Following the release of the 2019 conforming loan limit, HUD announced the 2019 FHA loan limits, which like the former will move higher next year.

Similar to conforming loans, FHA loans have loan amount limits set either at the floor, the ceiling, or somewhere in between.

The big difference is that the FHA floor (also the maximum loan amount in many counties) is much lower than the conforming limit, the latter of which is set to rise to $484,350 in 2019.

This can be pretty important depending on the metro in which you’re buying or refinancing a home loan to ensure it is eligible for backing by the FHA.

[Also see: 2019 mortgage rate forecast]

2019 FHA Loan Limit Increasing to $314,827

- New maximum FHA loan amount for low-cost areas is $314,827

- Up roughly 7% from $294,515 in 2018

- This means a home buyer in Phoenix, AZ can use FHA financing

- For a slightly larger home purchase, up to $326,000 vs. $305,000 currently

Nationwide, this floor will increase to $314,827 from $294,515 come January 2019, which is 65% of the national conforming loan limit of $484,350.

It represents a roughly seven percent increase from 2018, which is a reflection of rising home prices nationwide.

A quick example of the impact would be the Phoenix, Arizona metro, which is set at the floor despite having a very wide range of home prices both high and low.

The max FHA loan limit will climb from $294,515 to $314,827 in 2019, meaning a prospective home buyer could soon use FHA financing (with a 3.5% down payment) on a $326,000 property.

As it stands in 2018, they’d be limited to a home purchase of around $305,000, assuming they put the minimum 3.5% down.

Unfortunately, many properties are priced significantly higher, meaning FHA loans won’t be an option on these transactions.

Here are the full FHA floor numbers by number of units:

One-unit property: $314,827

Two-unit property: $403,125

Three-unit property: $487,250

Four-unit property: $605,525

As you can see, FHA loan limits are higher if the property is a duplex, triplex, or fourplex.

FHA High Cost Loan Limits Match Those of Fannie/Freddie

Meanwhile, like conforming home loans, the FHA has high-cost loan limits as well, which they refer to as the “loan limit ceiling.”

These actually align with the Fannie Mae and Freddie Mac limits because they use the same formula, 150% of the national conforming loan limit.

That means those buying or refinancing in high-cost regions of the country can take out loan amounts as high as $726,525 via an FHA loan.

And even bigger loan amounts on multi-unit properties as follows:

One-unit: $726,525

Two-unit: $930,300

Three-unit: $1,124,475

Four-unit: $1,397,400

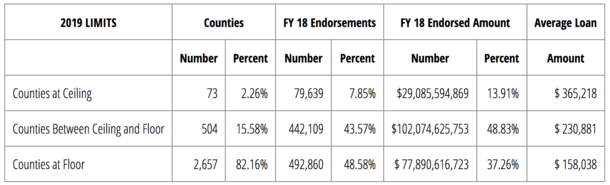

There are 73 counties nationwide at the ceiling in 2019, down slightly from 75 in 2018.

They include the usual suspects like the Bay Area, Los Angeles, New York City, Seattle, Washington D.C. and even Jackson, Wyoming.

Another 504 counties will fall somewhere between the floor and the ceiling, up from 502 in 2018.

This includes places like Atlanta ($379,500), Chicago ($368,000), Denver ($561,200), Las Vegas ($322,000), and Minneapolis ($366,850), and many others.

The remaining 2,657 counties will be at the floor in 2019, including Des Moines, New Orleans, Orlando, Phoenix, and St. Louis, to name but five.

Keep these loan limits in mind if you’re thinking about buying or refinancing in 2019 as it may affect eligibility for a certain loan product.

In short, you may find that FHA financing isn’t an option if you’re buying an expensive property for your area.

Read more: FHA vs. conventional loan differences.

- UWM Launches Borrower-Paid Temporary Buydown for Refinances - July 17, 2025

- Firing Jerome Powell Won’t Benefit Mortgage Rates - July 16, 2025

- Here’s How Your Mortgage Payment Can Go Up Even If It’s Not an ARM - July 15, 2025