Mortgage crisis Q&A: “What is an underwater mortgage?”

I have no idea why I never touched on this topic before…perhaps I thought it was too simple of a concept, but clearly it could use a proper explanation seeing that millions of mortgages are now underwater nationwide.

Put simply, an “underwater mortgage” is defined as a home loan with an outstanding balance that exceeds the value of the associated property.

An underwater mortgage can also be referred to as an “upside-down mortgage” or a “negative equity mortgage.”

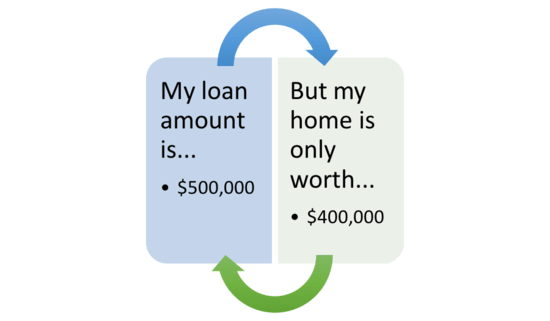

Let’s look at an example of an underwater mortgage to illustrate:

Current mortgage balance: $500,000

Current house value: $400,000

Home equity: -$100,000 (negative equity)

In this rather common scenario, the borrower would be $100,000 underwater on their mortgage because they currently owe $500,000, yet the home is now only worth $400,000.

Typically, you’d see the opposite in a healthy real estate market. The homeowner might have a mortgage balance of $500,000 and a property value of $600,000 thanks to regular mortgage payments and home price appreciation.

If that were the case, the homeowner would have $100,000 in home equity, and it would put their loan-to-value ratio (LTV ratio) at roughly 83%.

In the underwater mortgage example, the borrower would have an LTV ratio of 125% (the lower the number the better here folks).

An LTV above 100% implies negative equity, or underwater status. It’s not good!

Why are mortgages underwater?

- Borrowers owe more than their homes are worth

- Because many took out zero down mortgages

- And made interest-only payments or let their mortgage negatively amortize

- Then home prices took a big dive

The underwater mortgage example above is actually pretty common nowadays for several reasons.

No, there wasn’t a great flood…nor was there any water damage.

During the housing boom, home prices were very inflated, no one will argue that. At the same time, scores of borrowers took out no money down mortgages, aka 100 percent financing, to qualify.

Essentially, because home prices were so high, new entrants to the market were basically forced to finance their too-expensive homes with risky types of financing, as it was the only way they could afford the properties in question.

And they probably also chose these risky types of loans simply simply because they could.

After all, why put a bunch of money down if you don’t need to, especially if you think home prices are going to rise. That was the fatal flaw.

When home prices abruptly tanked, those who started out with no equity (100% financing) quickly fell into a so-called “underwater” position, especially since most were only making interest-only mortgage payments at best.

This problem was further exacerbated for those who opted to take out option arm mortgages, which allowed for negative amortization.

Yes, at the time there were mortgages that permitted homeowners to pay less than the total amount of interest due each month, and were even designed to allow borrowers to fall into underwater positions.

But everyone assumed home prices would keep rocketing to the moon, so no one gave it much thought.

Even homeowners who made their mortgage payment in full each month fell into underwater positions thanks to the grossly inflated home prices and precipitous declines that followed.

This also explains strategic default, where homeowners choose to walk away from their mortgages because they’re so far underwater they never expect to recoup the lost equity.

Or simply feel they can start out fresh with a mortgage balance more closely aligned with today’s home prices.

[Underwater Mortgage Insurance: Yes, It Exists Now]

What to do if you’ve got an underwater mortgage…

- There are options for borrowers with underwater mortgages

- Namely the Home Affordable Refinance Program (HARP)

- Which allows homeowners to refinance with no LTV constraints

- But you need to be current on payments

- And your loan needs to be owned by Fannie Mae or Freddie Mac

- If you have an FHA loan, a streamline refinance may also be an option

While the options aren’t great for those with underwater mortgages, there are certainly more and more programs being unveiled that deal with them.

You may have heard about a certain government loan modification program aimed at those with underwater mortgages that allows refinancing up to 125 percent LTV…it’s no coincidence.

And recently the government launched a program to help homeowners with underwater mortgages refinance, regardless of how deeply underwater they are.

Unfortunately, this program, known as HARP Phase II, is only available to those with Fannie Mae and Freddie Mac backed mortgages.

However, similar options are available to those with FHA loans and VA loans, so don’t fret.

If you have an underwater mortgage, it’d be wise to contact your mortgage lender and/or loan servicer to see what options are available for you.

You may be surprised to find that there are refinance options available to snag lower mortgage rates and even principal reduction in some cases.

Of course, there are going to be cases where borrowers are so deeply underwater that the best option could actually be walking away.

Simply put, if a borrower is so underwater that it will take a decade or longer just to break even, the argument is there.

It may be better to walk away, rent for a few years, and buy again when you’re ready to do.

That way you won’t be waiting years for your mortgage to get back above water.

Just be sure to weigh all your options and come up with a long-term plan first. It’s a major decision and should be treated as such.

Read more: How to refinance an underwater mortgage.

- Rocket Mortgage Completes Redfin Takeover, Offers $6,000 Home Buyer Credit - July 1, 2025

- Mortgage Rates Quietly Fall to Lows of 2025 - June 30, 2025

- Trump Wants Interest Rates Cut to 1%. What Would That Mean for Mortgage Rates? - June 30, 2025