Now that tapping home equity is back in fashion, I figured it’d be helpful to see who the top HELOC lenders are.

This is especially timely with the prime rate finally falling after 11 successive hikes, making these loans cheaper again!

As you probably know, the year 2023 was a rough one for mortgage lenders thanks to much higher interest rates, and second mortgages were impacted as well.

The latest annual figures from the Consumer Financial Protection Bureau (CFPB) revealed that HELOC volume fell from 1.4 million units in 2022 to just 1 million in 2023.

That’s quite the drop-off, which the agency attributed to a sort of leveling off after volume surged in 2022 when homeowners gave up on cash-out refinances.

HELOC Volume Slipped in 2023 After a Very Big Year

As noted, HELOC volume reversed course pretty markedly in 2023 (the latest full year of data currently available as of early 2025), falling 23.5% after a very strong year in 2022.

Banks and mortgage lenders doled out about 1.4 million home equity lines of credit (HELOCs) in 2022, per the latest HMDA data, but only about one million in 2023.

That 2022 total was 41.2% higher than the 962,000 HELOCs opened in 2021, and the second consecutive annual increase after several years of falling volumes.

I expected HELOC applications to show increases again in 2023 and 2024 since mortgage rates on existing mortgages are so low relative to what’s available today.

After all, homeowners can tap into their equity without losing that 2-4% rate on their first mortgage. The same can’t be said of a cash out refinance, in which you give up your old rate in the process.

But they didn’t hold up in 2023, perhaps because 2022 was such a strong year. Note that they did still surpass 2021 levels though.

Anyway, let’s talk a look at who the top HELOC originators were in 2023 (most recent year available).

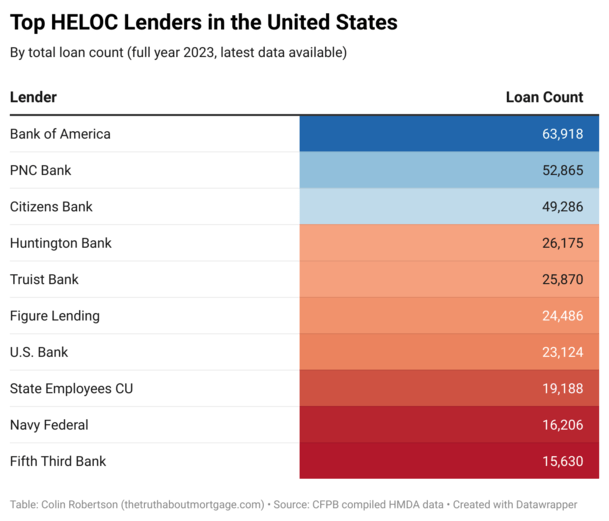

Top HELOC Lenders in 2023: Bank of America Was #1

| Ranking | Company Name | 2023 Loan Count |

| 1. | Bank of America | 63,918 |

| 2. | PNC Bank | 52,865 |

| 3. | Citizens Bank | 49,286 |

| 4. | Huntington Bank | 26,175 |

| 5. | Truist Bank | 25,870 |

| 6. | Figure Lending | 24,486 |

| 7. | U.S. Bank | 23,124 |

| 8. | State Employees CU | 19,188 |

| 9. | Navy Federal CU | 16,206 |

| 10. | Fifth Third Bank | 15,630 |

| 11. | Third Federal | 13,575 |

| 12. | Coastal Community | 12,403 |

| 13. | Regions Bank | 12,344 |

| 14. | TD Bank | 12,153 |

| 15. | Boeing Employees CU | 11,396 |

| 16. | BMO | 9,935 |

| 17. | Summit CU | 9,802 |

| 18. | Flagstar Bank | 8,695 |

| 19. | America First CU | 8,630 |

| 20. | UWM | 7,531 |

| 21. | Zions Bancorp | 7,274 |

| 22. | First Citizens | 7,263 |

| 23. | Desert Financial | 6,799 |

| 24. | Homebridge | 6,744 |

| 25. | ??? | ???? |

In 2023, Bank of America led all HELOC lenders with nearly 64,000 lines of credit originated, representing a solid 6.2% market share, per HMDA data from the CFPB.

Back in 2020, BofA had been the #1 HELOC lender with a 5.6% market share before falling to fifth in 2021 and back to third in 2022. So they’ve made up a lot of ground and then some.

They were followed by PNC Bank with nearly 53,000 HELOCs originated for a 5.1% share.

In third was Citizens Bank (49,286) with a market share of 4.7%.

