out of your Social Security check!

Me? I’m either going to purchase a home for cheap (all cash) during the next crash, or just keep saving my money and renting! As I save money on rent, my cell phone ($20/month from MetroPCS), my car insurance ($25/month from Insurance Panda), etc., I’ll be able to invest more into index funds with my freed up capital… something homeowners can NEVER do!

I bought my first house 2 yrs ago, my mortgage lender told me 80/20 or 80/10/10 loans weren’t legal in Oregon anymore. I’m stuck in a fha loan with pmi, can I go after them at all for giving false info

Cc,

Weren’t legal, or weren’t available? I haven’t heard of that rule…you might not be stuck if you refinance into a conventional loan and have the equity now to avoid MI.