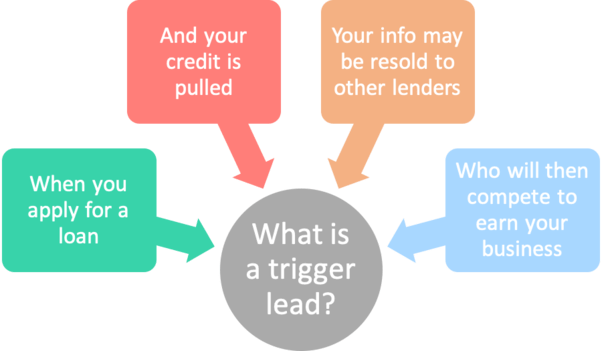

If you’ve recently applied for a home loan and been bombarded by competing offers, a “trigger lead” might be to blame.

Simply put, when your credit is pulled, other creditors may be alerted in real-time.

Armed with your contact information and your intent, they can reach out with competing offers via phone, email, or even snail mail.

And the best part is the credit bureaus themselves are the ones selling this information!

On the one hand, this can be seen as a major nuisance and/or invasion of privacy. But on the other, a means to shop around for your mortgage with a little less effort.

Your Mortgage Application Could Alert the Competition

When you apply for a mortgage, a tri-merge credit report will be ordered to determine your FICO scores and associated credit history.

This allows lenders to qualify you based on your credit history, which is a key component of mortgage underwriting.

A credit score is generated by Equifax, Experian, and TransUnion, collectively known as the three major credit reporting agencies (CRAs).

In the process, a credit inquiry is also created, which is a record that you applied for a certain form of credit, be it a credit card, auto loan, or a mortgage on a certain date.

This information can then be sold to other creditors who wish do business with you, whether it’s a mortgage lender, insurance company, auto lender, and so on.

Your contact information, including name and address, along with your FICO scores, credit history, and the type of loan you’ve applied for are packaged and sold as “trigger leads.”

Competing banks and lenders can order them directly from the CRAs by selecting certain criteria such as loan type, credit score, or location.

How a Trigger Lead Works

- You apply for a mortgage with Lender A

- They pull your credit report to determine creditworthiness

- The credit bureau sells that information to Lender B

- Then Lender B contacts you with a competing mortgage offer

Whenever you apply for a loan and your credit report is pulled, it results in a hard inquiry that is logged by the credit bureaus.

You can see these inquiries on your credit report, as can other lenders. They alert prospective creditors that you’ve applied for a loan in recent days, weeks, or months.

Too many inquiries in a short period may indicate that a consumer is in distress and could result in lower scores.

But mortgage inquiries are relatively safe because they are grouped together as one when made in a short window of time, typically 45 days.

This allows you to shop around and obtain multiple quotes without racking up tons of inquiries, which could lower your scores.

Anyway, these inquiries are essentially an alarm bell that you’re about to “convert,” making you a high-value, high-intent consumer.

If Lender B knows you applied for a mortgage with Lender A, there’s a good chance you’ll at least hear them out if they can make contact.

Instead of casting a wide net, lenders can purchase the contact information of those already in the loan process directly from the credit bureaus.

Then it’s just a matter of sending an email or making a phone call to pitch their competing offer.

In short, lenders can skip the guessing games and find prospective clients fast, even if another lender found them first.

How Much Do Trigger Leads Cost?

- Price can vary from $5 per lead to $150 or more

- Depends on quality of the lead/prospect

- Attributes such as loan type, FICO score, and loan amount can determine cost

- Along with demand for the type of trigger lead at any given time

Similar to other products, there are varying costs depending on the quality and nature of the mortgage trigger lead.

The credit bureaus may have their own algorithm that determines which prospects are most likely to convert and charge a higher price accordingly.

In addition, mortgage companies can fine-tune the criteria so they only receive leads that meet certain requirements, such as a minimum FICO score, loan amount, or loan type.

For example, a lender may be very aggressive when it comes to VA loans or rate and term refinances, and purchase trigger leads that meet those criteria.

Once a consumer matching those filters has their credit pulled, it triggers the lead and a prospective client’s information is sent to the competing bank or lender.

They are then charged for the lead. It could be $5 or it could be $150, depending on the quality of the lead, demand, and so on.

Why Are Trigger Leads Allowed?

- While it doesn’t seem right for the credit bureaus to sell your credit information

- There’s an argument that trigger leads encourage comparison shopping

- And that tends to result in the discovery of lower rates/fees in the process

- But there is proposed legislature to limit their use due to numerous complaints

While a trigger lead seems like an invasion of privacy, especially coming from the credit reporting bureaus, there’s some logic to it.

Government agencies including the Consumer Financial Protection Bureau (CFPB) actively encourage shopping around.

They have conducted studies and found that consumers who shop around, i.e. obtain multiple quotes, tend to save money.

Conversely, those who use the first lender they speak with may be charged a higher mortgage rate and/or higher closing costs.

So as a means to promote comparison shopping, trigger leads got the green light. And remember, the credit bureaus are for-profit companies.

In a sense, this allows you to let one lender pull your credit, then wait for the other offers to roll in.

Instead of having to make phone calls and do lots of research, you can let the other companies come to you.

Granted, it can get annoying quickly, especially if you have no intention of using a different company.

And if any of the other companies are aggressive, which they often are, you may feel overwhelmed.

This is one reason why both a Senate bill and house bill have been introduced to limit their use.

How to Opt Out of Trigger Leads

Fortunately, there are ways to avoid trigger leads. Because they’ve become so pervasive, some lenders now conduct “soft pulls” that don’t create an inquiry.

This allows your loan application to evade detection from other lenders early on, but eventually the lender will need to do a hard pull once you formally apply for a mortgage.

This can at least allow you to stay under the radar while you shop around or continue to look for a house.

You can also register your phone number on the FTC’s National Do Not Call Registry.

And use OptOutPrescreen.com, which is the official website to Opt-In or Opt-Out of firm offers of credit or insurance from the CRAs.

Granted, your mileage may vary here. I’ve opted out of many things in the past and still seem to get hit with all types of offers.

When I refinanced my mortgage a few years ago, I received countless mailers, phone calls, and emails from competing lenders I had never spoken with, or even knew existed.

Of course, it wasn’t really a big deal because I screen my phone calls, unsubscribe from unwanted emails, and simply tear up junk mail.

But perhaps you’ll be more successful by opting out well ahead of time, as it often takes weeks or months for pre-screened offers and trigger leads to effectively be prevented.

So similar to working on your credit scores before applying for a mortgage, you may want to opt out early as well.

Just remember that consumers who obtain more than one mortgage quote tend to save more money than those who don’t.