Let’s take a moment to talk about “interest-only mortgages.” A decade ago, very few individuals seemed to be interested in actually paying off their mortgages.

Many prospective and existing homeowners alike just wanted to get the cheapest financing available, with the lowest monthly payment options, regardless of the consequences.

That meant buying real estate with 100% financing and throwing in an interest-only option on top. Oh, and these loans were typically adjustable-rate mortgages, not 30-year fixed mortgages.

However, they were available on pretty much any loan program, from a one month adjustable-rate mortgage to a 30-year fixed rate mortgage.

And the once very popular pick-a-pay loan had an interest-only option available as well.

Jump to interest-only loan topics:

– How Does an Interest-Only Mortgage Work?

– Pay Off Your Loan or Keep Payments Low

– Interest-Only Home Loans Eventually Adjust Higher

– You Pay for the Interest-Only Privilege

– How to Calculate an Interest-Only Mortgage

– Interest-Only Mortgage Qualification

– Can You Still Get an Interest-Only Mortgage?

– Pros and Cons of Interest-Only Mortgages

With so many exotic mortgage programs available, such as negative-amortization loans and loan programs with introductory teaser rates, it was easy to understand why borrowers did what they did.

In fact, interest-only options used to be almost a given on mortgages back then. But we all know how things turned out.

We experienced the worst housing crisis in modern history, driven largely by loose mortgage lending.

Fortunately, times have changed, and these days it’s pretty uncommon to find a mortgage lender willing to give you an exotic loan, including an interest-only mortgage.

Of course, there are still lenders out there, it’s just more of a specialty now. And perhaps a lot harder to qualify.

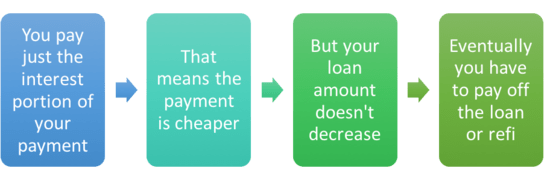

How Does an Interest-Only Mortgage Work?

- You get the option to pay only the interest due each month

- None of your monthly payment goes toward the principal balance

- This means the loan amount doesn’t decrease with the payments

- But you can still make fully-amortized payments if you want

In a nutshell, an interest-only mortgage gives you the option to pay just the interest portion of the mortgage payment each month.

This allows a homeowner to save money and still gain equity if home prices increase, even though their loan balance stays the same.

A standard mortgage payment consists of two main components: principal and interest.

The principal portion is the amount you owe (the loan amount), and the interest portion is the cost of financing what you owe. The bank isn’t lending you money for free you know.

Instead of paying principal and interest, you just pay interest each month. And that makes it significantly cheaper.

Let’s look at an interest-only home loan to highlight this point:

Loan amount: $400,000

Mortgage rate: 6%

Principal & interest payment: $2,398.20

Interest-only payment: $2,000.00

Imagine a $400,000 loan amount with a 6% mortgage rate. And pretend it’s a 30-year fixed-rate loan.

As you can see, the interest-only payment is much more attractive than the principal and interest payment, nearly $400 less each month. That’s the appeal.

Note: You still have the option of making the fully-amortized payment (principal and interest) if you choose.

The interest-only option is just that, a payment option, which is totally optional. It’s basically just added flexibility.

Do You Want to Pay Off Your Loan or Keep Payments Low?

- An interest-only mortgage is good for keeping payments low

- Can be helpful if you have limited cash flow or uneven income

- The downside is you won’t actually be paying down the loan

- Eventually you’ll need to unless home prices rise and you sell it

The main advantage of an interest-only mortgage is the lower monthly payment.

But the tradeoff is you pay more interest over the life of the loan.

If you make interest-only payments on your mortgage each month for the first ten years, you will pay substantially less than the fully-amortized payment, but gain nothing in the way of home equity.

So if you took out a mortgage with no money down, you would have zero ownership in your home unless it appreciated during that time. Meaning home prices must rise for you to gain any equity whatsoever.

If home values happened to fall during that time, you could easily find yourself in an underwater position with nothing put down and no principal paid.

This could be a big problem if you planned on selling the home in a short period of time. Or expected to refinance.

