In an effort to make mortgage costs a little more bearable, the U.S. Department of Veterans Affairs (VA) is lowering the VA funding fee.

This applies to VA loans used for a home purchase or new construction, and even cash out refinances, which likely aren’t being utilized at the moment with interest rates as high as they are.

The one-time fee is paid to lower the cost of VA loans for U.S. taxpayers since the VA home loan program doesn’t require monthly mortgage insurance.

It can be paid at closing all at once or rolled into the loan and paid off over time by financing it.

For loans closed on or after April 7th, 2023, the VA funding fee is being reduced by 15 to 30 basis points (.15% to .30%).

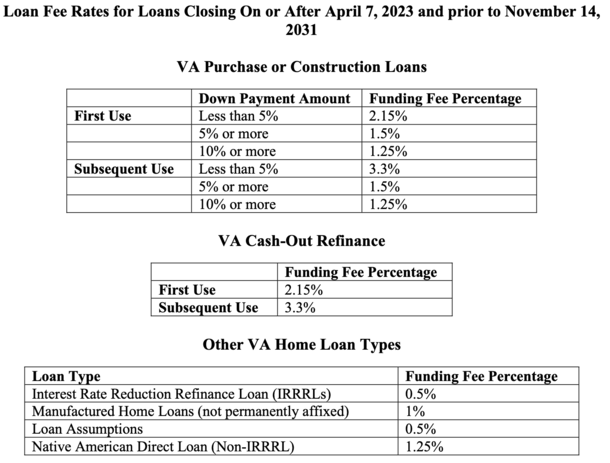

New VA Funding Fees for 2023

Pictured above is the new VA funding fee chart that applies to VA loans closed on or after April 7th, 2023 and prior to November 14th, 2031, announced in VA circular 26-23-06.

As you can see, those who put down less than 5% on a VA-backed home purchase will pay a funding fee of 2.15%.

It’s based on the loan amount, which is often the purchase price since VA loans do not require a down payment.

The new fee is 15 basis points less than the current fee of 2.30% for a home purchase with less than 5% down.

On a $300,000 home purchase with nothing down we’re talking about a funding fee of $6,450 versus $6,900.

So you either save $450 at closing or finance the funding fee and pay a bit more each month via a slightly larger loan amount ($306,450 vs. $306,900).

If you put down 5% on that same $300,000 purchase, the funding fee drops to 1.5%, from $4,703 to $4,275. That’s a savings of $428.

It’s not a major difference, but every little bit helps, especially with both home prices and mortgage rates quite elevated.

Those using VA loans a second time (subsequent use) get hit with a larger funding fee if putting less than 5% down. For such borrowers, it’s currently 3.6% with less than 5% down, but will drop to 3.3%.

This is an even bigger improvement (.30%), but there’s a caveat. If you put down 5% or more the funding fee matches the “first use” fee.

So chances are it’s better to put down 5% to get that better pricing of 1.5% regardless.

Still, come April 7th, 2023 this fee will drop from the old 1.65% to 1.5%, providing savings nonetheless.

[Foreclosures on VA loans halted until mid-2024]

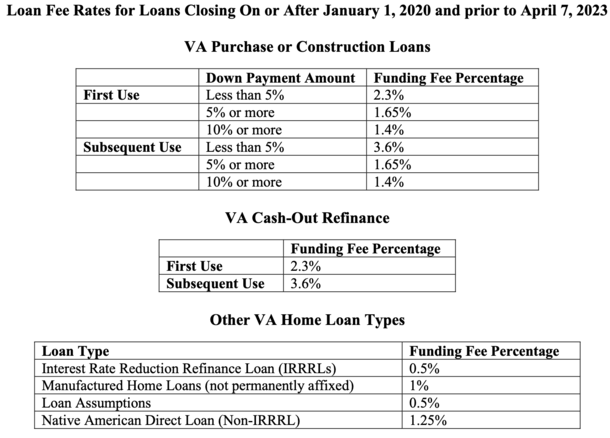

The Old VA Funding Fee Chart

Pictured above is the old VA funding fee chart, effective January 1st, 2020 and prior to April 7th, 2023.

This might be applicable for a couple weeks or so, or until lenders decide to incorporate the new pricing as home loans typically take a month or longer from start to finish.

For the record, the funding fee can be avoided entirely in some cases for eligible veterans or a surviving spouse.

And there are reduced funding fees for rate and term refinances (IRRRL) of .50%, for loan assumptions, also .50%, and for manufactured homes, 1%. As well as for Native American Direct Loans.

Earlier this week, the U.S. Department of Housing and Urban Development (HUD) also unveiled lower mortgage insurance premiums for FHA loans.

Annual mortgage insurance premiums will be reduced by 30 basis points (.30%), saving the average home buyer roughly $70 a month, or more than $800 annually. And even more for larger loan amounts.

While these reduced fees aren’t necessarily a game changer, they can help reduce the burden somewhat in a tough home buying environment.

Read more: The Top VA Loan Lenders by Loan Volume