These days, home equity is booming thanks to rapidly appreciating property values.

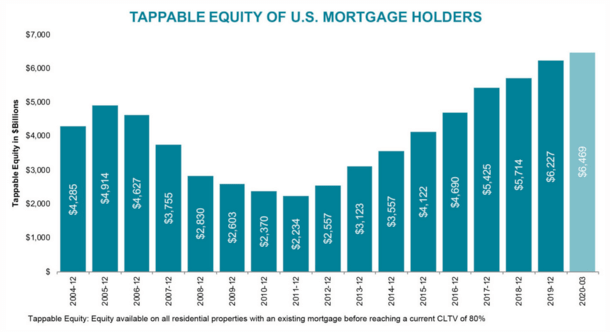

At last glance, total equity on mortgaged properties exceeded $10 trillion, with more than $6.5 trillion of it tappable, per recent figures from Black Knight.

Yes, that’s a “T” not a “B.” But you would of never guessed it less than a decade ago after the housing bubble burst and put millions in underwater positions.

In the early 2000s, it was all about tapping into your home equity with a line of credit or a cash-out refinance, often at absurdly high loan-to-value ratios (such as 100%).

The whole using your house as an ATM thing to make lavish purchases or even just pay the bills each month became the norm.

As a result of all that excess, the narrative quickly changed to overpriced homes, declining equity, negative equity, underwater mortgages, loan modification programs, foreclosures, and so on.

Funny how that works…

This reversal of literal fortune was caused by crashing home prices and zero down mortgages, many of which weren’t properly underwritten to begin with.

Most of those who got into trouble purchased homes at the height of the market at unsustainable prices, while at the same time relying on 100% financing to get the deal done.

This caused lots of homeowners to leave or think about walking away, as home price deprecation was found to be the leading driver of default.

But many of those who stuck around and rode it out are actually in great shape, maybe even better positions than when they first took out their mortgages.

In fact, those who held on, even if they purchased a home in 2006, could be up 50% today thanks to the recent boom.

However, others are still feeling the negative effects of the housing crisis, even after several years of double-digit home price gains.

If you’re one of those homeowners, or even if you’re not, you may be wondering how to build some home equity.

That way, when it comes time to sell your home (or refinance your mortgage), you can do so without worry.

Those with more home equity will walk away with more cash in their pocket, and if refinancing, may be able to qualify for a lower interest rate.

Let’s look at the many ways you can build equity in your home:

1. Rising home prices – Here’s an easy one that requires no effort on your part.

When property values climb higher, you will gain equity simply because your home or condo will be worth more. It’s as simple as that.

For example, if your home was worth $200,000, and then rose to $250,000 after five years, you’d have $50,000 more equity.

This is the beauty of homeownership, and one of the many advantages of owning a home versus renting.

In fact, the most recent Survey of Consumer Finances (SCF) from the Federal Reserve revealed that homeowners had a net worth of $255,000 versus just $6,000 for renters. A lot of that can be attributed to home equity.

Of course, the opposite can also occur if home prices drop, as we all now know. But at the moment, everything appears to be on the up and up.

2. Falling mortgage balance – Here’s more low-hanging fruit. As you pay off your mortgage each month, you pay a portion of interest and a portion of principal (assuming it’s not an interest-only home loan).

Any principal payments made will boost your equity as your home loan gets paid down.

For example, you’d gain $343 in principal during the first month on a 30-year fixed with a $200,000 loan amount set at 3%.

After a year, that’s about $4,000. And after five years, more than $22,000!

Every time you make your mortgage payment, you’ll gain some home equity. And when combined with an appreciation, it can be a powerful one-two punch.

3. Larger mortgage payments – This one requires more money out of your pocket, but can save you money at the same time.

If you make larger payments each month, with the extra portion going toward principal, you will pay off your mortgage much faster and gain home equity a lot quicker. Simple and effective.

While it will cost you more initially, you’ll pay a lot less interest over time.

For example, your total interest expense would fall from $104,000 to $59,000 if you paid just $200 extra each month, and your mortgage would be paid off nearly a decade early.

