In an effort to make homeownership more affordable, the U.S. Department of Housing and Urban Development (HUD) is reducing fees on FHA loans.

Specifically, HUD in conjunction with the Biden-Harris Administration will slash the annual mortgage insurance premium (MIP) by 30 basis points.

The move is expected to save the average homeowner about $800, or roughly $67 per month, and even more for those with larger loan amounts.

Collectively, it should translate to an estimated $600 million in savings over the next year alone, and “many billions over the next decade.”

New pricing applies to forward mortgages endorsed on or after March 20th, 2023.

FHA Annual Mortgage Insurance Premium Drops to 0.55% for Most Home Loans

The FHA MIP reduction announced today is the first improvement in pricing in about eight years.

It lowers the annual insurance cost on most FHA loans from 0.85% to 0.55%.

I say most because that pricing applies to loan-to-value (LTV) ratios of 95%+ with mortgage terms greater than 15 years.

Many FHA borrowers put down 3.5% and take out 30-year fixed mortgages, so this is the most common insurance pricing.

On a $450,000 loan, the monthly insurance premium will drop from roughly $319 to $206 per month. That’s a savings of about $113, or $1,356 annually.

It’s significant enough to make borrowers rethink the FHA vs. conventional loan argument.

If you’re a prospective home buyer, be sure to carefully compare the total payment on both types of loans.

While a ~$100 reduction in payment may not make or break a home buying decision, it could impact your loan type decision.

As noted, this change will go into effect for forward mortgages endorsed on or after March 20th, 2023.

This means home buyers will be able to take advantage of better pricing on FHA loans this spring.

It should further boost the FHA loan share, which had already been on the rise in recent months.

And could widen the divide between conforming loans backed by Fannie Mae and Freddie Mac thanks to the new DTI pricing hit and 780 FICO scoring bucket.

First FHA Loan Pricing Improvement Since 2015

This is the first time FHA loans have gotten cheaper since January 2015, back when the annual MIP was lowered from 1.35% to 0.85%.

In early 2017, a 0.25% cut to the MIP was approved but quickly frozen by then-President Donald Trump.

So this is somewhat of a big deal given how long it has been since we’ve seen mortgage insurance premiums fall.

However, mortgage insurance remains in force for the duration of the loan term in most cases, which remains a huge negative for FHA loans.

For example, borrowers who put down 3.5% (the flagship FHA down payment) and have a mortgage term greater than 15 years are stuck with annual MIP for the life of the loan.

That negative change went into effect back in June 2013, as the housing market was recovering from the Great Recession.

Prior to the change, FHA borrowers could see their premiums drop off once their original LTV ratio fell to 78%.

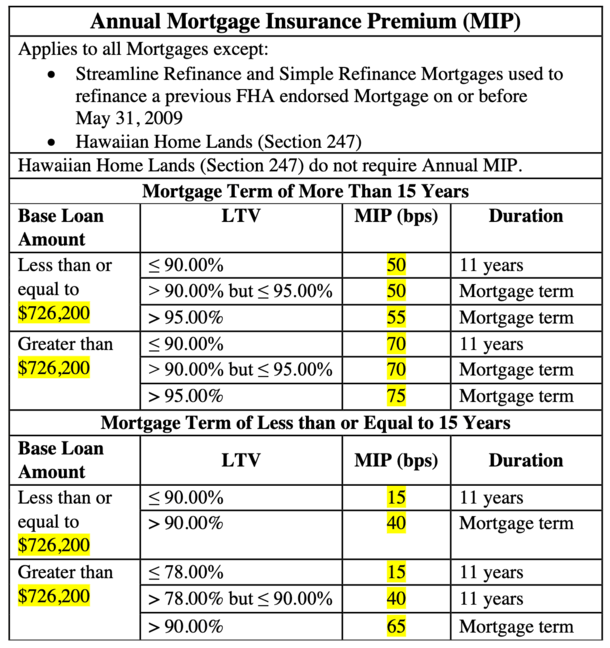

The New 2023 FHA Annual MIP Chart

This is the new annual MIP chart for FHA loans. Aside from the lower 0.55% MIP for 3.5% down loans, borrowers who put down 10% or more will see their MIP fall to 0.50%.

The MIPs are higher for loan amounts greater than the 2023 conforming loan limit of $726,200.

Depending on LTV, an annual MIP of either 0.70% or 0.75%, all of which are also 0.30% cheaper.

Those who go with a 15-year fixed (not common on FHA loans) will see an FHA MIP as low as 0.15%.

The annual MIP for streamline refinances remains unchanged at 0.55%. These transactions were incredibly popular when mortgage rates were low, but are now few and far between.

In summary, this is a positive change for FHA loans and could make them cheaper than conforming loans backed by Fannie and Freddie.

And now that on-time rental history back is considered (as of September 2022), it could be easier to qualify for an FHA loan.