The new threat to those resisting the urge to buy real estate (how dare you) is the risk of rising mortgage rates.

All the pundits believe interest rates are headed closer to 5% for a 30-year fixed, up nearly a full percentage point from current levels.

The sales pitch is pretty straightforward – if you wait any longer you’re really going to be priced out of the market, what with home prices and mortgage rates on the rise.

If you think things are expensive today, worry about tomorrow, they say.

But you have to question whether it’s a good deal to buy at this point, given the tremendous price increases over the past couple years.

Are Low Interest Rates Really a Strong Enough Tradeoff?

Sure, low mortgage rates are great. They make monthly mortgage payments more affordable, even if home prices are (a lot) higher than they once were.

And despite wages being stagnant, people can afford to buy more expensive homes because interest rates are so cheap. That’s the point, right?

But if you look at things from a home price-to-income ratio perspective, property values look pretty inflated historically.

So are the low rates still incentive enough to buy a home? And should you buy now because rates and prices are only going to climb higher?

That’s the million-dollar question, and one nobody can really answer with absolute certainty.

You could argue that we’re due for another correction after two solid (insane) years of gains. It’s clear home price growth is already slowing down, and it could even turn negative in the near future.

Just Take a Look at Property Histories

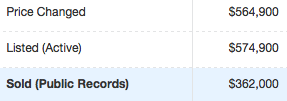

You don’t have to be a real estate genius to see what I’m talking about. Just go to Redfin or Zillow and scroll down to the property history for just about any for sale listing that sold recently.

You’ll see something like the screenshot above, a home that was purchased relatively recently and listed not too long after for a huge premium. Sure, they probably flipped it (and that kitchen looks absolutely breathtaking), but come on.

In this example, the home is being sold for 56% more just five months later! And this isn’t an outlier, it’s the norm in today’s bloated real estate market.

Just to do a little math, you could have purchased this home for $362,000 earlier this year and put down 20%, leaving you with a mortgage of $289,600.

Factor in a mortgage rate around 4.125% for a 30-year fixed and the monthly mortgage payment is just over $1,400.

But the asking price is now $564,900 (notice the price cut), which requires a down payment of $112,980 to get to 80% LTV (that’s about $40,000 more you need to bring to the closing table).

At a loan amount of $451,920, you’d be looking at a monthly mortgage payment of $2,190 at today’s ultra low rates (4.125% on a 30-year fixed).

To put it in perspective, mortgage rates would need to rise to about 8.25% at the original sales price for the monthly mortgage payment to be a similar amount (roughly $2,175).

In other words, home prices seemed to have shot way too high despite the low rates doing their part to keep things reasonable.

Sure, low mortgage rates make this home a lot more affordable to a lot more people, even at today’s inflated price, but it requires a much larger down payment.

And what happens when interest rates do rise to more historic norms? Who will buy this house from you at a premium in the future if everyone is priced out?

I suppose the takeaway here is to be really cautious when searching for a home to buy today, instead of just trying to get in to avoid missing the boat. A year or two ago, any house would do, now you need to be a lot more particular.