You’ve heard it a million times, but I’ll say it again. It pays to shop around for your mortgage.

Freddie Mac told us a while back, and now the Consumer Financial Protection Bureau (CFPB) has echoed the same.

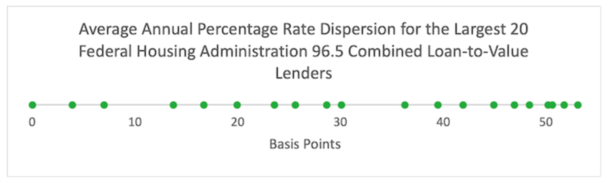

And it’s not a trivial amount of savings. The bureau found that price dispersion for mortgages is often 50 basis points (.50%) of the APR.

When looking at a median loan amount of about $300,000, we’re talking a difference of roughly $100 per month.

That’s $1,200 annually in extra costs (or savings) and $6,000 through the first five years of the loan term.

Mortgage Lenders Offer the Same Exact Products at Different Prices

Similar to just about any other business, mortgage lenders offer the same products for different prices (why are mortgage rates different?).

Home loans aside, a lot of companies sell the exact same product. That’s why there are comparison websites or Google shopping.

You enter a product and you’re presented with various prices, shipping costs, and so on.

Throw in a coupon code or pricing special and one company could be offering quite the bargain relative to the rest.

While mortgages are a little more unique, as you’re working with a team of individuals to close your loan, the underlying product is generally the same, a 30-year fixed mortgage.

Most home buyers and even existing homeowners who refinance choose a 30-year fixed-rate loan.

This means you’re getting the same product regardless of where you get it from. The difference is the service and perhaps the competency of the company or individual to actually fund the thing!

But assuming we’re comparing two competent lenders (or mortgage brokers), you wind up with exactly the same thing.

As such, you shouldn’t pay more for it. And to avoid paying more for it, you should put in the time to shop mortgage rates AND fees.

Pricing Can Vary Considerably Across All Mortgage Types

The CFPB conducted an analysis to determine the magnitude of price dispersion among home loans.

They did this by combing through Home Mortgage Disclosure Act (HMDA) data from 2021.

And they found that prices varied “in virtually every segment of the mortgage market.”

This includes conforming loans backed by Fannie Mae and Freddie Mac, jumbo loans, and government-backed options, such as FHA loans and VA loans.

As noted, this price dispersion for mortgages often hovers around 50 basis points (0.50%) of the annual percentage rate (APR).

For example, during 2021 the median interest rate was 3% (yes, we all miss those days!).

But not everyone got a 3% mortgage rate. Many homeowners got saddled with a rate of 3.5% or higher.

We’re talking a monthly payment of $1,265 for a 3% interest rate versus $1,347, which is a difference of $82 a month.

Today, we might be talking about a 6.5% rate vs. a 7% rate, respectively, or roughly $1,896 vs. $1,996.

Not only are you overpaying even more today, but doing so might make the loan unaffordable given how high rates and home prices are.

Why Do Mortgage Rates Vary by Lender?

Now as to why there’s price dispersion in the first place, the CFPB points out several different reasons.

For one, not all lenders are created equal. Some have retail branches, while others only exist online. We’re talking a website vs. brick-and-mortar office space.

In terms of business practices, some retain their loans on their books and/or the loan servicing, while others quickly sell them off and move on to the next loan.

There’s also branding – the ones you’ve heard of might spend a lot of money on advertising and charge slightly higher rates as a result.

Others may keep their interest rates elevated to ration demand, aka limit applications due to capacity. Or simply calibrate to their appetite.

It’s also possible that companies that don’t impose lender overlays charge more for the increased risk.

Finally, it’s simply a matter of borrowers not shopping around. The typical borrower only speaks to one lender and believes prices are the same regardless.

So rates aren’t necessarily dictated by traditional supply and demand variables.

My assumption is it’s more difficult to compare prices on a mortgage than it is a toaster.

For this reason, many consumers just go with the first lender they speak with and call it a day.

If You Don’t Shop Your Mortgage, You Could Overpay for the Next 30 Years

Now here’s the kicker when it comes to a home loan. If you do wind up with a mortgage rate .50% higher than the competition, it’ll hit your wallet month after month.

It’s not a one-time misstep like a TV purchase or a hotel room. You don’t just pay extra one time and forget about it.

That higher payment sticks with you for as long as you hold your mortgage. If we’re talking about a 30-year fixed home loan, that could be a while.

So the mistake of not shopping your rate might cost you $100 each month for as long as the loan is held.

For me, that’s a lot worse than overpaying for a product one time.

Long story short, if you’re serious about saving money, you’ve got to put in some time and speak to more than just one lender.

A proper home loan search should include local banks, credit unions, mortgage brokers, and online lenders. Don’t limit yourself to just one type of company.