The Main Disadvantage of an Interest-Only Loan: They Eventually Adjust Higher

- The interest-only period typically ends after 10 years

- Then you must make fully amortized mortgage payments

- Over a 20 year period (remaining loan term if 30 years)

- This can result in a very significant payment increase

Here’s another important warning about interest-only home loans.

The interest-only period typically only lasts for the first 5-10 years of the loan, at which point your monthly mortgage payments can jump to possibly unmanageable levels.

You actually get hit twice. After the interest-only periods ends, your minimum payment converts to the fully-amortized payment (principal and interest payments).

And because the beginning mortgage balance could still be fully intact after only paying the interest due each month, you’d have to pay that full loan balance in 20 years instead of 30 (assuming it’s a 30-year loan).

Hello significantly larger mortgage payment! If it’s an ARM, you could get hit three times if the interest rate also adjusts higher.

That is, unless you’re able to refinance your mortgage or sell the property before that happens…which is what most people seem to bank on.

But you can’t always count on lower mortgage rates in the future, and if you can’t handle the larger payment amount, beware!

With home prices on the up and up, the idea is that you can eventually gain considerable ownership in your home without ever paying any money toward the principal balance.

This was the main argument behind the infamous option arm. But those days are now well behind us.

You Pay for the Privilege of an Interest-Only Payment

- The interest-only option typically isn’t a free add-on

- Expect either a higher mortgage rate for the option

- Or higher closing costs thanks to a pricing adjustment

- And some banks may require that you park your deposits in their low-yielding accounts

Interest-only loans usually come at a cost, maybe 0.25 to the fee, or perhaps .125 (1/8) to the interest rate.

So instead of an mortgage rate of 6.5%, you might be stuck with a rate of 6.625% if you opt for an interest-only option.

Or you may need to pay higher closing costs to the lender. On a $500,000 loan amount, this could be another $1,250 in fees.

Simply put, you pay for the privilege to not pay down your principal balance, which sounds a bit odd.

At this point you might think interest-only mortgages are a complete waste of time. And that you should always pay down at least some principal each month.

But it really depends on what you plan to do with your home, and if you see yourself owning the property outright at some point.

If it’s just an investment property, or a short-term fixer upper, you could argue in favor of making interest-only payments to keep costs low while leveraging the money elsewhere.

But if you plan on staying in your home long-term, it is generally wise to pay both principal and interest to gain ownership in your home.

How to Calculate an Interest-Only Mortgage

- It’s actually very easy to calculate since we don’t have to factor in principal

- Simply multiply the loan amount by the interest rate

- Then divide by 12 (months) to get the monthly cost

- And voila, you’ve got your interest-only payment!

This is probably one the easier mortgage calculations out there. Seriously, you don’t even need a mortgage calculator (or an interest only mortgage calculator for that matter).

All you have to do is take the interest rate, multiply it by the loan amount, and then divide that by 12 (months).

So if the mortgage rate is 4% and the loan amount is $400,000, simply input .04 and multiply it by $400,000.

That equates to $16,000, which is the annual amount of interest paid. Then divide by 12 and you get $1,333.33, which is the monthly interest-only mortgage payment.

And because the loan balance doesn’t change (go down) if you’re only making interest payments, the calculation never changes either. Easy!

Just note that there might be taxes and insurance paid monthly as well, if you have a mortgage impound account.

Interest-Only Mortgage Qualification

- In the past lenders may have used the interest-only payment for qualifying purposes

- But that was clearly flawed seeing that the payment wasn’t fully-amortizing

- Today expect to be underwritten with the principal and interest payment

- This ensures you can manage regular payments once the IO option disappears

Back in the day, it may have been easy for home buyers to qualify for an interest-only loan. Why? Because you could use the interest-only payment. Not anymore.

Lenders wised up and realized they couldn’t qualify someone using the lowest payment possible and ignore the higher payment looming on the horizon.

Thus, they tend to qualify borrowers at the fully-amortized payment or even higher. In fact, despite the 30-year loan term, qualification is often based upon a 20-year amortizing payment!

If it’s an adjustable-rate mortgage, which is a common combination with IO loans, it could be the higher of the start rate +2% or the fully-indexed rate.

For example, if your 7/1 ARM has an interest-only option and a start rate of 5.75%, you’ll need to qualify at a rate of 7.75% or even higher, depending on the fully-indexed rate.

