It’s that time of year again, when we enter the housing doldrums and everyone in the industry begins to panic.

Further exacerbating things this time around is the fact that mortgage interest rates are in uncharted territory. Yes, I’m being facetious, they’re a mere percentage point above their all-time lows.

And last time I checked, a 30-year fixed mortgage in the 4% range is a pretty decent rate, even if it isn’t the lowest rate ever offered in history.

But sure, it doesn’t help matters that financing is more expensive and clearly does nothing to boost eroding affordability. Though it probably won’t hinder the market much either.

It’s Typical for Things to Slow Down This Time of Year

- If you’ve been seeing reports of slowing home sales

- And headlines warning that we could be headed toward another bubble

- Know that it’s normal for housing to sputter out in the heat of summer

- Before repeating its spring fling next year

The housing market is more or less predictable, with a quiet winter, followed by a busy spring home buying period, followed by a waning summer and less busy fall.

So it’s not unusual for market watchers and everyday Joes to begin questioning the housing market this time of year, wondering if this is the last great year for real estate.

After all, if the market isn’t absolutely crushing it, something must be seriously wrong, right?

We’re already starting to see the articles about the housing market “cracking.” Or beginning to “slow down.” That buyers are getting “fatigued” and a “bubble” is on the horizon.

But are these just your run-of-the-mill seasonal freak-outs, published by big media companies when there’s not much else to talk about?

I’m not going to lie, it’s been a slow news cycle for real estate and mortgages lately, which explains why I haven’t posted as much as I usually do. There’s just not a lot happening, nor anything novel to discuss in most cases.

This phase of the housing cycle isn’t all that exciting. It’s been the same story for a long time; rising home prices, limited supply, and worsening mortgage rates.

Since that hasn’t changed, journalists have to come up with something. So they begin twisting the data to create a narrative, which may be completely irrelevant come next April. Not that it matters.

In the meantime, just hope it sticks, but be sure to make it clickworthy and scary.

It Could Just Be That Inventory Has Finally Bottomed

- Maybe the takeaway here is that housing inventory has finally found a bottom

- After so many months and years of declines

- This doesn’t mean the housing market is all of a sudden going to get bogged down

- Nor does it mean the rally is over just yet

A recent favorite of mine was a worry that the housing supply was beginning to shift.

But instead of calling a housing market top, perhaps it’s more reasonable to call a bottom to the inventory of housing for sale.

While there is still an obvious inventory shortage, it’s beginning to improve by some measures.

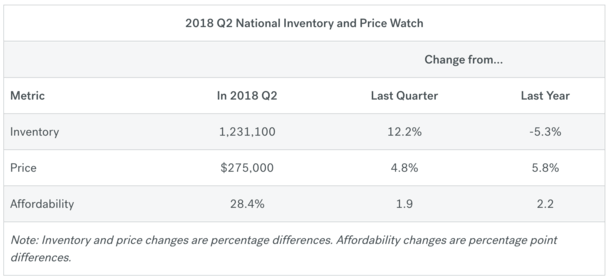

For example, Trulia noted that while housing inventory was still down 5.3% year-over-year, it grew 12.2% from the first quarter to the second quarter. That was the biggest second quarter jump since 2015.

A year ago, inventory rose just 3.9% during the same period, which could cause some panic. Or at least foster an alarming headline.

Despite this increase, the year-over-year downward trend in inventory that began in the first quarter of 2015 and went on for 14 consecutive quarters has not yet been offset.

And in hot markets such as New York and Los Angeles, the supply of homes only climbed a mere 1% and 2.9% year-over-year, respectively.

The takeaway, without getting too long-winded here, is that while inventory might not be dropping as much as it was, it’s not like we have a supply crisis on our hands all of a sudden.

All it might mean is that some homes are taking longer to unload, especially the ones that haven’t been updated (nor even had the light bulbs changed) in the past 30 years.

Put simply, it’s getting harder to sell real estate. Which is probably a good thing because it’s something that requires some thought, not a sight unseen frenzied bid over asking. And you wonder why homeowner regrets are rising.

Calling it a buyer’s market overnight is probably a little ridiculous. It might be a seasonal buyer’s market in some metros nationwide, but not in the sense that buyers can bargain hunt.

Just that they may not have as many buyers to compete with, and they might actually be able to keep some of their contingencies in place.

Fear a Bubble When Financing Gets Silly

- They say bubbles are financially driven

- The last housing bubble was certainly related to the loan programs being offered

- And the lack of sound underwriting practices

- It has become a lot harder to make bad mortgages today, though there are some liberal programs that exist and probably more in the pipeline

While you could argue that some of the loan programs being offered today are a little wobbly, such as the 3% down required by Fannie Mae and Freddie Mac, and the 3.5% down required by the FHA, underwriters are still underwriting.

They’re still documenting income and assets, pulling credit reports, and making sure borrowers are properly qualified for home loans.

And as mentioned, today’s home buyers are still getting their hands on stellar interest rates, albeit not at the absolute steal we saw a year or two ago. But they remain undeniably attractive.

If and when financing takes a turn, and we start seeing a prevalence of stated income underwriting and other questionable stuff, you can worry.

In the meantime, if you’re a prospective home buyer, use this lull to your advantage. Home prices aren’t on sale by any stretch, but it could be a better time to shop than it was in March and April.

As I pointed out in my 2018 home buying tips post, buying later in the year, such as in August and September, could be beneficial.

Less buyer traffic and stale listings could play right into your hands. Not to mention a slowing mortgage market can also lead to a lower rate.

And let’s be honest, 2019 is probably going to be a repeat of 2018, despite all the recent hoopla about the market crashing.

I expect spring 2019 to be just as competitive as it was this year, with plenty of buyers and few good homes on the market.

If you have a crappy home for sale, make a little more effort and it should still sell for a premium.

If you’re a buyer, might as well look now while the other buyers are on vacation…

Read more: When will the next housing bubble burst?