Mortgage Q&A: “What is home equity?”

You’ve probably heard the phrase “home equity” get thrown around, likely during a fast-paced radio or TV commercial urging you to pull the equity out of your home NOW!

So what the heck is it, and why do mortgage lenders keep bringing it up? It must be important, right?

Let’s learn more about it so you can determine if it’s something you should be tinkering with.

I’ll also show you the formula to calculate how much you’ve got and discuss various ways to tap into it.

How to Calculate Home Equity: Your Property Value Minus Loan Balance(s)

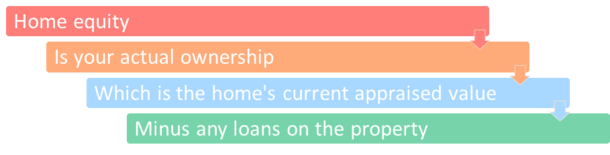

In short, home equity is your ownership in an underlying property, minus any liens (mortgages) a bank or lender may have against it.

To calculate your home equity, simply take the current market value of your property and subtract any outstanding liens/mortgage balances.

It’s actually pretty easy to figure out how much equity you’ve got in your home, as long as you know what your home is worth. But that’s often the sticking point.

A home value estimator like Zillow’s Zestimate or the Redfin Estimate, or your own personal opinion, might not align with what the bank or lender feels your home is worth.

Let’s look at a quick home equity example:

Current property value: $500,000

Existing liens: $350,000 first mortgage, $100,000 second mortgage

Home equity: $50,000

In the scenario above, you’d have total outstanding liens of $450,000 on a property currently worth $500,000.

The $50,000 difference would be your home equity, or actual ownership in the home.

The remainder is made up of loans, and one could argue that the bank is the one who owns that portion of the property since they could technically take it in the event of foreclosure.

Anyway, you could potentially tap into this home equity by refinancing your mortgage or taking out a home equity loan/HELOC.

However, it’s not always recommended because doing so increases your total loan balance and monthly mortgage payment.

It also means it’ll take that much longer to actually pay off your home loan(s), assuming that’s a personal financial goal.

Do You Have Equity in Your Home?

- First find out what your home is currently worth

- Then subtract any existing loan balances

- Lenders will also want you to have an equity cushion

- So you’re not borrowing every last dime in your home, which is risky

If you have high loan balances and your home isn’t worth much more than those outstanding liens, home equity financing may not even be an option for you.

The property acts as collateral for the loan, but if it’s already fully loaned out, there won’t be much left to tap into.

After all, you can’t borrow money if you have nothing to borrow from.

Additionally, you often need an equity cushion beyond what you’re able to borrow.

For example, mortgage lenders may allow you to tap equity up to 90% combined loan-to-value (CLTV), with the other 10% remaining untouched to ensure you have some skin in the game if home prices take a turn for the worse.

These maximum CLTVs will vary by bank and lender, and may also be dictated by current market conditions.

If the real estate market is strong, or lenders feel the need to adjust their risk appetites to garner more business, these limits may rise.

Conversely, if lenders are feeling particularly risk-averse, you might be limited to only 80% CLTV, meaning you won’t be able to touch a full 20% of your home equity.

During the early 2000s, borrowers could easily tap all 100% of their home equity, but that clearly didn’t go well.

How to Tap Home Equity

- If you have available home equity

- You might be able to tap into it if you need cash

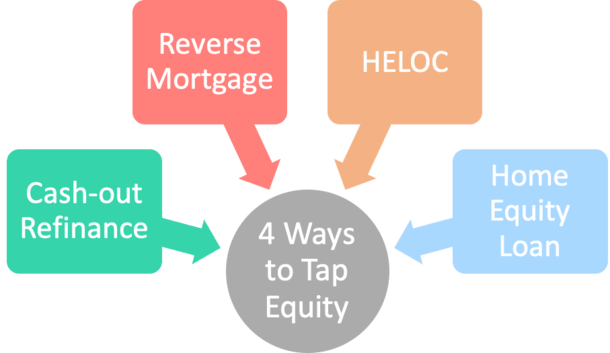

- Via a cash-out refinance, reverse mortgage, HELOC, or home equity loan

- This could result in a second mortgage behind an existing first mortgage

Now let’s talk about those four main financing options as seen in the illustration above.

A common and relatively straightforward way to tap your equity is via a cash-out refinance, which as the name implies involves pulling cash out of your home via refinancing.

This works just like a rate and term refinance, except you wind up with a larger loan amount because you’re borrowing additional funds.

For example, if your current loan balance is $250,000 and you want $50,000 cash, your new loan amount would be $300,000.