Additionally, the lender may use a monthly payment based on a 20-year amortization, which would be the remaining period after the typical 10-year IO period.

Imagine the loan amount is $400,000 and the start rate is 5.75%. That would equate to an interest-only payment of $1,916.67.

Now if we pretend the fully-indexed rate is 7%, the qualifying, fully-amortized payment would be a much higher $3,101.20 based on a 20-year term.

It just got a lot harder to qualify for the mortgage because that monthly payment will push your DTI ratio up a lot higher.

In other words, you have to make a decent amount of money to qualify for these types of loans. They don’t necessarily allow you to borrow more.

Can You Still Get an Interest-Only Mortgage?

Lastly, note that interest-only options are only available on certain types of mortgages these days.

They were easy to obtain in the early 2000s, but are mostly outlawed due to the Qualified Mortgage (QM) rule, which doesn’t permit an interest-only period.

This means you won’t be able to get one on a conforming loan backed by Fannie Mae or Freddie Mac.

Nor will you be able to get one on a government loan program like an FHA loan or VA loan.

However, they are commonly found on jumbo mortgages, typically with big banks that hold them in their portfolios.

So if you’re looking for an interest-only loan, consider a bank or perhaps a credit union that makes its own mortgage guidelines.

Just note that you might need to deposit a considerable amount of money to qualify.

For example, KeyBank offers an interest-only mortgage to clients with at least $100,000 or more in deposits or investments.

Pros and Cons of Interest-Only Mortgages

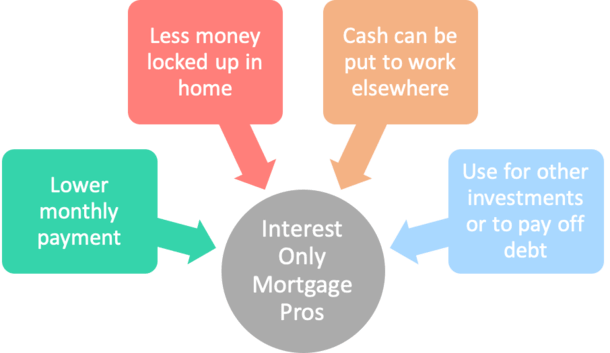

Benefits of interest-only mortgages

- Smaller monthly mortgage payment

- More affordable if money is tight (improved cash flow)

- You can buy a bigger/more expensive home today

- Excess cash each month can be used for other higher-yielding investments, retirement, Roth IRA, etc.

- Or to pay off student loans, credit cards, personal loans, etc.

- Less money locked up in an illiquid asset

- You can still build equity if home prices rise over time

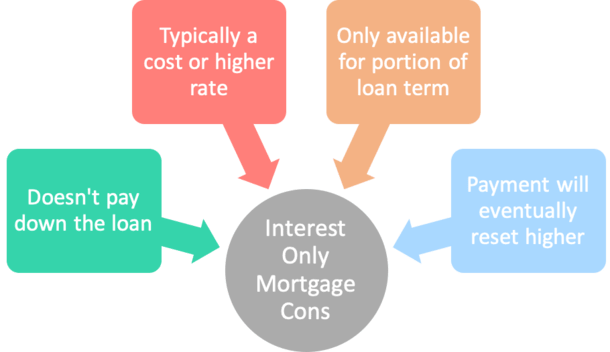

Disadvantages of interest-only mortgages

- None of the monthly payment goes toward principal

- You typically must pay a cost or take on a higher interest rate for the IO option

- You can land in an underwater position pretty easily

- The interest-only period is temporary

- You will need to refinance, sell, or make larger payments in the future

- Harder to sell/refinance with little or no equity

- Doesn’t really work without home price appreciation

Thanks for your article Colin. Boy do I wish I knew how to get my family out of the underwater, interest only, bank held property we are now carrying around like an anchor! We desperately want to get out and buy a new modestly bigger property, but are held down by our current situation.

TT

We currently have a interest only loan we took out 10 years ago. It still has another two years to go on it. Our current total loan is $275,000.00. Houses in our neighborhood have gone up and we figure our house is worth about $400,000.00. My wife and I are over 60 and we know we will never pay our house off and we don’t care. We have had our home for 26 years. Since we will have some addition equity we thought another interest only loan would be good for us as we are both retired. Should we take equity out when we refinance for home updates (which we could use) or leave it in which seems like a waste to us. We like the idea of lower monthly payments. A big factor is our lack of knowledge in any type of home financing. One broker told us interest only loans are hard to get and we may need mortgage insurance. We have never had to pay insurance before so it’s a bit confusing. Would you be willing to point us in the right direction?

