Well, another year is nearly in the books, which means it’s time to look ahead at what 2024 might have in store.

As is customary, I take a look at mortgage rate predictions from a variety of economists and offer up my own take for the upcoming year.

I also look back at the predictions for the current year to see how everyone did (hint: not well!).

The big story in 2023 was out of control inflation. The story going forward might be cooling inflation.

Though there’s also the risk it resurges, at which point mortgage interest rates could rise again.

[2025 mortgage rate predictions are now LIVE]

Mortgage Rates Are Expected to Go Down in 2024

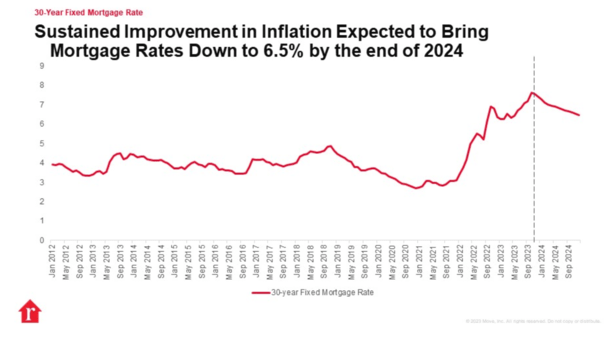

First let’s talk about the general outlook. Most expect mortgage rates to go down in 2024, which was actually the call in 2023 as well.

But guess what? Everyone was wrong. Expectations that the 30-year fixed would fall back into the 5% range were way off.

Instead, interest rates on the popular loan program surpassed the 8% mark before finally letting up over the past month.

So while many economists are optimistic for the coming year, take note that they felt the same way a year ago. And got it wrong.

But things aren’t exactly the same. The Fed increased its fed funds rate 11 times, which many believe has worked to corral inflation.

And this could lead to weak economic output and rising unemployment, which could result in Fed rate cuts as early as March 2024.

This doesn’t necessarily mean mortgage rates would follow the Fed lower, but it could signal that the worst is behind us.

As such, mortgage rates may have peaked, and it’s possible they could continue to drift lower and find a comfortable medium between their old record lows and recent near-21st century highs.

MBA 2024 Mortgage Rate Predictions

First quarter 2024: 7.0%

Second quarter 2024: 6.6%

Third quarter 2024: 6.3%

Fourth quarter 2024: 6.1%

First up is the Mortgage Bankers Association (MBA), which is often fairly bullish about mortgage rates improving.

They are, after all, fans of mortgages being originated, and lower rates equate to higher funding volume.

Last year, they predicted that the 30-year fixed would ease throughout 2023 and average 5.2% in the fourth quarter.

That didn’t work out as planned, with the 30-year fixed closer to 7% today. And it was actually above 8% just a month ago.

Still, they are predicting lower mortgage rates in 2024, just as they did last year. The difference this time around might the inflation story.

It has cooled a lot since then, which could lead to Fed rate cuts and an easing in the 10-year treasury yield, which correlates well with mortgage rates.

Ultimately, they may have expected inflation to improve faster than it did, which is why they got rates wrong in 2023.

Now that inflation actually is significantly lower, their predictions could come to fruition. Also note that their latest prediction is a full percentage point higher than it was a year ago.

They only expect the 30-year fixed to fall to 6.1% by the end of 2024 versus 5.2% when they made the same forecast a year ago.

Fannie Mae 2024 Mortgage Rate Predictions

First quarter 2024: 7.0%

Second quarter 2024: 6.8%

Third quarter 2024: 6.6%

Fourth quarter 2024: 6.5%

Next up is Fannie Mae, which purchases and securitizes conforming mortgage loans.

They’re a bit less bullish than the MBA, as they expect the 30-year fixed to remain in the upper-6% range for all of 2024.

However, this is a big improvement from their November forecast, which had the 30-year staying above 7% for all of 2024.

So we can take this to mean they expect mortgage rates to continue to improve as the Fed cuts its own rates and inflation improves throughout 2024.

But given Freddie Mac already has the 30-year averaging 6.61%, they might need to make additional adjustments.

Freddie Mac 2024 Mortgage Rate Predictions

First quarter 2024: n/a

Second quarter 2024: n/a

Third quarter 2024: n/a

Fourth quarter 2024: n/a

While Freddie Mac stopped releasing a monthly outlook for mortgage rates (for reasons unknown), they still do a monthly commentary.

