It’s time for another mortgage match-up, with the latest in the series pitting the lesser known “deed in lieu of foreclosure” vs. the more popular short sale.

Nowadays, there are plenty of options to get rid of your home and avoid foreclosure, even if you owe more than the property is currently worth.

By avoiding the full-blown foreclosure process, you can reduce the negative impact to your credit score and ensure the lender won’t come after you for any deficiency balance.

Additionally, you may be able to purchase real estate and qualify for a mortgage much sooner if you go with one of these foreclosure alternatives.

What Is a Deed in Lieu of Foreclosure?

- As the phrase “deed in lieu” suggests

- Instead of the lender pursuing foreclosure and taking your home

- They will allow you to voluntarily deed back your property

- It’s basically a preemptive forfeiture of the home in exchange for some benefits

In short, a deed in lieu of foreclosure is exactly what it sounds like. Instead of foreclosure, you agree to voluntarily deed your property to the lender.

In exchange for this transfer of ownership, the lender will release the associated lien (mortgage), allowing you to move on with your life.

However, banks will only agree to a deed in lieu if you keep the property in good shape and meet some sort of hardship requirements.

The trade-off is that the bank gets a property free from damages typically associated with foreclosure, and they don’t need to deal with costly foreclosure proceedings.

Of course, with home prices much lower now than they once were, properties are often being dumped for less than what is owed on the mortgage.

As a result, the lender may be able to come after you for the deficiency balance, or the shortfall between the current property value and the loan balance, depending on state foreclosure laws.

If this is the case, you may be on the hook for all or part of the shortfall, which clearly isn’t ideal if you can’t even afford your mortgage payments.

It certainly won’t make your tax returns any more pleasant, especially after surrendering the property to the lender.

This is why it’s imperative that you negotiate with the lender to forgive any deficiency balance before agreeing to one of these deed in lieu of foreclosure agreements. And to get it in writing!

You must also do this with any junior liens, or second mortgages (or thirds). If you don’t, those lenders can come after you for any shortfall in certain situations.

Finally, you’ll want to determine if the Mortgage Forgiveness Debt Relief Act applies to your situation.

Even if the lender doesn’t come after you for any money, Uncle Sam still might by way of tax liability. So there are two potential pitfalls you must try to avoid.

Why Choose a Deed in Lieu?

- There are several possible advantages to a deed in lieu

- Including less credit score damage (see chart below)

- A shorter waiting period to get another mortgage in the future

- And less required work (compared with a short sale)

Aside from avoiding an outright foreclosure, a deed in lieu may be the quickest option to part with your home if you don’t qualify for some other form of relief, such as a mortgage refinance or a loan modification.

Instead of being tasked with selling your home and waiting for the bank to accept the short sale offer, you can have the bank take care of it.

However, the bank may still ask that you list the property for a period of time before agreeing to a deed in lieu.

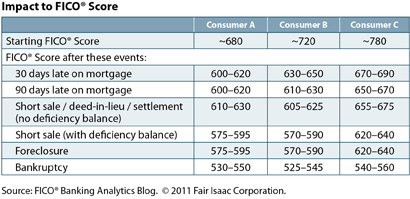

Also, a deed in lieu may not be nearly as bad as a foreclosure with regard to your credit score. It will still hurt your credit, but the impact could be less, assuming there is no deficiency balance.

Credit Score Impact of a Deed in Lieu

Check out the credit score impact of a deed in lieu as opposed to a foreclosure, according to FICO. It’s still not great, but it probably won’t do as much damage as a foreclosure.

On top of that, you’ll be able to qualify for a new home loan in a shorter period of time.

Instead of waiting up to seven years after a foreclosure, you may only need to wait as few as two years if you have extenuating circumstances, or four years under normal circumstances.

Lastly, you may be able to stay in your home with a deed in lieu if the lender offers a “Deed-for-Lease” option, as Fannie Mae and Freddie Mac now do (along with Bank of America). Or you may receive some spending money for relocation costs.

For example, Fannie Mae has a so-called “Mortgage Release” program that provides options such as vacating a home immediately, staying for up to three months rent-free, or leasing the home at fair market rates for up to a year. This can be especially helpful if you have limited monthly income.

They may also provide relocation assistance (up to $3,000 to help you move and find a new residence), while also eliminating your remaining mortgage debt. That sounds a lot better than a foreclosure, doesn’t it?

What About a Short Sale?