Thank you for any help you might share with us!

Rob and Colleen

Rob,

Interest-only loans are a lot harder to get nowadays and you’ll pay more to get one because of the Qualified Mortgage rule, which outlawed them. Pulling out equity is your decision as is going with an IO loan vs. a fully amortizing one. If you never want to pay back the loan that’s your call. You won’t need mortgage insurance unless you borrow more than 80% of the home’s current value in a single loan.

We have a situation:

1.0 House bought $220k, in 2005. It is now worth $180k,

2.0 Financed $220 K, $175 now fixed, but $45k is IO.

3.0 10 yrs. are up for IO and payment jumped from $125/mo. to $825/mo.

What the heck should I do?

Big B,

This is exactly why interest-only loans have been given the boot. Traditionally, most folks in your situation would refinance into a new loan…but obviously you may have difficulty finding a solution seeing that you’re underwater. Options may include a cash-in refinance to get the LTV down or some kind of loan modification to reduce the rate and possibly extend the term to get payments down.

I have a regular home loan mortgage of $208,000 with 4% interest and a second interest only mortgage of $26,000 (interest only for 5 years, then payments with a fixed 4%) Which account will I be better served by sending extra principal payments? Would it be better to send all extra money to pay off the interest only account

Mary,

Since they are both set at the same rate, 4%, and you have a larger balance on the $208k first mortgage, you’re paying more interest each month and would reduce the outstanding balance a lot faster making extra payments on it. Conversely, some folks recommend paying off smaller balances first so you can completely eliminate them and get a short-term “win.” But that’s a psychological thing that may not apply to everyone. Also consider what happens to the interest-only loan once it becomes fully amortizing, including what the monthly payment will rise to and what the remaining term will be (e.g. 25 years, 20 years, etc.).

We are in our 70s and owe $550,000 on our townhome which is currently appraised at $800,000. We are interested in a 40 year refi with interest only for the first 10 years.

Our current rate is 4.25%. Any advise is appreciated.

Linda,

Some lenders offer that option…I think Union Bank has 40-year IO.

Hi Linda,

Came across your post, feel free to email me if you’d like to discuss our 40 Year I/O and qualifying criteria.

I asked my commercial loan banker if they had interest only loans and he acted like he didn’t know what I was talking about.I asked him whats the best loan he could get me on a 675 k loan and and he said 165 k down and finance,500 k with 4-5 k payments a month on a 20 year and it’s income producing property,3 k,and possibly 4 k monthly income in a high traffic appreciating area..I get a feeling they are saving this for their other investors of the bank and just trying to scare me off wanting it..gettin a feeling there’s a monopoly going on here..Anybody else out there reading this do me any better…

D P

My wife and I are looking at buying a new home. We have a lot of equity in our current home and will sell that to make a sizeable down payment. We also have a rental property in our back pocket that has equity and we think we can sell down the line. My thought was to buy our new home with an IO loan, but make what equates to a 30 fixed payment each month, thus paying down principal and paying less interest over the life of the loan. Yes we plan to pay off the new house and live there into retirement. When the IO time period is up, I’d either look to refi into another loan option or sell the rental property to pay off the loan. What are your thoughts on this strategy?

Kenneth,

Is the IO loan going to be cheaper than a 30-year fixed? Otherwise what’s the point of adding an IO option that you often have to pay extra for when you’re not going to use it?

Our situation is complicated. We have an IO loan that just matured. Our mortgage payment went from $2200 to $4000. Our loan is for $505K, our house is worth approximately $870K. We are worried we won’t be able to refinance because we are self-employed and our tax returns don’t show enough income, and we have a large loan on an investment property (we owe $447K, and it is worth approximately $660K, and we make about $700/month in rents). We also have a $40K line of equity we used to buy a business. No other debt in terms of credit cards, cars, etc. We make around $90-100K, but our tax returns show much less (not sure exact amount). We haven’t filed 2016 yet (we always get an extension) and have a little wiggle room with how many write offs we want to submit. I have spent the day filling out modification paperwork, and we have started talking to lenders to refinance. Do you think we will be able to do one or the other? What is our best course of action? I cannot believe we have been in our house for 12 years and haven’t paid down any principal. The IO loan was supposed to be temporary, but then the recession hit, and then we had circumstances where we could never qualify for a better loan. Oh ya, we have a foreclosure from 4 years ago on an investment property that went bad during the housing crash. Would appreciate any advice you have!