Ideally, you’d execute this type of refinance while mortgage rates were low, and potentially keep your new monthly payment similar to the old one.

If you’re 62 years of age or older, a reverse mortgage may also be an option. This allows homeowners to tap into their equity without taking on monthly payments.

Then we’ve got the home equity loan, where you receive a lump sum amount that can be deposited into your bank account and used for whatever purpose.

Typically, this tends to be a type of home improvement loan used for renovations or additions. But it could also be used to pay off credit card debt or pay for college tuition, etc.

It usually comes in the form of a second mortgage and sits behind your existing first mortgage, which remains unaffected by this new financing.

But now you need to pay two mortgages back instead of just one. This can be a good option if the mortgage rate on your first mortgage is fixed and you don’t want to lose it.

Finally, there is the home equity line of credit, or HELOC, which allows you to withdraw money if and when you need to, up to your credit limit.

It’s kind of like a credit card. Some folks open equity lines of credit simply to have a lifeline in case they need cash fast, and may never actually use them.

But it’s common to receive a rate discount on an equity line early on in the loan term to encourage you to use it.

Additionally, borrowed money can be paid back via interest-only or fully-amortized payments.

Both types of loans are generally easier to obtain than first mortgages, and come with lower or no closing costs (no origination fee) depending on the bank in question. You can also apply online in most cases.

They can be opened after you buy your home, or at the same time you get your first mortgage to extend home purchase financing.

For example, you could potentially get a first mortgage for 80% of your home’s value and secondary financing via a home equity loan for another 10-20%, depending on what is permitted.

This may allow you to avoid mortgage insurance and/or receive a more favorable mortgage rate on your first mortgage, though the second may be a higher rate loan.

Home Equity Builds as Mortgage Payments Are Made

- Each time you make a monthly mortgage payment

- A portion of it pays down your principal balance

- As a result, you gain home equity

- Which is another way of saying ownership in your home

As you make mortgage payments each month, your home equity will steadily increase since you’re repaying the loan the bank gave you.

When you first take out a home loan, most of your monthly payment will go toward interest, thanks to the sizable outstanding balance.

But as your mortgage balance decreases over time, more of your monthly payment will go toward principal, which really starts to builds your home equity (learn more about mortgage amortization).

Note that interest-only home loans don’t technically build home equity, as you’re only paying off accrued interest each month, but if home prices appreciate while making interest-only payments, you will still gain equity in your home.

This principle explains why so many homeowners elected to go with interest-only loans prior to the housing crisis, or even option arm loans during the mortgage boom.

The general thinking was that you’d gain home equity no matter what you did. And we all know how that ended…

Home Equity Increases as Home Prices Rise

- Even if you make interest-only payments or don’t have a mortgage

- You can accrue home equity thanks to home price appreciation

- Which will create a gap between what you owe on the property

- And what your home is worth

If home prices rise over time, you will gain a larger amount of home equity as a result.

Using our previous example from above, if the value of the home increased to $550,000, your home equity would rise to $100,000 for doing absolutely nothing (other than staying current on your mortgage).

In fact, it would actually be more than $100,000 thanks to mortgage payments made between the time the home’s value increased from $500,000 to $550,000, but you get the idea.

This is where homeownership starts looking attractive. That combination of regular payments reducing the principal balance and home prices increasing can be pretty sweet.

Just keep in mind the opposite is also true, and if you refinance and pull “cash-out” at market peak, you may find yourself underwater on your mortgage(s).

What About Negative Equity?

- It’s also possible to have negative home equity

- When your home is worth less than the mortgage(s)

- This was very common after the latest housing crisis

- Thanks to zero down financing and steep home price declines

When the mortgage balance(s) exceeds the current value of the home, the loan(s) is considered underwater.

This would put you in a position of negative equity, making it difficult to refinance, as your loan-to-value would surpass 100%.

However, there are a few refinancing options for those with negative equity.

Negative equity became a major problem during the latest mortgage crisis.

Simply put, many homeowners elected to take out zero down mortgages and/or negative amortization loans just as home prices peaked.

This deadly combination of falling home prices and low and no-down payment loans sapped borrowers’ equity, leaving many with no choice but to walk away from their overpriced mortgages.

This partially explained the record number of foreclosures seen nationwide during that time.

But had these homeowners stuck around, which some did, they’d probably have plenty of equity at their disposal thanks to rebounding home prices and regular payments of principal and interest.

If you want more home equity faster, you can pay your mortgage off early via biweekly mortgage payments.

Read more: 10 ways to build home equity.