Mortgage match-ups: “Mortgage rates vs. the stock market.”

With all the recent stock market volatility, you may be wondering what effect such events have on mortgage rates.

Do mortgage rates go up if stocks go down and vice versa? Or do they move in relative lockstep? Let’s find out!

Stocks and Mortgage Rates Follow the Economy

- Both stocks and mortgage rates take cues from the economy

- And they react to news in mostly the same way

- Whether it’s good news or bad news

- Because what’s going on economically matters to the underlying security

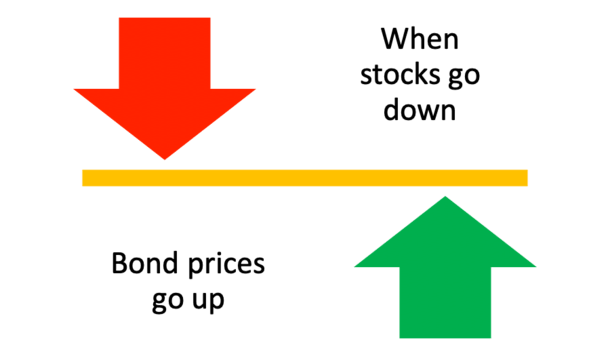

Simply put, when economic fears rise, as they commonly do, whether justified or not, investors flee the stock market and head toward safer U.S. Treasury bonds, such as the benchmark 10-year bond.

So stocks and bonds have an inverse relationship. Imagine a scale that is constantly rising and falling as investors jump from one side to the other.

This phenomenon is known as the “flight-to-quality,” whereby investors ditch the risk and head to safe havens like gold and U.S. Treasuries when fear is in the air.

They do this because Treasuries have an explicit government guarantee, whereas anything can happen with individual stocks. In fact, a stock could go to zero and that would be that. Investment lost.

Anyway, when demand for Treasuries and bonds increases, prices go up and yields drop because demand is so strong that a higher yield is no longer necessary to lure in investors.

And because the 30-year fixed tends to follow the direction of the 10-year bond yield, both up and down, mortgage rates tend to decline when stocks fall. And mortgage rates generally rise when stocks go up.

Stock Market Fear = Lower Mortgage Rates

- Fear is good if you want a lower mortgage rate

- Because if things are looking gloomy in the economy

- It means investors will likely ditch stocks and flock to bonds

- Thereby pushing the price of the bond up and the yield (interest rate) down

Yesterday, the stock market plummeted thanks to an ongoing trade war with China that just ratcheted higher.

At the same time, the yield on the 10-year bond fell to its lowest point since late 2016.

Mortgage rates also moved lower on the news, and they may even improve further thanks to the general uncertainty in the air.

This is great news for prospective homeowners, as mortgage rates were expected to climb throughout 2019 while the economy supposedly improved.

But it is a bit of a catch-22, as lower mortgage rates mean more economic unrest, which can translate to flat or even lower home prices for those looking to sell.

After all, there might be fewer prospective home buyers if people are losing their jobs, getting paid less, or simply feeling less positive about their finances. And that could lead to price cuts.

[Home prices vs. mortgage rates]

Mortgage Rates Follow the Stock Market

- Mortgage rates and the stock market aren’t directly related

- But rates do tend to follow stock market moves

- So if stocks go up, mortgage rates may follow, and vice versa

- Just note that there might be a time tag with regard to mortgage lenders adjusting rates

As a rule of thumb, bad economic news sends mortgage rates lower, while good economic news pushes mortgage rates higher.

Stocks move in much the same way, except of course higher stock prices are seen as a positive and higher mortgage rates are viewed quite unfavorably, rightly so.

So when stocks rise, mortgage rates often climb as well. And when stocks fall, mortgage rates typically decrease too.

This could lead to disappointment if you’re keeping one eye on your stock portfolio and another on mortgage rates, assuming you’re in the market to refinance your mortgage.

Your stocks may be up, but mortgage rates won’t be as low. Conversely, your stock portfolio could be in the dumps while mortgage rates inch lower. Think of this as a bittersweet, but often unavoidable situation.

Of course, a lower fixed mortgage rate may mean a lot more long term than a temporary blip in stock prices. If you’re in it for the long-haul, the lower rate can be much more meaningful.

Experts will probably tell you that you shouldn’t be watching your stock portfolio on a daily or even monthly basis, as any losses are simply paper ones until you’re ready to cash out much later in the future.

Also keep in mind that there are many factors that determine mortgage rates, and a change in stock prices may not always translate to a similar change in rates thanks to the complexities involved.

It should just give you a general indication of the direction rates may go if they even move at all.

Tip: What mortgage rate can I expect?

- UWM Launches Borrower-Paid Temporary Buydown for Refinances - July 17, 2025

- Firing Jerome Powell Won’t Benefit Mortgage Rates - July 16, 2025

- Here’s How Your Mortgage Payment Can Go Up Even If It’s Not an ARM - July 15, 2025