A week ago, it seemed like we were on the fast track to 8% mortgage rates.

But then something spectacular happened, nearly a week’s worth of economic data pushed rates back toward 6%.

However, that hasn’t stopped some folks like Shark Tank’s Kevin O’Leary from warning the worst is yet to come.

In an interview last Friday, he warned of a minimum of two additional rate hikes from the Fed, which he believes would push mortgage rates above 8%.

So is he right, or is the economic data we saw this week proof that the existing hikes are beginning to work?

Is Mr. Wonderful Right About Higher Mortgage Rates?

As noted, Kevin O’Leary, or Mr. Wonderful as he’s known as Shark Tank, believes mortgage rates are going even higher than current levels.

He told Fox News this last Friday, when the 30-year fixed was closer to 7.50% and looking to move higher.

But now that we have another four days of data at our fingerprints, the 30-year fixed appears to be trending lower.

In fact, we could hit the high 6% range tomorrow if a favorable jobs report is delivered, which would make sense given the other reports seen lately.

It’s certainly no guarantee, but it’s a real possibility. On the other side of the coin, a stronger-than-expected jobs report could unravel all the rate improvements we’ve seen this week in quick order.

O’Leary’s argument is that Jerome Powell and the rest of the Fed isn’t messing around when it comes to inflation, and will do everything in their power to return to their target 2% inflation rate.

For him, this means at least two more federal funds rate hikes, which would push that range to 5.75% – 6%.

If mortgage rates followed suit, which they mostly have recently, it could result in a 30-year fixed above 8%, especially if mortgage rate spreads also worsen.

Mortgage Rates Have Tracked the Fed Funds Rate Fairly Closely This Year

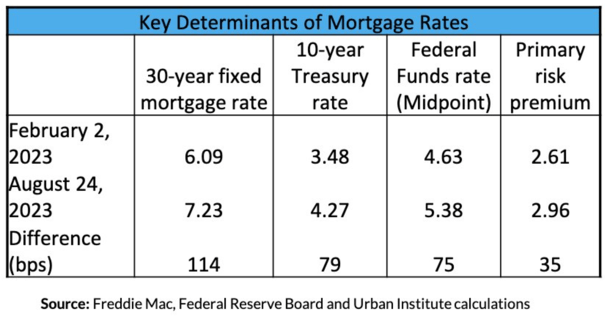

As you can see from this chart via the Urban Institute, the 30-year fixed has tracked the 10-year treasury and federal funds rate midpoint pretty solidly this year.

The so-called “primary risk premium” is the spread, which has widened due to a variety of factors, including general volatility, decreased origination profits, prepayment risk, and more.

Typically, the spread between the 30-year fixed and 10-year treasury yield is about 170 basis points.

At the moment, it’s closer to 300 basis points because of all the uncertainty in terms of where rates (and the economy) go next.

However, several weak economic reports released this week revealed that the Fed’s already 11 rate hikes were beginning to take a bite out of inflation.

This pushed the 10-year bond yield down from 4.24% on Tuesday to 4.08% today. On top of the ~16 basis point improvement, spreads also narrowed.

As such, the 30-year fixed now sits closer to the high-6s than the mid-7s.

Mind the (Data) Lag on Inflation and Mortgage Rates?

Ultimately, no one is quite sure what’s going to happen regarding inflation, the economy, and mortgage rates.

We’re all guessing, but given the data we saw so far this week, it does appear the many rate hikes already in the books are beginning to make an impact.

So it might be wise to respect the lag as it takes time for tighter monetary policy to make its way down to the consumer.

Clearly the average American is going to feel stress from significantly higher interest rates, as are businesses.

It’s just a matter of when. This explains the recent pause by the Fed as it assesses the data.

At last glance, there is an 88.5% probability the fed funds rate is held steady in September, and a 54.6% chance for November.

That’s probably the tightest margin for an additional rate hike, with a 0.25% increase currently holding a 41% probability.

Beyond that, the odds of a hike drops off in December, with rate cuts the next likeliest move by May and June 2024.

In other words, we’re getting closer to the terminal fed funds rate, or are already there if the economic data keeps coming in soft.

This is important because if the Fed is done hiking, and even considering cutting rates, it means long-term rates like mortgage rates can take cues and also begin falling more significantly.

Time will tell if Mr. Wonderful is right about 8% mortgage rates. But maybe we just need more time to let the data roll in.

For the record, the 30-year fixed was climbing close to its highest point of the century prior to this week.

That number is 8.64%, per Freddie Mac, which took place during the week of May 19th, 2000.

Hopefully we don’t get near it or surpass it, but anything is on the table until the econ data is unequivocally moving in the right direction.

Lastly, I remember something O’Leary once said on Shark Tank that really resonated with me at the time. It was about buying mid-priced homes, which allow owners to be nimble.

Anything too expensive and it can be hard to move, rent out, etc.. That really made sense, and might explain why investors target starter homes, often at the expense of first-time home buyers sadly.