4. Biweekly mortgage payments – Here’s another way to save on interest with very little effort.

You can go with a biweekly mortgage payment plan, where you make 26 half payments throughout the year, which equates to 13 monthly payments.

This will shave down your mortgage term, save you a ton in interest, and help you build home equity a lot faster.

There’s also a simple way to do this without having to sign up for a program that may cost money where you just add 1/12 to each monthly payment.

5. Shorter mortgage term – If you’ve got the means, and want to extinguish your home loan earlier, think beyond the 30-year fixed.

It’s possible to refinance into a shorter-term mortgage with a lower mortgage rate, such as a 15-year fixed, which will increase the size of your payments, but build equity at a much higher rate than a traditional 30-year mortgage.

You might also be able to pick something in between, like a 20- or 25-year fixed, or even something that matches your original term, like a 22-year loan term.

This will keep you on track, or even ahead of schedule, and also help you avoid resetting the clock.

6. Avoid refinancing – Conversely, if you don’t refinance and pull cash out, you’ll retain all the equity in your home.

During the prior housing boom, scores of homeowners refinanced their loans over and over until they sucked their equity dry.

This was actually one of the reasons why many chose to walk away, or were forced to sell short or foreclose.

Had they just paid down their loans over time, most would of been in pretty good shape.

Simply put, it’s fine to tap equity, but like everything else, moderation is key.

7. Home improvements – Here’s a potential win-win that you can actually enjoy.

If you make smart home improvements, where the expected value exceeds the cost, you’ll increase your home equity by owning a home that’s worth more.

While it’s seemingly the same exact house, smart home devices, quartz countertops, and stainless steel appliances still draw buyers in, and you might be able to sell for more.

You can even do it for free if it’s your own sweat equity. And in the meantime, you get to enjoy a better house.

8. Maintenance – Now let’s talk about being a responsible homeowner.

Keep your home in tip-top shape and you will be rewarded when it comes time to sell.

If you can unload it for more as a result of proper maintenance, you’ve essentially created more equity in your home.

Home buyers often hit sellers with costly repair requests, but it’ll be more difficult for them to ask for concessions if you took great care of your home.

It could even be prudent to get a home inspection yourself, before you sell, to address any red flags before a buyer tries to get you to pay for them.

9. Curb appeal – This is one of my favorites and something anyone can do to boost their home value, and therefore equity if selling.

I’m referring to curb appeal and also home staging. Make your home look good when you list it and there’s a better chance it’ll sell, and sell for more.

Simple things can make a big difference, such as new paint, carpet, bright lighting, plants, flowers, and even basic cleanliness or a lack of clutter.

Or even how you arrange your home. For example, if home offices are en vogue, make a room that served a different purpose into an office to bring in more buyers.

10. Rent it out – One of the best ways to build equity is to have someone else do it for you.

If you rent out part or all of your property, it’s possible to build equity via the rent you receive from your tenants each month.

Having someone else pay off your mortgage is pretty sweet, especially if the property appreciates at the same time.

11. Bigger down payment – Finally, you can make a larger down payment at the outset to automatically acquire home equity and build it faster thnaks to a lower outstanding balance.

While this may seem like you’re putting money in an illiquid investment, more equity means a lower loan-to-value ratio, which may equate to a lower interest rate, no mortgage insurance, and easier-to-obtain financing.

Over time, that lower mortgage rate and smaller loan balance will mean less interest paid and more equity accrued.

It’s also possible to recast a mortgage or complete a cash in refinance to get your loan balance down and increase your equity.

Just remember that any extra money might be better served elsewhere, such as the stock market or a retirement account.

Bonus: If you happen to be an underwater homeowner, get the bank to grant you principal forgiveness and you’ve essentially built home equity, even if you’re still just above water as a result.

- Rocket Mortgage Completes Redfin Takeover, Offers $6,000 Home Buyer Credit - July 1, 2025

- Mortgage Rates Quietly Fall to Lows of 2025 - June 30, 2025

- Trump Wants Interest Rates Cut to 1%. What Would That Mean for Mortgage Rates? - June 30, 2025