Mimi,

It sounds like you have lots of equity, despite paying no principal…maybe an LTV around 63% if outstanding loans are $545k based on $870k value. That’s a plus because it’s so low. The negatives are the foreclosure, your potential income issue, and the fact that it might be treated as a cash out refi because of the line of credit. May want to speak with some brokers/lenders to run the numbers and see what you qualify for and if that foreclosure will be an issue.

I have a a 10 IO/30 yr mortgage that recently “reset”, paying an additional $1K/mo, I have 6.25% rate right now and was thinking of refinancing it. My question is, what will happen if I refinance, will it get recalculated lowering my payoff amount due the interest that I already paid? ex. The original loan is $472K, and I’ve been paying $2500 IO for 10yrs, now paying $3500 Interest + principal for 1yr, making my outstanding loan ~$460K, will my payoff amount be lower than that? Thank you for your advice.

Jared,

Interest paid doesn’t affect an outstanding principal balance. As you mentioned, your loan balance is around $460k now, reflecting about one year of principal AND interest payments based on a 20-year term (time remaining from 30 years). All the interest-only payments before that time didn’t go toward your principal balance, hence why it’s referred to as IO. Your loan servicer should be able to provide you with a payoff statement, or you might be able to log-on to their website to see your current balance, which should be close to the payoff amount if/when you refinance.

I have been in my home since June 6, 2006. I have a conventional loan where I pay $1916.00 a month and most of it goes to interest. I have a fixed 30 year loan rate at 11.0%. Been trying to refinance but can’t get anyone to refinance. One company says my credit score was to low at time, not even income. How can we earn equity or refinance? My husband income tax don’t show all that he received. What can we do?

Shelia,

That’s a very high interest rate considering fixed rates are closer to 4% these days. You may want to shop around a bit more and ask different lenders as requirements will vary from bank to bank. A broker may also be helpful as they can run your loan scenario by a variety of lenders all at once and ideally find one that will work with you. At the same time, if your credit score is the problem, you may want to work on improving it to boost your chances of finding a home for your loan. Good luck!

I live with my mom. In the past, she and my dad obtained an interest only home equity loan of 10k ( their home is paid off) we figured now we are paying and paying ( only $50 / mo) but never paying it down. A friend told me it is like a lien on the house. Bank isn’t addressing what to do. We changed our mind on getting line of credit. I wanted my mom to be able to use equity ( since they paid off their home) I have new work starting soon with good pay and want to pay that off. What do we do? Pay a chunk at end of year and assign it to principal? We talk about selling home. ( I will probably live with her. We don’t want apartment. She is 79 and I’m 57) her home appraised $70k. With that 10k IO loan. Can this IO loan be changed to a principal/ interest loan? I do know we were paying $47/ month and now $53..not even sure what term is. I called bank and stated we want to not be paying endlessly on 10k and still have the same balance ( no callback. We will go in personally)…would so appreciate your advice. Thank you. ( think this is 4.25 % rate) should we have accepted the line of credit? (50k at 4.75%)

Jan,

It’s possible to refinance the IO loan into a fully-amortized loan if you wish, just pay attention to closing costs associated with the refinance. Also note that a very small loan mount might be hard to obtain financing for with some banks/lenders. It may also be possible to make additional payments to the principal balance, but ask your loan servicer first and make sure payments are directed properly. Lastly, the IO period might come to an end (they typically last 10 years), at which point the loan automatically becomes fully-amortized.

Why to pay sooner the house when the bank interest is not going to go down?

Yes, we pay interest first. But in the long run by making extra payments, are we sending our cash to the bank instead of investing it somewhere else. Now I don’t think is a good idea to send the money faster. Any opinions on this?

Dori,

Yes, many people make the argument that home loans are cheap and the money could earn more elsewhere like the stock market or other places that yield a higher return than the 2-3% mortgage rate.