We’ve been worrying that mortgage rates would go up for years now, but it just hasn’t happened yet. Sure, they’re up a little bit from record levels, but not by as much as expected.

The 30-year fixed still sits firmly around 4%, while the 15-year fixed is in the low 3% range. Both have been slightly lower at different points in the past five years.

This prolonged period of low rates has kept the mortgage business humming along while also propelling the housing market to record heights.

But what happens when mortgage rates start to really take off higher? Well, six main things, this according to a working paper by Laurie Goodman over at the Urban Institute.

Mortgage Volume Will Fall

- This one is inevitable

- If mortgage rates rise

- Mortgage loan application will fall

- There’s just no way around that

What goes up will cause something else to go down, and we’re talking about mortgage origination volume.

As rates rise, fewer mortgages will be made because there will be less of an incentive to refinance.

Fannie Mae, Freddie Mac, and the Mortgage Bankers Association all expect mortgage lending volume to decrease significantly from last year to this year. And they anticipate an even slower 2018.

Of course, we’ve been hearing this for years, only to see these groups revise their estimates higher. But they’ll probably be right eventually…

The Mortgage Industry Will Consolidate

- Because higher rates lower application volume

- Mortgage industry consolidation is also likely

- With smaller players absorbed by larger ones

- And some mortgage companies falling by the wayside

Because fewer loans will be made in a high-rate environment, banks and lenders will need to “right-size” their staff to ensure they remain profitable.

We’ve seen this happen already with the loss mitigation departments at banks as foreclosures and short sales become a thing of the past.

Along with that will come mergers and perhaps a return to a more consolidated group of mega mortgage lenders.

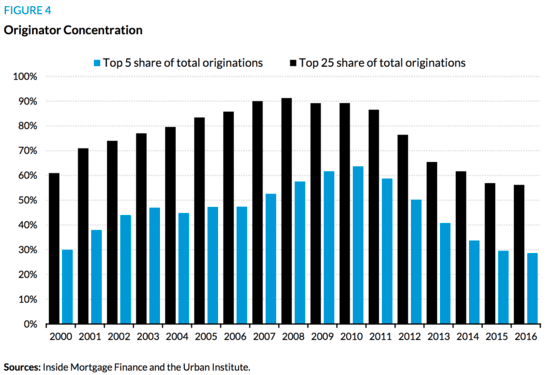

Per Goodman, the market share of the top five mortgage lenders fell from 64% in 2010 to just 29% last year, while the top 25 saw its share decrease from 89% to 56% over the same period.

However, we continue to see new entrants into the mortgage space, such as Redfin Mortgage and fintech companies like Better Mortgage. I don’t see them going anywhere, but there’s always the possibility of getting acquired.

If the old brick-and-mortar banks sense a threat, and/or the ability to innovate, perhaps they’ll just buy one of those startups.

Mortgage Prepayment Speeds Will Slow Down

- As mortgage rates increase

- There is less incentive to refinance an existing home loan

- And so prepayment speeds slow down

- As homeowners hunker down

Related to the drop in mortgage volume will be a slowdown in mortgage prepayment speeds. That’s how long a mortgage is actually held before it’s paid off or refinanced.

As mortgage rates increase, prepayment speeds tend to slow because there are fewer people who stand to benefit from a rate and term refinance.

And if rates are higher, existing homeowners will have less motivation to move out, knowing it’s more expensive. They’ll also want to hold onto their more prized low rate if it’s much lower than the going rate of the future.

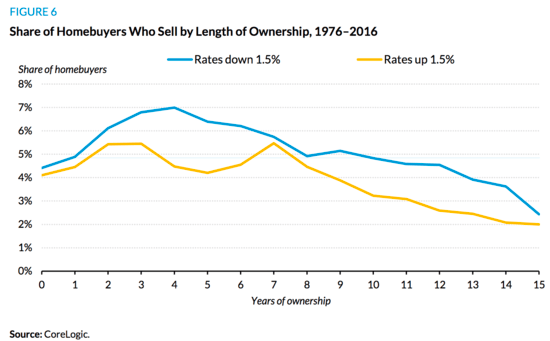

CoreLogic found that when interest rates were 1.5% lower than at the point of origination, a quarter of homeowners sold within five years.

A lower rate is a good opportunity to unload your old home and get a new one with even better financing terms.

Home Prices Will Rise

- While the logic might sound off

- Interest rates and home prices tend to rise together

- Because higher rates are often the sign of an improving economy

- Which means home buyers have additional income to purchase more expensive homes

Here’s one that continues to confuse folks. If mortgage rates rise, home prices will probably increase too. This seems to counter common sense, but it’s not as simple as it looks.

The easiest way to explain this phenomenon is that a growing economy leads to inflation, which leads to higher interest rates.

But because things are going well, we can also expect higher home prices thanks to rising wages and improved consumer confidence.

That good economy means a larger pool of buyers can spend more money on homes, which despite some decreased affordability rate-wise can propel prices higher.

Banks and lenders may also be willing to loosen underwriting guidelines to facilitate more aggressive financing, which can also give home prices a bump.

Lastly, inflation can increase real assets like home prices.

Repeat Buying Will Slow

- One problem with the really low rates that were available

- Is the so-called “lock-in effect”

- Existing homeowners with really cheap mortgages will stay put

- Because they don’t want to give up their low rate for a higher one

Some say those low mortgage rates are a blessing and a curse. Sure, they make homeownership cheap, but they also make it really hard to leave your current digs.

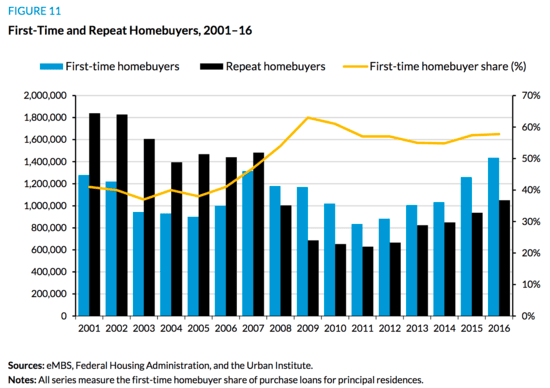

As rates rise, the repeat buyer share is expected to fall thanks to the “lock-in effect.” That’s the staying in place to keep your low rate dilemma.

Compounding this issue is the fact that many existing homeowners haven’t built much home equity over the past decade. In fact, some remain underwater despite the massive price gains seen in recent years.

Without a sizable amount of equity, it’s pretty difficult to move out and up, especially if rates are also higher.

Second Mortgages May Return

- Homeowners could turn to second mortgages instead

- If they want cash and are able to tap into their equity

- This way they’ll preserve the low rate on their first mortgage

- But get the funds they need to cover other costs

Fortunately, there’s a solution to some of the problems discussed above. And it comes in one neat little package called a second mortgage.

For those who don’t want to lose their precious low-rate first mortgage, they can tap into their equity using a second mortgage like a HELOC.

And for those struggling with affordability due to both higher home prices and higher rates, they can extend financing and buy more house via a second lien.

Heck, maybe we’ll see the popular 80/20 loan return, allowing new buyers to get a home with nothing down. We’re not far off now, with 97% LTV lending available nationwide.

In the meantime, enjoy the low rates and don’t let them pass you by…

- Mortgage Rates Quietly Fall to Lows of 2025 - June 30, 2025

- Trump Wants Interest Rates Cut to 1%. What Would That Mean for Mortgage Rates? - June 30, 2025

- What the Fannie Mae and Freddie Mac Crypto Order Really Means - June 26, 2025