And from that we can glean some ideas about where they think mortgage rates will go in 2024.

Their latest outlook notes that they expect “recent volatility in Treasury yields to abate which will allow modest reductions in mortgage rates.”

How modest? Well, they said mortgage rates will probably not fall below 6% “in the short run” thanks to the higher for longer narrative.

But given the recent improvement in rates (and the 10-year bond yield), it’s possible rates could get back in the low-6s in 2024.

And if the borrower pays discount points, a rate in the 5% range is also possible, assuming those mortgage rate spreads tighten due to decreased volatility.

A year ago, they expected the 30-year fixed to fall to 6.1% by the fourth quarter of 2023. So perhaps they’re being a bit more conservative.

However, they expect home prices to rise a further 2.6% in 2024 thanks to mortgage rate lock-in effect and favorable demographics, including an elevated share of first-time home buyers.

Freddie recently provided an update, saying they expect the Fed to cut rates in the second half of the year if the job market cools enough “to keep inflation muted.”

If this transpires, they expect mortgage rates “to ease throughout the year while remaining in the 6% range.”

NAR 2024 Mortgage Rate Outlook

First quarter 2024: 7.5%

Second quarter 2024: 6.9%

Third quarter 2024: 6.5%

Fourth quarter 2024: 6.3%

The National Association of Realtors (NAR) releases a monthly U.S. Economic Outlook that contains their mortgage rate predictions for the year ahead.

I’m going off their October version until I can get a more updated one, so I expect their numbers to get even more optimistic given the recent improvement in mortgage rates.

There’s even a chance they’ll throw out a number in the high-5% range for the fourth quarter of 2024.

NAR chief economist Lawrence Yun also expects the 30-year fixed to average between 6-7% by the spring home buying season.

He added that “we’ve already reached the peak in terms of interest rates.” So his expectation is it’ll get better from here. The question is how much better.

Zillow’s 2024 Mortgage Rate Prediction

Next we have Zillow. Sometimes they make mortgage rate predictions, sometimes they don’t.

Given how wrong everyone has been lately, they said, “Predicting how mortgage rates will move is a nearly impossible task…”

However, they do expect home prices to “hold steady in 2024,” declining by a negligible 0.2%.

They also believe mortgage rates may “hold fairly steady” too in coming months if recent inflation readings are any indication.

Together, the cost of buying a home could level off next year, or even drop if mortgage rates do too. But they aren’t throwing out specific numbers.

Interestingly, Zillow expects more mortgage rate locked-in homeowners to “end their holdout for lower rates and go ahead with those moves.”

So even if rates don’t get much better, the holdouts might say enough is enough and list their properties.

If rates do keep dropping, this argument becomes even more compelling. So much-needed supply could be freed up in the process.

Redfin 2024 Mortgage Rate Predictions

Meanwhile, Redfin believes mortgage rates will steadily decline throughout 2024, but remain above 6%.

Specifically, they expect the average 30-year mortgage rate to linger around 7% in the first quarter, then inch down as the year goes on.

By the end of 2024, the real estate brokerage thinks mortgage rates will fall to about 6.6% thanks in part to 2-3 rate cuts from the Fed.

Offsetting these cuts is the expectation that we will avoid a recession in 2024. So a lack of serious economic pain means more modest declines in rates as opposed to sizable ones.

Still, they see home buyers finally catching a break because home prices are also predicted to be flat.

This means monthly payments will fall further from their recent all-time highs, which we can all agree is a good thing.

Realtor 2024 Mortgage Rate Forecast

Meanwhile, the economists at Realtor.com are predicting a minimal decline in mortgage rates, but still an improvement.

They expect the 30-year fixed to average 6.8% in 2024 after averaging 6.9% in 2023. So just a 10-basis point decrease.

However, they do expect rates to finish off 2024 at 6.5%, which is a little more optimistic.

It’s also markedly better than the 2023 year-end expectation of 7.4%. And would essentially take us back to the end of 2022, when the 30-year fixed averaged 6.42%.

In other words, we might be able to forget 2023 ever happened. But we still won’t be able to revisit early 2022 anytime soon.

At that time, the 30-year fixed was a mindboggling 3.22%.

