If you thought 8% mortgage rates were bad, what about 9% mortgage rates?

What was once unthinkable is now not so hard to believe, with 30-year fixed mortgage rates climbing ever higher.

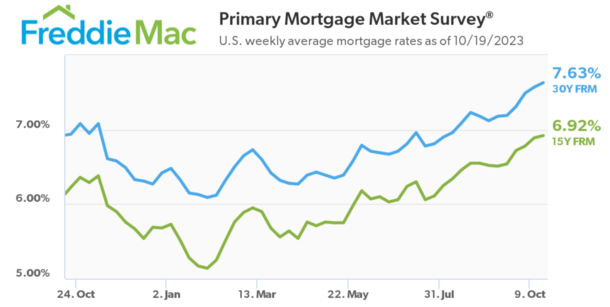

At last glance, the 30-year was priced at 7.63%, per Freddie Mac’s lagging weekly survey.

But other estimates have been higher, including MND’s daily index that put the 30-year at a ripe 8.03%.

And today I even saw someone calling for 12% mortgage rates by Q2 2024. Yikes!

Are 9% Mortgage Rates Next?

I’ve already written about 7% mortgage rates and 8% mortgage rates for that matter, at the time wondering if and when they’d arrive.

Now here I am writing about 9% mortgage rates, which is worrisome given those past fears coming to fruition.

However, that doesn’t necessarily mean we keep going higher from here, nor do we climb another 1% higher.

If you look at mortgage rates over the past year, they’ve gone up, but not by an enormous amount.

Take Freddie Mac’s weekly survey data, which pegged the 30-year fixed at 6.48% to begin 2023.

Today, they said the 30-year fixed averaged 7.63%, which represents an increase of 1.15%.

Yes, it’s higher. And yes, it’s further eroding home buyer affordability and hurting housing demand. But an increase of just over 1% over more than 10 months isn’t massive movement.

Consider the year 2022, when the 30-year kicked off January at 3.22% and ended with a bang at 6.42% in December.

Mortgage rates literally almost doubled during 2022 (short two basis points), while they’ve only risen 17% so far in 2023.

So the rate of ascent has slowed tremendously, if there is but one silver lining here (the other actually being that more high-rate loans being originated will present opportunity later).

Anyway, because mortgage rates are now a lot higher, the percentage gains pale in comparison. And there’s the question of rates nearing their peak.

I’m not convinced we go to 9%, at least by Freddie Mac’s measure, or even MND’s.

Sure, some loan scenarios with layered risk (low FICO score, high LTV, investment property, etc.) may already be at 9%. Or close.

But for the average home loan scenario, I don’t know if we go that high. If anything, 8% rates could signal a turning point.

The 21st Century High for Mortgage Rates Is 8.64% Per Freddie Mac

While we’re on the subject, I’d like the point out that the 21st century high for the 30-year fixed is 8.64%, per Freddie Mac data.

And it took place during the week of May 19th, 2000. So we are not far off from hitting a new high for this century, assuming rates continue their upward trajectory.

But until then, I’d be wary of anyone saying rates haven’t been this high since the 1990s, or something to that effect.

Also, recall that rates only increased 1.15% so far in 2023. They’d still need to rise another one percent by Freddie’s measure to get there.

Maybe that happens, maybe it doesn’t. Either way, there’s still a ways to go to reach that point.

3% vs. 9% Mortgage Rates: About Double the Payment

| $600k Loan Amount | ||

| Interest Rate | 3% | 9% |

| Monthly Payment | $2,529.62 | $4,827.74 |

| Monthly Savings | $2,298.12 | n/a |

| Savings after 5 years | $137,887.20 | n/a |

| Balance after 5 years | $533,438.47 | $575,280.48 |

Do We Need Higher Rates, or Just More Time to Let Them Sink In?

Everyone seems to be obsessed with higher and higher interest rates. As if pushing them ever higher will fix inflation.

But do they actually need to keep climbing into the stratosphere, or are we simply being impatient?

Perhaps they just need time to do their thing, which is basically what Fed chair Jerome Powell echoed today.

It coincides with the higher for longer mantra, that interest rates will need to stay at elevated levels longer than expected.

That could be enough to slow demand, consumer spending, home price appreciation, new hiring, etc.

They don’t necessarily need to keep going up from here. And that’s perhaps why the Fed is taking a wait and see approach with their own policy rate.

Of course, the Fed doesn’t control mortgage rates, but their own fed funds rate can act as a signal for the direction of the economy, and long-term rates such as 30-year fixed mortgage rates.

The fact that they’ve essentially stopped hiking should be a somewhat bullish sign that rates are sufficiently restrictive.

Powell also noted that the bond market might be turning its attention to the federal deficit and increased government spending, for which a couple wars might be to blame.

So there might be less importance to look at what the Fed is up to as there was earlier in the year.

The 10-Year Bond Yield Is About to Hit 5%

Meanwhile, the 10-year bond yield, which has been a fairly reliable indicator of 30-year mortgage rates, nearly hit 5% today.

At last glance, it was literally 4.99%, with apparent resistance at slightly higher levels. Some believe it could be a tipping point where bond buyers see opportunity.

If that’s true and yields calm down, chances are mortgage rates can too. At the same time, the mortgage rate spread between the 10-year yield is double its normal.

Usually around 170 basis points, it has widened to over 300 bps, meaning 5% yield plus that spread puts the 30-year fixed at roughly 8%.

During normal times, the math puts the 30-year fixed at about 6.75%. That alone would go a long way in fixing mortgage rates.

But until mortgage-backed securities (MBS) investors get more certainty, those spreads will remain wide.

Especially when you consider the prepayment risk if rates go down a lot and everyone refinances their 7-8% mortgages.

The takeaway for me at this juncture is that mortgage rates probably will continue rising from here, but maybe only gradually and by much smaller amounts.

That’s the good news. The bad news is they might have to linger at these high levels for longer than anticipated.

Ultimately, I really don’t want to write an article about 10% mortgage rates anytime soon.