Today we’ll take a good look at On Q Financial, a direct mortgage lender based in Tempe, Arizona that wants to make getting a mortgage simple.

In fact, their slogan is, “Mortgages Simplified,” so my guess is their loan process is pretty straightforward and possibly easier than the other guys.

That could have something to do with their digital mortgage offering that promises a faster and easier experience, complete with a smartphone app that can do most of the heavy lifting.

While they’ve only been around since 2005, they’re growing rapidly and making a name for themselves in the industry.

They weren’t in the top 100 based on 2018 HMDA data, but now refer to themselves as a top-50 lender.

On Q Financial Quick Facts

- Direct mortgage lender headquartered in Tempe, Arizona

- Founded in 2005 by former mortgage loan officer John Bergman

- A top-50 mortgage lender with more than 550 employees and 70 locations

- Offers a digital mortgage experience that allows you to apply via smartphone app

- Specialize in home purchase loans but also offer refinancing

- Licensed in 47 states and DC (not available in Hawaii, New Jersey, or New York)

- Helped over 10,000 families purchase a home in 2019

On Q Financial Digital Mortgage Process

On Q Financial prides itself on making the often-agonizing home loan process fast and easy, so you should expect a better experience than what you may have heard or are used to.

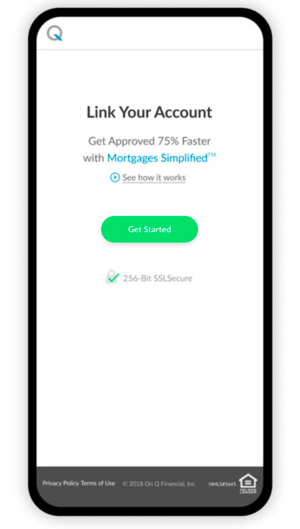

Their “Mortgages Simplified” digital mortgage solution allows you to submit income, asset, and employment information through your smartphone thanks to an app called Simplicity, available for both Apple and Android devices.

Aside from offering a full mortgage application via the app, it has various mortgage calculators, document scanning and uploading capabilities, and provides real-time loan status notifications.

Instead of having to gather your W-2 forms, paystubs, and bank statements, you can link your financial accounts and import everything right into the loan application.

They say this cuts down the processing time by four to seven days so you can close your home loan a lot quicker and with less work.

It’s also more secure than dealing with paperwork and probably more accurate too, leading to fewer duplicate requests from underwriters.

On Q Financial also offers full mortgage pre-approvals that go be beyond a basic pre-qualification with actual upfront underwriting.

Those who want a face-to-face or more personal experience are welcome to visit a local branch or get on the phone with a loan officer as well.

You can also apply right on the website and select a loan officer by name if one is known to you or if you’ve been referred to a specific individual.

All in all, they make it pretty easy to get going on your mortgage loan application.

What On Q Financial Offers

- Home purchase loans, renovation loans, construction loans, and refinance loans

- Conventional loans, government home loans, and jumbo loans

- Down Payment Assistance (DPA) and interest-only also available

- Various fixed-rate and adjustable-rate loan programs to choose from

- Lending on all residential property types including manufactured homes

One great thing about On Q Financial is the breadth of loan options available – they’ve basically got you covered no matter what type of real estate transaction is involved.

With regard to home loan type, they offer both conventional loans backed by Fannie Mae and Freddie Mac, and government home loans backed by the FHA, USDA, and VA.

They are big on home purchase loans thanks to their strong relationships with local real estate agents, and equally proficient when it comes to refinancing a mortgage, including cash out refinances.

There are also several down payment assistance (DPA) options available for first-time home buyers with limited assets.

Beyond that, they offer home renovation loans, such as an FHA 203k loan and Fannie Mae HomeStyle loan, along with construction loans.

Their builder division specializes in one-time close (OTC) construction loans, which are available via conventional, FHA, USDA, or VA.

The loan covers both the interim construction costs and the eventual mortgage, converting from a construction loan to a permanent home loan once construction is completed.

They also offer financing on manufactured homes and the Native American Home Loan HUD184.

On Q Financial can also go BIG if you need jumbo loan financing, with loan amounts as high as $5 million and low down payment options.

In the non-QM space, they also offer interest-only financing, which isn’t available from too many lenders these days.

You can get a fixed-rate mortgage with several different terms (10, 15, 20, 25, and 30 years) or an adjustable-rate mortgage such as the 5/1 ARM or 7/1 ARM.

And they lend on primary residences, second homes (vacation properties), and investment properties.

On Q Financial Contact-Free E-Closing

On Q Financial has been offering a hybrid closing option for several years, combining some online document submission with in-person signings.

But because of the COVID-19 pandemic, they realized it was urgent to develop a completely remote closing solution.

Their new E-close option is totally contact-free and allows you to close remotely from just about anywhere.

It relies upon secure document signing and automated verification, and certain core technology like an internet connection and webcam for identity verification.

When the pandemic first started, they were able to close a refinance loan for a borrower who was stranded in Costa Rica, completely online.

On Q Financial Mortgage Rates

In terms of interest rates, On Q Financial says they offer “low, low rates and excellent service.”

Just how low is a bit of a mystery because they don’t make mention of their rates otherwise anywhere on their site.

I prefer a lender that openly advertises their mortgage rates, even if they’re just generic rates, to get a better feel for their competitiveness.

For me, doing so shows they’re more transparent than other lenders. Unfortunately, On Q Financial chooses to keep their rates close to their chest.

The same goes with lender fees, so we’re in the dark when it comes to rate and fees.

In other words, take the time to shop around with other lenders if you speak with On Q to ensure they are competitive.

While easy and fast is good, a cheaper mortgage might be even better long-term.

On Q Financial Mortgage Reviews

They have a very strong rating on Zillow, a whopping 4.98 out of 5-stars, which is pretty much as close to perfection as you can get.

It’s based on nearly 1,800 customer reviews, many of which indicate that the mortgage rate was lower than expected.

They also have a 4.8 out of 5-star Google Review Rating based on 140 ratings from past customers.

Since 2005, they’ve been an accredited business with the Better Business Bureau, and currently have an A+ rating.

They have 1 out of 5 stars on the BBB, but only on a very small sample size of four total customer reviews.

Many of their individual loan officers also come highly rated via SocialSurvey.

On Q Financial Pros and Cons

The Good Things

- A fast digital mortgage process

- Free smartphone app for both Apple and Android

- Tons of loan programs to choose from

- Ability to update pre-approval at any time while shopping different homes

- E-closing option for contact-free loan fundings

- Free mortgage calculators on site

- A multilingual website (Spanish, Russian, Simplified Chinese)

The Maybe Not So Good Things

- Not yet licensed in every state

- Do not disclose mortgage rates or lender fees

- No second mortgages available

(photo: Alan Levine)