First American’s 2024 Mortgage Rate Outlook

Also weighing in is First American Financial chief economist Mark Fleming.

He expects mortgage rates to hover between 6.5% and 7.5%, which he refers to as “higher than goldilocks-level mortgage rates.”

As for why he’s not more bullish given the projected rate cuts, he believes the Fed will remain vigilant in its battle against inflation.

But the direction of rates will ultimately hinge on the health of the economy, which remains strong. If things cool as expected, mortgage rates may extend their recent retreat since hitting 8%.

However, he notes that while the 2020-2021 housing market was ‘too hot,’ and the 2023 market ‘too cold,’ 2024 still won’t yet be quite ‘just right.’

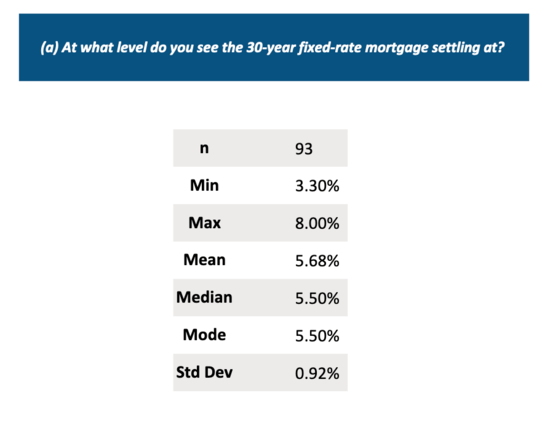

Fannie Mae Q4 2023 Home Price Expectations Survey Question

In the latest Home Price Expectations Survey from Fannie Mae, a special question was asked of the more than 100 housing experts.

Specifically, where the 30-year fixed would fall once the current rate volatility settles down.

And as you can see from the table above, this interest rate appears to be around 5.50%.

So while mortgage rates are expected to move lower once the dust clears, the amount of movement might be somewhat limited.

If we’re currently hovering around 7% on the 30-year fixed, we might see a further 150 basis points in improvement.

That could be enough to reinvigorate the housing market without causing unhealthy demand.

The Truth’s 2024 Mortgage Rate Predictions

First quarter 2024: 6.875%

Second quarter 2024: 6.625%

Third quarter 2024: 6.25%

Fourth quarter 2024: 5.875%

Like everyone else, I was wrong about mortgage rates in 2023. I thought they’d slowly move lower throughout the year before ending the year around 5%.

Instead, we are closer to 7% today, which is a pretty big miss. That being said, what I assumed would play out last year (lower inflation), seems to be happening now.

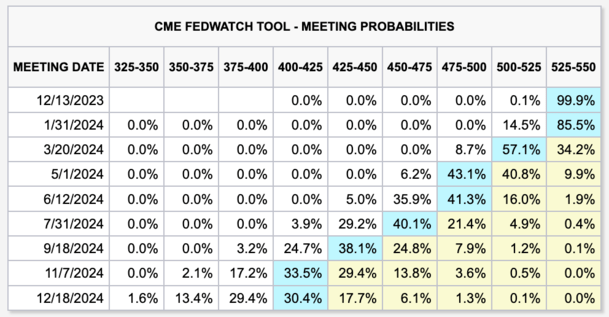

There are also several rate cuts now expected in 2024, with the CME FedWatch Tool favoring a 4% – 4.25% range for the federal funds rate by December 2024.

The 10-year bond yield is also expected to moderate further, and could be back to the mid-3% range.

If we assume that mortgage rate spreads also tighten from their current levels near 300 bps to something more reasonable, such as 200 bps, we could see noticeably lower mortgage rates in 2024.

Taken together, a spread of 200 bps and a 3.5% 10-year yield could signal a return to mid-5% mortgage rates.

That might sound a little too good to be true, so I’ll err on the side of caution and go for an average rate as low as 5.875% to end the year.

Remember, there are still a lot of unknowns and potential curveballs ahead. We’ve got multiple geopolitical events that are still unfolding.

And potentially the most contentious U.S. presidential election in history. So as always, mortgage rates will ebb and flow, and opportunities will present themselves.

There will be good months and bad months, but I expect mortgage rates to continue trending lower as 2024 unfolds.

Read more: 2024 Mortgage and Real Estate Predictions

(photo: Marco Verch, CC)