- The downside here is that you actually have to do some work

- As the name suggests you’ve got to sell the place

- And you need to do so with the approval of your lender

- This can be time-consuming and a major burden during what is probably already a stressful time

I’ve already written extensively about short sales, which are probably the most popular foreclosure alternative available today.

Put simply, you must convince the lender to allow you to sell your property for less than the associated mortgage balance.

The downside is that you must list your home for sale, which obviously takes work, results in people tracking mud through your home, dealing with annoying real estate agents, and can take many (many) months to finalize.

First off, you need the bank to approve the sale, and secondly, you need to close the deal. It’s a lot more difficult to sell homes these days, so it can be quite a pain.

It’s basically a home sale without the profits at the end, but it might beat the foreclosure process.

However, new rules have sped up short sales, and now that they’re so commonplace, the process can be a lot more effortless.

The result is similar to a deed in lieu in that you are released from the loan once the home is sold, and you avoid foreclosure.

Again, you must ensure that there isn’t a deficiency balance to avoid owing any money on your tax returns after the deal is done.

And if there are second or third liens, they must also be dealt with.

Tip: If you complete a short sale or deed in lieu via the Home Affordable Foreclosure Alternatives (HAFA) program, the deficiency balance must be waived.

The advantages of a short sale are like a deed in lieu in that you can reduce the credit score impact and get a new mortgage sooner. You may also be offered a financial incentive to short sell.

The drawback is that a short sale may be more time consuming and tedious. However, banks are probably more willing to approve a short sale than they are a deed in lieu, especially if there is another mortgage loan is involved.

Though beginning in March, Fannie and Freddie will allow borrowers with illness or the need to relocate for a job apply for a deed in lieu, even if current on their mortgages. This just so happens to be taking place when home prices are on the rise…

In either a short sale or deed in lieu, there are also potential tax consequences, so consult a CPA and/or a lawyer before deciding which choice is best for you, if either. And pay attention to any legal updates on foreclosure laws, as they can change over time.

Read more: Foreclosure vs. short sale

The comment on the real estate agent shows that you have little knowledge of the real world we are in. Hope you can sell your property by yourself .

I live in Florida and am buying a house under ashort sale , i have a contract . We also live in the house and pay the borrower rent. we are waiting for the short sale approval.

I was told yesterday that the borrower want to do a deed in lieu of foreclosure. Is this illegal ? We want the house.

As you noted, the short sale still requires bank approval, despite being in contract between buyer and seller. Ask your real estate broker/agent how to proceed.

I always wondered what the benefit of a deed in lieu was instead of foreclosure/walking away. Makes sense to avoid some of the repercussions of foreclosure.

So there is some credit benefit to the deed in lieu…I also like the idea of your lender not coming after you.

can I refinance after deed in lieu

It’s the same as the waiting period after a short sale. Basically 2 years if you put at least 20% down, 4 years if between 10-20%, and seven years if less than 10% down. Those are Fannie’s guidelines, it could be less with FHA or longer with Freddie.

Is a deed in lieu better than a foreclosure for the mortgage company as well? Meaning, does the mortgage company stand to make more off the property with a deed in lieu vs a foreclosure sale? Can a deed in lieu be done last minute before a sale date or is there a cut off if there is a sale date?

Scott,

As I noted in the article, the benefit to the bank is that the property should be well taken care of, as opposed to abandoned and left damaged, and they may save on foreclosure costs.

What about after filing bankruptcy?

We filed 4 years ago when I got cancer, but managed to still keep up the house payments until about 4 months ago.

We decided to let the house go into foreclosure. I understand the foreclosure process can take a long time, which would give us a chance to try to save some of that mortgage payment. Does “deed in Lieu of foreclosure” mean that you might not be able to stay in the house as long as if you waited for foreclosure?

We will probably not purchase another home as I am 67 and have very little savings.. At this point we are hoping to buy a old mobile for cash.

I have 2 rental homes and own my home . #1 rental i have an interest only loan that will convert to a 20 year term on the balance of $ 156,000 also have a second mortgage interest only loan that i pay $91.00 at 9.675%. My payments will go up substantially plus the home needs a lot of work, new roof, siding replaced, old stucko in front and original a/c unit. Home is 23 years old. The home is valued at approx. $135,000 I would like to get out of this rental. Can i do a deed-in-lieu or short sell. i do have equity in my home and some savings but looking ahead to retirement within the next 10-12 years. Thanks Rob

Rob,

If you have equity you may want to try a traditional sale first to avoid any credit-related hit.

