Large Credit Card Purchases Really Can Tank Your Credit Score

- While missed payments are arguably the worst offense

- Even racking up a lot of debt can lower your credit score significantly

- So it’s best to put the spending on hold a few months before applying for a home loan

- That way there won’t be any unwelcome surprises when it comes time to pull your credit

You’ve probably heard at some point that making large purchases with your credit card(s) before applying for a mortgage is a no-no.

In fact, you may have read that on this very site, since I’ve warned about it on numerous occasions in multiple posts because it’s such a common problem.

You might be aware of this issue, but shrugged it off, thinking what’s a few points, right?

You already have excellent credit so it doesn’t matter if you purchase a new $5,000 couch with your AmEx card for the new digs ahead of time.

Well, think again. It really does matter, and it can do serious damage to your credit score.

I’m not just talking about 5-10 points. I’m talking enough movement to potentially take you out of the running for a mortgage altogether, or at minimum raise your mortgage rate.

My Credit Score Got Rocked After Maxing Out a Credit Card

- I maxed out one of my credit cards a few years ago

- And my excellent credit score dropped about 50 points seemingly overnight

- That’s enough to raise your mortgage rate depending on how low your scores drop

- Or worse, disqualify you from obtaining a mortgage altogether if your credit wasn’t great to begin with

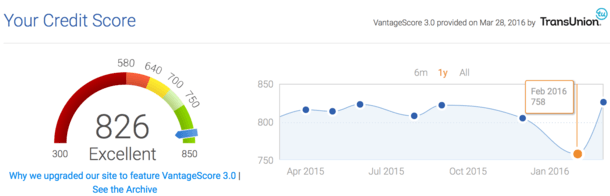

Let’s take a look at a very real example; my credit score back in 2016. Yes, I’m using my own credit score to illustrate this very real problem.

Fortunately, I didn’t apply for a mortgage during this period so it wasn’t an issue for me.

Instead, it was a moral blow as I saw my near-perfect credit score drop from over 800 to the mid-750 range, which incidentally is still excellent credit.

But for those who followed my path and did apply for a home loan, it could have spelled serious, serious trouble.

For most of that year, my credit score had been stuck in a range from the low 800s to around 820. This was good because it meant I wouldn’t have any issues qualifying for a mortgage based on credit score alone.

Not only that, but I would have received the most favorable rates and avoided as many mortgage pricing adjustments as possible.

Once you get your credit scores above 760 there aren’t many pricing adjustments (if any) to worry about, so you don’t need perfection.

However, when the holidays hit I started making a lot of purchases on my credit card. There was a promotion with Discover and Apple Pay that offered 23% cash back on all purchases so I hit it hard.

I basically maxed out my Discover card, which had a pretty dismal credit limit (maybe only $5,000 or so) because Discover is a pretty conservative lender.

When all was said and done, I think I had 1% available credit on the card, otherwise known as 99% utilization.

This is not a good idea, especially before applying for a mortgage because it will literally tank your credit score, even if you pay off the balance in full by your due date.

The problem is that the credit bureaus will take a snapshot of your credit balances on a certain date and then compute your credit score based on that information.

Chances are TransUnion flagged this maxed out credit card and docked my score accordingly, basically assuming I was going down a bad path by making a ton of charges in a short span of time.

This is usually a signal that a consumer is in trouble financially, assuming the behavior continues. And the bureaus basically sent out an SOS to new lenders to proceed with caution.

In the matter of a couple months, my credit score fell nearly 50 points. From peak to trough, it fell a total of 65 points.

I went from having stellar credit to having very good credit. Still, my score was below 760, which could cost you on a mortgage.

Tip: If you must swipe, consider spreading the purchases across several credit cards to keep utilization rates on a per-card basis low. This may be less damaging than maxing out a single card.

The Good News Is I Bounced Back Pretty Quickly!

- Thankfully my maxed out credit card was a short-lived event

- My credit score bounced back fairly quickly once I paid off the credit card debt

- So you can resolve it rather easily, assuming you have time to do so

- But the takeaway is not to chance it because you might not always have time!

Now the good news. Once I paid my credit card bill in full, and the bureaus took note of the new $0 balance (this isn’t immediate), my credit score shot up to its highest point in the past 12 months.

My 758 credit score went all the way up to 826, not too far from the perfect credit score of 850. It was also the highest it had been since Credit Karma began keeping track of it a couple of years earlier.

So despite the big hit early in 2016, I wound up in even better shape than I had been to begin with.

This was great in hindsight, but had I applied for a mortgage at any time during that 30-45 day window, I could have jeopardized the entire thing.

For someone with a lower starting score, they could have knocked themselves out of eligibility, or at minimum been forced to take on a higher mortgage rate as a result.

Don’t Make the Same Mistake I Did If There’s Even a Tiny Chance You’ll Apply for a Mortgage Soon

- If there’s any chance you’ll purchase a home or refinance an existing mortgage in the near future

- Put all your credit cards away and avoid any unnecessary purchases

- It’s just not worth the aggravation or the possibility of a higher mortgage rate and/or denied application

- Just be patient and you can go back to spending once your home loan funds

The moral of the story is to heed the warnings of avoiding large purchases before taking out a mortgage. It’s no joke.

For the record, the same can be said of spending your cash because you’re depleting your assets if you make large cash purchases.

And you may need more money than anticipated for the down payment, reserves, and closing costs.

This is especially true nowadays with many homes going for above-asking.

Make sure you set aside lots of money in a verifiable account (like a checking or savings account) several months before you begin making bids or inquiring about a refinance.

Also note that the more outstanding debt you have on your credit card(s), the higher your debt-to-income ratio (DTI) will be.

And this just happens to be one of the main reasons why mortgages get declined.

So racking up credit card debt can hurt you in two different ways at the same time if you’re not careful.

In other words, practice frugality before and during the mortgage application process and until the loan is funded.

Those purchases can wait and you’ll be better for it.

After all, mortgages can stick with you for decades – you’d hate for one ill-timed purchase to haunt you for years to come.

Interestingly, once you get your mortgage, you might be able to pay it with a credit card, not that it’s necessarily a good idea either.

Just note that using a credit card for the down payment on a house is not permitted.

Read more: 10 Things You Should Do Before Applying for a Mortgage