Huntington Bank took fourth with 26,175 HELOCs opened and a 2.5% market share, followed by Truist Bank with 25,870 lines of credit opened for a similar market share.

The only nonbank in the top 25, other than United Wholesale Mortgage, was Figure Lending, which came in sixth with a 2.4% market share.

You can see the top 25 HELOC lenders in the table above for more details. These 25 institutions alone accounted for about 44% of the HELOC market overall.

Note that for some reason the CFPB is missing one of the top-25 entries and I’m not sure which one.

For reference, I have kept the 2022 numbers in this post as well if you’re curious about the year-to-year movement, which you can see below.

In 2022, PNC Bank was #1, followed by Citizens Bank and then BofA.

PNC Bank Was the Top HELOC Lender in 2022

| Ranking | Company Name | 2022 Loan Count |

| 1. | PNC Bank | 78,473 |

| 2. | Citizens Bank | 64,687 |

| 3. | Bank of America | 57,084 |

| 4. | U.S. Bank | 41,554 |

| 5. | Truist Bank | 37,186 |

| 6. | Huntington Bank | 32,027 |

| 7. | Figure Lending | 25,150 |

| 8. | Fifth Third Bank | 22,617 |

| 9. | State Employees CU | 17,687 |

| 10. | Boeing Employees CU | 16,921 |

| 11. | Navy Federal CU | 16,576 |

| 12. | Third Federal | 16,332 |

| 13. | TD Bank | 16,198 |

| 14. | Regions Bank | 15,916 |

| 15. | Mountain America CU | 15,236 |

| 16. | PenFed | 15,189 |

| 17. | KeyBank | 13,756 |

| 18. | M&T Bank | 12,596 |

| 19. | America First CU | 12,472 |

| 20. | Spring EQ | 11,820 |

| 21. | Zions Bancorp | 10,999 |

| 22. | Ent CU | 10,877 |

| 23. | Flagstar Bank | 10,220 |

| 24. | BMO | 9,872 |

| 25. | First Citizens | 9,528 |

Looking for a HELOC? Try a Bank or a Credit Union

If you’re in need of a HELOC, you should know that they’re mostly offered by depository institutions (DIs).

In 2023, all but three of the top 25 HELOC lenders were DIs and none of the DIs were considered small banks.

In other words, practically every HELOC was opened by a large bank or a credit union because they keep the lines of credit on their books instead of selling them off after origination.

This differs from first mortgages, which have been dominated by nonbank lenders over the past several years.

These nonbank lenders, or non-DIs, including Figure, UWM and Homebridge, accounted for just 3.7% of the HELOC market. This number has ticked higher in recent years, but still remains very low.

It’s unclear if that will change in 2024 and beyond, though these companies are looking to get in on the action by offering HELOCs and home equity loans.

For example, Rocket Mortgage launched a closed-end home equity loan (HEL) in early August of last year.

[Three Key Differences Between HELOCs and Home Equity Loans]

Meanwhile, wholesale lender United Wholesale Mortgage (UWM) released three HELOCs, including a standalone and a piggyback.

Regardless, there’s a good chance a local credit union (or the bank you already do business with) will offer HELOCs.

Tip: Credit unions also seem to offer a wide selection of adjustable-rate mortgages as well, unlike big banks and nonbank lenders.

Who Are the Best HELOC Lenders Out There?

We know it’s mostly banks and credit unions that offer HELOCs. The question is which one is the best of the bunch?

That’s hard to say because banks and credit unions offer lots of different products, not just HELOCs.

As such, reading their reviews probably won’t give us a lot to chew on. Sure, we can see how they’re rated on the whole, but that might mean nothing with regard to their home equity lending.

Ultimately, I would pay more attention to the interest rate and loan terms offered since HELOC rates can range significantly from bank to bank.

And the closing costs! Many of these banks and CUs offer HELOCs with little to no closing costs.

Also keep your eye on the margin offered, which combined with the prime rate determines your rate. This is perhaps the best way to compare HELOCs.

Be sure to take note of the loan term (how many years to draw and pay it off) and the starting interest rate, which is sometimes discounted for a promotional period.

There may also be unique perks, such as the ability to lock in your rate so it’s no longer adjustable.

Though the way things are going, HELOC rates might have already peaked in 2023. And could be slated to fall even more this year as the Fed continues to lower its own lending rate.

Either way, be sure to exhaust all your options in your HELOC search to ensure you don’t miss out on a better deal.

Read more: Can you refinance a HELOC?