Mortgage Q&A: “Does the Fed control mortgage rates?”

With all the recent hubbub concerning mortgage rates, and the Fed, you might be wondering how it all works.

Does the Federal Reserve decide what the interest rate on your 30-year fixed mortgage is going to be?

Or is it dictated by the open market, similar to other products and services, which are supply/demand driven.

Before getting into the details, we can start by saying the Fed doesn’t directly set mortgage rates for consumers. But it’s a little more complicated than that.

The Federal Reserve Plays a Role in the Direction of Mortgage Rates

- A more accurate way of defining the Fed/mortgage rate relationship

- Is that it might be an indirect, long-term one that takes a lot of time to materialize

- If the Fed is raising rates over time, long-term mortgage rates may eventually follow

- The same is true if the Fed is guiding rates lower, as common economic factors typically affect both

As noted, the Federal Reserve doesn’t set mortgage rates. They don’t say, “Hey, the housing market is too hot, we’re increasing your mortgage rates tomorrow. Sorry.”

This isn’t why the 30-year fixed started the year 2022 at around 3.25%, and is now closer to 7% today.

But you could argue that the Fed indirectly influences mortgage rates. Ultimately, the Fed is just trying to control inflation via short-term rates. This in turn dictates how longer-term rates may play out.

Essentially, the market for longer-term rates such as 30-year mortgages (and mortgage-backed securities) might seek direction from Fed cues.

The Fed does get together eight times per year to discuss the state of economy and what might need to be done to satisfy their “dual mandate.”

That so-called “dual mandate” sets out to accomplish two goals: price stability and maximum sustainable employment.

Those are the only things the Federal Reserve cares about. What happens as a result of achieving those goals is indirect at best.

For example, if they determine that prices are rising too fast (inflation), they’ll increase their overnight lending rate, known as the federal funds rate.

This is the interest rate financial institutions charge one another when lending their excess reserves. Theoretically, higher rates mean less lending, and less money sloshing around the economy.

When the Fed raises this target interest rate, commercial banks increase their rates as well.

They also give an indication as to which way we’re (the economy is) headed and what kind of monetary policy is in store, which can be important to longer-term rates, such as 30-year fixed mortgages.

So things do happen when the Fed speaks, but it’s not always clear and obvious, or what you might expect.

Perhaps more importantly, their actions are usually known in advance, so lenders often begin raising or lowering rates well beforehand.

Watch Out for Those “Fed Raises Mortgage Rates” Articles

- It’s fine to pay attention to Fed announcements when they’re released

- But don’t give them too much weight or worry about them

- Or better yet, think you can predict what will happen to mortgage rates

- There’s no clear short-term correlation, even if they do sometimes make an immediate impact

When the Fed raises its own rates, the headlines typically flood in about your rate going up too.

If they hike, it tends to be the same regurgitated article that comes out around the time the Fed meets, which is every six weeks throughout the year (eight times annually).

You’ll see news articles about the “Fed raising mortgage rates,” even though the Fed doesn’t price mortgages. Period.

You can’t blame them (the media) – it makes for a good headline, but much of what is thrown out there usually isn’t true or anything to worry about.

In most cases, it’s excitement-inducing or fear mongering, or simply something to fill the page.

It may be a straight up definitive article warning you about the impending rate rise and what you should/can do to mitigate the damage. Even if mortgage rates don’t actually go up afterwards.

Sure, the Fed statement can have an immediate impact on mortgage rates on the day it’s released, to the point where lenders may need to reprice their rate sheets from morning to afternoon.

But that reprice can completely counter the Fed’s move. For example, the Fed can lower its key rate while mortgage lenders reprice rates higher. Or it may do absolutely nothing to affect pricing.

Ultimately, these types of articles are simply not accurate and tend to do more harm than good.

Tip: The only direct mortgage impact you’ll see from a Fed announcement is an increase or decrease in the prime rate, which directly affects the pricing of HELOCs.

The Fed Doesn’t Announce Mortgage Rates

- The Fed doesn’t set or announce consumer mortgage rates

- Regardless of the bountiful misinformation you’ll find out there

- When they announce a Fed rate change, mortgage rates may go up or down (or do nothing!)

- Ultimately mortgage rates are affected by countless factors beyond a singular Fed announcement

When the Fed gets together to set the target rate for the Federal Funds Rate, financial markets (stocks, bonds, etc.) pay attention and react.

As does the media because it’s generally a big deal. But Jerome Powell and his posse don’t sit down and decide which way mortgage rates will go.

They don’t say, “Hey, the 30-year fixed should be 5%, not 4%. Let’s increase rates!”

Rather, they discuss the state of the broader economy, inflation, monetary policy, and so on.

They almost never mention mortgages explicitly, except for in recent years thanks to the remnants of the quantitative easing program known as QE3.

That is expected to turn into QT, or quantitative tightening, where the assets they hold are finally unloaded.

The pace of that move could make a big impact on mortgage rates, as they hold a ton of mortgage-backed securities (MBS).

But because mortgage rates have already risen so much already, it could be priced in.

In fact, mortgage rates sometimes get a breather, despite an interest rate hike!

No Correlation Between Fed Funds Rate and Mortgage Rates

Ultimately, there’s no clear correlation between the federal funds rate and mortgage rates.

In other words, one can go up while the other goes down. Or one can do nothing while the other does something. Or they can move in the same direction for a while.

But the spread between the two won’t remain in a certain range over time like mortgage rates and the 10-year bond yield do.

You can’t say the 30-year fixed should be X% higher or lower than the Fed Funds Rate at any given time.