I got one for you!!!! Been fighting with my mortgage company for a modification for 8 years!!!!!!!!! Haven’t made a payment to them since 2010 when I lost my job. And now after years of paperwork, they are asking for a short sale. Said I don’t qualify for any programs. Any hope of getting out of this mess?

Theresa,

Not sure if it’s already been eight years and you’ve missed all those payments. Your mortgage balance might be enormous with fees and interest and so forth. Only upside is home prices have increased a lot in the past few years. But you could research programs in your state, things offered via the Hardest Hit Fund, etc. Good luck!

We have a second home- investment. We were modified with a huge 20 yr term – hence a huge mo payment.

We applied and have been approved for a Short sale and Deed in Lieu. We r 4 months behind.

It is the same amount of points off credit report it looks like from your chart- short sale or deed in lieu.

Also, I see you say it depends on how much we would put down for a down payment as far as how soon we could buy another house.

So, it seems like the big issue is how many mo behind. Not – short sale vs deed in lieu?

The bank is trying to tell us – deed in lieu is like foreclosure (which is it in a sense-yes).

A supervisor gave an example of a customer a few yrs ago – where bank made a mistake of reporting a foreclosure to credit bureaus (not deed in lieu). They couldn’t buy another house until it was corrected to short sale (what they did).

However, it was not reported to credit bureaus as deed in lieu.

The supervisor in Short Sale dept (13 yrs exp) is trying to lead me to believe that deed in lieu will mean we could not get a home at all in 3-5 yrs. But she is not in consumer lending/approval dept.

Yr info on this site is telling me that – that is not true. It is really how many mo we r behind- not short sale vs deed in lieu. (Given debt forgiveness on 1st and 2nd lien – both with same bank)

Correct? We have to make a decision this morning by noon latest . CST 6-27. (Just found yr site trying to decide on answer to them).

Hope u can get back to me right away.

Diana,

Looks I’m too late but here’s the waiting periods from Fannie Mae: https://www.fanniemae.com/content/guide/selling/b3/5.3/07.html#Deed-in-Lieu.20of.20Foreclosure.2C.20Preforeclosure.20Sale.2C.20and.20Charge-Off.20of.20a.20Mortgage.20Account

Hi Colin ,, due to circumstances out of my control, I got behind several months on my mortgage . My home has gone into foreclosure , however it has been suspended for 2 months. It’s been suspended because I have someone interested in purchasing my home . It’s a traditional loan and there agent showed proof of interest to my mortgage company. I was told by my agent, that this is the best route for me. I was offered $4000 less than my home is worth , but it will cover the loan , closing cost and my agent. Is this the best route for me and will I be able to purchase another home ? Thank you

Yolanda,

Whether it’s the best option for you is your business, as for purchasing another home with a mortgage, there may be a waiting period thanks to the prior missteps, such as missed mortgage payments, even if you aren’t foreclosed on.

Hello, I’m planning to buy a townhouse at the moment I’m living in a Condo unit. I never miss any monthly fee at my mortgage. What is the best way to do, will I do the short sale or the Deed in Lieu. The difference between the money that I own is 5K only. Will I buy the townhouse first before applying for short sale/ deed in lieu? I’m worried because I’m not sure if I can borrow later if I apply for the short sale or the deed of lieu first (My credit report will definitely go down).

Cheng,

Hmmm…lenders refer to this as buying and bailing, that is, ditching your old place after buying a new place, which they don’t see as very ethical.

OK than thanks, so that means I can not buy the townhouse that I like since I still have my condo unit. Any advise for me?

Cheng,

Lenders these days tend to require that you qualify for both payments (existing home and new home) if you try to buy a second property while still holding the original property, unless you have significant equity in the first property. This is how they avoid borrowers buying and bailing. You can see if you qualify for both properties by speaking with brokers/lenders. Good luck.

Thank you.

Hello,

I am upside down on an investment property for which I am unable to rent or sale. I currently owe $58,000 at 10.3% interest. Previously, the mortgage company offered me a 3 year loan modification at a lower interest rate, which just ended. I have asked for an additional one but was told it is unlikely. I have been unable to secure a refinance on this loan and cannot afford the monthly payment. Any advice?

Crystal,

That’s a toughie…not sure other than pouring money into it to get the LTV down and refinance at today’s much lower rates, but that’s probably something you don’t want to do given the situation.