While mortgages are largely a commoditized product, unlike perhaps a TV or a smartphone with unique technology, their cost can still vary considerably by lender.

The reason mortgage rates are different across banks and lenders could be a result of operating costs, risk appetite, desire to dominant a certain region, and so on.

If one bank’s strategy is to be the most competitive on rate in California, they might be able to smoke the competition. But you won’t know that if you only speak to one company and it happens to not be that bank.

Even One Additional Quote Can Save You Thousands!

- Here’s why one mortgage quote simply isn’t enough

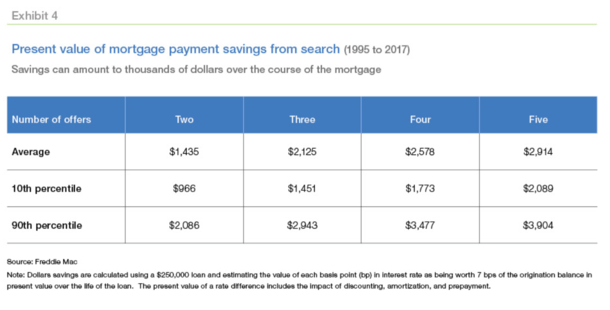

- Borrowers who gather two mortgage quotes can save between $966 and $2,086 over the life of the home loan

- The savings jump even higher if you take the time to get 5+ quotes

- With the average expected savings a whopping $2,914!

I get it – no one wants to do it, it’s painful, it’s annoying, it can be time-consuming. Who wants to be badgered by multiple salespeople? No one.

But you need to change your mindset and look at that time spent as an investment. What is your ROI for spending a few additional hours speaking to other banks, credit unions, and mortgage brokers?

A new analysis from mortgage financier Freddie Mac found that the ROI could be sky-high, seeing that 80% of borrowers who obtained just one additional mortgage rate quote will save between $966 and $2,086 over the life of their home loan.

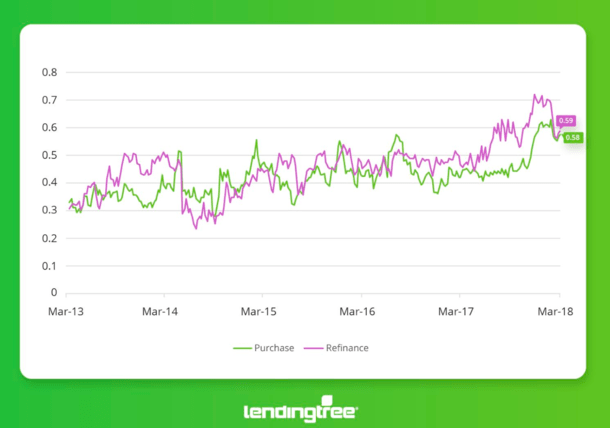

This all has to do with what Freddie refers to as the “dispersion of mortgage rates,” which is essentially the difference in mortgage rates offered by lenders during a typical week.

Freddie releases their popular mortgage rate survey every Thursday, so they know firsthand there’s quite a disparity in mortgage interest rates offered by their many survey participants.

For example, one lender might be offering a rate of 4.5% on the 30-year fixed, while another could be offering a significantly lower 4.125%.

The table above shows the average difference in rates between lenders over time by home purchase and refinance quote. It’s more than half a point at the moment.

That difference in rate would result in monthly payment savings and even more in interest savings over the course of the loan term.

But you might not ever know about that 4.125% rate if you simply settle for the first rate you see, which is what more than half of mortgage shoppers do.

Yes, the majority only obtain one quote, and a study a few years ago revealed that lower-income borrowers were even more likely to obtain just one quote.

How Much Can You Save on Your Mortgage?

- Like mortgage rates, the savings will range depending on loan attributes

- This includes things like the loan amount (larger ones produce bigger savings)

- How long you actually keep the mortgage (to maturity or just a few years)

- And how much interest rates vary at the time of shopping your home loan

While the savings will of course vary based on a number of factors, Freddie’s analysis revealed some interesting tidbits.

I already mentioned that just one more quote could save you thousands. But it gets even better if you obtain five or more quotes. Sure, that sounds like a grind, but hear me out.

The average expected savings jump to $2,914 if a borrower gathers five rate quotes. And some of these shoppers could save as much as $3,904.

How much you’ll actually save will be driven by loan amount, with larger ones capable of saving homeowners more money due to their sheer size.

Another factor is tenure, with those who keep their lower-rate mortgages longer saving more money.

So if you don’t plan to refinance your mortgage or sell your home anytime soon, taking a moment to shop around can be even more profitable.

Conversely, someone who only plans to keep their home loan for a year or two may not see much of a difference.

The final factor Freddie pointed out is the dispersion of rates over time, which they said has “remained surprisingly constant over time.”

Yep, apparently no matter when you apply for a mortgage, there’s always a pretty wide spread between lender rates.

However, during periods of so-called “economic stress,” the potential gains realized from rate shopping can be even greater.

In other words, if the economy is on a roller coaster ride, there’s a good chance you can find a sweet spot and save even more dough if you take the time to click or call around.

Read more: How many mortgage quotes should I get?

- Will Mortgage Rates Be Higher or Lower by the End of 2025? I Asked AI. - July 2, 2025

- Rocket Mortgage Completes Redfin Takeover, Offers $6,000 Home Buyer Credit - July 1, 2025

- Mortgage Rates Quietly Fall to Lows of 2025 - June 30, 2025