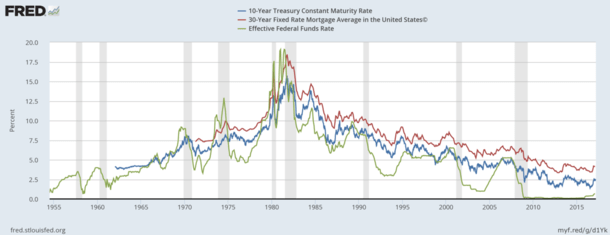

As you can see from the St. Louis Fed chart above, the 10-year yield and the 30-year fixed (based on Freddie Mac data) move in relative lockstep.

You can see the blue line (10-year yield) and red line (30-year fixed) move in a very similar fashion over the years with a pretty steady spread. Then there’s the green line (fed funds rate), which is all over the place.

Sometimes you see a long-term trend, but other times you see no apparent correlation.

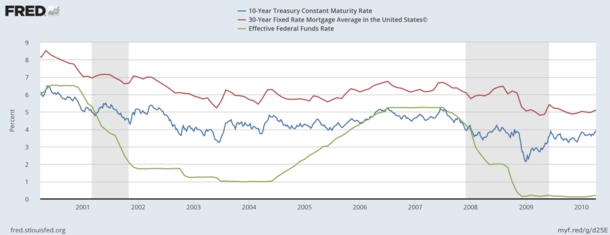

Check out the second graph below, from 2000-2010, which shows some similar movement between the FFF and mortgage rates, but at times no obvious relationship.

What Does the Fed Decision Mean for Mortgage Rates?

The Fed Open Market Committee (FOMC) holds a closed-door, two-day meeting eight times a year.

While we don’t know all the details until the meeting concludes and they release their corresponding statement, it’s typically fairly telegraphed.

So if they’re expected to raise the fed funds rate another .50%, it’s generally baked in to mortgage rates already.

Or if they plan to cut rates, you might see lenders repricing their rates in the weeks preceding the meeting.

Since early 2022, they’ve increased the federal funds rate 11 times, from about zero to a target range of 5.25% to 5.50%.

When they raise this key rate, banks charge each other more when they need to borrow from one another.

And commercial banks will increase the prime rate by the same amount. So a 0.50% move in the fed funds rate results in a 0.50% move in the prime rate.

As a result, anything tied directly to prime (such as credit cards and HELOCs) will go up by that exact amount as well.

However, and this is the biggie, mortgage rates will not increase by 0.50% if the Fed increases its borrowing rate by 0.50%.

In other words, if the 30-year fixed is currently priced at 7%, it’s not going to automatically increase to 7.5% when the Fed releases its statement saying it increased the fed funds rate by 0.50%.

What the Fed Says or Does Can Impact Mortgage Rates Over Time

So we know the Fed doesn’t set mortgage rates. But as noted, what they do can have an impact, though it’s typically over a longer time horizon.

Fed rate hikes/cuts are more of a short-term event, while mortgage rates are long-term loans, often offered for 30 years.

This is why they correlate better with the 10-year bond yield, as mortgages are often held for about a decade before being refinanced or the home sold.

As such, mortgage rate tracking is better accomplished by looking at the 10-year yield vs. the federal funds rate.

But if there’s a trend over time, as there has been lately with hike after hike, both the federal funds rate and mortgage rates can move higher in tandem as the years goes by.

For the record, sometimes mortgage rates creep higher (or lower) ahead of the Fed meeting because everyone thinks they know what the Fed is going to say.

But it doesn’t always go as expected. Sometimes the impact post-statement will be muted or even potentially good news for mortgage rates, even if the Fed raises rates.

Why? Because details might already be “baked in,” similar to how bad news sometimes causes individual stocks or the overall market to rise.

The Fed Has Mattered More to Mortgage Rates Lately Because of Quantitative Easing (QE)

While the Fed does play a part (indirectly) in which direction mortgage rates go, they’ve held a more active role lately than during most times in history.

It all has to do with their mortgage-backed security (MBS) buying spree that took place over the past near-decade, known as Quantitative Easing (QE).

In short, they purchased trillions in MBS as a means to lower mortgage rates. A big buyer increases demand, thereby increasing the price and lowering the yield (aka interest rate).

When the Fed’s meeting centers on the end of QE, which is known as “Policy Normalization,” or Quantitative Tightening (QT), mortgage rates may react more than usual.

This is the process of shrinking their balance sheet by allowing these MBS to run off (via refinance or home sale) or even be sold, instead of continually reinvesting the proceeds.

Since the Fed mentioned this concept in early 2022, mortgage rates have been on a tear, nearly doubling from their sub-3% levels. That’s been more of the driver than their rate hikes.

Mortgage lenders will be keeping a close eye on what the Fed has to say about this process, in terms of how quickly they plan to “normalize.”

And how they’ll go about it, e.g. by simply not reinvesting MBS proceeds, or by outright selling them.

They won’t really bat an eye regarding the increase in the fed funds rate, as that has already been telegraphed for a while, and is already baked in.

So the next time the Fed increases its rate by 50 basis points (.50%), don’t say the Fed raised mortgage rates. Or that 30-year fixed mortgage rates are now 7.5%.

It could technically happen, but not because the Fed did it. Only because the market reacted to the statement in a negative way, by increasing rates.

The opposite could also be true if the Fed takes a softer-than-expected stance to their balance sheet normalization. Or if they cut their own rate. But mortgage rates would not fall by the same amount of the rate cut.

By the way, mortgage rates could actually fall after the Fed releases its statement, even if the Fed raised rates.

(photo: Rafael Saldaña)